Complete Guide to Inbound USA Insurance

This is a complete guide to Inbound USA Insurance a simple, inexpensive best visitor insurance providing limited coverage plan to your parents visiting USA and Foreign nationals requiring short-term medical insurance when travelling to the United States for pleasure or business.

It comes with scheduled benefits, is reasonably priced even for longer journeys, and offers 24/7, bilingual travel assistance services from a skilled team that can aid you with finding medical treatment.

This article will provide you with information to assist you evaluate whether this plan is appropriate for your trip or your parents’ trip to the USA.

About Inbound USA visitor health insurance

The affordable US visitor insurance option for foreign visitors to the USA is Seven Corners’ inbound USA basic insurance. Fixed or scheduled benefit insurance is offered through the Inbound USA visitor insurance plan. Acute onset of a pre-existing condition is likewise covered by inbound USA visitor insurance up to age 79.

This limited coverage insurance policy covers international travelers visiting the US temporarily.

Inbound USA offers 3 options viz.

- Inbound USA basic insurance

- Inbound USA choice and

- Inbound USA Elite

Where the coverage limits are higher in Inbound USA Choice and Elite as compared to Inbound USA Basic.

Inbound USA is a low-cost insurance policy that provides limited coverage for each occurrence.

Green card holders or other permanent cardholders who are US residents who travel into and out of the country cannot use Inbound USA visitor Insurance.

Travelers to the United States should be aware that American medical costs and healthcare service are among the highest in the world. The cost of emergency medical evacuations can be extremely high, if you need to be transported to medical service in case of an emergency then this plan pays up to $1,00,000.

For your protection against getting sick or harmed while traveling, it’s crucial to think about getting a travel medical insurance plan like Inbound USA.

It provides 24/7 multilingual travel assistance services offered by an expert team who can help you obtain medical treatment.

Coverage Eligibility Requirements

Inbound USA can be purchased by Non-US citizens travelling to the USA.

Coverage can be purchased for you, your partner, your kids, and your travelling colleagues. You must be under 99 years of age and at least 14 days old in order to be covered.

For travel to the United States and U.S. territories, Green Card holders and United States citizens, including those with dual citizenship, are not permitted to purchase this plan.

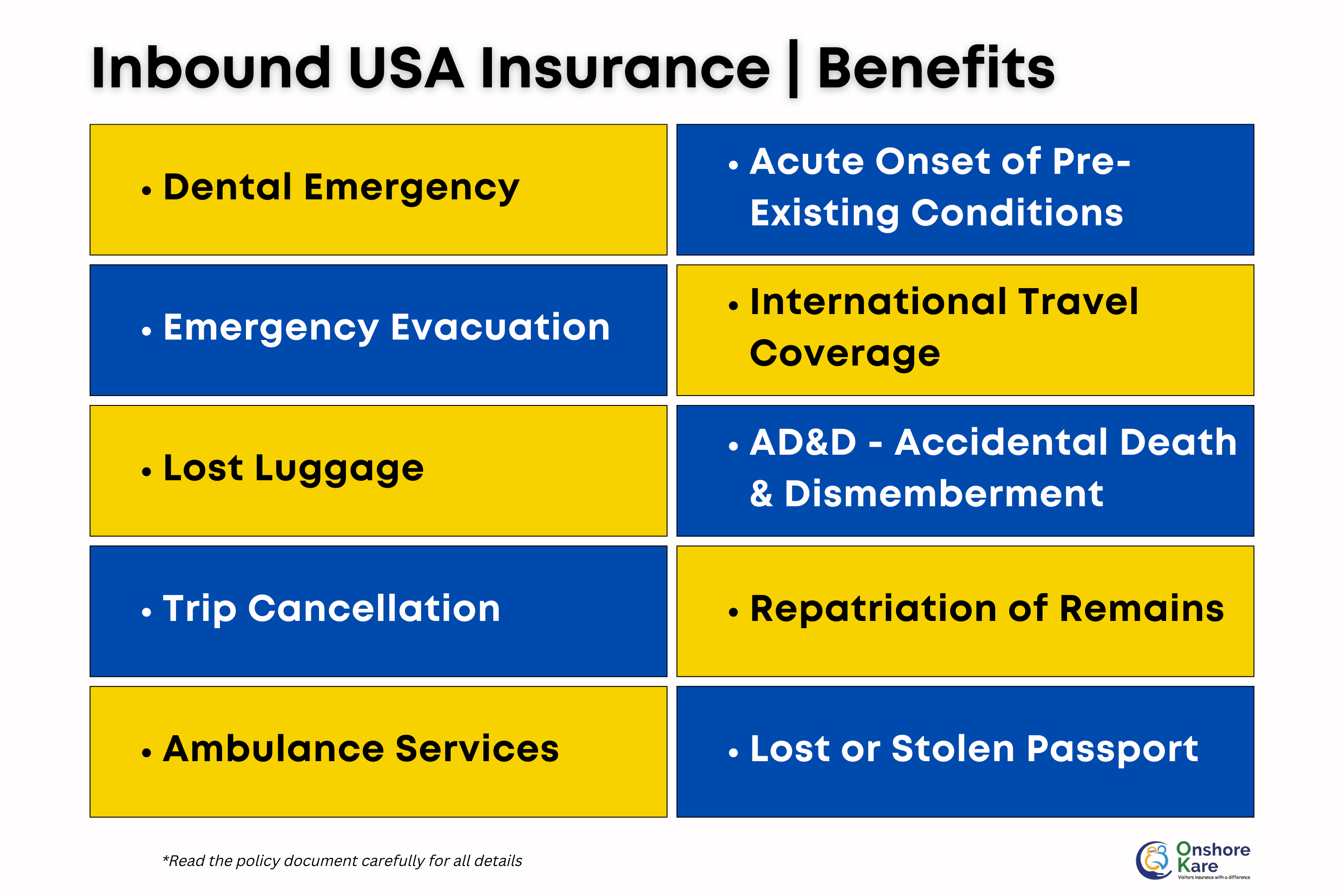

What are the benefits and coverage provided by Inbound USA visitor insurance?

Inbound USA is a limited Travel Medical insurance policy that offers pre-determined sums for different covered medical expenses and emergency assistance to foreign travelers to the United States for their travels and short-term stays abroad.

The range of coverage lengths is 5 days to 364 days. After the deductible is met while in the US, the insurance provider will cover each covered treatment or service up to the maximum amount specified in the policy agreement. As Inbound USA does not participate in PPO network, you are free to go to any hospital or doctor of your choice. Covid-19 is not covered by Inbound USA visitor insurance

-

Medical Coverage :

Inbound USA visitor insurance provides coverage for diseases and accidents that happen during the duration of your policy. Benefits are paid above your deductible up to the medical maximum and treatments indicated in the schedule of benefits. Initial care must be sought within 30 days of the date of the accident or the beginning of the sickness.

-

Dental Emergency Accident Coverage :

If a sound natural tooth is injured due to an accident involving exterior contact with a foreign object, the plan may be able to cover the cost of medical emergency to restore it.

-

Return of Mortal Remains:

If you pass away while travelling outside of your native country, you will be covered for transportation, shipping fees, and regulatory approvals for the return of your remains. Whether or not your death was caused by a pre-existing ailment, the plan nevertheless pays out.

-

Emergency Medical Evacuation :

You will be covered for the medical expense and transportation to the closest suitable facilities or medical provider for treatment in case of emergency medical evacuation.

-

Terrorism :

In the event that you sustain injuries as a result of terrorist activities, you will be covered for your medical expenses if the following criteria are satisfied:

1. You are not involved in the terrorist activities, either directly or indirectly.

2. Neither the U.S. government nor the relevant authorities in your host country or your country of residence have issued any Level 3 Terrorism, Level 3 Civil Unrest, or any Level 4 Travel Advisories, any of which have been in effect within six months prior to your date of arrival.

-

International Travel Coverage :

The benefit can provide up to 14 days of coverage for trips outside of the US. It does not extend past your expiration date and does not apply to travel to your home country. The trip’s starting point must be in the United States, and this benefit must be used during your current period of coverage.

-

Common Carrier Accidental Death & Dismemberment (AD&D):

If you pass away due to an injury sustained in an event that happened while you were a passenger on a common carrier, this benefit will pay out.

Affordable Medical Benefits

Inbound USA visitor insurance is a multi-purpose policy that includes both travel insurance and fixed medical benefits including coverage outpatient surgical facility. This means during a policyholder’s trip they may receive inpatient, outpatient, or emergency medical services, as well as limited dental and vision procedures at a pre-defined cost. The predetermined medical costs are listed in your policy and clearly show the benefits available to you should there be a need for medical care while traveling.

Although the coverage may be viewed as Inbound USA basic or Inbound USA choice , the Insurance offers all the necessary travel protections at a reasonable cost which makes it a consistently outstanding plan.

What is Pre-existing conditions coverage?

Any medical condition, sickness, injury, disease, mental illness, or mental nervous disorder that required medical advice, diagnosis, care, or treatment, or for which a prudent person would have sought treatment is referred to as a Pre-Existing Condition.

Any medical issues you had prior to the policy’s effective date are referred to as pre-existing condition. When a qualifying application is enrolled, this coverage can be added. Make sure to review the coverage offered by this rider to not miss any important details.

What does it mean by acute onset of pre existing conditions?

It is a sudden and unexpected outbreak or return of a pre-existing ailment. That develops suddenly, unexpectedly, and without prior notice in the form of symptoms or doctor’s advice and necessitates urgent care.

The following conditions must be met in order for this benefit to apply:

- The acute onset must take place after the effective date of the plan and before the age cap indicated in the Schedule of Benefits.

- The abrupt and unexpected breakout or recurrence must be treated within 24 hours.

- Incurred costs must take place in the United States.

Prior to your arrival in the United States and the start of your plan, there is no coverage for known, scheduled, required, or eligible medical expenses , medications, or treatments that were existent or essential.

Is acute onset of pre existing conditions covered by Inbound USA visitor insurance?

Inbound USA also provides coverage for the acute onset of pre-existing conditions up to 79 years of age.

Up to the age of 79, acute onset of pre-existing conditions is covered. For this benefit, those under 70 receive $50,000 or $75,000 for the Basic or Choice option. The coverage limit for those between the ages of 70-79 is $25,000. No coverage for 80 and over.

A chronic, congenital, or progressively worsening pre-existing ailment is not covered by this benefit. It excludes coverage for known, anticipated, essential, or scheduled medical care, medications, or treatments that existed or were required prior to the effective date of coverage.

Why is Inbound USA the best limited coverage visitor insurance plan in the USA?

Visitors to the USA can get health insurance through Inbound USA. It’s important to get this travel insurance policy for a number of reasons:

- If you go to the USA without health insurance from your home country. Then you may be responsible for paying for your expected medical care if you get sick or injured.

- Visitors medical insurance is a crucial component of any trip to the USA because medical costs there are among the highest in the world. Inbound USA offers scheduled benefit visitor insurance, which is priced inexpensively even for longer trips.

- Services for 24-hour travel help are offered with Inbound USA. Their multilingual staff can assist you in finding a doctor and provide information on benefits and travel.

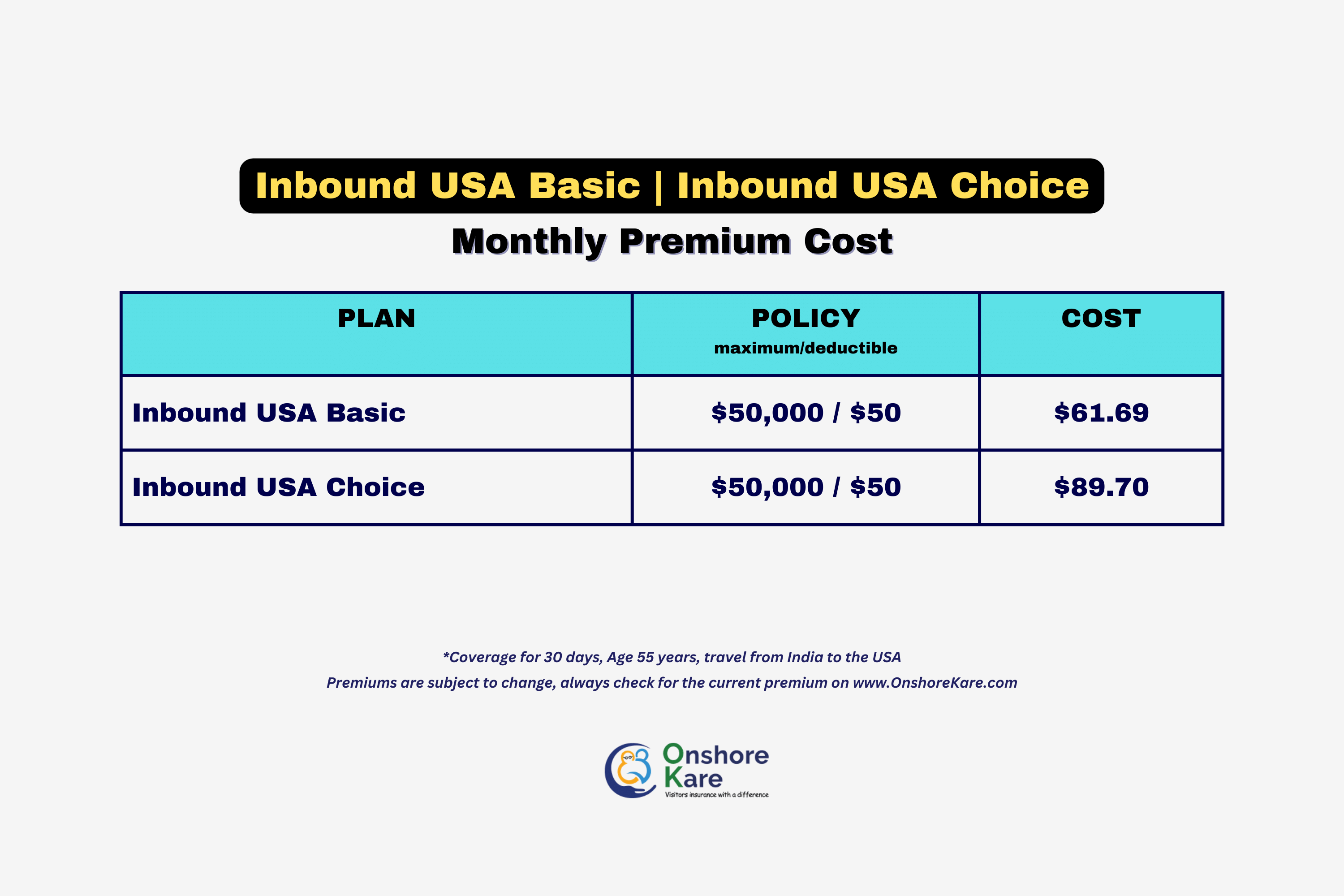

How much does Inbound USA cost?

The cost of the insurance depends on many factors including age, coverage length, limit of the plan and deductibles.

Limit of the plan :

If you choose a higher maximum benefit for your plan, your monthly premium will increase accordingly. In terms of policy maximums, you can pick between $50,000, $1,00,000, $1,50,000.

Deductible :

Select a deductible amount between $0, $50, $100 and $200. The premium can be lowered by selecting a higher deductible.

Age factor :

As one gets older, one usually has to pay a higher premium or rate. The premium increases as one get older. Anyone with more than 14 days old can sign up for the plan.

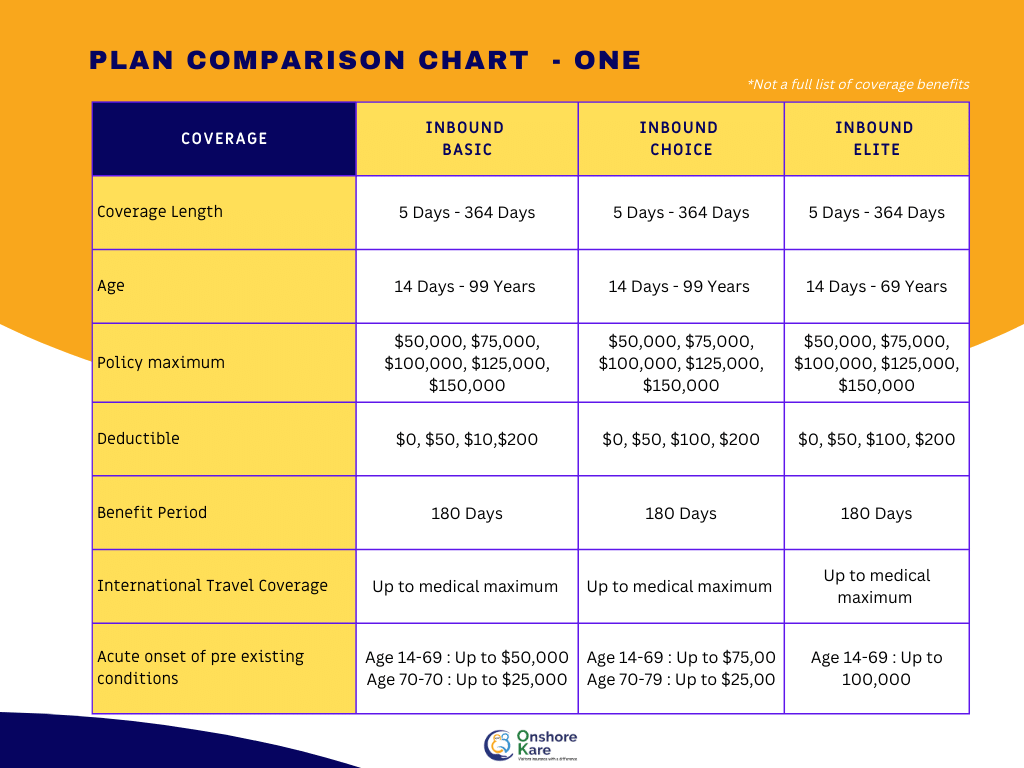

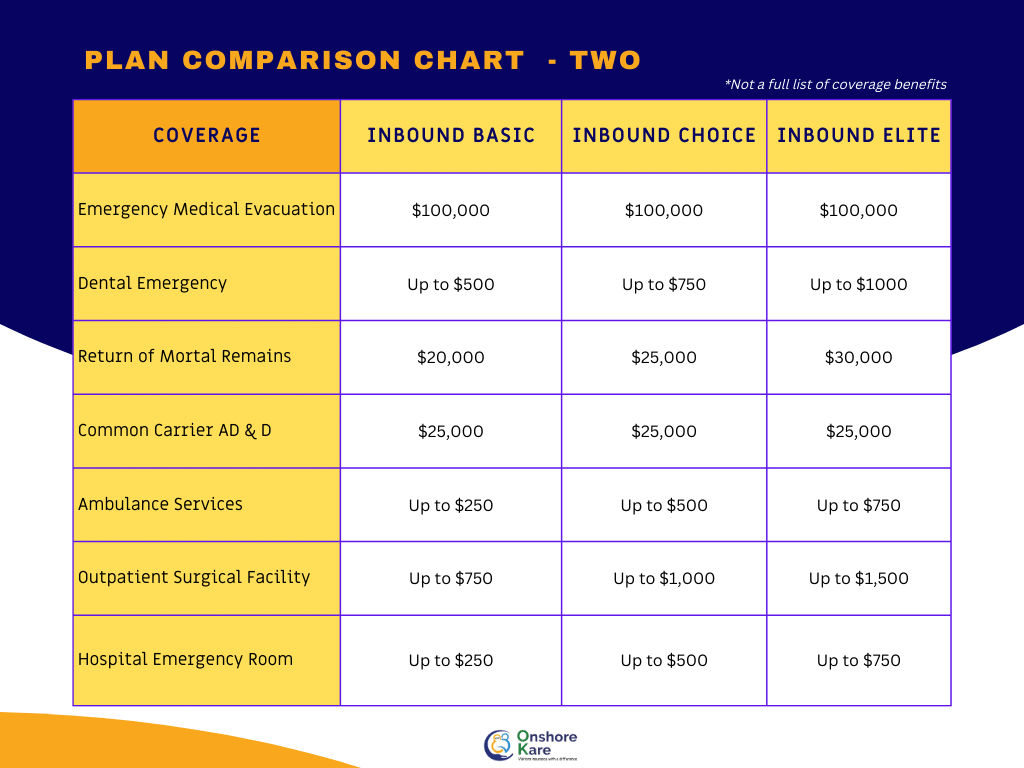

What are Inbound USA basic insurance, Inbound USA Choice and Inbound USA Elite Insurance coverage?

These three plans are from Inbound series of limited travel insurance coverage from seven corners insurance.

- Inbound USA basic : It is a cost-effective choice for anyone under 100 years old. For both foreign visitors and non-US citizens travelling to the US, it provides limited or fixed benefit travel health insurance. It is a reasonably priced option for your family’s trip to the USA. This policy may be extended for up to 364 days.

- Inbound USA Choice : It is the most popular and provides plan which covered medical expenses incurred during emergency. This plan can be extended up to 1092 days and people below 99 years of age can apply for this benefit limits.

- Inbound USA Elite : It is a premium plan which provide the best fixed benefit plan for people below 70 years of age. It can be extended up to 1092 days.

Key differences between Inbound USA basic, Inbound USA Choice and Inbound USA Elite Insurance

What kind of coverage are offered by these plans?

-

Trip cancellation insurance

It covers all non-refundable travel expenses, including airfare, excursions, and hotel stays.

If a flight is cancelled or delayed and it stops you from getting to your destination, you probably won’t be able to get a refund because most hotels and tour companies have very severe policies on last-minute cancellations or missed flights.

The best approach to safeguard your investment is with travel insurance if you have carefully planned a lengthy, pricey journey with your loved ones.

-

Trip interruption coverage

The plan may compensate you for the unused portion of your trip and may cover additional costs for last-minute travel modifications if you are already halfway through your vacation and need to change your itinerary, return home early, or reroute your plans for a covered cause.

-

Medical expenses

Medical costs might range from simple injuries to major injuries treated in an emergency department or a foreign hospital. A travel insurance plan can offer coverage for accidents and illnesses when travelling, as most health insurance plans in the U.S. do not cover international incidents or needs that may develop.

-

Emergency medical evacuation

If you suddenly require a helicopter airlift, a trip home with medical equipment, or ambulance transfer to a nearby hospital, emergency evacuation coverage can potentially save you tens of thousands in out-of-pocket costs.

About Insurance company of Inbound USA – Seven Corners Travel Insurance

Seven Corners is a travel insurance company that offers a variety of visitor insurance and international health insurance plans. These plans can provide coverage for things like trip cancellation, medical expenses, and emergency evacuation.

Some of the company’s plans are specifically designed for travelers who are going abroad for work, study, or leisure. In addition to travel health insurance. Seven Corners also offers pet insurance and other types of insurance products.

For both US and non-US citizens, Seven Corners is a travel insurance company with a large selection of plan choices. The business offers annual and one-time vacation packages, as well as student-specific choices and travel health insurance.

The following are some advantages of the plans provided by Seven Corners:

- Best visitor insurance plan with comprehensive coverage including emergency medical evacuation for people traveling to the USA.

- They provide customer support so you can always get in touch with them when you need them.

- For every need, Seven Corners provides a wide range of travel insurance options.

Check out the Complete Guide to Seven Corners Travel Insurance

Tips for Purchasing the Plan

In order to send the necessary insurance documents, the application will need the

- Visitor’s name

- Date of birth

- Home country and address

- Email address

- A passport number can be entered if you have one

- To complete the purchase, a credit card number and expiration date will be needed.

- A confirmation email with links to download the ID card, Visa Letter, and Certificate wording will be sent to the address provided on the application immediately after submission.

Which is the best travel insurance coverage from Seven Corners travel insurance?

Knowing what kind of protections you need while away from home is important when choosing the right package.

- For Visitors Insurance: People who have family/relatives/parents visiting them in the USA can consider highly competitive comprehensive coverage travel plans from Seven Corners Travel Insurance.

- For premium travel credit card holders: If you currently have appropriate trip cancellation coverage through a premium travel credit card, you may not need additional coverage beyond a standalone emergency medical policy.

- For people requiring more comprehensive coverage: If the credit card coverage you have isn’t enough for your needs, if you don’t have credit card coverage, or if you didn’t pay for your trip with the credit card, you may want to consider upgrading to a more extensive and comprehensive coverage plan, such as a RoundTrip or Annual Trip plan from Seven Corners, depending on how often you travel and how much you spend.

- For people traveling frequently: Long-term travelers who plan to take multiple journeys per year will find the annual plans to be the most convenient. There is a 60-day limit on travel coverage, so if you anticipate being away from home for longer than that, you may want to check into alternative choices.

Frequently Asked Questions

HOW ARE PRE-EXISTING CONDITIONS COVERED BY SEVEN CORNERS’ INBOUND USA POLICY?

They are protected by the benefit of Acute Onset of Pre Existing medical conditions. For more information, including monetary amounts and age limits, refer to the policy documents. Based on age and plan, coverage varies.

IS SEVEN CORNERS A LEGITIMATE INSURER?

Since 1997, Seven Corners Inc. is an insurance provider and has been selling travel insurance. With over 200 workers and offices in Carmel, Indiana, Seven Corners Travel Insurance provides both domestic and international travel insurance policies. Seven Corners Insurance offers travelers health coverage, protection, and security for travelers away from their home country.

HOW CAN INBOUND USA BASIC BE USED WHILE SEEKING MEDICAL ATTENTION?

Inform the healthcare practitioner you are visiting that you have Inbound USA Basic insurance. If they want to confirm your benefits and eligibility, show them your ID card. Instruct them to contact Seven Corners Assist.

WHAT IS SEVEN CORNERS’ TRAVEL PROTECTION?

Seven Corners Travel Insurance company is based in Carmel Indiana, USA. They have over 4000 reviews on Trustpilot with a rating of 4 stars (Great).

Options for travel insurance from Seven Corners range from one-time trips to yearly policies, medical provider, student discounts, and even coverage for those traveling internationally. people from other countries who are tourists in the United States, etc. Additional coverage options include plans with benefits tailored to the spread of COVID-19.

Which travel insurance plan should you consider if your parents are elderly travelers visiting the USA?

We recommend considering a Comprehensive Travel medical insurance plan, you can read more about things to consider when buying insurance for seniors

A reputable online marketplace for travel insurance, such as OnshoreKare, allows you to compare and purchase visitors’ insurance.

Bottom Line

The benefits and coverage that Inbound USA insurance provides outweigh the price of the plan. This temporary medical insurance which provides fixed benefit coverage would be great for your parents or relatives visiting the USA.

We hope this article has helped you understand the international benefits and the coverage that Inbound USA insurance provides to non-US residents traveling to the USA for a short period of time.

Make sure you go through the policy’s terms and conditions before purchasing the plan. If you need any help with questions related to the plan do not hesitate to contact our customer service team.

Have a nice trip!