Royal Caribbean Travel Insurance – Complete Guide, 2024

Royal Caribbean travel insurance protects your cruise investment. Going on a cruise ship is an exciting experience.

Planning a cruise with Royal Caribbean Cruise Line? It’s important to consider travel insurance to safeguard your vacation investment.

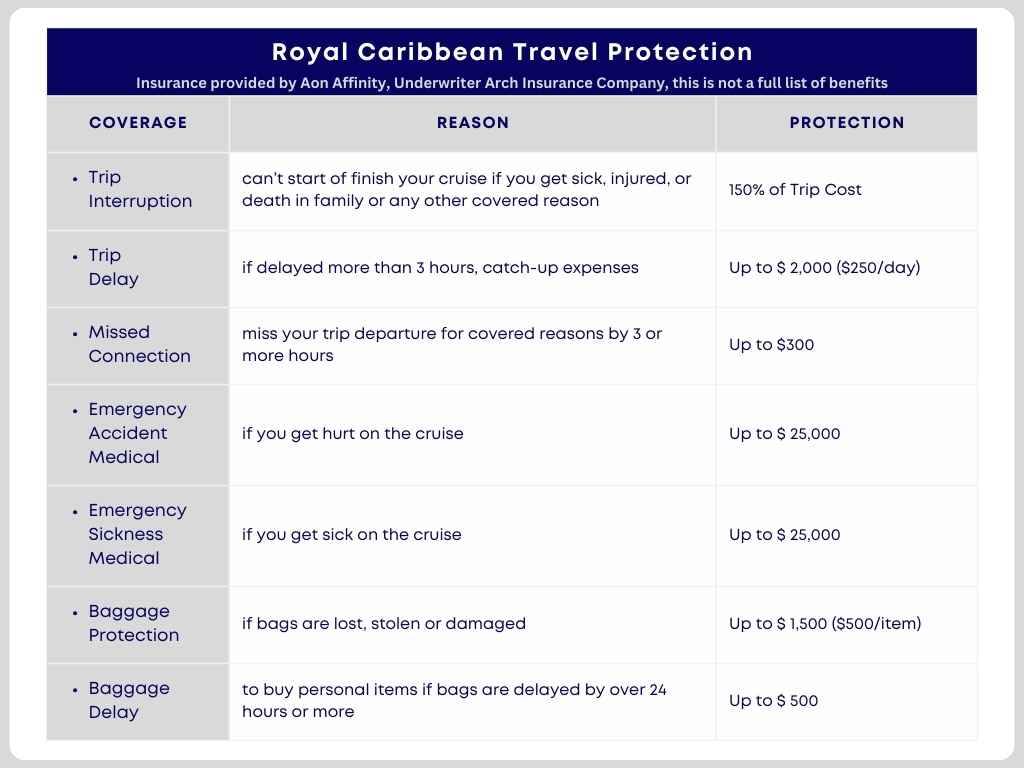

Royal Caribbean travel insurance offers comprehensive coverage, ensuring travelers’ peace of mind. Aon Affinity is the insurance partner for the Royal Caribbean travel protection program.

This guide is updated from our previous coverage of Royal Caribbean travel insurance and will provide an in-depth look at what their insurance coverage entails, its benefits, and why it’s crucial for your next cruise.

What Is Royal Caribbean Travel Insurance?

Known as the Royal Caribbean Travel Protection Program, it is a specially designed insurance package the cruise line offers to protect travelers from unexpected events that can disrupt their vacation.

This travel insurance is tailored to cover various aspects of your trip, including trip cancellation, medical emergencies, and travel interruptions.

Did you know that you can also book last-minute cruises with Costco Travel?

Key Features Of The Royal Caribbean Travel Protection Program

- Cruise Cancellation: Royal Caribbean offers two non-insurance features: the Cruise Vacation Cancellation Enhancement Program and the Cancellation Penalty Waiver.Cancellation Penalty Waiver*: Royal Caribbean will refund up to 100% of the cancellation fees if you cancel for a specified reason.

Cancel for any reason Cruise Vacation Enhancement: Royal Caribbean cancel for any reason benefit will reimburse up to 90% of cancellation fees if you cancel for any other reason. The cancel for any reason benefit will be in the form of a future cruise credit. *Please be advised that the Cancellation Penalty Waiver is not available to residents of New York and Hawaii. Conversely, Arch Insurance Company is responsible for the underwriting of Trip Cancellation benefits. Furthermore, the Cancel for Any Reason Cruise Vacation Enhancement is available for purchase independently of the Travel Insurance Benefits by contacting Aon Affinity. - Emergency Medical Evacuation: If you suffer a medical emergency while on your cruise, this benefit covers the cost of transportation to the nearest appropriate medical facility.

- Medical Insurance Coverage: Covers medical expenses incurred due to illness or injury during your cruise.

- Trip Interruption: If your trip is interrupted for a covered reason, this benefit helps cover the cost of unused portions of your trip and additional travel expenses incurred to return home.

- Travel Delay: Reimbursement for additional expenses if your trip is delayed for a covered reason.

- Baggage Protection: Covers lost luggage, stolen, or damaged baggage, and personal belongings.

The Royal Caribbean travel protection program is underwritten by Arch Insurance Company and the travel insurance benefits are administered by Aon Affinity.

Explore Cruise Insurance policy

Royal Caribbean Travel Insurance Cost

Cruise vacations can be a significant financial investment. The cost of a Royal Caribbean cruise can vary widely depending on several factors, including the length of the cruise, the destination, the type of stateroom, the time of year, and any special promotions or discounts available.

However, as a general guideline:

- Short Cruises (3-5 days): The average cost for a short cruise can range from $300 to $1,000 per person, depending on the factors mentioned above.

- Week-long Cruises (7 days): For a typical seven-day cruise, the cost generally ranges from $500 to $2,500 per person. The lower end of the range usually reflects interior staterooms, while the higher end can include ocean-view, balcony, or suite accommodations.

- Longer Cruises (10 days or more): These cruises can range from $1,000 to over $5,000 per person, depending on the length of the cruise and the level of luxury.

- Luxury and Specialty Cruises: Cruises with more exclusive destinations, specialty itineraries, or higher-end accommodations can cost significantly more, sometimes exceeding $10,000 per person.

These prices typically include accommodations, meals, entertainment, and access to many onboard activities. However, additional costs may include shore excursions, specialty dining, alcoholic beverages, gratuities, and travel insurance. Special deals, promotions, and early bookings can also affect the final price.

Understanding The Cost Of Royal Caribbean Travel Insurance

The cost of Royal Caribbean travel insurance varies based on several factors, including the total trip cost, the length of the cruise, and the age of the travelers.

On average, travel insurance costs around 5-10% of the total trip cost. Factors influencing the cost include:

- Trip Cost: Higher trip costs typically result in higher insurance premiums.

- Duration: Longer trips may have higher insurance costs.

- Age: Older travelers may face higher premiums due to increased risk.

- Coverage Level: Enhanced coverage options may increase the cost of insurance.

Travel insurance protects you against unexpected events that can occur before or during your cruise. Here are some reasons why purchasing the Royal Caribbean travel protection program is essential:

Do You Need Insurance For Your Cruise?

Trip Insurance Protection

One of the primary benefits of the Royal Caribbean travel protection is trip cancellation insurance. Suppose an unforeseen event, such as a medical emergency or severe weather, forces you to cancel your trip.

In that case, trip insurance helps you recover the cost of your cruise and other travel expenses.

Medical Emergencies

Regular health insurance often does not cover medical treatment outside your home country.

The Royal Caribbean travel protection program provides medical coverage for emergencies during your cruise, ensuring you receive the necessary care without worrying about medical bills.

Emergency Medical Evacuation

In a serious medical issue, emergency medical evacuation can be costly. Royal Caribbean travel protection includes coverage for emergency medical evacuation, ensuring you are transported to the nearest suitable medical facility.

Trip Interruption And Delay

Travel disruptions, such as missed connections or delays, can ruin your vacation. With trip interruption and travel delay coverage, you are reimbursed for additional expenses incurred due to these disruptions.

Understanding The Royal Caribbean Travel Protection Program

Royal Caribbean travel travel protection program offers comprehensive coverage designed to address the unique needs of cruise travelers.

Here’s a closer look at the key components:

Trip Cancellation And Interruption Insurance

If you need to cancel for a covered reason, Trip cancellation insurance reimburses you:

- For the prepaid, non-refundable portion of your trip.

Covered reasons typically include:

- Illness, injury, or death of the insured, a traveling companion, or a family member.

- Severe weather prevents you from reaching your departure point.

- Involuntary job loss.

- Military deployment or travel restrictions.

Trip interruption insurance provides reimbursement for the unused portion of your trip and additional travel expenses incurred if you need to return home early due to a covered reason.

Medical Insurance Coverage

Medical expenses incurred during your cruise can be substantial, especially if you need medical treatment onboard or in a foreign country, it covers medical expenses such as:

- Doctor visits.

- Hospitalization.

- Prescription medications.

- Emergency medical treatment.

Emergency Medical Evacuation

If you suffer a severe medical emergency, emergency medical evacuation coverage ensures you are transported to the nearest appropriate medical facility.

This benefit covers the cost of air or ground transportation, which can be extremely expensive without insurance.

Baggage And Personal Effects

Baggage protection covers the cost of lost, stolen, or damaged luggage and personal belongings.

This ensures you can replace essential items and continue your vacation without significant disruption.

Travel Delay And Missed Connections

If your trip is delayed for a covered reason:

Travel delay coverage reimburses you for additional expenses such as:

- Accommodation.

- Meals.

- Transportation.

Missed connections coverage helps you catch up to your cruise if a delay causes you to miss your departure.

How To Purchase Royal Caribbean Cruise Insurance?

Cruise insurance purchase can be done at the time of booking your cruise or anytime before your final payment.

Here are the steps to buy:

- Book Your Cruise: Select your Royal Caribbean cruise and complete your booking.

- Add Travel Insurance: During the booking process, you will have the option to add travel insurance. If you have already booked your cruise, you can add insurance through the Royal Caribbean website or by contacting their customer service.

- Review Coverage Details: Ensure you understand the coverage provided by the Royal Caribbean Travel Protection Program, including any limitations or exclusions.

- Make Payment: Pay for your travel insurance along with your cruise deposit or final payment.

Please note that the travel insurance policies are administered by Aon Affinity and underwritten by Arch Insurance Company. Worldwide Emergency Assistance, services provided by CareFree Travel Assistance™

What Is Not Covered By Royal Caribbean Travel Insurance?

While Royal Caribbean travel insurance offers extensive coverage, it’s essential to understand what is not covered.

Common exclusions include:

- Pre-existing medical conditions (unless you purchase a waiver if available).

- High-risk activities (e.g., skydiving, scuba diving).

- Intentional self-harm or substance abuse.

- Travel to regions with active travel advisories from the State Department.

Tips For Maximizing Your Royal Caribbean Travel Insurance

To ensure you get the most out of your Royal Caribbean travel insurance, consider the following tips:

Purchase Early

Buy your travel insurance at the time of booking or soon after to ensure maximum coverage.

Some benefits, like coverage for pre-existing conditions, may only be available if you purchase insurance within a specific time frame after your initial trip payment.

Keep Documentation

Maintain records of all travel documents, medical records, and receipts. This documentation will be crucial if you need to file a claim.

Understand Your Policy

Read your travel insurance policy thoroughly to understand what is covered and what is not. Contact the travel insurance company with any questions or clarifications.

Monitor Travel Alerts

Stay informed about travel advisories and weather conditions that may affect your cruise. This information can help you make timely decisions and take necessary precautions.

Conclusion

Royal Caribbean travel insurance provides comprehensive protection for your cruise vacation, covering everything from trip cancellations and medical emergencies to lost baggage and travel delays.

By investing in travel insurance, you safeguard your trip investment and ensure peace of mind throughout your journey.

Whether you’re a seasoned cruiser or planning your first voyage, Royal Caribbean travel insurance is an essential component of a worry-free vacation.