Visitor Insurance in USA – The Ultimate Guide

This article will help you with a comprehensive overview of visitor insurance in the USA

Table of Content:

-

What is Visitor Insurance?

-

Why do you Need Visitor Insurance?

-

What kind of visitor health insurance should you be looking for?

-

What is Covered by Visitor Insurance?

-

What are the best Travel Insurance Plans for USA Visitors?

-

How much does visitor insurance cost?

-

Which USA insurance providers offer the best visitor insurance?

-

How to Choose the Right Visitor Insurance Plan

-

Frequently Asked Questions (FAQs)

What is Visitor Insurance?

Visitors’ insurance is an insurance plan that offers medical protection to international travelers visiting USA. It is made to shield visitors from unforeseen medical costs brought on by illness or injury.

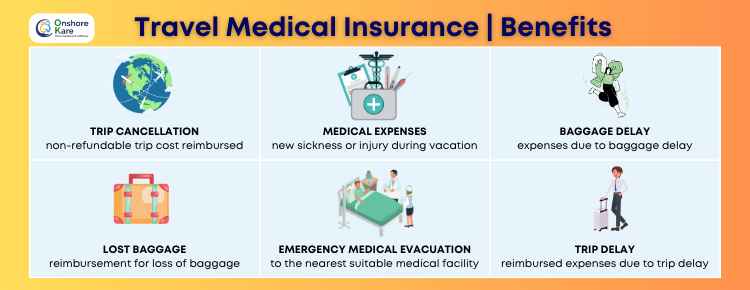

Plans for visitor insurance could also include advantages like a trip interruption and emergency medical evacuation.

Visitor insurance is created especially for international travelers to the United States. The qualified medical expenses incurred during a medical emergency are covered by travel medical insurance plans.

You reduce the risks of unjustified medical expenses for your parents visiting the USA by purchasing visitors’ health insurance.

There’s Travelers Insurance for US visitors worth exploring for your next trip to the United States.

Why do you Need Visitors Insurance?

Due to illness or accident, visitors may encounter unanticipated medical issues, and US healthcare can be quite expensive. A single medical emergency can easily cost thousands of dollars, and without adequate medical coverage, visitors might be forced to bear costs out of pocket.

Additionally, even in emergency cases, US healthcare providers might demand payment before administering service. Visitors without insurance can be turned away or might not get the care they need because they can’t afford it. Delays in treatment have the potential to aggravate medical illnesses and cause more severe health issues.

Visitors can feel secure throughout their stay in the US with the help of visitors insurance, offering financial protection against these unforeseen medical costs. Visitors can receive vital medical coverage with visitors insurance, without being concerned about the high expense of healthcare in the US.

A contract between an insurance company and a healthcare provider offers coverage for a variety of medical costs, including hospitalization, doctor visits, prescription medications, medical treatment, and emergency medical evacuation.

Additionally, a few visitors insurance plans might also provide benefits including trip cancellation, common carrier accidental death, and dismemberment coverage. Visitors, especially those who are visiting the US for an extended period of time, may benefit from additional safety provided by this.

We have covered the Top 10 Reasons to Buy Travel Insurance in our YouTube video.

What kind of Visitor Health Insurance should you be looking for?

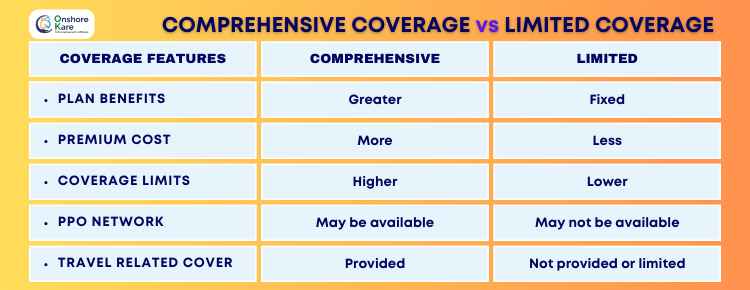

The two primary types of visitor medical insurance plans are :

-

Fixed Coverage Plans

-

Comprehensive Coverage Plans

The fixed benefit travel insurance has a fixed limit of coverage for various medical benefits, however, it is the most affordable US travel insurance plan. Fixed benefit visitors insurance is effective for minor sickness but may fall short for more serious illnesses requiring hospitalization.

Full medical expense coverage is offered by comprehensive travel insurance up to the policy’s medical maximum level. There are no coverage restrictions for any of the benefits, unlike visitors insurance with limited coverage. When compared to fixed benefit plans, it is much more expensive but also offers significantly better coverage, particularly in the event of serious medical emergencies or hospitalization.

While comprehensive plans provide more extensive coverage for medical costs, emergency medical evacuation, and other benefits, fixed coverage plans have a set benefit amount for each covered medical expense.

For international visitors traveling to the USA, we recommend comprehensive coverage policies because they provide better and more coverage advantages.

Despite having greater prices, comprehensive coverage medical plans provide more advantages over fixed coverage policies, such as higher policy maximum limits. As a result, choosing comprehensive coverage options for travel insurance in the USA is often a preferable option.

Exploring the options of Comprehensive Coverage vs Fixed Coverage helps you decide the kind of visitor health insurance needed for the trip.

What is covered by Visitors’ Insurance?

A wide range of medical costs incurred while foreign visitors are in the US are normally covered by visitors insurance plans.

These costs could consist of:

Hospitalization:

Patients may need to be admitted to a hospital for a variety of conditions, including surgery, hospital emergency room, the treatment of a severe sickness, or an accident. In the US, hospitalization charges might be very high, however, visitors’ insurance can help with hospital expenses and hospital emergency room charges.

Doctor Visits:

Patients may need to go for regular checkups or treatment for minor injuries or diseases. The eligible medical expenses of doctor visits, including consultations, examinations, and treatments, are often covered by visitor insurance plans.

Prescription Medications:

While visiting the US, visitors might need to buy prescription medications. Prescription medications issued by a doctor are frequently covered by visitors’ insurance policies. If you have parents visiting USA then you can get details on carrying prescription medicines to the USA.

Emergency Medical Evacuation:

In the event of an emergency medical evacuation especially during a life-threatening situation, visitors may need to be sent to a hospital or other nearest medical facility that can offer the required care. The cost of emergency medical evacuation, including travel by ambulance or helicopter, may be covered by travel medical insurance plans.

Return of Mortal Remains:

In the tragic event that the insured person passes the mortal remains may need to be sent to the home country. The cost of transporting mortal remains is very high. If the medical insurance plan covers the repatriation of mortal remains then you can insurance might pay for the eligible expenses of returning the visitor’s remains to their place of origin as defined in the insurance policy.

Dental Care:

Dental treatment is generally excluded from travel insurance coverage. Some plans may offer limited emergency treatment. Healthcare costs in the USA are extremely expensive and so is the cost of dental treatment.

Senior persons should take particular note of this because they are more vulnerable than younger travelers. When you buy visitor health insurance pay attention to the common exclusions in travel insurance. If you are worried about some dental issues then look for plans that offer emergency dental coverage.

Trip Cancellation or Trip Interruption Coverage

In the event that a visitor’s vacation is cut short or stopped due to unforeseeable occurrences like an emergency, a natural disaster, or other covered situations, trip interruption coverage offers financial protection.

Trip interruption insurance may pay out for non-refundable travel expenses like transportation fees, hotel reservations, and other pre-paid expenses if a covered incident causes a visitor’s trip to be interrupted. Depending on the travel insurance policy, the trip interruption coverage’s specific terms and conditions and coverage amount may change.

Some visitor medical insurance policies could also provide trip interruption coverage along with additional travel-related advantages like emergency evacuation to the nearest medical facility, travel assistance services, and accidental death and dismemberment coverage. To make sure they have the right protection while visiting the US, visitors should carefully study their insurance coverage to determine what benefits are covered and what are not.

Pre-Existing Conditions Coverage

Before you buy visitor medical insurance assess if you need coverage for pre-existing medical conditions. A pre-existing medical condition is a sickness that was present at the time the visitors’ insurance policy was first issued.

For parents visiting USA, it may be prudent to check their medical records and see if they have pre-existing medical conditions.

There are many medical issues that are regarded as pre-existing diseases, but some of the frequent illnesses in this group include diabetes, cancer, high blood pressure, kidney disease, asthma, and conditions related to the heart and the blood vessels.

Finding visitor medical insurance that provides coverage for pre-existing conditions can be challenging. Pre-existing conditions are not always covered by travel insurance policies. Most travel insurance plans offer acute onset coverage only.

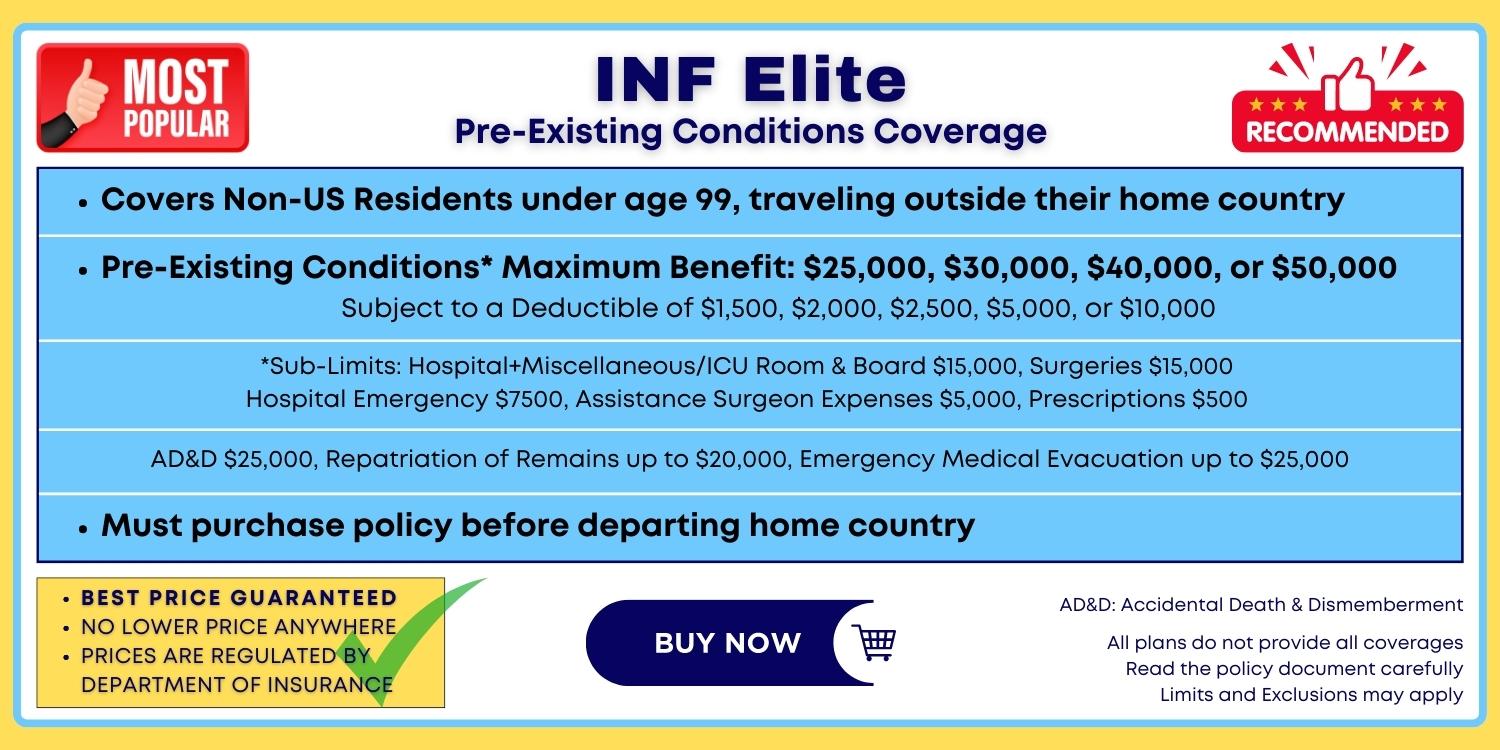

INF Plans is an insurance company that provides foreign visitors to the US with US travel insurance plans that cover pre-existing conditions. Going through the details INF perhaps offers the best travel insurance for pre-existing medical issues.

INF travel insurance offers patient protection with pre-existing medical condition coverage and covers any in-patient, or out-patient, who requires urgent medical care, specialist, doctor visits, or other pre-existing condition-related services.

Any pre-existing diseases, such as high blood pressure, diabetes, kidney problems, and arthritis, will be covered by INF insurance. The INF Premier Plan and INF Elite Plan both provide coverage for all of these problems.

If your parents have pre-existing conditions, then you must also know the Best Visitors Insurance for Pre-Existing Medical Conditions, and choose the best one that suits your needs.

What is the Acute Onset of Pre-Existing Conditions? Is it covered by Visitor Medical Insurance?

Pre-Existing Conditions are a big concern for Senior Travelers and for Parents Visiting USA. For business travelers, the travel insurance provided by your employer/company may not offer coverage for pre-existing conditions.

A sudden and unexpected outbreak of pre-existing health condition that necessitates prompt medical intervention is referred to as an acute onset.

For instance, a visitor with a history of high blood pressure can have a sharp rise in their blood pressure when visiting the US, necessitating immediate medical attention. In this instance, the acute onset of a pre-existing ailment is the abrupt and unexpected onset of elevated blood pressure.

Acute onset of pre-existing conditions may be covered by some visitor insurance policies, while pre-existing conditions may not be covered at all by others.

Travel Medical Insurance is primarily of 3 types:

- Covered illness includes the Acute Onset of Pre-Existing Conditions Coverage

- International Travel Medical Insurance plan does not include coverage for the Acute Onset of Pre-Existing Condition

- International Travel Insurance plan covers Pre-Existing Medical Conditions

When you buy visitors insurance ensure you read the policy document carefully and ensure it includes the coverage you need. For parents visiting USA one of the biggest concern is coverage for pre-existing conditions, know well that your options in such situations are limited.

What are the Best Travel Insurance Plans for USA Visitors?

Some of the most popular travel insurance plans for visitors traveling to USA are:

Patriot America Plus Travel Insurance

- Administered by International Medical Group (IMG)

- Comprehensive coverage

- Coverage for non-US citizens traveling to the US

- Coverage duration is from 5 days to 365 days, renewable up to 24 months

- The policy maximum is up to $1,000,000

- Deductibles options from $0 to $2,500

- Plan pays 100% up to the policy maximum after the deductible is met

- PPO network

There are many reasons to purchase visitor insurance like Patriot America Plus. But, knowing the Top 10 Reasons to Buy Patriot America Plus for Parents Visiting USA helps to understand the plan better before purchasing.

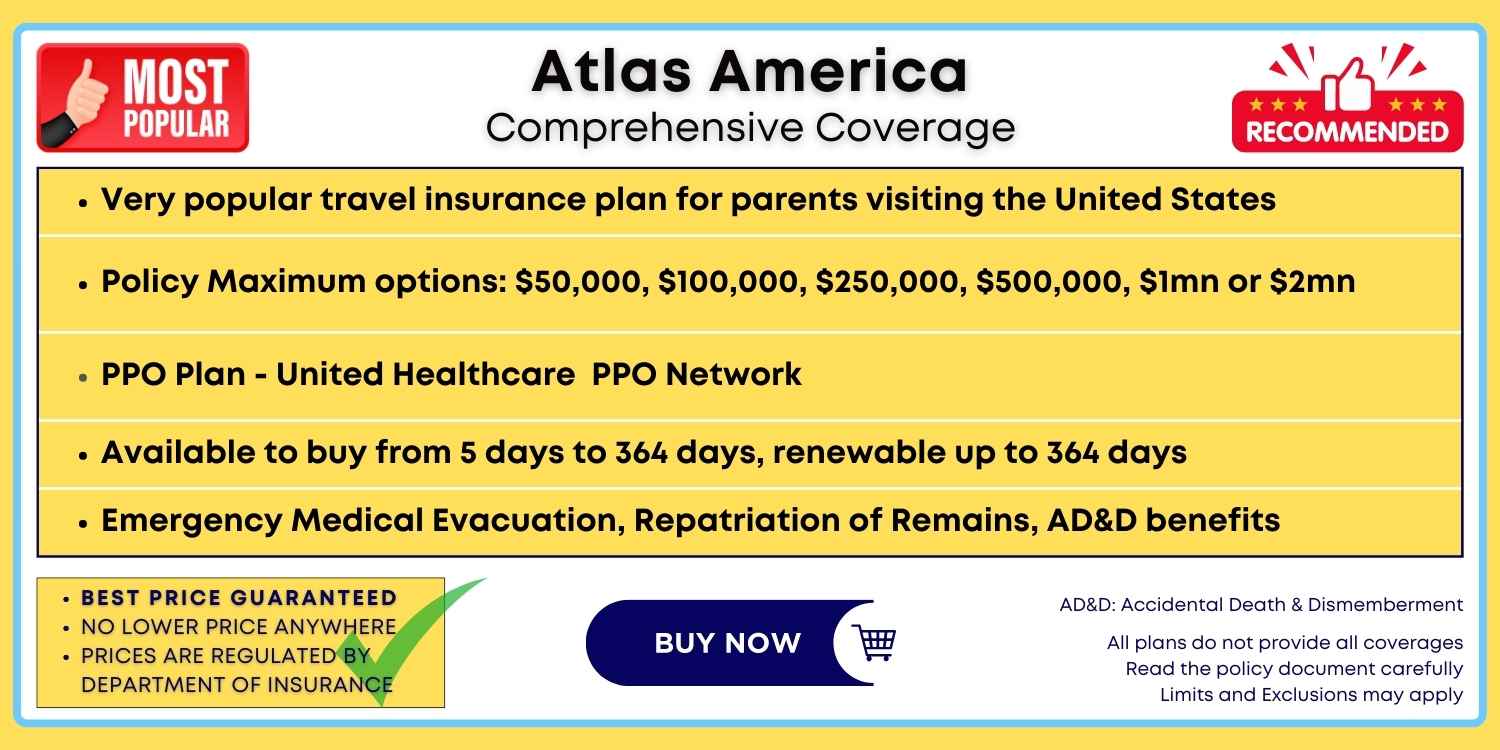

Atlas America Travel Insurance

- Administered by WorldTrips

- Comprehensive coverage

- Coverage for US and non-US residents traveling outside their home country to visit the US

- Coverage duration is from 5 days to 365 days, renewable up to 364 days

- The policy maximum is up to $2,000,000

- Deductibles options from $0 to $5,000

- Plan pays 100% up to the policy maximum after the deductible is met

- PPO networkBefore you buy this plan, make yourself aware of the Top 10 Reasons to Buy Atlas America for Parents Visiting USA to know why it is amongst one of the most popular plans, before deciding on the plan.

Safe Travels USA Comprehensive

- Administered by Trawick International

- Comprehensive coverage

- Coverage for non-US citizens traveling outside their home country to visit the US

- Coverage duration is from 5 days to 365 days, renewable up to 364 days

- The policy maximum is up to $1,000,000

- Deductibles options from $0 to $5,000

- Plan pays 80% of the first $5,000 of eligible expenses, then 100% up to the policy maximum

- PPO network

Visitors Care Travel Insurance

- Administered by International Medical Group (IMG)

- Limited coverage plan for Non-US citizens traveling to the USA

- Coverage is available from 5 days to 365 days, renewable up to 24 months

- Coverage for acute onset of pre-existing conditions up to $100,000

- Policy maximum up to $100,000

- Deductible per incident options available $0, $50 & $100

VisitorSecure

- Administrator: WorldTrips

- Underwriter: Llyod’s of London

- AM Best Rating: A

- Coverage Type: Limited (Fixed Coverage Plan)

- Not Available in: New York, Maryland, Washington

- Provides Coverage: For USA and International

- For Non-US citizens traveling outside their home country

- Covers: Acute Onset of pre-existing conditions up to policy Maximum (for age below 70 years)

- Coverage Duration: Minimum 5 days Up to 364 days

- Policy Maximums: From $50,000 to $130,000

- Deductibles: from $0 to $200 (Depending upon the age)

- Providers Network: Visit any doctor (No PPO Network)

- Cancellable: Yes

Inbound USA Insurance

- Administered by Seven Corners

- Limited coverage plan for Non-US Citizens traveling to the USA

- Coverage is available from 5 days to 364 days

- A deductible of $0 to $200 Per Injury/Per Sickness

- Policy maximum up to $150,000

- State Restrictions for Maryland, Washington, New York, South Dakota, and Colorado

- Pre-existing conditions are not covered except for an Acute Onset of a Pre-existing Condition up to $120,000

Visitors Protect by IMG (Pre-Existing Medical Conditions Coverage)

- Administered by IMG

- Underwriter: SiriusPoint Speciality Insurance Corporation

- AM Best Rating: A

- Comprehensive coverage for non-US residents traveling outside their home country to the US, Mexico, or Canada

- Coverage Duration: From 90 days to 12 Months

- Temporary Medical Insurance with coverage for Pre-existing conditions.

- Pre-existing conditions covered (Limits Apply)

- The policy maximum from $50,000 up to $250,000 (for ages below 70 years)

- Deductibles: $250, $500, $1,000, $2,000, $5,000(Per Insured person)

- Emergency Reunion: $100,000

- Return of Minor Children: $100,000

- Emergency Medical Evacuation: $25,000

- AD&D: $25,000 (Death occurs 90 days from the accident)

- Return of Mortal Remains: $25,000

- Local Burial/Cremation: $5,000 (Maximum Limit)

INF Elite Insurance (Pre-Existing Medical Conditions Coverage)

- Administered by INF Visitors’ Insurance Plans

- Comprehensive coverage for non-US residents traveling outside their home country to the US, Mexico, or Canada

- Coverage duration is from 90 days to 364 days

- Pre-existing conditions coverage is available

- The policy maximum is up to $1,000,000

- Deductible options are $100, $250, $500, $1,000, $2,500, or $5,000 per Injury/Sickness

INF Premier Insurance

- Administered by INF Visitors’ Insurance Plans

- Limited coverage for non-US residents traveling outside their home country to the US, Mexico, or Canada

- Coverage duration is from 30 days to 12 months

- Covers All Pre-Existing Conditions up to $60,000

- First Health PPO Network

- Coverage for Dental & Vision Medical Services

- Coverage is available for travelers up to age 99

How much does Visitors’ Insurance cost?

The cost of visitor insurance can vary significantly based on a number of variables, including the length of the visit, the visitor’s age, the type of coverage chosen, and the insurance provider.

Factors that determine the cost of travel medical insurance in the USA are:

Area of Coverage:

Due to the high expense of medical bills in the country, visiting the United States will result in a greater premium than traveling to another region of the world.

Age factor:

Another factor that may affect the price of USA visitors’ insurance is the traveler’s age. Due to their higher risk of illness or accident, older visitors may be assessed higher premiums.

Visitors of all ages can discover a visitor insurance package that meets their requirements.

Duration of stay

One of the main elements influencing the price of visitor insurance is the length of the visit. The cost of insurance often increases with the length of stay in the US.

Level of coverage

The price of travel insurance may vary depending on the type of coverage chosen. While more comprehensive policies may offer extra benefits like trip interruption coverage, dental coverage, or coverage for the acute onset of pre-existing conditions, basic plans typically only give limited coverage for medical expenses. The cost of insurance rises with the extent of the coverage.

When choosing a USA visitors’ insurance plan, visitors should take into account the deductible and coverage limits in addition to the aforementioned elements. The premiums may be less expensive with a higher deductible, but the out-of-pocket costs for visitors’ medical care will be more. Similar to coverage options, coverage limits can differ significantly between plans, with more expensive ones typically providing higher options.

Which USA insurance providers offer the best visitor insurance?

The ideal insurance provider for you will depend on your unique demands and circumstances. There are various insurance companies that provide visitors insurance in the USA.

Here are a few well-known companies that provide visitors insurance in the USA:

- IMG Global Travel Insurance

- Seven Corners Travel Insurance

- Trawick International Travel Insurance

- WorldTrips – Tokio Marine Travel Insurance

- INF Travel Insurance

How to choose the right visitor medical insurance plans?

To guarantee that you have sufficient coverage during your journey to the US, it is crucial to select the appropriate visitor insurance plan. Here are some things to take into account while choosing visitors medical insurance policy:

Type of Coverage:

Depending on your unique situation, you may require several types of insurance. Emergency care and hospitalization are examples of basic coverage, however more comprehensive coverage could also provide benefits including trip cancellation, accidental death and dismemberment, and covering for newly discovered pre-existing diseases. The coverage specifications of each plan should be thoroughly examined in order to choose the one that best suits your needs.

Deductible:

The deductible is the sum you must pay before your insurance agent begins to pay for medical costs. Plans with greater deductibles typically have cheaper rates, but prior to the insurance coverage starting, customers should think about how much they are willing and able to spend out of cash.

Coverage Limits:

The maximum sum that the insurance provider will pay for charges that are covered will vary depending on the plan. Visitors should choose a plan with sufficient coverage limitations and take into account their possible medical expenses.

Provider Network:

Some insurance companies could have a list of recommended medical professionals who charge less. If these providers are available to them, visitors should think about how much they can save by using them and buy health insurance from a reputed provider which provide adequate health coverage.

Coverage Duration:

In order to ensure that they have coverage for the entire trip, visitors should think about how long they plan to stay in the US.

Pre-Existing Conditions:

If you have a pre-existing medical condition, it’s crucial to choose a plan that covers pre-existing conditions that manifest suddenly or that cover your particular condition.

Price:

Customers should evaluate insurance costs from several companies and choose the plan that offers the most value for their money.

Visitors should carefully examine the plan details and exclusions in addition to these considerations to be sure they are aware of the coverage and any potential limitations or restrictions. Visitors who take the time to choose the best travel medical insurance plan can feel secure knowing that they will have enough coverage while visiting the US.

Frequently Asked Questions

What distinguishes plans with fixed coverage from those with comprehensive coverage?

While comprehensive coverage plans provide more extensive coverage for medical costs, emergency evacuation, and other covered medical expenses, fixed coverage plans have a set benefit amount for each covered medical expense.

After I arrive in the US, can I purchase visitor insurance?

Yes, you may acquire visitors medical insurance once you reach the US. To make sure you are covered from the start of your vacation, it is advised that you buy insurance before leaving your home country.

CAN I GET HEALTH INSURANCE for parents visiting usa?

You can buy visitor medical insurance for parents visiting USA.

A person who is a US citizen, an immigrant, a permanent resident, or someone who is currently in the US on a work visa may submit the application on their parent’s behalf and pay the business with a debit or credit card.

Can pre-existing medical issues be covered by visitors insurance?

Pre-existing medical issues may be covered by some visitors insurance policies but not by others. Understanding the coverage and benefits offered by the plan requires a close reading of the policy.

When should I get USA visitors’ health insurance?

We advise you to get visitor health insurance after making your flight and/or travel arrangements. The planning process should begin the day you depart for your destination and continue until you get there.

Which US visitor travel insurance for parents visiting the USA is the best?

The best health insurance for parents visiting the USA should be chosen based on a variety of considerations. Visitors should contrast comprehensive visitors insurance plans with set benefits. Foreign tourists to the USA should be aware of the ideas of deductibles, co-insurance, and travel health insurance for pre-existing diseases. A wise and well-informed traveler will select the best tourist insurance in the USA for his or her particular requirements.

Can you buy visitor insurance to the USA after making travel plans?

Yes, after making trip reservations, you can buy visitor insurance for the United States. In order to ensure that you have coverage in the event of unforeseen situations, it is actually advised that you buy visitor insurance as soon as you can after making travel arrangements.

Many insurance companies let you choose a flexible start date for your visitor insurance plan, so you can buy protection even if your travel dates are already booked. Before making a purchase, it’s crucial to carefully research each insurance plan’s terms because some insurance plans may have limitations or exclusions depending on when you acquire the plan.

How can I submit a claim for USA visitor health insurance?

The claim can be filed by emailing the insurance provider with the completed claim form and a scanned copy of the hospital bill and any related receipts. After receiving the bill, the insurance provider reimburses the customer for the expenses. The doctor’s provider can send the insurance provider a direct bill, and they can pay the doctor directly if the hospital provider and insurance company agree to direct billing.

In the US, do I require student health insurance?

It is strongly advised that you have student health insurance if you are an international student studying in the US. International students are frequently required to carry health insurance as a prerequisite for enrollment at several universities.

In the event of unforeseen healthcare costs or accidents, which may be very expensive in the US, having this insurance might offer financial security. While you are studying in the US, it may also give you access to high-quality healthcare and medical services.

What is the oldest age at which travelers can purchase this USA travel insurance?

From the age of 14 days to 90+ years old, there are different levels of travel insurance. It’s crucial to keep in mind that, for the majority of plans, the benefit changes and sharply decreases after age 70.

Do foreign Visitors who visit the US need health insurance?

Though medical insurance is not mandatory to visit the United States, it is recommended to buy visitors insurance when you travel to the USA. Healthcare costs in the USA are very expensive, even minor medical illnesses can burn a hole in your pocket. Serious conditions that require hospitalization can be financially disastrous. Without adequate visitors’ medical insurance, you risk having to bear all costs from your pocket.

Conclusion

In conclusion, anyone contemplating a vacation to the United States should take visitors’ medical insurance into account. Review the plan document before you buy visitor medical insurance. Ensure you are covered for any eventuality and travel worry-free.

Travel safe!