Travel Insurance from India to USA – All You Need to Know

Having a travel insurance from India to USA for anyone traveling to the USA from India needs proper consideration, the need to buy visitors insurance should not be overlooked.

Though visitors insurance is not mandatory to visit the United States healthcare in the USA is very expensive.

Unexpected events like illness, accidents, mishaps, or lost luggage can interfere with your trip plans and result in financial losses. It’s crucial to obtain travel insurance if you want to safeguard yourself against such unforeseen events.

A visit to a doctor for a common cold or flu can set you back by a few hundred dollars!!!

The best travel insurance ensures that you will have the financial support you require if you experience any health problems on your USA trip.

Whether you are there as a tourist, to visit your children, or even for business visitors. Getting visitor insurance is essential for safeguarding your health and safety while traveling to the USA from India.

If your parents are visiting the USA then reading Travel Insurance for Parents Visiting USA will also be helpful to you.

This blog article discusses all you need to know about travel insurance from India to the USA. This will help Indian visitors to the United States.

Watch this short video

Table of Content:

-

What is travel insurance?

-

Why should visitors from India to the USA get insurance?

-

What does travel insurance cover?

-

What are the types of the travel insurance plans for Indian visitors from India to USA?

-

How to buy the best visitor insurance plans for parents visiting the USA from India?

-

What is the cost of USA travel insurance plans?

-

How to buy travel insurance from India to USA?

-

Frequently Asked Questions (FAQs)

What is Travel Insurance?

A type of insurance policy known as travel insurance offers coverage for unanticipated situations that may arise while you are traveling. Many insurance companies offer travel insurance which is made to guard you against monetary losses that could occur as a result of circumstances like a trip interruption or cancellation, medical emergency, misplaced or stolen luggage, and personal liability.

But Is Travel Insurance Worth it? if it gives financial Protection and peace of mind while traveling read on, to make your trip more enjoyable and less stressful.

Why should visitors from India to the USA buy visitors insurance?

When you buy visitors insurance it offers protection against unforeseen events that can happen while you’re away, like medical emergencies, trip cancellations, and lost luggage.

Without travel insurance for USA, you will need to cover these costs from your own pocket, and that can be quite expensive.

Watch our video on YouTube on Top 10 Reasons to Buy Travel Insurance

What does Travel Insurance cover?

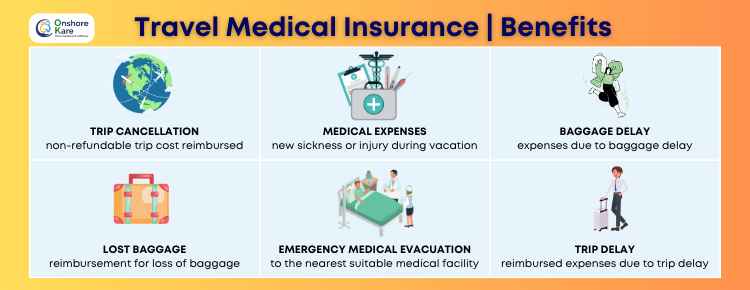

Travel insurance frequently covers medical expenses, emergency evacuation, trip cancellation or interruption, lost or stolen luggage, and personal liability.

Before you buy visitors insurance, it is important to check with the insurance provider because some policies may also cover adventure sports or pre-existing medical conditions.

You must also be aware of the Common Exclusions in Travel Insurance do check it out before finalizing.

Visitors’ insurance provides the following medical benefits:

Emergency Medical Expenses

This insurance covers any medical fees you may incur if you become ill or injured while traveling. It might pay for hospitalization, medical bills, and prescription drugs.

It covers the costs of any medical treatment you might need while traveling, such as hospitalization, physician fees, prescription medication, and emergency dental care. Some insurance policies may also cover the expense of medical transportation, such as airlift.

Emergency Evacuation:

This coverage can help with the associated costs if you need to be transported to a hospital or returned home due to a medical emergency.

You might need medical evacuation in some situations if you need medical care that is unavailable locally or if you need to go home for more care. Emergency medical evacuation can be quite expensive without medical insurance coverage.

In emergency life-threatening sickness or injury, Your Medical Evacuation Insurance pays for the costs of transporting you to a hospital when you need medical care.

Trip Cancellation or Interruption:

This coverage can pay you for the non-refundable costs you have already spent, such as airline tickets or hotel reservations, if you need to cancel or interrupt your trip due to unforeseen circumstances like illness or a natural disaster.

Baggage Lost or Stolen:

If your luggage or other personal items are lost or stolen while you’re traveling, travel medical insurance will pay you for it.

Personal Liability:

Apart from medical coverage, a travel insurance plan can also protect you financially from third-party damage. In the event that you are held accountable for the harm, you may have caused to someone else’s property or someone else’s health while on vacation.

Accidental Death and Dismemberment (AD&D):

Travel medical insurance may offer a lump sum payment to you or your beneficiaries in the event that an accident leaves you dead or permanently disabled. This is applicable if your travel insurance covers AD&D.

Repatriation of Remains:

In case of the death of the insured, a travel medical insurance policy may be able to help with the expense of repatriation of remains.

What are the types of Travel Insurance Plans for Indian visitors from India to USA?

Some of the travel insurance options for Indian visitors traveling to USA are:

- Individual Travel Insurance

- Family Travel Insurance

- Group Travel Insurance

- Student Travel Insurance.

Selecting the appropriate policy depending on your travel requirements is crucial because each type of policy offers various coverage and perks.

Travel insurance policies come in a variety of forms, each created to satisfy the requirements of a certain group of travelers. The following are some of the popular types of travel insurance:

Insurance for Trip Cancellation or Interruption:

This kind of insurance covers non-refundable costs in the event that you have to postpone or cancel your trip due to a covered event, such as illness, injury, or bad weather. The price of airline tickets, hotel bookings, and other pre-paid travel costs may be covered expenses.

Travel Medical Insurance:

This kind of insurance covers potential medical costs incurred when traveling abroad from your country of residence. It can pay for healthcare costs including hospitalization, physician bills, prescription drugs, and urgent dental care.

Insurance that covers Emergency Medical Evacuation:

If you become extremely ill or injured while traveling, this sort of insurance will pay for your transportation to a hospital or other medical institution. Additionally, it can pay for your repatriation if you need to be taken back home for medical care.

Insurance for baggage and personal effects:

This kind of visitor health insurance protects you against the loss, theft, or destruction of your luggage and other possessions while you’re on the road. If your luggage is delayed or lost while you’re traveling, it may also cover the expense of replacing important items.

Insurance for rental car damage:

This kind of visitors insurance covers damage to a rental car sustained while traveling. Both alone and as a component of a comprehensive travel insurance plan, it is available for purchase.

Insurance for adventure sports:

This kind of insurance covers accidents or injuries sustained while engaging in high-risk activities like bungee jumping, skydiving, and scuba diving.

How to buy the best visitor insurance plans for parents visiting the USA from India?

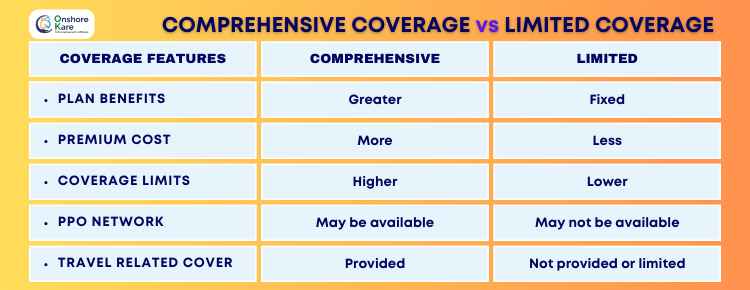

For Indians traveling to USA, a top-rated insurance company offers a variety of international travel insurance options between India and the United States. There are two types of policies, fixed benefit, and comprehensive visitors insurance, depending on the requirements for travelers’ coverage.

While comprehensive policies are pricey and provide extensive coverage, fixed benefit insurance is more affordable but offers more restricted coverage.

Some of the most popular visitors health insurance plans for visitors to the USA are :

- Patriot America Plus by International Medical Group (IMG)

- Atlas America by WorldTrips

- Safe Travels USA comprehensive by Trawick International

- INF Elite and INF Premier by INF Visitors Insurance plans

How is the Fixed Benefit plan different from the Comprehensive plan?

Limited plans, often called fixed benefit plans are frequently less expensive than comprehensive policies and include a smaller range of benefits.

These policies typically cover unexpected medical expenses, emergency medical evacuation, travel interruption or cancellation due to things like death, illness, or extreme weather, as well as lost or delayed baggage.

The coverage limits for these benefits, however, are typically more limited than those provided by comprehensive policies.

On the other hand, comprehensive plans offer a wider range of coverage and are more expensive than limited policies.

These policies often cover unexpected medical bills, emergency medical evacuation, trip interruption or cancellation for any reason, lost or delayed luggage, and accidental death and limb loss.

Get more details before deciding between Comprehensive Coverage vs Fixed Coverage to know what suits your needs.

Additionally, some all-inclusive plans could include cover damage to rental cars, adventure sports, and pre-existing medical issues.

What is the cost of USA Travel Insurance Plans?

The cost of travel health insurance coverage for visitors to the USA depends on the factors below:

The Travelers’ Age :

The age of the traveler directly affects how much the travel insurance plan will cost. The cost of the visitor’s health insurance will increase as the traveler becomes older.

Travel Insurance Types

Travel insurance with comprehensive coverage costs more than travel insurance with fixed benefits.

Optional Deductibles and Maximum Coverage

The cost of visitors’ health insurance is directly correlated with the maximum medical coverage and inversely related to the selected plan’s deductible.

Coverage Area

The coverage area affects the cost of the travel insurance plan. The most expensive visitor health insurance is for the United States.

Travel Insurance Duration of Coverage

The cost will increase since visitor medical insurance is required for a longer period of time.

You can Check Cost and Compare Plans here before deciding.

Pre-Existing Conditions Coverage

A pre-existing condition is a health issue that existed before the travel insurance policy was issued. Acute onset of a pre-existing condition is sudden, without warning recurrence of the condition that necessitates immediate medical intervention.

It is frequently challenging for Indian travelers with pre-existing diseases to purchase visitors’ medical insurance. There are many problems that are regarded as pre-existing diseases, but some of the frequent illnesses in this group include diabetes, cancer, high blood pressure, kidney disease, asthma, and conditions related to the heart and the blood vessels. Most insurance companies have restrictions and conditions governing the pre-existing condition coverage they offer.

Indian Travelers can purchase visitors’ insurance plans without undergoing a medical exam, but the majority of insurance companies only cover the acute onset of pre-existing conditions. It is crucial for any travelers from India who have one of these ailments to purchase a policy that covers them and to be knowledgeable about the conditions of pre-existing condition coverage benefits.

Here is a list of some of the Best Visitors Insurance for Pre-Existing Medical Conditions that you can go through.

How to buy Travel Insurance from India to USA?

It’s crucial to buy travel insurance if you’re planning a journey from India to the US in order to safeguard yourself from unanticipated occurrences like medical emergencies, trip cancellations, or lost luggage. The steps to buying travel insurance for USA are as follows:

Determine how much Travel Insurance Coverage you need:

It’s crucial to think about your travel requirements and the dangers associated with your trip before buying visitors insurance coverage. Think about things like your travel plans, intended activities, duration of stay, and medical history. This will enable you to choose the kind of insurance you require.

Compare Visitors’ Insurance Plans

After determining your visitors’ insurance requirements, it’s vital to examine the coverage offered by various insurance companies.

To choose a policy that best suits your needs and budget, examine coverage limits, deductibles, and exclusions for policies that offer coverage for the risks associated with your trip.

Compare Visitors’ Insurance Plans

Purchase a Policy

You can buy visitors insurance either online or from an insurance agent after you’ve made your choice. You can also buy visitors insurance from medical providers who offer travel insurance and buy an insurance plan from the insurance providers directly.

To ensure that you are qualified for coverage when purchasing insurance, be careful to provide correct information about your trip and any current medical issues.

Review Policy Documentation

After acquiring a visitors insurance policy, it’s crucial to carefully read the policy documents to comprehend the coverage and exclusions. Make sure to write down the insurance company’s contact details and the claim submission guidelines.

Always carry your policy documentation with you

A copy of your visitors’ insurance policy papers should be brought with you when visiting the United States. By doing this, you will make sure that you have access to crucial data in the event of an emergency or if you need to submit a claim.

Frequently Asked Questions

Do I require a visa to enter the United States?

A visa is necessary for Indian citizens to enter the United States.

Is travel insurance required for trips to the United States?

Although visitors’ medical insurance is not required, it is strongly advised to protect yourself from unforeseeable events.

Which place should I travel to while visiting USA?

There are many places to visit in the USA from the Grand Canyon to Las Vegas to New York City to the Golden Gate, the US offers a vast playground for every type of visitor. There are many national parks that you can visit like Yellowstone, Yosemite, etc. Carefully planning your trip will help you get the maximum out of it.

Can I purchase travel insurance once I arrive in the USA?

Visitors’ medical insurance is available from some insurance providers for those who have already arrived at their destination. It is advised to purchase visitors’ medical insurance before leaving on your trip, nevertheless.

Which should I choose: a US or Indian insurance provider?

If you or a family member is traveling to USA from India, you’re undoubtedly considering getting travel medical insurance or visitors insurance.

If you are an Indian citizen traveling to the USA, you may be debating between purchasing your visitor’s insurance from India or the United States.

Before deciding you must be aware of The hidden cost of cheap travel insurance from India or you may end up spending more out of pocket when you travel abroad.

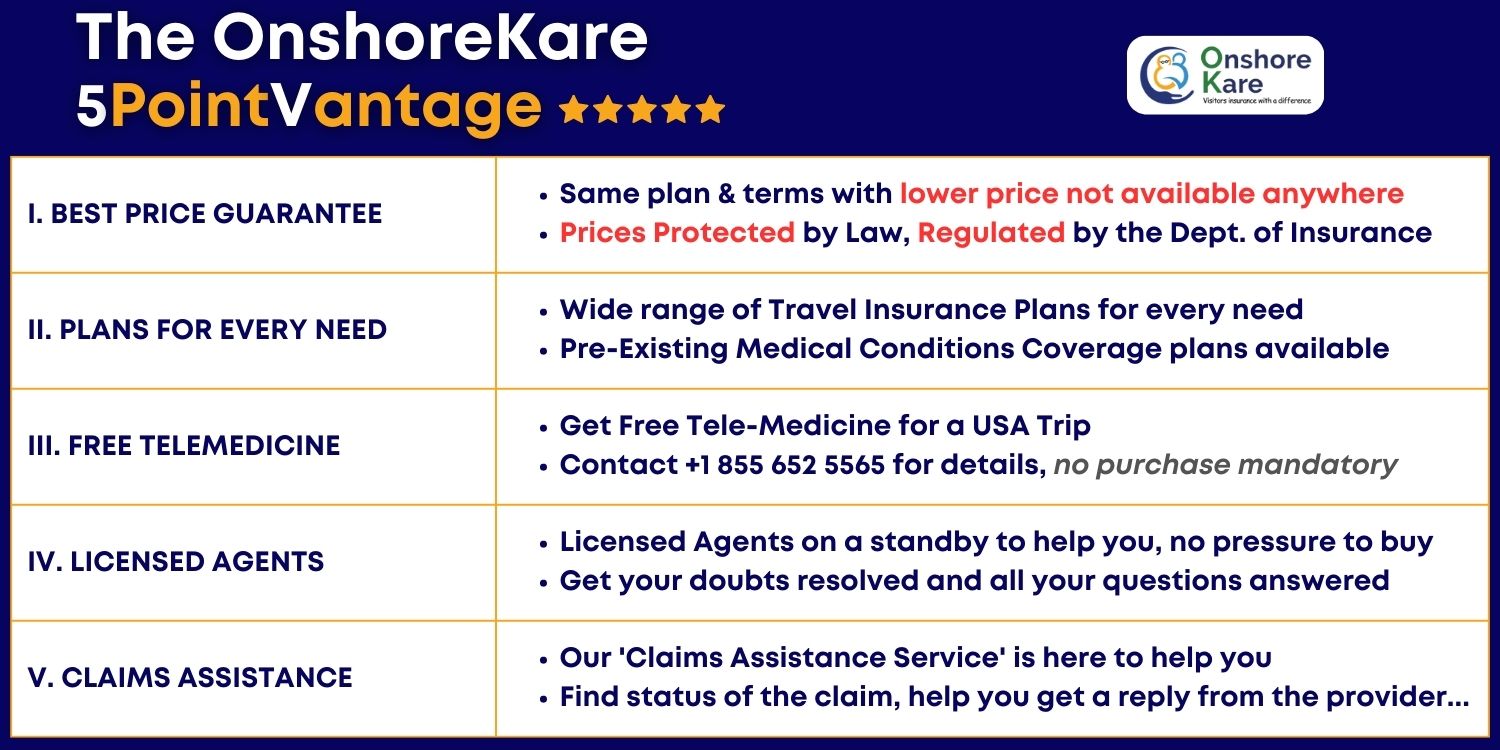

Some of the reasons why you should choose a USA insurance company rather than an Indian insurance company are :

- When buying visitors insurance from an Indian-based insurance company, when you have to use the policy you will need to coordinate with the travel insurance providers and it is easier when the company is based in the USA.

- The insurance providers in the USA are regulated by the Department of Insurance whereas the Indian companies are not regulated in the United States.

- If the traveler is already in the USA then they cannot buy visitors insurance from India, they have to buy it from a US-based provider.

- When you are subject to U.S. law, Indian insurance regulations might not be able to safeguard your rights.

- In an emergency, if you need immediate assistance, connecting with the customer support of an Indian insurance provider might be difficult, as it might be unavailable in the U.S. time zone. This might cause delays when you need assistance or have to file claims.

What are the Common exclusions in visitor insurance policies?

High-risk activities:

Some visitors’ insurance plans don’t cover dangerous pursuits like scuba diving, bungee jumping, and skydiving. Verify that they are covered by your policy if you want to engage in any high-risk activities while on your trip.

Mental Health Issues:

Many visitors’ insurance policies do not cover mental health issues. Your policy might not provide coverage if you have a mental health condition and need medical care while traveling.

War or terrorism:

Visitors’ insurance policies might not cover harms or losses brought on by terrorism or war. It’s critical to confirm that your policy covers you if you are going to a place where terrorism is a concern.

Are free healthcare facilities provided in the USA?

In the USA, healthcare is provided through a combination of privately and publicly funded health programs. So, there exist both for-profit and nonprofit clinics and hospitals. However, the government-sponsored free healthcare facility is provided to the people of the nation. Visitors and tourists are not eligible for free healthcare services. Therefore, if you experience a medical emergency while flying to the USA and require assistance, you will be responsible for paying for it.

The USA offers some of the top medical technologies and healthcare facilities in the world. However, the amenities are not inexpensive. Hospitalization and medical care are highly expensive and can easily cost thousands of dollars in Indian rupees.

Medical crises and medical expenses are covered by visitors insurance policies. You wouldn’t have to look for or worry about free healthcare facilities on the trip if you have a travel strategy from a reputable insurance provider. You can receive the required medical care, and the costs will be covered by your visitors’ insurance plan.

Can a visitor to the USA purchase health insurance?

Yes, tourists to the USA can get short-term travel health insurance. For travelers and tourists to the USA, reputable US insurance companies offer travel health insurance plans. Travelers can buy health insurance based on their choice. Evaluate travel insurance solutions from India to the USA based on pricing as well as coverage advantages.

Based on their unique requirements, travelers can get the finest US travel insurance from India to the US.

Conclusion

One of the safety and precautionary measures of International travel is to buy travel insurance, it is crucial to pick the correct plan based on your trip requirements.

You can also buy visitors insurance from a reputable online marketplace like OnshoreKare and get a no-obligation quote in less than 60 seconds.

To guarantee that you are covered in the event of an unforeseen catastrophe, it is crucial to buy travel health insurance from a reputable insurance company. Before buying a policy, make sure to carefully read the policy papers and comprehend the coverage and exclusions.

Always travel under the cover of insurance!