What is an Acute Onset Of Pre-Existing Conditions?

What Is Covered, What Gets Denied, and Why Most Travelers Get This Wrong

Quick Reality Check: Acute Onset Coverage Is NOT Full Pre-Existing Condition Insurance

Acute onset coverage in travel insurance is not full coverage for pre-existing medical conditions.

It is limited, emergency-only protection, and it applies only when strict insurer-defined conditions are met at the time of the medical emergency.

Most travel insurance claim denials involving pre-existing conditions do not happen because travelers lied, hid information, or bought the wrong insurance plan.

They happen because travelers misunderstood what insurers mean by acute onset of a pre-existing condition.

If you are traveling to the United States — especially if you are arranging travel insurance from India for parents, senior family members, or travelers with chronic but “controlled” medical conditions — this distinction matters more than the plan name, price, or coverage limit.

When acute onset eligibility rules are not met, even a genuine medical emergency in the U.S. can be partially paid or fully denied.

Why Acute Onset of Pre-Existing Conditions Confuses So Many Travelers in Travel Insurance

Travel medical insurance feels simple until a pre-existing condition enters the picture.

When a condition is stable or well controlled, many travelers assume:

- “It shouldn’t be an issue”

- “The condition hasn’t caused problems in years”

- “If something sudden happens, travel insurance will cover it”

These assumptions usually rest on one phrase commonly found in travel insurance policy documents:

“Acute onset of a pre-existing condition.”

Here’s where confusion begins.

Travelers tend to interpret the word acute emotionally — based on how sudden, painful, or serious the emergency feels.

Insurance companies interpret acute medically and contractually, based on predefined criteria written into the policy.

A medical emergency can be severe, frightening, and even life-threatening — and still be denied — if it does not meet the insurer’s definition of acute onset.

This misunderstanding is especially common among:

- Parents visiting the United States

- Senior travelers

- Travelers with long-standing but controlled conditions

- First-time buyers of visitor or travel medical insurance

This guide explains how insurers actually define acute onset, how claims are evaluated in practice, and why many denials are predictable — and avoidable — before travel begins.

Why Acute Onset of Pre-Existing Conditions Confuses So Many Travelers in Travel Insurance

Travel medical insurance feels simple until a pre-existing condition enters the picture.

When a condition is stable or well controlled, many travelers assume:

- “It shouldn’t be an issue”

- “The condition hasn’t caused problems in years”

- “If something sudden happens, travel insurance will cover it”

These assumptions usually rest on one phrase commonly found in travel insurance policy documents:

“Acute onset of a pre-existing condition.”

Here’s where confusion begins.

Travelers tend to interpret the word acute emotionally — based on how sudden, painful, or serious the emergency feels.

Insurance companies interpret acute medically and contractually, based on predefined criteria written into the policy.

A medical emergency can be severe, frightening, and even life-threatening — and still be denied — if it does not meet the insurer’s definition of acute onset.

This misunderstanding is especially common among:

- Parents visiting the United States

- Senior travelers

- Travelers with long-standing but controlled conditions

- First-time buyers of visitor or travel medical insurance

This guide explains how insurers actually define acute onset, how claims are evaluated in practice, and why many denials are predictable — and avoidable — before travel begins.

What This Guide Helps You Understand About Acute Onset Coverage Before Traveling to the USA

This guide is designed to help you clearly understand:

- What insurers legally classify as a pre-existing condition

- What acute onset means in travel insurance policies

- When emergency treatment may be covered — and when it is excluded

- Why stability before travel plays a critical role in claim decisions

- Why the same medical condition can be covered in one case and denied in another

- Why acute onset coverage is not the same as a pre-existing condition waiver

This is particularly important for visitors traveling to the United States, where medical costs are high, claim scrutiny is strict, and misunderstandings around pre-existing condition coverage often lead to unexpected out-of-pocket expenses.

The sections that follow break this down step by step, using insurer definitions and real-world claim logic — not marketing language — so you can make informed decisions before you rely on acute onset coverage.

What Is a Pre-Existing Condition in Travel Insurance?

In travel insurance, a pre-existing condition is any medical condition that existed before your policy start date, regardless of how mild, controlled, or inactive it may feel to you.

Insurers do not decide this based on how you feel today.

They decide it based on medical history and documented records.

A medical condition is considered pre-existing if, before your travel insurance policy began, any of the following applied:

- You received a medical diagnosis

- You underwent treatment or medical monitoring

- You were prescribed medication

- You experienced symptoms that reasonably required medical attention

Even if the condition is well managed, symptom-free, or has not caused issues for years, it can still be classified as pre-existing under travel insurance rules.

Stability Does NOT Remove Pre-Existing Condition Classification in Travel Insurance

This is where many travelers — especially parents visiting the United States — get caught off guard.

A condition being stable does not mean it is no longer pre-existing.

Stability affects eligibility for limited benefits, such as acute onset coverage.

It does not change how the condition is classified.

From an insurer’s perspective:

- A stable condition is still a pre-existing condition

- Stability only determines whether limited emergency coverage may apply

This distinction is critical and directly affects claim outcomes.

Why Pre-Existing Condition Definitions in Travel Insurance Directly Affect Claim Decisions

Travel insurance policies rely on objective, documentable criteria — not personal judgment or intent.

Insurers evaluate pre-existing conditions using:

- Doctor visit records

- Prescription histories

- Diagnostic tests and reports

- Treatment timelines

This approach allows insurers to assess risk consistently, but it also means:

- Feeling “fine” is not a deciding factor

- Personal explanations carry less weight than medical documentation

For travelers to the United States — where medical costs are high and claims are closely reviewed — this definition determines whether:

- Acute onset coverage may apply

- A claim is partially paid

- Or a claim is denied entirely

Understanding this definition before travel is essential, especially when arranging travel insurance from India for parents, seniors, or family members with long-standing medical conditions.

Key Takeaways About Pre-Existing Conditions in Travel Insurance

If a medical condition existed in any documented form before your policy start date, insurers will treat it as pre-existing, even if it is controlled or inactive.

The next section explains when and how acute onset coverage may still apply, and why stability before travel becomes the most important factor insurers examine.

What “Acute Onset” Actually Means in Travel Insurance

In travel insurance, acute onset does not mean that a medical emergency felt sudden, painful, or serious to the traveler.

Insurers use a strict medical and contractual definition, not an emotional one.

For a medical event related to a pre-existing condition to qualify as acute onset, all of the following criteria must be met at the time of treatment.

If any one of these conditions is not satisfied, the claim is likely to be denied.

1. Sudden: Symptoms Must Appear Abruptly, Not Gradually

Symptoms must appear abruptly and escalate quickly.

They must not:

- Develop gradually over days or weeks

- Represent a slow worsening of an existing condition

- Be part of an ongoing or recurring pattern

From an insurer’s perspective, gradual progression is not acute, even if treatment becomes urgent later.

2. Unexpected: No Prior Warning Signs or Foreseeable Need for Care

The medical event must be unforeseen based on prior medical history.

This condition fails if, before travel or policy start:

- Symptoms were already present

- Warning signs were ignored

- Follow-up care was advised or expected

- Tests, investigations, or treatment were pending

If medical records show that care could reasonably have been anticipated, the event is considered foreseeable, not acute.

This is one of the most common reasons acute onset claims are denied.

3. Emergency: Immediate Medical Treatment Must Be Medically Necessary

The situation must require immediate, medically necessary treatment.

Acute onset coverage does not apply to:

- Routine or planned care

- Monitoring, observation, or follow-up visits

- Elective procedures

- Preventive treatment

Insurers assess whether delaying treatment would have posed a serious medical risk.

If not, the event may fail the emergency requirement.

Why Severity Alone Does NOT Qualify as Acute Onset in Travel Insurance

This is where many travelers — especially parents visiting the United States — are surprised.

A medical event can be:

- Extremely painful

- Clinically serious

- Even life-threatening

…and still be denied, if insurers determine that

- Symptoms were present before travel

- The condition was worsening gradually

- Treatment was reasonably foreseeable

In travel insurance, severity does not override predictability.

Insurers focus on timing, stability, and medical documentation, not how frightening the emergency felt in the moment.

Why Acute Onset Definitions Matter More for Visitors to the United States

For visitors traveling to the United States, acute onset definitions are applied with particular scrutiny.

U.S. medical costs are high, and cy against:

- Medical timelines

- Prior treatment records

- Prescription history

- Physician notes

This is especially relevant when arranging travel insurance from India for:

- Parents visiting the USA

- Senior travelers

- Travelers with chronic but controlled medical conditions

Understanding how insurers define acute onset before travel is often the difference between a paid emergency claim and a denied one.

Key Takeaways About Acute Onset in Travel Insurance

- Acute onset requires a medical event to be sudden, unexpected, and an emergency

- All three conditions must be met — not just one

- Severity alone does not guarantee coverage

- Foreseeability based on medical records is a common denial trigger

- Acute onset coverage is limited, not comprehensive

The next section explains how stability before travel affects acute onset eligibility, and why even small changes in treatment history can influence claim outcomes.

Stability Before Travel: Where Most Acute Onset Claims Actually Fail

Acute onset coverage almost always depends on one factor more than any other:

medical stability before travel.

Even when an emergency during travel appears sudden and severe, insurers look backward — not forward — to determine whether the condition was stable before the policy start date and before travel.

This is where many travelers, especially parents visiting the United States, unknowingly lose eligibility for acute onset coverage.

How Insurers Define “Stability” in Travel Insurance

A medical condition is generally considered unstable if, shortly before your travel insurance policy began or before travel, any material medical change occurred.

Insurers commonly treat a condition as unstable if there was:

- A change in medication

- An increase or decrease in dosage

- Introduction of a new prescription or therapy

- New or worsening symptoms

- A doctor visit, ER visit, or hospitalization related to the condition

- Pending tests, investigations, or follow-up care

Even if the emergency during travel seems unrelated or unexpected, recent instability weakens — and often eliminates — acute onset eligibility.

Why Medical Timing Matters More Than Intent in Acute Onset Claims

Travelers often assume that intent matters:

- “The doctor wasn’t concerned”

- “The change was minor”

- “I felt fine when I traveled”

- “The emergency happened suddenly”

Insurers do not evaluate intent or personal judgment.

They evaluate medical timelines.

If medical records show that a condition was actively managed, adjusted, or monitored shortly before travel, insurers may determine that the emergency was foreseeable, not acute.

Common Stability-Related Mistakes That Lead to Claim Denials

The following scenarios frequently result in denied acute onset claims:

- Traveling soon after a medication adjustment

- Ignoring mild symptoms before departure

- Traveling while test results were pending

- Assuming a “routine” doctor visit does not matter

- Believing that stability resets automatically after a short period

From an insurer’s perspective, recent medical activity equals increased predictability, even if the traveler felt well.

Why Stability Is Scrutinized More for Travel to the United States

For visitors traveling to the United States, stability requirements are applied with heightened scrutiny.

U.S. medical costs are high, and claims involving pre-existing conditions are carefully reviewed against:

- Detailed treatment timelines

- Prescription refill histories

- Physician notes and recommendations

- Diagnostic testing records

This is particularly relevant when arranging travel insurance from India for:

- Parents visiting the USA

- Senior travelers

- Travelers with chronic but controlled medical conditions

Small, well-intentioned medical changes before travel often become decisive evidence during claim review.

Key Takeaways About Stability and Acute Onset Coverage

- Stability before travel is a core eligibility requirement for acute onset coverage

- Recent treatment or medication changes can invalidate eligibility

- Insurers rely on medical records, not personal explanations

- Foreseeability is often inferred from recent medical activity

- Stability affects eligibility, not whether a condition is pre-existing

The next section explains what acute onset coverage does NOT include, and why many emergencies fall outside coverage even when stability requirements are met.

What Acute Onset Coverage Does NOT Include in Travel Insurance

Acute onset coverage in travel insurance is narrow by design.

It is intended to cover sudden, unforeseeable medical emergencies linked to pre-existing conditions — not ongoing care, delayed treatment, or predictable complications.

Many denied claims occur even when a medical emergency is real, simply because the situation falls outside what acute onset coverage allows.

Understanding these exclusions clearly is essential to avoid costly assumptions, especially when traveling to the United States.

Gradual Worsening or Progressive Symptoms Are NOT Covered Under Acute Onset Travel Insurance

Acute onset coverage does not apply to medical conditions that worsen gradually.

This includes:

- Symptoms that develop over days or weeks

- A slow escalation of pain, discomfort, or dysfunction

- Recurrent flare-ups of a known condition

From an insurer’s perspective, gradual progression is foreseeable, even if treatment becomes urgent during travel.

Foreseeable progression does not qualify as acute onset.

Planned, Expected, or Follow-Up Medical Care Is NOT Covered Under Acute Onset

Acute onset coverage does not include:

- Planned or scheduled treatments

- Follow-up visits for known medical conditions

- Monitoring, observation, or routine evaluations

- Care that could reasonably have been arranged before or after travel

If medical care was anticipated, advised, or expected before travel, it is not considered acute — even if symptoms worsen while abroad.

Symptoms That Existed Before Travel but Were Ignored Are NOT Covered as Acute Onset

This is one of the most common reasons acute onset claims are denied.

Acute onset coverage does not apply when:

- Symptoms were present before departure

- Warning signs were ignored or downplayed

- Medical care was delayed until travel began

From an insurer’s standpoint, ignoring symptoms does not make an event sudden.

Medical records showing pre-travel symptoms typically outweigh traveler explanations during claim review.

Complications Caused by Missed Medication or Poor Control Are NOT Covered Under Acute Onset Travel Insurance

Acute onset coverage typically excludes complications that arise because:

- Prescribed medication was missed, stopped, or taken incorrectly

- Dosages were not followed as directed

- A condition was poorly controlled before travel

If a medical emergency results from non-adherence or inadequate management, insurers may classify it as preventable, not acute.

Ongoing Treatment for Chronic or Known Conditions Is NOT Covered Under Acute Onset Travel Insurance

Acute onset coverage does not extend to:

- Long-term treatment of chronic conditions

- Continued care for previously diagnosed illnesses

- Rehabilitation, therapy, or extended recovery services

Even when an initial emergency visit may qualify, subsequent or ongoing treatment is often excluded once the condition is stabilized.

Why Acute Onset Coverage Exclusions Matter More for Travel to the United States

For visitors traveling to the United States, these exclusions carry significant financial consequences.

U.S. healthcare costs are high, and claims involving pre-existing conditions are reviewed carefully against:

- Symptom timelines

- Treatment and visit history

- Medication adherence

- Physician notes and records

This is especially relevant when arranging travel insurance from India for:

- Parents visiting the USA

- Senior travelers

- Travelers with chronic but controlled medical conditions

Many large out-of-pocket expenses arise not because insurance was absent, but because expectations did not match policy limitations.

Key Takeaways About Acute Onset Coverage Exclusions in Travel Insurance

- Acute onset coverage is emergency-only, not ongoing care

- Gradual or progressive symptoms are commonly excluded

- Planned or expected treatment does not qualify as acute onset

- Ignored pre-travel symptoms weaken eligibility

- Complications caused by missed medication or poor control may be denied

- Coverage often ends once the emergency is stabilized

The next section explains which pre-existing conditions may still qualify for acute onset coverage, and why the same condition can be covered in one case and denied in another.

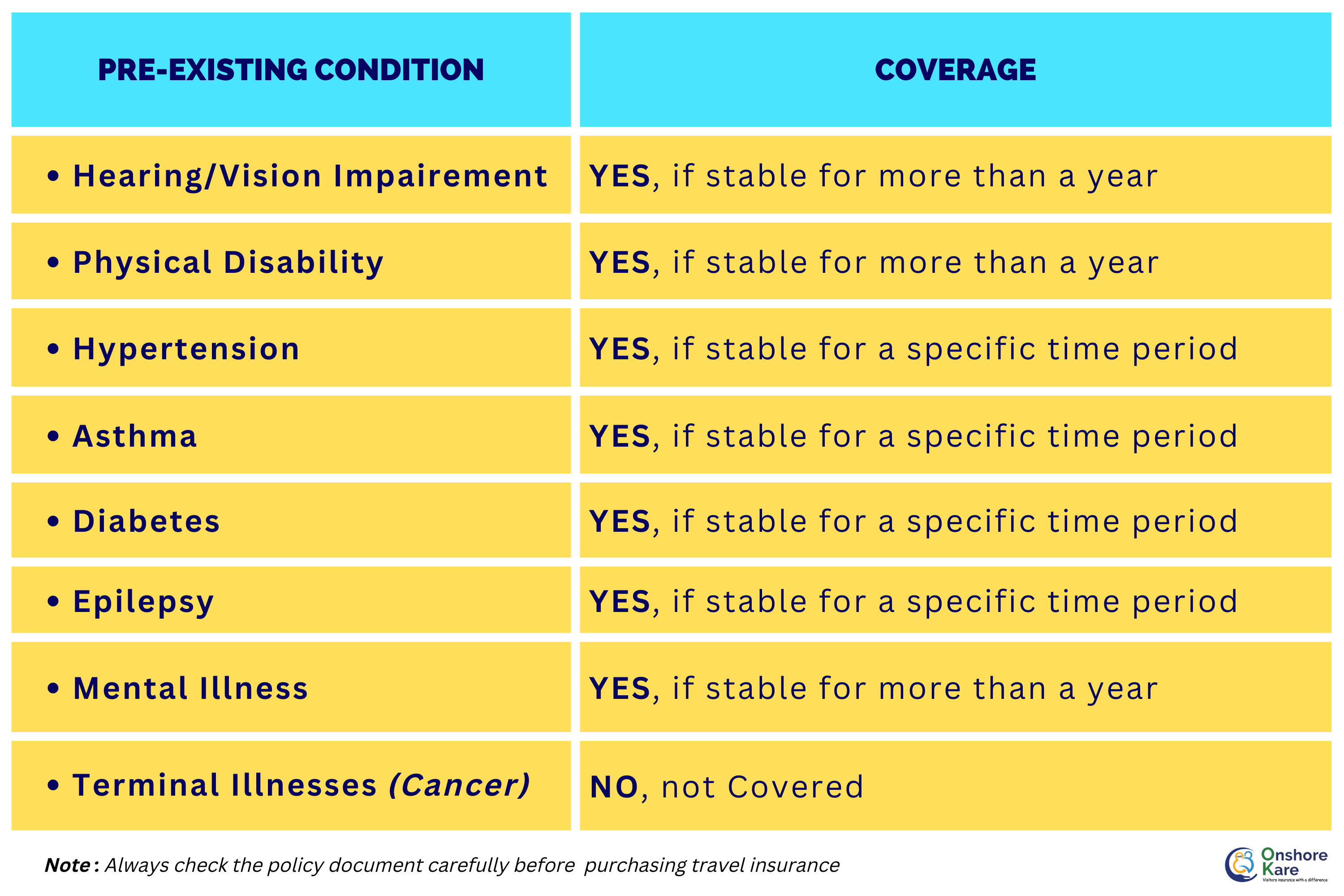

Which Pre-Existing Conditions May Be Covered Under Acute Onset Travel Insurance (And When)

There is no fixed list of pre-existing conditions that are automatically covered under acute onset travel insurance.

Coverage is not determined by diagnosis alone.

It is determined by stability, timing, and foreseeability based on medical records.

This means the same medical condition can be covered in one situation and denied in another — depending entirely on whether acute onset eligibility rules are met.

This distinction is especially important for parents and senior travelers visiting the United States, where claim scrutiny is high and medical costs are significant.

How Insurers Actually Assess Pre-Existing Conditions for Acute Onset Coverage

When reviewing acute onset claims, insurers do not ask:

“What condition does the traveler have?”

They ask:

“Was this medical emergency sudden, unexpected, and unforeseeable based on documented medical history?”

Insurers typically evaluate:

- Stability of the condition before travel

- Absence of recent treatment or medication changes

- No warning signs or symptoms before departure

- No foreseeable need for care

If these conditions are met, acute onset coverage may apply, regardless of the diagnosis.

Heart Conditions: How Acute Onset Coverage Is Typically Assessed

(Cardiac History, Prior Stents, Angina)

May be covered when:

- The condition was stable for a prolonged period

- No recent chest pain, breathlessness, or fatigue

- No medication changes or pending procedures

- A sudden cardiac event occurs without warning

Often denied when:

- Symptoms existed before travel

- Follow-up care or investigations were advised

- Medication was adjusted shortly before departure

Diabetes: When Acute Onset Coverage May Apply — and When It Is Denied

May be covered when:

- Blood sugar levels were well controlled

- No recent dosage changes or complications

- A sudden, unexpected complication occurs

Often denied when:

- Control was poor or inconsistent

- Medication adherence issues are documented

- Complications were developing before travel

Hypertension: How Stability and Control Affect Acute Onset Eligibility

May be covered when:

- Blood pressure was consistently controlled

- No recent medication changes

- A sudden hypertensive emergency occurs

Often denied when:

- Blood pressure was poorly managed

- Dosage adjustments occurred before travel

- Monitoring or follow-up care was pending

Asthma and Chronic Respiratory Conditions: Acute Onset Coverage Criteria

May be covered when:

- The condition was stable and symptom-free

- No recent exacerbations or treatment changes

- A sudden, severe attack occurs unexpectedly

Often denied when:

- Chronic symptoms were present

- Preventive or rescue treatment was recently adjusted

- Prior flare-ups occurred before travel

Mental Health Conditions: Acute Emergencies vs Ongoing Treatment

May be covered when:

- There was no prior diagnosis or ongoing treatment

- A first-time, acute emergency occurs

Often denied when:

- Ongoing therapy or medication existed

- Prior episodes were documented

- Follow-up care was expected

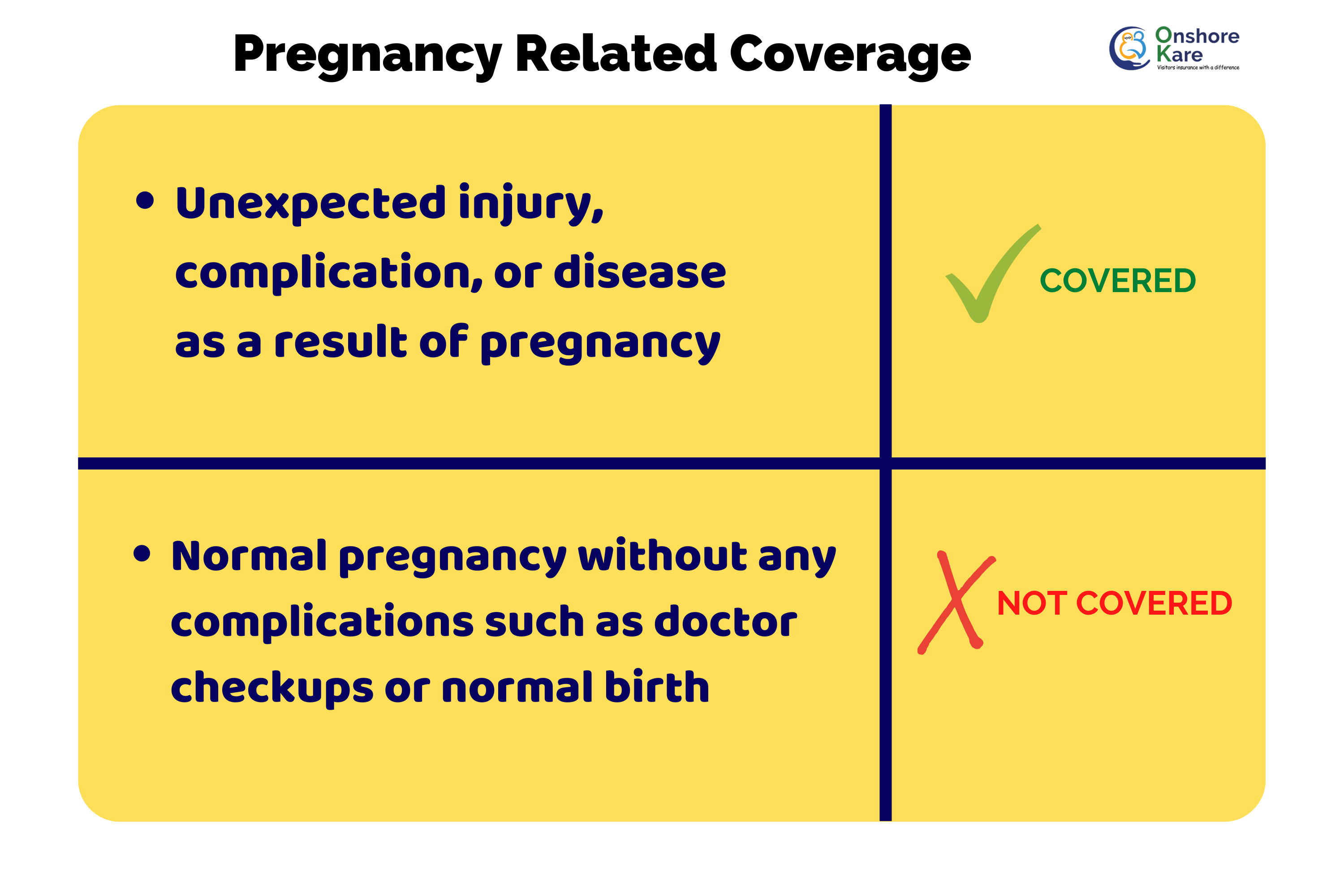

Pregnancy-Related Conditions: Unexpected Emergencies vs Routine Care

May be covered when:

- A sudden, unexpected medical emergency occurs

- No prior complications were documented

Often denied when:

- Care was routine, scheduled, or anticipated

- Pregnancy-related monitoring was ongoing

- The issue was foreseeable based on medical history

Read the policy document to understand the Inclusions & Exclusions in the travel insurance plan you shortlist to buy.

Why Diagnosis Alone Does NOT Determine Acute Onset Coverage

This is one of the most misunderstood aspects of acute onset coverage.

From an insurer’s perspective:

- A serious condition can still qualify

- A minor condition can still be denied

What matters is predictability, not perceived severity.

Medical records showing stability and no warning signs strengthen eligibility.

Records showing recent activity, symptoms, or monitoring weaken it.

Why Acute Onset Coverage Matters More for Parents Visiting the United States

For parents and senior travelers visiting the United States, acute onset claims are:

- Reviewed more strictly

- More expensive when denied

- Less forgiving of ambiguity

When arranging travel insurance from India for parents visiting the USA, relying on diagnosis-based assumptions is risky.

Understanding how insurers actually evaluate conditions is the only reliable way to set realistic expectations.

Key Takeaways: When Pre-Existing Conditions May Qualify for Acute Onset Coverage

- There is no guaranteed list of covered conditions

- Stability before travel is critical

- Recent treatment or symptoms weaken eligibility

- Diagnosis alone does not determine coverage

- The same condition can be covered in one case and denied in another

The next section explains how disability is treated in travel insurance, and why disability status alone does not automatically exclude coverage.

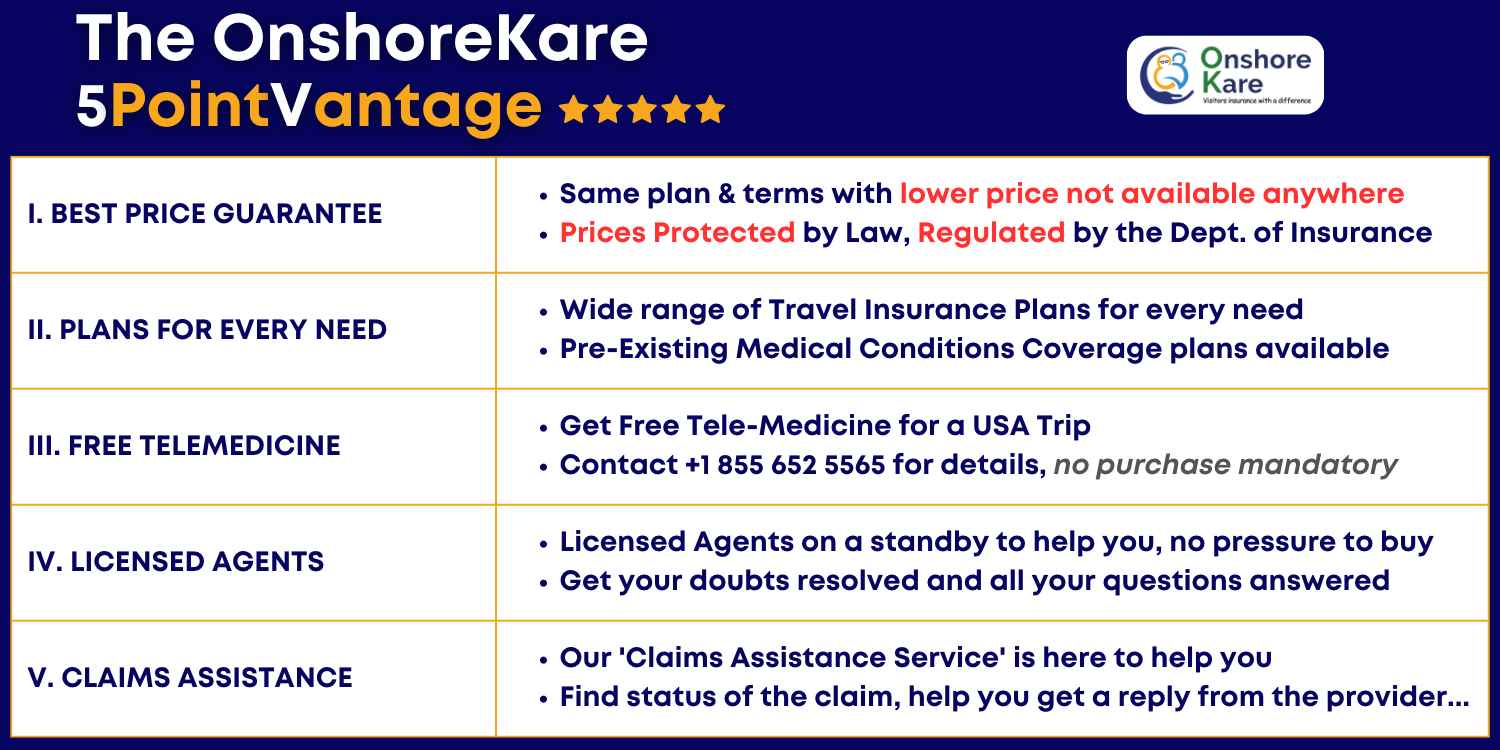

To sign up for a policy with the insurance provider, all you have to do is visit their website. By using an intermediary, like Onshorekare’s insurance services, you can easily select the best policy that will cover the sudden onset of a pre-existing condition by comparing the options on the website. You can also buy plans that cover Pre-Existing Conditions.

Disability and Travel Insurance: What Actually Affects Coverage

Having a disability does not automatically exclude someone from travel insurance coverage.

What insurers evaluate is not the disability itself, but whether it is linked to an underlying medical condition that may require treatment during travel.

This distinction is especially important for parents and senior travelers visiting the United States, where misunderstandings around disability and insurance coverage often lead to unnecessary fear — or incorrect assumptions.

How Insurers Evaluate Disability in Travel Insurance Claims

Insurers do not assess risk based on disability labels.

Instead, they evaluate:

- Whether the disability is connected to an underlying medical condition

- Whether that condition was stable before travel

- Whether it requires ongoing treatment, medication, or supervision

- Whether any medical care during travel was foreseeable

If a disability is stable and does not involve active medical management, it may have little to no impact on coverage eligibility.

When Disability Typically Does NOT Affect Travel Insurance Coverage

Disability is less likely to affect coverage when:

- The condition is long-standing and stable

- No recent treatment or medication changes occurred

- No routine medical care is required during travel

- The medical emergency during travel is unrelated to the disability

In these situations, insurers focus on the actual medical event, not the presence of a disability.

When Disability Becomes Relevant to Travel Insurance Claim Decisions

Disability becomes relevant when it is linked to:

- Ongoing medical treatment or therapy

- Prescribed medications

- Medical supervision or monitoring

- A condition that could reasonably require care during travel

In these cases, the underlying medical condition, not the disability label, determines whether:

- Coverage may apply

- A claim is partially paid

- Or a claim is denied

Why Disclosure Matters for Travelers With Disabilities

Accurate disclosure is critical.

Failing to disclose relevant medical conditions — even unintentionally — can affect claim outcomes, even if the disability itself is not the reason for treatment.

Insurers rely on:

- Application disclosures

- Medical records

- Prescription histories

- Physician notes

Consistency between disclosed information and medical documentation plays a major role in claim review.

Why Disability Considerations Matter More for Travel Insurance in the United States

For visitors traveling to the United States, disability-related claims are reviewed with greater scrutiny because:

- Medical costs are high

- Pre-existing condition rules are strictly applied

- Documentation requirements are rigorous

This is particularly relevant when arranging travel insurance from India for:

- Parents visiting the USA

- Senior travelers

- Travelers with disabilities linked to chronic medical conditions

Understanding how disability is evaluated before travel significantly reduces the risk of denied or limited claims.

Key Takeaways About Disability and Travel Insurance Coverage

- Disability alone does not exclude travel insurance coverage

- Insurers assess underlying medical conditions, not labels

- Stability before travel remains critical

- Accurate disclosure directly affects claim outcomes

- Acute onset and pre-existing condition rules still apply when disability is involved

The next section explains acute onset coverage vs pre-existing condition waivers, and why confusing the two often leads to costly mistakes.

Acute Onset Coverage vs Pre-Existing Condition Waivers in Travel Insurance (Key Differences That Matter)

These two terms are often used interchangeably. They are not the same.

Confusing acute onset coverage with a pre-existing condition waiver is one of the most common reasons travelers assume they are protected — and then face denied or limited claims.

Understanding the difference is essential before you rely on either.

What Acute Onset Coverage Actually Provides

Acute onset coverage is a limited, emergency-only benefit.

It may apply only if all eligibility rules are met at the time of treatment, including:

- Sudden onset of symptoms

- No prior warning signs or foreseeability

- Medical stability before travel

- Immediate, medically necessary treatment

Key characteristics of acute onset coverage:

- Applies only to emergencies

- Often includes age limits

- Usually has lower benefit caps

- Excludes ongoing or follow-up care

- Can be denied based on medical timelines

Acute onset coverage is not designed to manage chronic conditions. It is a narrow safety net.

What a Pre-Existing Condition Waiver Actually Does

A pre-existing condition waiver is designed to provide broader protection for travelers with known medical conditions.

When properly obtained, a waiver can:

- Reduce or remove pre-existing condition exclusions

- Provide more predictable claim outcomes

- Extend beyond emergency-only scenarios (subject to policy terms)

However, waivers:

- Must usually be purchased within a short time window after trip booking

- Still require stability before travel

- Do not guarantee coverage for all situations

- May cost more than plans without waivers

A waiver improves certainty, not certainty without conditions.

Key Differences Between Acute Onset Coverage and Waivers

Acute Onset Coverage

- Purpose: Emergency-only safety net

- Purchase timing: Any time before symptoms

- Stability requirement: Yes

- Age limits: Common

- Coverage certainty: Limited and conditional

Pre-Existing Condition Waiver

- Purpose: Broader protection for known conditions

- Purchase timing: Shortly after trip booking

- Stability requirement: Yes

- Age limits: Varies

- Coverage certainty: Higher, but still conditional

Which Option Is More Appropriate: Acute Onset Coverage vs Pre-Existing Condition Waivers

Acute onset coverage may be appropriate when:

- The traveler is younger or middle-aged

- Conditions are long-term and very stable

- No recent treatment or medication changes occurred

- The traveler accepts limited emergency-only protection

A pre-existing condition waiver is often more appropriate when:

- Parents or seniors are visiting the United States

- Chronic conditions require ongoing management

- Recent medical history increases predictability

- Greater coverage certainty is needed

Choosing between the two is a risk management decision, not a pricing decision.

Why the Difference Between Acute Onset Coverage and Waivers Matters More for Travel to the United States

For visitors traveling to the United States:

- Medical costs are high

- Claim scrutiny is strict

- Emergency-only coverage can be insufficient

When arranging travel insurance from India for parents visiting the USA, relying solely on acute onset coverage often creates false confidence.

Understanding whether a waiver is available — and whether it fits the traveler’s medical profile — can significantly reduce financial risk.

Key Takeaways: Acute Onset Coverage vs Pre-Existing Condition Waivers

- Acute onset coverage is limited and emergency-only

- Waivers offer broader protection, but must be purchased early

- Both still require medical stability before travel

- Neither option guarantees coverage without conditions

- The right choice depends on age, medical history, and risk tolerance

The next section explains how travel insurance plans handle acute onset coverage in practice, and why plan names matter less than definitions at claim time.

How Travel Insurance Plans Handle Acute Onset Coverage in Practice (What Actually Matters at Claim Time)

Not all travel insurance plans handle acute onset coverage the same way.

The differences rarely show up on marketing pages.

They show up during claim review.

Plan names, pricing, and brand reputation matter far less than how acute onset is defined, limited, and capped inside the policy document. This is where many travelers — especially those arranging insurance for parents visiting the United States — make costly assumptions.

Why Plan Names Matter Less Than Acute Onset Definitions in Travel Insurance

Travel insurance plans often advertise phrases such as:

- “Acute onset included”

- “Pre-existing conditions covered”

- “Emergency medical benefits available”

These phrases are not standardized.

What determines claim outcomes is:

- How acute onset is defined in the policy

- Age limits tied to eligibility

- Stability requirements before travel

- Benefit caps for pre-existing condition emergencies

- Whether follow-up or ongoing care is excluded

Two plans with similar names can produce very different claim results because their definitions and limits are different.

Why “Acute Onset Coverage Included” Does Not Mean Claims Are Guaranteed

When a plan states that acute onset coverage is “included,” it means eligible under defined conditions, not automatically payable.

Claims are evaluated after treatment, using:

- Medical records

- Prescription history

- Symptom timelines

- Physician notes

If the insurer determines that eligibility conditions were not met, coverage may be:

- Reduced

- Partially paid

- Or denied entirely

This distinction is especially important for parents and senior travelers visiting the United States, where claims involving pre-existing conditions receive closer scrutiny.

Common Ways Travel Insurance Plans Restrict Acute Onset Coverage

In practice, acute onset coverage is often restricted through one or more of the following:

- Age limits, after which coverage is reduced or excluded

- Lower benefit caps for pre-existing condition emergencies

- Strict stability look-back periods

- Exclusion of follow-up or ongoing care after stabilization

- Narrow emergency definitions

These restrictions are usually found in the policy wording, not in plan summaries or marketing highlights.

How to Compare Travel Insurance Plans for Acute Onset Coverage More Effectively

Instead of comparing plans based on:

- Brand names

- Price alone

- Promotional language

Travelers should compare:

- Acute onset definitions

- Stability requirements

- Age-related restrictions

- Pre-existing condition benefit caps

- Emergency versus follow-up care rules

This approach leads to fewer surprises at claim time, even if the plan costs slightly more.

Why Acute Onset Plan Differences Matter More for Travel to the United States

For visitors traveling to the United States:

- Emergency medical care is expensive

- Claims involving pre-existing conditions are closely reviewed

- Benefit caps can be reached quickly

When arranging travel insurance from India for parents visiting the USA, choosing a plan based on definitions rather than names is one of the most effective ways to reduce financial risk.

Key Takeaways: How Travel Insurance Plans Handle Acute Onset Coverage

- Plan names do not guarantee outcomes

- Acute onset definitions vary significantly between policies

- Age limits and benefit caps are common

- “Included” does not mean automatically payable

- Claim outcomes depend on policy wording, not marketing

The next section explains practical steps that actually improve claim outcomes, and what travelers can do before travel to reduce risk.

Practical Steps That Actually Improve Acute Onset Claim Outcomes (Before You Travel)

Most acute onset claim problems are not caused by policy fine print.

They are caused by timing, documentation gaps, and assumptions made before travel.

The steps below consistently improve claim outcomes in real-world scenarios—especially for parents and senior travelers visiting the United States.

Buy Travel Insurance Early: Timing Directly Affects Acute Onset Eligibility

Buying travel insurance early does not make a condition non–pre-existing.

However, timing directly affects acute onset eligibility.

Buying early:

- Reduces the chance that medical changes occur before the policy start date

- Preserves access to time-limited options, such as pre-existing condition waivers (when applicable)

Waiting until just before travel increases the risk that:

- A routine doctor visit

- A minor medication adjustment

- New test results

will unintentionally weaken acute onset eligibility.

Read Acute Onset Policy Definitions — Not Just Travel Insurance Plan Highlights

Plan brochures summarize benefits.

Claims are decided using policy definitions.

Before relying on acute onset coverage, review:

- The policy’s acute onset definition

- Stability and look-back requirements

- Age-related eligibility limits

- Pre-existing condition benefit caps

- Emergency vs follow-up care rules

If a definition feels vague, assume it will be interpreted strictly at claim time.

Rely on Medical Records, Not Memory for Acute Onset Coverage

Insurers evaluate eligibility using medical documentation, not recollection.

Before travel:

- Review recent doctor visits and prescriptions

- Note any dosage changes or pending tests

- Understand what your medical records actually show

Many denied claims occur because travelers remember being “stable,” while medical records show recent medical activity.

Be Extra Cautious After Recent Treatment or Medication Changes Before Travel

Recent medical changes are one of the strongest denial triggers for acute onset claims.

If there has been:

- A medication change

- A dosage adjustment

- New or worsening symptoms

- Ongoing diagnostic investigations

Acute onset eligibility is weaker—even if the emergency during travel feels unrelated.

In such cases, relying solely on acute onset coverage may not be sufficient.

Carry Prescriptions and a Brief Medical Summary for Acute Onset Claims

In an emergency, documentation matters.

Travelers should carry:

- Current prescriptions

- A brief medical summary (conditions, medications, allergies)

- Contact information for treating physicians

This helps emergency providers and reduces ambiguity during claim review.

Do Not Assume Emergency Severity Guarantees Acute Onset Coverage

A severe medical emergency does not override eligibility rules.

Claims are evaluated based on:

- Stability before travel

- Predictability based on medical records

- Whether acute onset criteria were met at the time of treatment

Severity affects medical urgency, not coverage determination.

Why These Preparation Steps Matter More for Acute Onset Claims in the United States

For visitors traveling to the United States:

- Medical costs escalate quickly

- Claims involving pre-existing conditions are closely reviewed

- Documentation standards are high

When arranging travel insurance from India for parents visiting the USA, small preparation steps taken before travel often determine whether:

- A claim is paid smoothly

- Coverage is capped

- Or expenses become out-of-pocket

Key Takeaways: How to Improve Acute Onset Claim Outcomes

- Buy insurance early to protect acute onset eligibility

- Read policy definitions, not marketing summaries

- Assume medical records—not memory—will decide claims

- Be cautious after recent treatment or medication changes

- Carry basic medical documentation while traveling

- Do not rely on emergency severity to override eligibility rules

The next section explains who should be especially cautious about relying on acute onset coverage, and when broader protection should be considered.

Who Should Be Extra Careful Before Relying on Acute Onset Coverage in Travel Insurance

Acute onset coverage is designed for limited, clearly defined emergencies.

It is not suitable for every traveler profile.

Certain travelers face higher scrutiny, tighter limits, and greater financial exposure if they rely on acute onset coverage alone.

This section helps you identify whether acute onset coverage is a reasonable safety net — or a high-risk assumption.

Parents Visiting the United States: Higher Risk, Higher Scrutiny

Parents visiting the United States represent one of the highest-risk groups for acute onset claim denials.

This is due to:

- A higher likelihood of chronic but controlled conditions

- Greater probability of recent medical management

- Age-based eligibility limits and benefit caps

- Stricter claim review driven by high U.S. medical costs

For parents, acute onset coverage may help in a narrow emergency, but it should not be treated as comprehensive protection.

Senior Travelers: Age Limits and Narrower Acute Onset Definitions

Senior travelers often encounter:

- Reduced coverage limits

- Narrower definitions of what qualifies as acute onset

- Increased scrutiny of medical timelines and stability

Even minor treatment changes before travel can significantly weaken eligibility.

For seniors traveling to the United States, relying solely on acute onset coverage often creates false confidence.

Travelers With Chronic but “Controlled” Medical Conditions

Medically controlled conditions still:

- Qualify as pre-existing conditions

- Require documented stability before travel

- Receive close scrutiny during claim review

Common examples include diabetes, hypertension, heart conditions, asthma, and arthritis.

The term “controlled” may be reassuring medically, but it does not override insurer eligibility rules.

Travelers With Recent Treatment, Medication, or Dosage Changes

Recent medical activity is one of the strongest predictors of acute onset claim denial.

If, before travel, there was:

- A medication change

- A dosage adjustment

- New or worsening symptoms

- Pending tests or investigations

Acute onset eligibility is significantly weaker — even if the emergency during travel seems unrelated.

First-Time Travel Insurance Buyers: Higher Risk of Misinterpretation

First-time buyers frequently:

- Rely on marketing summaries instead of policy definitions

- Assume emergencies are automatically covered

- Misread “acute onset included” as guaranteed coverage

Without understanding how insurers evaluate claims, expectations often diverge sharply from reality.

Why Acute Onset Risk Is Higher for Travel to the United States

For travel to the United States:

- Medical costs escalate quickly

- Pre-existing condition claims are reviewed aggressively

- Benefit caps are reached faster

- Documentation standards are strict

When arranging travel insurance from India for parents or seniors visiting the USA, misjudging reliance on acute onset coverage often results in large out-of-pocket expenses.

Key Takeaways: Who Should Be Cautious About Relying on Acute Onset Coverage

- Acute onset coverage is not one-size-fits-all

- Parents and seniors face higher scrutiny and limits

- Recent medical changes dramatically increase denial risk

- Controlled conditions are still pre-existing

- Risk profile matters more than plan names

The next section explains how to decide whether acute onset coverage is sufficient, or when broader protection should be considered.

Is Acute Onset Coverage Enough — or Should You Consider Broader Protection?

Acute onset coverage can be adequate only in specific, low-risk scenarios.

For many travelers, especially those visiting the United States, it is not sufficient on its own.

This section helps you decide — realistically — whether acute onset coverage fits your situation or whether broader protection should be considered.

When Acute Onset Coverage May Be Sufficient

Acute onset coverage may be reasonable when all of the following are true:

- The traveler is younger or middle-aged

- Any medical conditions are long-standing and clearly stable

- There have been no recent treatments, medication changes, or investigations

- The traveler understands coverage is emergency-only and limited

- The traveler is comfortable accepting conditional coverage risk

In these cases, acute onset coverage can function as a basic safety net, not comprehensive protection.

When Acute Onset Coverage Is Often NOT Enough

Acute onset coverage is often insufficient when:

- Parents or seniors are visiting the United States

- Chronic conditions require ongoing management

- There have been recent medical changes

- Medical history increases foreseeability risk

- Higher certainty of claim payment is desired

In these situations, relying solely on acute onset coverage frequently leads to surprise exclusions or capped benefits.

Situations Where Broader Coverage Should Be Strongly Considered

Broader protection options (such as plans with structured pre-existing condition coverage or waivers) should be considered when:

- The traveler has multiple chronic conditions

- Medical care during travel is more likely

- Peace of mind and predictability matter more than minimum cost

- The traveler cannot absorb large out-of-pocket expenses in the U.S.

These options do not guarantee coverage, but they generally provide greater certainty than acute onset coverage alone.

Why This Decision Matters More for Travel to the United States

For visitors traveling to the United States:

- Emergency care costs escalate rapidly

- Claims involving pre-existing conditions are closely reviewed

- Acute onset benefit caps are often reached quickly

When arranging travel insurance from India for parents visiting the USA, choosing insufficient coverage is one of the most common and expensive mistakes.

Key Takeaways: Deciding Whether Acute Onset Coverage Is Enough

- Acute onset coverage is limited and conditional

- It works best for low-risk, stable travelers

- Parents and seniors often need broader protection

- Recent medical history matters more than diagnosis labels

- The right choice balances risk tolerance, cost, and predictability

The next section provides a concise summary of everything covered, so you can make a final, informed decision before you travel.

Final Summary: What Travelers Need to Get Right About Acute Onset Coverage

Acute onset coverage in travel insurance is real, but it is limited, conditional, and frequently misunderstood.

It is not full coverage for pre-existing conditions.

It is emergency-only protection, applied strictly based on medical stability, timing, and foreseeability — not how serious or frightening an emergency feels.

Most denied claims are not surprises.

They happen because expectations were shaped by marketing language instead of policy definitions and medical timelines.

The Core Truth Travelers Must Understand

If a medical condition existed before your policy start date, insurers will treat it as pre-existing, even if it is stable or well controlled.

Whether an emergency qualifies as acute onset depends on all of the following being true:

- Symptoms appeared suddenly

- There were no prior warning signs

- The condition was medically stable before travel

- Immediate treatment was medically necessary

If any one of these fails, coverage may be reduced or denied.

Severity alone does not override eligibility rules.

A Quick Reality Check Before You Rely on Acute Onset Coverage

As you decide whether acute onset coverage is enough, ask yourself honestly:

- Are you arranging insurance for parents or senior travelers?

- Does the traveler have any chronic or long-standing condition, even if controlled?

- Was there any doctor visit, test, or medication change in the last few months?

- Are there pending tests or follow-up appointments?

- Were any symptoms present recently, even if mild?

- Would a large U.S. medical bill be difficult to manage out-of-pocket?

- Are you relying on the phrase “acute onset included” without reviewing definitions?

Answering “yes” to several of these does not mean a claim will be denied.

It means your situation carries higher scrutiny and uncertainty under acute onset rules.

A lower-risk profile suggests acute onset coverage may act as a limited safety net.

A moderate-risk profile means reliance on acute onset coverage is uncertain.

A higher-risk profile indicates that relying on acute onset coverage alone is often unsafe.

This is guidance, not a guarantee — it mirrors how insurers assess risk at claim time.

Why This Matters Especially for Travel to the United States

For visitors traveling to the United States:

- Medical costs escalate rapidly

- Pre-existing condition claims are reviewed aggressively

- Acute onset benefit caps are reached quickly

- Documentation standards are strict

When arranging travel insurance from India for parents or senior family members, relying blindly on acute onset coverage is one of the most common and expensive mistakes.

How to Use This Guide Correctly

Use this guide to:

- Set realistic expectations

- Identify risk factors before travel

- Decide whether acute onset coverage is reasonable or risky

- Avoid false confidence based on plan names or summaries

Do not use it to assume outcomes.

Insurance decisions are about risk management, not guarantees.

Final Advisor Verdict

- Acute onset coverage is a narrow safety net, not a blanket solution

- Stability, timing, and documentation matter more than diagnosis

- Parents and seniors face higher scrutiny and financial risk

- Definitions — not assumptions — decide claims

Travel confidently — but do it with clarity, not optimism.

Before relying on acute onset coverage, it’s worth checking your real risk factors like age, medical stability, and recent treatment history. OnshoreKare’s Risk Calculator gives a quick, practical snapshot of where coverage gaps may exist—especially for parents or senior travelers—so you can make informed decisions before travel.

Frequently Asked Questions About Acute Onset Coverage in Travel Insurance

What does “acute onset of a pre-existing condition” mean in travel insurance?

Acute onset refers to a sudden, unexpected medical emergency related to a pre-existing condition, provided strict insurer-defined conditions are met at the time of treatment.

It does not mean:

- Any serious emergency

- Any sudden pain

- Any worsening of a known condition

Eligibility depends on timing, stability, and foreseeability, not how severe the emergency feels.

Is acute onset coverage the same as pre-existing condition coverage?

No. They are fundamentally different.

- Acute onset coverage is limited, emergency-only protection

- Pre-existing condition coverage or waivers offer broader protection but must usually be purchased early and still require stability

Confusing the two is one of the most common causes of denied claims.

Does a stable medical condition still count as pre-existing?

Yes.

A medical condition remains pre-existing even if it is stable, controlled, or symptom-free.

Stability only affects whether limited acute onset benefits may apply.

It does not remove the pre-existing classification.

Can a claim be denied even if the emergency was sudden?

Yes.

Suddenness alone is not sufficient.

Insurers also review:

- Whether symptoms existed before travel

- Whether care was foreseeable

- Whether there were recent treatments or medication changes

A medical event can feel sudden and still be denied if medical records show predictability.

Does the severity of an emergency guarantee acute onset coverage?

No.

Severity does not override eligibility rules.

Claims are decided based on medical timelines and documentation, not how serious or frightening the emergency was.

How far back do insurers look to assess medical stability?

There is no universal timeframe.

Insurers review:

- Recent doctor visits

- Medication and dosage changes

- Diagnostic tests and follow-up recommendations

Even activity in the last few months can affect eligibility if it suggests foreseeability.

Is acute onset coverage usually enough for parents visiting the United States?

Often, no.

Parents visiting the United States typically face:

- Age-based limits or caps

- Greater scrutiny of medical history

- Very high medical costs if coverage is limited

Acute onset coverage may help in a narrow emergency, but it should not be treated as comprehensive protection for parents or seniors.

What happens if medication was missed before the emergency?

Complications caused by missed medication or poor control are commonly excluded.

If records show non-adherence, insurers may classify the emergency as preventable, not acute.

Does having a disability affect acute onset coverage?

Disability alone does not exclude coverage.

Insurers evaluate whether the disability is linked to an underlying medical condition, and whether that condition was stable before travel.

Accurate disclosure matters.

What documents help most during an acute onset claim?

Claims are assessed using:

- Medical records and treatment timelines

- Prescription history

- Physician notes

Carrying prescriptions and a brief medical summary while traveling can reduce ambiguity during claim review.

If I’m unsure whether acute onset coverage is enough, what should I do?

Do not assume.

Review:

- Recent medical history

- Policy definitions and limits

- Your risk profile (age, stability, financial exposure)

If uncertainty remains, broader protection should be considered before travel, not after an emergency.

Final FAQ Reminder

Acute onset coverage is a narrow safety net — not a guarantee.

Stability, timing, and documentation decide claims, not assumptions.