Best Visitors Insurance for Pre-Existing Medical Conditions

What you need to know about Pre-Existing Conditions and INF Elite Plus Travel Insurance

When selecting travel insurance, it is crucial to understand what the plan covers and what it excludes.

In this article, we discuss why it is important to understand pre-existing medical conditions when selecting travel insurance plans and how INF Elite Plus specifically addresses these concerns.

INF Elite and INF Premier are the flagship insurance program plans from INFPlans.

The only drawback is that their most popular plans i.e. INF Elite and INF Premier have a minimum purchase period and coverage duration of 90 days up to 364 days and have to be purchased before leaving the home country.

Business travelers and other non-US citizens and non-US residents who are visiting the USA for less than 90 days can explore other travel insurance options. If you have already arrived in the USA then these alternatives are your best bet for coverage.

What are Pre-Existing Medical Conditions?

A pre-existing condition is any medical or health condition that an individual has before purchasing travel insurance.

These conditions can range from minor issues such as allergies or asthma to more severe ailments like heart disease or cancer.

It may affect an individual’s travel plans, and insurance providers often charge higher premiums or exclude coverage for such conditions. Hence, it is essential to declare a pre-existing condition when purchasing travel insurance.

The importance of understanding pre-existing conditions while selecting travel insurance lies in ensuring that an individual has the appropriate coverage for their medical coverage during their trip.

Visitors’ insurance may provide coverage for new sickness/illness insurance including coverage for medical expenses for treatment, emergency medical evacuation, repatriation of remains, and AD&D benefits.

It is important to read the policy document carefully to understand the inclusions, exclusions, limits, and restrictions of the travel medical plan you plan to purchase.

How does Pre-Existing Condition Coverage work?

Any injury, illness, sickness, disease, or other physical, medical, mental, or nervous condition, disorder, or ailment that, with reasonable medical certainty, existed at the time of application or at any time during the three years prior to the effective date of the insurance policy, including any subsequent, chronic, or recurring complications or consequences related to or arising from them, whether or not previously manifested or known, is considered to be a pre-existing condition.

Most travel insurance plans only cover the acute onset only. Each insurance provider you select including INF Plans will have a different restriction on the coverage of the acute onset of a pre-existing ailment.

It is worth noting that insurance providers may have different definitions of what constitutes a pre-existing condition, and these definitions may vary depending on the policy and the insurer.

Therefore, it is crucial to read the policy’s fine print carefully and ask questions to ensure that the policy offers pre-existing condition coverage and any related medical care.

What is the INF Elite Plus Insurance Plan?

INF Elite Plus insurance is a comprehensive travel medical insurance plan that covers a wide range of benefits, including coverage for medical conditions (pre-existing).

If you have a pre-existing condition, you may find it challenging to obtain travel insurance coverage, but with INF Elite Plus, you can travel with peace of mind knowing that you are covered.

For elderly international travelers, INF insurance offers a few different and distinctive pre-existing coverage. They offer two different kinds of pre-existing coverage:

- Acute onset medical coverage and

- Full pre-existing medical conditions coverage

What are the INF Insurance plans which provide coverage for a Pre-Existing Condition?

INF visitors insurance offers distinctive and cutting-edge accident and illness insurance to people from over the world traveling to the United States, Mexico, and Canada. It would be beneficial to quickly review the special plan options of INF insurance:

INF Premier Plan:

This Fixed Benefit Plan offers policy maximums of $150,000 and $100,000 for policyholders aged 0-69 and $100,000 for policyholders aged 70-99, respectively. This is a full pre-existing condition insurance plan, therefore it covers everything that “acute onset of pre-existing” coverage plans do not, such as doctor visits, blood tests, specialized care, and urgent care.

For people aged 0-69, the coverage can be as high as $20,000, $30,000, $40,000, or $60,000 depending on the policy limit and deductible choices.

The possibilities for the pre-existing deductible are $1000 and $5000. The coverage for people aged 70 to 99 may be $25,000 or $15,000, depending on the deductible they choose.

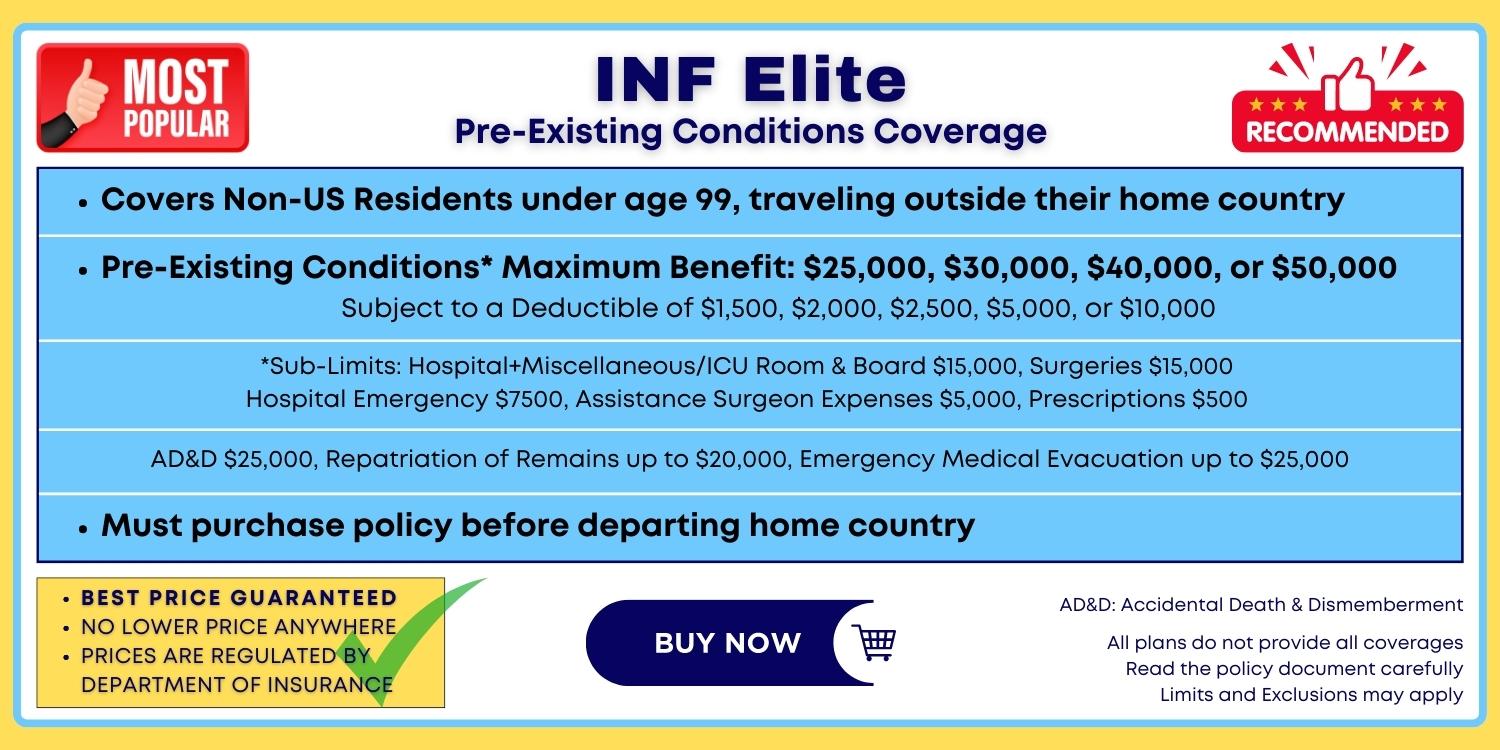

INF Elite Insurance Plan:

The INF Elite Plan is a comprehensive plan that offers “complete” pre-existing condition coverage, which sets it apart from other comprehensive plans.

INF Elite IVAS Plan (IVAS – International Visitor Accident & Sickness Insurance) is designed for international trips to USA, Canada & Mexico.

The insurance policy maximum options for this plan are $150,000 for those aged 0 to 69 and $75,000 for those aged 70 to 99. 80% of eligible medical expenses are covered by this plan.

The INF Elite Plan pays for all medical visits, lab work, special care, emergency medical evacuation, urgent care, and other necessary medical treatment for a condition that was under control prior to travel but developed into a problem while the visitor was traveling.

With a pre-existing deductible of $1500, the coverage limit is provided for ages 0-69 at a maximum of $25,000, and for ages 70–99 at a maximum of $20,000 per person.

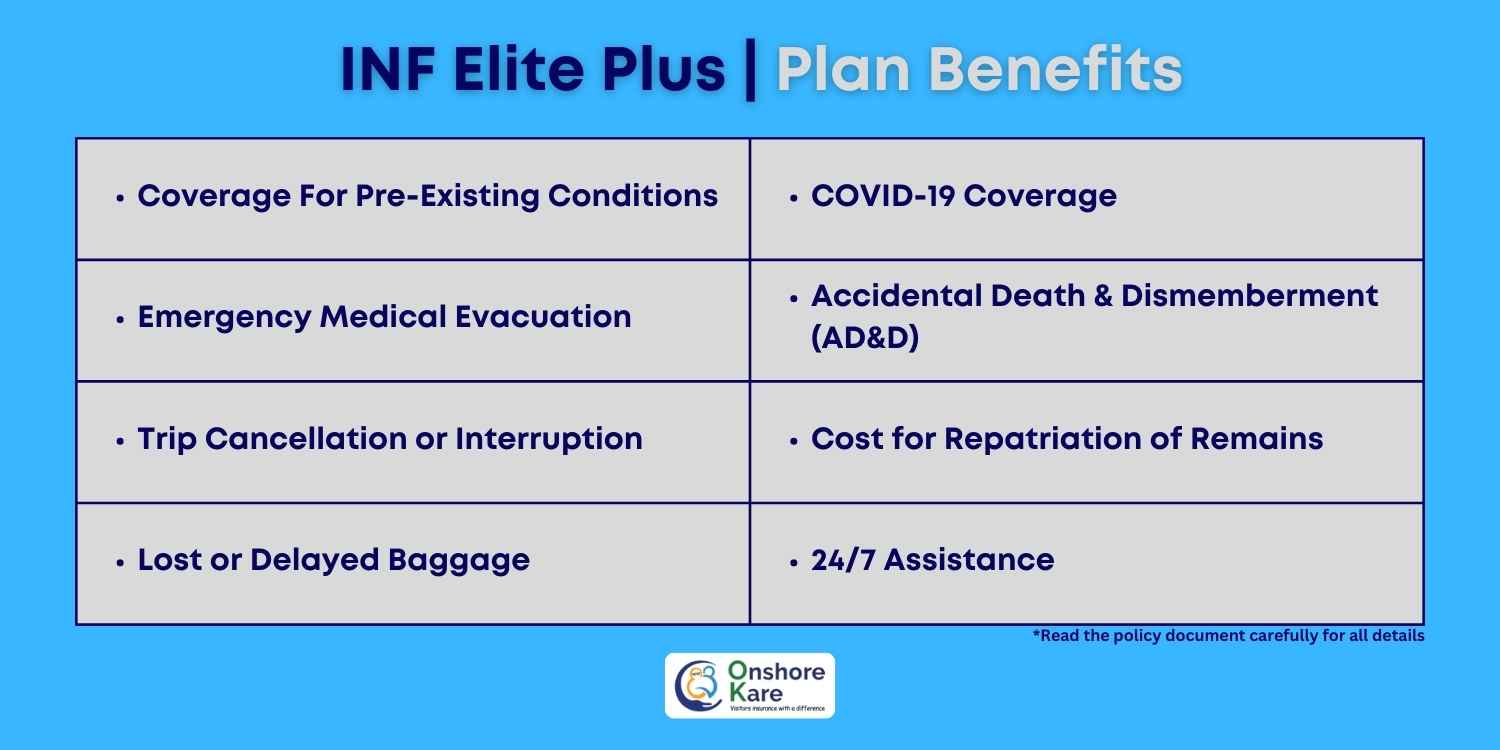

INF Elite Plus Plan:

This is a comprehensive plan that stands out from the crowd because it provides full pre-existing coverage.

This plan has a policy maximum per accident or sickness expense options of $150,000, $250,0000, and $300,000 for people aged 0 to 69 and $75,000 for people aged 70 to 99.

This plan includes preventive and maintenance care, TDAP, flu, and other vaccines, as well as coverage for full-body physicals.

This is a comprehensive pre-existing condition plan that covers doctor appointments, emergency medical evacuation, blood tests, special care, urgent care, and any other treatment required for a condition that was stable prior to travel but became problematic during the visitor’s trip.

With a pre-existing deductible of $1500, the pre-existing coverage limit is provided for ages 0-69 at a policy maximum of $25,000, and for ages 70–99 at a maximum of $20,000 per person. This plan must be purchased for a minimum of three months. The pre-existing condition would be covered up to a defined pre-existing condition maximum limit under the Elite Network plan.

INF Standard Plan (No Pre-Existing Conditions Coverage):

This plan is available to the ages of 0 and 99 who are traveling abroad. Up to 12 months after the initial involvement time, it can be renewed online. The duration of short-term travel medical insurance ranges from 30 to 364 days.

The policy maximum can be as low as $50,000 and as high as $150,000.

It covers dental work, prescription medications, eye irritation, pregnancy and childbirth, chiropractic therapy, and urethritis in addition to dental and prescription drug coverage. It’s vital to remember that this plan is only accessible to travelers who are leaving for the United States.

INF Traveler USA (No Pre-Existing Conditions Coverage):

The INF Traveler USA is a comprehensive IVAS Plan (IVAS – International Visitor Accident & Sickness Insurance).

INF Traveler USA is available to non-US residents between the ages of 0 and 99 who are traveling to the USA, Canada, or Mexico. Visitors without known pre-existing conditions can buy this plan for a minimum of 30 to 364 days.

Age 0-69 The policy maximum can be $150,000, $250,000, or $300,000 ($75,000 for 70-99 age).

We have covered complete details of INF visitors insurance plans, do read it to get more information on INF Visitors’ Insurance.

How does INF Elite Plus Insurance cover Pre-Existing Conditions?

INF Elite Plus insurance covers medical conditions including existing ones as long as you meet certain criteria. You must apply for coverage before you leave for your trip, and you must have a stable medical condition. The insurance company defines a stable medical condition as a condition that has not changed in any way for the past 90 days.

If you have a pre-existing condition and meet the eligibility criteria, INF Elite Plus will provide coverage for your condition. The coverage includes medical treatment, hospitalization, and prescription drugs. If you need emergency medical evacuation or repatriation, the insurance plan will cover those costs as well.

Benefits of INF Elite Plus Insurance

Coverage for Pre-Existing Conditions:

One of the main benefits of INF Elite Plus insurance is that it covers pre-existing conditions. This is a significant benefit for travelers who have existing medical conditions and want to be covered while traveling.

Comprehensive Coverage:

INF Elite Plus insurance provides comprehensive coverage for a range of eligible medical expenses, including emergency medical treatment, hospitalization, prescription drugs, and emergency medical evacuation or repatriation.

Affordable Premiums:

Despite the comprehensive insurance plan, INF Elite Plus insurance premiums are affordable and competitively priced. This makes it a great option for travelers who want excellent coverage at a reasonable cost.

Premiums as compared to other Travel Medical Insurance plans like: Patriot America Plus or Atlas America will be higher because of the nature of coverage being provided.

24/7 Assistance:

INF Elite Plus insurance provides 24/7 assistance to travelers. If you need medical assistance or have any questions, you can call the assistance hotline, and a representative will be available to help you. There is a commitment to providing innovative insurance products, quality customer care, and supporting members when they need it the most.

Why is it important to consider INF insurance plans while buying travel insurance with pre-existing condition coverage?

Pre-existing medical conditions are health problems or illnesses that you had before the start of your insurance coverage. Some common pre-existing conditions include high blood pressure, diabetes, asthma, cancer, and heart disease. Pre-existing conditions can be a significant concern for travelers, especially when they are seeking medical coverage.

The majority of travelers want medical coverage for pre-existing medical issues as one of the most crucial features. INF plans are distinctive from other types of travel insurance since they cover pre-existing conditions.

The comprehensive coverage plans offered by INF cover the acute onset of pre-existing conditions. Even routine checkup related to pre-existing diseases is covered by some insurance policies.

Pre-existing conditions coverage essentially means that conditions for which a patient has received medical attention during the previous year will be regarded as pre-existing for a traveler insured under the INF Elite and Premier plans.

Frequently Asked Questions

CAN I PURCHASE INF ELITE FOR MY PARENTS WHO ARE VISITING THE USA?

You can purchase INF Elite for your parents visiting the USA. It is a well-liked and top-rated American visitor insurance policy that includes coverage for pre-existing diseases. You can read in detail about the INF plan’s thorough review here.

Check out this article to learn how to select US travel medical insurance for parents who have pre-existing conditions if they are traveling to the US.

What does it mean by pre-existing conditions? What kind of conditions is pre-existing for travel insurance?

While acquiring a pre-existing visitors insurance policy, you must disclose any pre-existing medical issues for which you are currently receiving treatment and/or being closely monitored.

Any injury, illness, sickness, disease, or other physical, medical, mental, or nervous condition, disorder, or ailment that, with reasonable medical certainty, existed at the time of application or at any time before the effective date of any visitors insurance policy, including any subsequent, chronic, or recurring complications or consequences related thereto or arising therefrom, whether or not previously manifested or known, diagnosed, treated, or disregarded, is included in this category.

For travel insurance purposes, do I have to disclose any pre-existing condition?

You won’t need to provide any medical information while buying visitor insurance coverage. You will receive a complete policy wording/certificate upon application that will identify all of your benefits, including any conditions that are listed in the exclusions. Visitors visiting the USA can choose from a number of visitor insurance policies that include acute onset of a pre-existing ailment coverage.

Can I purchase the INF Elite plan?

INF Elite Network Plan applications are open for medical coverage to non-US-Residents traveling to the USA, Canada & Mexico. The age range covered by this INF Plans is 0 to 99 with the INF Elite Network Plan. Please Note: You must make your purchase before leaving your home country.

Is coronavirus covered by INF Elite?

As long as the virus is contracted after the policy’s effective date and after you have left your country of residence, COVID-19 is covered by INF Elite and will be handled in the same way as any other qualifying medical condition including qualifying medical expenses for treatment.

What distinguishes an acute onset of pre-existing condition from a pre-existing condition?

A pre-existing condition is a sickness you had before signing up for a new health insurance policy. Diabetes, cancer, chronic obstructive pulmonary disease (COPD), and sleep apnea are a few examples of pre-existing conditions. They are typically chronic or have a long duration.

Acute onset of a pre-existing condition is the term used to describe a sudden, unexpected outbreak or worsening pre-existing conditions that occur spontaneously and without prior warning in the form of symptoms or medical advice. Acute onset coverage only covers treatment needed for stabilizing the insured and it does not cover medical expenses for treatment of the pre-existing medical condition.

What is an Acute onset of Pre-existing conditions? Read this article where we have covered the acute onset of pre-existing condition explanation in detail.

Travel Safe!