Does Trip Insurance Cover Cancelled Flights?

Your vacation plans could be completely ruined by flight delays and cancellations, but can you get your money back if something goes wrong?

If you’re unsure about how to safeguard your trip in these uncertain times, you might want to think about purchasing travel insurance, which might cover the trip cost associated with flights that are canceled or delayed for a covered reason.

Find out more about travel insurance for flight cancellations and how to choose the best plan before you book your upcoming trip.

What is insurance against flight cancellation?

Flight cancellation insurance often pays you back for insured, non-refundable trip costs connected to a canceled flight.

You won’t see travel insurance cover flight cancellation listed as a specific feature in your travel insurance plan when you purchase it. That’s because, depending on whether the canceled flight causes your trip to be delayed, interrupted, or completely cancelled, a variety of perks may be available which can cover the trip cost.

Can I purchase insurance for cancelled flights?

Standard travel insurance usually includes trip cancellation coverage, but if it isn’t sufficient for your needs, you can get specialized cancellation insurance as an add-on or as a stand-alone policy that can cover the trip costs. It could be worthwhile to compare premium travel insurance policies to determine which gives the best value as some of them also provide a higher degree of cancellation coverage. Always read the terms and conditions before purchasing a policy because the kinds of flight cancellations covered can vary between various policies.

When an airline cancels a flight and you wind up canceling your entire trip, how might flight cancellation insurance help?

When an airline cancels a flight, ruining your travel arrangements, you must choose whether to accept the rescheduled flight in this situation or to completely cancel your trip. Following a canceled flight, the airline must reimburse you the trip costs if you decide not to rebook. According to the Department of Transportation, “A consumer is entitled to a refund if the airline cancels a flight, regardless of the reason, and the consumer chooses not to go.” Even if you bought a non-refundable ticket, this still holds true. However, rather than giving out cash for the refund, airlines frequently give out travel credits or vouchers.

What about additional pre-paid travel costs, like an Airbnb rental or tickets you had already bought to a museum? Travel insurance can help with that. Your trip cancellation or trip interruption benefits take effect if your airline is unable to transport you to your intended destination for at least 24 continuous hours following the initially scheduled arrival time due to a natural disaster, severe weather, or other unforeseen circumstances. Therefore, you are permitted to cancel your trip and get a reimbursement for your pre-paid, non-refundable travel expenses.

When an airline cancels a flight and your trip is delayed, how might flight cancellation insurance help?

If the airline rebooks you on another flight after canceling your first one. Even so, you will get there a little later than expected. In this case, benefits from flight delay travel insurance will get you covered.

Did the cancellation of your flight result in a covered travel delay insurance under the terms of your plan? Then, your trip delay benefits may be used to reimburse you for food, lodging, travel, and other permissible costs incurred during the delay (up to the maximum limit for your plan). Additionally, you may get compensated for the portion of the trip that you didn’t make.

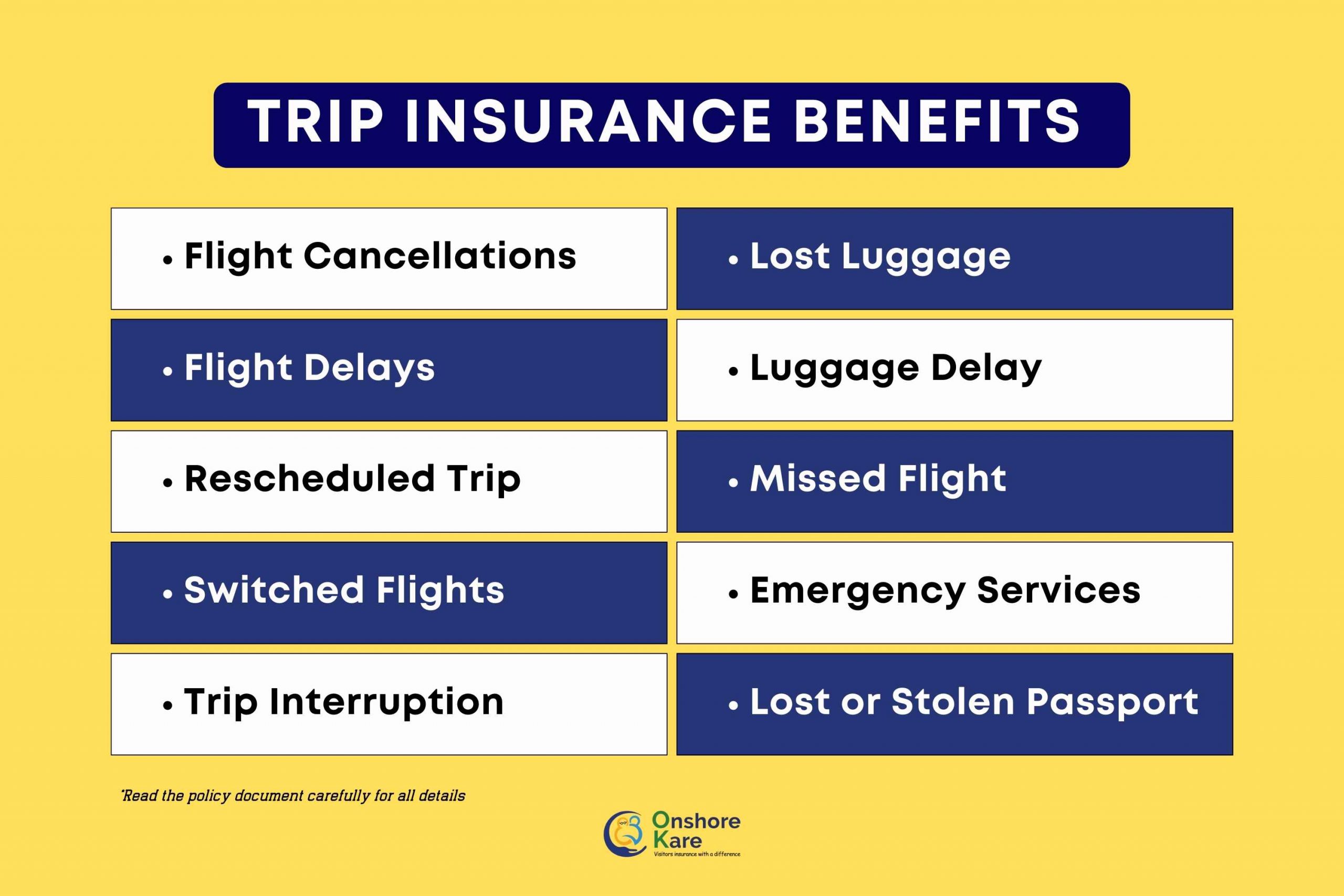

Benefits of Trip Insurance

- In the event of a travel delay or cancellation, you can protect the cost of your trip.

- Reduce the cost of additional expenses incurred as a result of a travel interruption by a delayed flight or loss of luggage.

- Trip insurance can protect you from cancellations at the last minute while traveling with your family, baggage loss, evacuation delay, or passports that have been lost or stolen.

When an airline cancels a flight and the rescheduled trip is not convenient for you, how might flight cancellation insurance help?

In this case, your travel insurance trip interruption coverage may reimburse you for alternate transportation, if you can reach your original destination in a different way if your travel carrier is unable to deliver you to your destination for at least 24 hours after your originally scheduled arrival time due to a covered reason.

All of the covered causes for travel cancellation are listed in your plan paperwork, including:

- You or a travel partner experiences a major illness, injury, or medical condition.

- If a family member who is not accompanying you on the trip experiences a major illness, injury, or medical condition

- A travel partner or relative passes away

- You have to be present for a family member’s birth.

- You can’t live in your main house.

- The place you are going to is uninhabitable

You will not be covered by trip cancellation insurance because of the following reasons:

- You stay up too late and miss your flight.

- You decide not to go at the last minute after changing your mind.

- Your dog becomes ill.

- If you forget your passport at home and the airline forbids you from boarding.

Is flight cancellation travel insurance worth the cost?

It’s always a good idea to protect yourself with travel insurance you can rely on, especially with airline cancellations and delays on the rise. When you purchase flight insurance as a feature of a comprehensive travel insurance package, you may travel without stressing out about all the potential problems.

How can I receive coverage for flight cancellations?

Most conventional travel insurance policies include cancellation insurance, but if the coverage is insufficient, you can purchase it individually. As an alternative, you can get it without luggage protection if all you need is cancellation protection to safeguard you against canceled or delayed flights.

Always read the fine print, so before you purchase insurance, be sure you are protected for everything. A greater level of coverage insurance policy will likely be more expensive, but it will also likely provide you peace of mind. It is always worthwhile to examine all the costs.

If my flight is canceled, is accommodation covered by travel insurance?

Your flight and accommodation should both be fully refunded if you have cancellation coverage as a part of your travel insurance policy. The airline won’t be responsible for your hotel reservation if you bought your trip and lodging separately, therefore you’ll need to file a travel insurance claim individually.

Your tour operator should provide reimbursement or an alternative flight and hotel reservation if you purchased your flight as part of a package. If your vacation is not included in a package, insurance is more important because it can cover every leg of the trip, including your travel, lodging, and any paid-for pre-arranged excursions.

Are Flight Cancellations Covered by Cancel for Any Reason (CFAR)?

You can cancel your travel arrangements for any reason with Cancel for Any Reason (CFAR) coverage. You could want to use the Cancel for Any Reason coverage, for instance, if you merely worry or are afraid of traveling (reasons that aren’t covered in typical trip cancellation insurance). A few limitations should be taken into account if you choose Cancel For Any Reason benefits. A minimum of 48 hours before your scheduled departure date must pass in order to cancel your trip and still be covered by the policy.

Unfortunately, that timeframe won’t apply for visitors who discover their flight has been canceled at the airport and have already checked their bags. However, if the airline modifies its schedule significantly and you decide to cancel your trip more than 48 hours before departure, it might be covered. Remember that, if you cancel for a covered reason, Cancel For Any Reason (CFAR) will normally only reimburse you for 50% to 75% of the pre-paid and non-refundable trip costs.

We have covered why cancel for any reason coverage is an important feature of trip insurance. Read here.

If my flight is canceled, how can I get reimbursed?

Your airline must provide you with compensation if your flight is canceled or significantly delayed. You can call in or visit the airline’s website to learn more about the individual claim process. Depending on how much of a disturbance you experienced, you may receive a different amount in compensation.

Additionally, it is important to confirm what is protected by your trip delay benefits or cancellation coverage. A travel insurance coverage claim could assist you in paying for your vacation, your rental car, the expense of missing a connecting flight, or the cost of the hotel room you had reserved in advance. Finding out what aspects of a trip are covered by your insurance before you depart is highly recommended because these expenses can rapidly mount up.

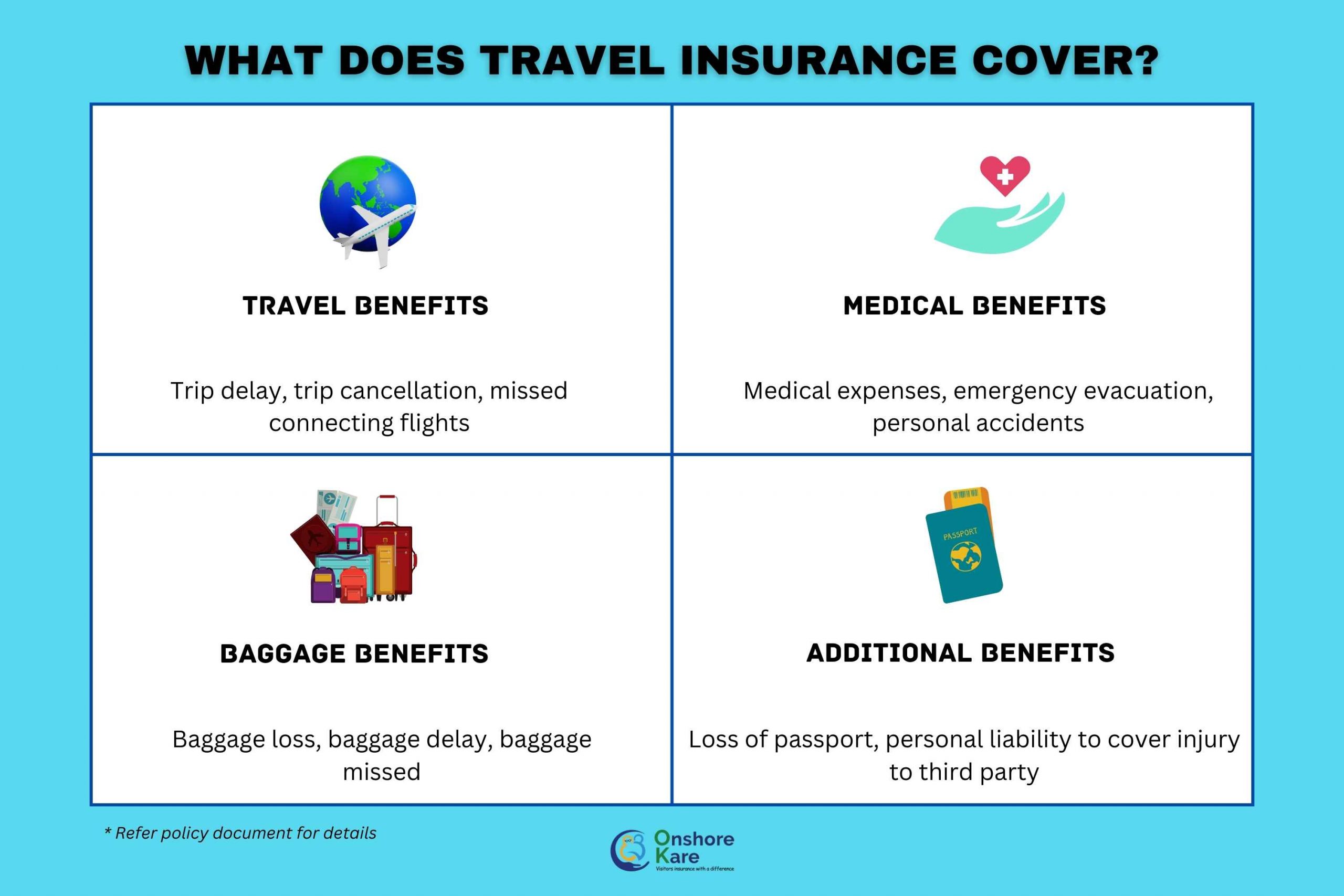

What is covered by travel insurance?

Here is a general notion of what you might anticipate being covered and the frequent exclusions from various travel insurance cover packages. Not every scenario will be covered because insurance is meant to pay for unforeseen expenses like unanticipated medical care.

Unexpected Events Not Covered by Travel Insurance:

Some events that may not be covered reasons in a travel insurance plan could include some or all of the incidents mentioned below:

- Natural disasters

- Disease or injury

- Immediate medical treatment

- Medical costs

- The destination becomes hazardous for travel

- Bereavement

- A theft, flood, or other disaster at your residence just before departure

- Redundancy

- Jury service

Common Exclusions in Travel Insurance include:

Some expected events may also not be covered by even a Comprehensive Travel Insurance Plan including:

- Medical conditions that aren’t declared but treatment being availed for the condition

- Known illness of a close relative (in this case, bereavement would not be considered)

- Injury, ailment, or medical care brought on by alcohol or drugs

Always double-check this with your travel insurance provider before purchasing coverage and getting ready to travel to prevent receiving an unpleasant surprise. It only requires a fast glance at the fine print or a phone call to a provider.

How long must a flight delay last before you receive compensation?

Depending on how long you were delayed, you may be entitled to certain things. If the airline is shown to have had influence over the delay, such as staffing issues, then compensation will be granted. Inclement weather or an airport staff strike would be regarded as circumstances outside the airline’s control (assuming that it’s not the airline’s employees on strike).

The airline is required to give you coupons for food and beverages if your delay is more than two hours. They must confirm that you may send emails or make phone calls as well.

You are entitled to monetary compensation if your delay lasts longer than three hours. The distance of the journey, the length of the delay, and the locations you’re flying between will all affect what you receive.

If you opt not to board the flight because it has been delayed more than five hours, the airline is required to issue a refund. If they are a part of the same route, this also applies to return flights and connecting flights. Even if you choose not to board the flight, you are entitled to accommodations if you are delayed overnight. The cost of taking a taxi to your hotel is an example of a reasonable charge that airlines will pay.

Do Airlines Always Issue Refunds for Flight Cancellations?

Airlines are required by federal law to provide a refund if a flight is cancelled for any reason and the consumer chooses not to travel. Airlines must also provide a refund if they make a significant schedule change or delay a flight and the consumer chooses not to travel. What’s the catch? The term “significant delay” is not defined and is determined case by case.

Your travel refund is subject to a number of factors, including the length of your flight and the length of the delay. The Department of Transportation (DOT) has complete discretion over when to offer a refund. Additionally, it is always possible, though not guaranteed, that your airline will grant you a refund even when it is not necessary.

If the airline refunds cancelled flight, why should I purchase travel insurance?

If you decide not to go on a canceled flight, the airline must reimburse you. Even so, you will probably incur hefty expenses in addition to the cost of refunded plane tickets. Airlines are not compelled by law to compensate you for any travel expenses you incur as a result of a flight cancellation, such as prepaid hotel, cruise, meal, or tour tickets.

It is wise to purchase travel insurance that covers additional non-refundable expenditures in the event that your flight is canceled because it is likely that the prepaid cost of your holiday will be far higher than the cost of your flight.

To make sure you are aware of the circumstances under which you can make a claim, it is crucial to study the covered grounds for travel insurance to cover canceled flights under your policy. Some, but not all, trip cancellation policies will cover a flight cancellation if the cancellation is brought on by an unforeseen strike or an aircraft mechanical issue.

If I Miss My Connecting Flight, What Happens?

Airlines will typically rebook you on the following flight, although it may take hours or even days to get a space. If you planned a connection flight on a different airline, there can be further issues and delays. The other airline might be willing to make accommodations for you or might ask you to purchase a new ticket.

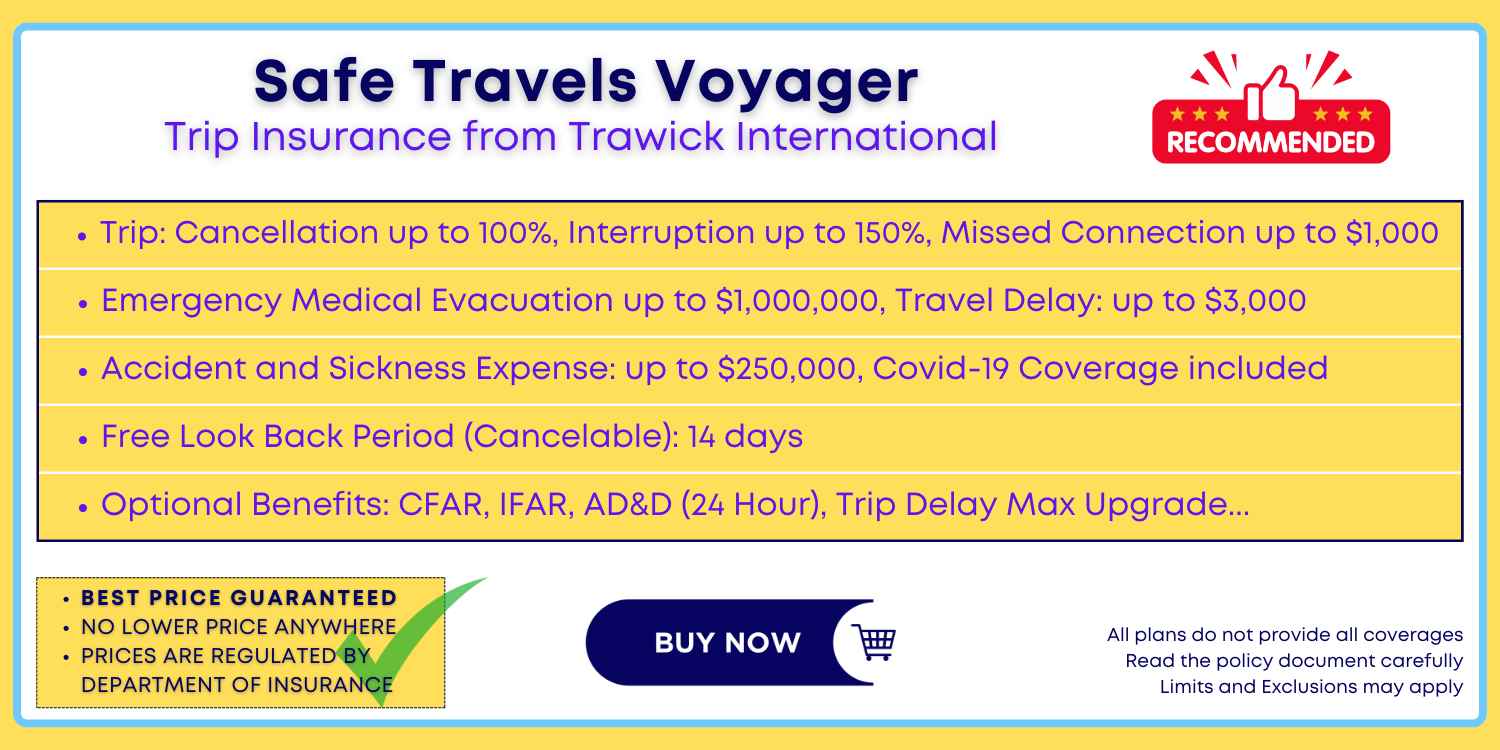

Missed Connection coverage is a common feature of travel insurance plans. If you miss your connecting flight due to airline delays brought on by bad weather or, in some situations, general airline delays, this coverage can reimburse you up to $1,000 for additional transportation costs.

What if after canceling the flight, the airline also misplaces my luggage?

Unfortunately, lost luggage is a common problem for travelers who experience flight delays or cancellations. While you search for your bags, you can end up spending a small fortune on new clothing and toiletries. The majority of travel insurance plans cover checked baggage for baggage loss and delay. Baggage delay insurance may be able to repay you for necessary personal items if your bags are delayed by six or more hours. The cost of replacing your lost or stolen belongings, however, may be covered by baggage loss insurance if your checked luggage is lost or stolen.

Will a Switch in Airlines Be Covered by My Travel Insurance?

What happens if your flight is canceled and you may resume your trip plans more easily by using a different airline? What’s next? Some travel insurance plans may pay for the cost of changing airlines if you must travel for a minimum of 24 straight hours past your scheduled arrival time. In this situation, you might be eligible for compensation for the expense of an alternative airline or mode of transportation.

What if I have to travel farther to get home? Will I Be Covered by Additional Insurance?

When a flight is cancelled, it is not unusual to suffer unforeseen delays traveling home. Most travel insurance policies will extend coverage for a week, but you must make sure that this advantage is offered by your specific policy. The trip interruption benefits could be used to pay for unforeseen costs like lodging and meals.

Do You Need Travel Insurance?

If your vacation doesn’t include flights, rental cars, hotels, or other planned fees, and if your health insurance is approved where you’re going, you might not require travel insurance. If not, the expense is well worth the security and safety you deserve. It’s crucial to prepare ahead and get the appropriate coverage for your trip because you can’t opt to purchase insurance after your vacation has begun or after you’ve left.

Travelers may easily compare and purchase online travel insurance from the most reliable providers using reputable online marketplaces like Onshorekare. We provide travelers with premium options that include round-the-clock emergency support. Our user-friendly comparison tool makes it simple to choose policies that offer the best pre-departure, pre-trip, and post-trip benefits at a fair price. For useful details, the absolute lowest pricing, and immediate coverage, request a quote right away.

When should I make a reimbursement claim from an airline?

The airline is required to provide you with an alternate flight or a full refund if the flight is canceled for any reason, such as insufficient staff. The airline should work with you to identify suitable dates if you decide to change your flight, and will then simply transfer your reservation. You may be given a voucher or credit by your airline to cover the cost of your flight, but you are not required to accept it. You have every right to request a full cash refund.

When should I make a reimbursement claim from the travel insurance provider?

You might not be eligible to compensation if the airline is forced to cancel the flight due to factors beyond their control. In this situation, you ought to consider filing a claim with your travel insurance company. Because it can act as a safety net in the event that you are unable to receive compensation from an airline, insurance is necessary.

If my flight is cancelled, is lodging covered by travel insurance?

Your flight and lodging should both be fully refunded if you have cancellation coverage as a part of your travel insurance policy. The airline won’t be responsible for your hotel reservation if you bought your trip and lodging separately, therefore you’ll need to file a travel insurance claim individually.

Your tour operator should provide reimbursement or an alternative flight and hotel reservation if you purchased your flight as part of a package. If your vacation is not included in a package, travel insurance cover canceled flights are more important because it can cover every leg of the trip cost, including your travel, lodging, and any paid-for pre-arranged excursions.

Frequently Asked Questions (FAQs)

Will flight cancellation due to an airline strike be covered by travel insurance?

Your travel insurance company will determine this. Check the terms and conditions before purchasing because some policies expressly restrict coverage for airline strikes.

Even if you are protected, if the strike wasn’t anticipated when you purchased your policy, you may only be able to file a claim through your canceled flight travel insurance. If you purchase your travel insurance after a strike has been declared, you won’t be protected.

When you decide to cancel your flight, how might flight cancellation insurance help?

Only when you cancel for a covered cause, do your trip cancellation benefits pay you back for a canceled flight and any pre-paid, nonrefundable trip costs. It’s important to be aware that the majority of travel insurance policies do not provide coverage for airline cancellations.

How much coverage do I need to have for flight cancellations under my travel insurance policy?

Depending on the insurance company and policy, you may receive a different amount of trip cancellation coverage. With Onshorekare, you can compare cancellation cover limits when you request a quotation.

Why do I need travel insurance when I can get reimbursed from the airline instead?

If your trip is disrupted, you will still need protection for other non-refundable charges even if the airline reimburses you for a flight. Your coverage will cover emergency medical expenses, including repatriation if you need to be flown home due to illness or accident, in addition to travel insurance for flights. Additionally, you’ll be protected in the event that your luggage is misplaced, stolen, or harmed without your fault.

Do flight cancellation benefits under travel insurance have any restrictions?

For each coverage, your travel insurance policy will have a maximum payout amount. You should look for the trip delay or trip cancellation coverage limit when determining the limits for cancelled flights. It could be a percentage of the associated expenses or a set sum of money.

How does coverage function in the event of a canceled or delayed flight?

Flight cancellations and delays are often covered by “trip delay” coverage in comprehensive travel insurance plans. You can submit a claim by contacting your insurer at the phone or website listed in your policy if your flight is delayed or cancelled for a covered reason and not rebooked within a specific length of time (often 3–12 hours, depending on your specific coverage). Depending on your policy, you might be eligible to receive reimbursement for some or all of the following expenses associated with your flight delay, subject to the policy limit:

- Extra expenses for lodging and food

- Prepaid vacation events that were missed

- Additional expenses for meeting your cruise or tour group

Some plans might even give you access to assistance services that can help you after a covered delay by making the appropriate arrangements. Find out more about the operation of travel insurance.

Bottom Line

It’s always a good idea to protect yourself with travel insurance you can rely on, especially with airline cancellations and delays on the rise. When you purchase flight insurance as a feature of a comprehensive travel insurance package, you may travel without stressing out about all the potential problems.