Travel Insurance for Parents Visiting the USA

Travel insurance for parents visiting USA can be extremely helpful in critical situations saving you a from huge financial impact.

Medical costs in the USA are extremely high, if your parents are visiting the USA then you need short-term health insurance plans to cover any risk or eventuality.

This article will help you understand the need for visitor insurance for parents visiting the USA and also some of the best visitor insurance plans.

Watch this short video on travel insurance for parents visiting the USA

What is visitor insurance for parents visiting the US?

Also known as Visitors’ insurance, travel insurance for parents is specially designed to meet the needs of US visitors.

These temporary health insurance plans (travel insurance) cover eligible medical expenses during medical emergencies.

With visitors’ health insurance for parents visiting the USA, you mitigate this risk of unwarranted medical expenses.

Do you need health insurance for parents visiting the USA?

A single hospital visit can bankrupt a family in America!

Some of the top reasons why you need visitors insurance for parents visiting the USA are:

- Visitors’ insurance is economical when compared to the total travel cost and the risk of getting sick in the U.S. without health insurance to cover medical expenses. Travel Insurance helps you reduce the financial risk in such situations

- The coronavirus pandemic has affected millions worldwide, Make sure your visitors’ insurance covers Covid-19. Now there is an added risk of Monkeypox. Travel Insurance for parents visiting USA helps manage the risk associated with the pandemic.

- Accidents happen often, especially when unfamiliar with the surroundings, and ER visits can cost thousands of dollars. Without travel insurance, you must pay for medical treatment in the U.S.

- Your parent’s immune system can weaken from travel, new surroundings, weather changes, and more. Their pre-existing conditions may make matters more complicated. Without travel insurance, your parents’ hospital bills could threaten your financial security and sponsorship.

- Legal U.S. residents and workers can buy health insurance, but visitors can’t be added to a U.S. resident’s health insurance plan. As a legal resident, you may be liable for visitors’ medical expenses, visitors insurance for parents helps mitigate this risk.

We always recommend buying visitor insurance for parents visiting the USA. If they have pre-existing conditions then look for plans that provide acute onset of pre-existing conditions coverage or plans covering pre-existing conditions.

What type of insurance should you look for?

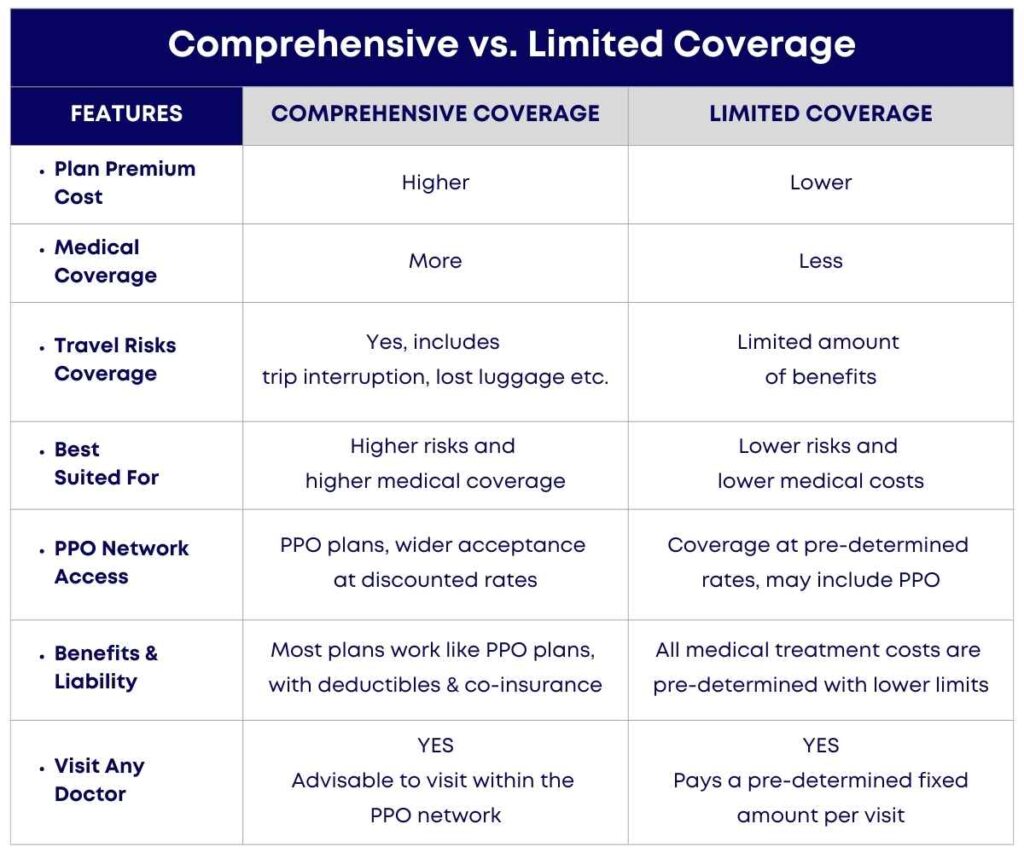

There are two types of visitor health insurance plans for parents visiting USA:

- Comprehensive Coverage visitor health insurance plans

- Fixed/Limited Coverage visitor health insurance plans

We recommend comprehensive coverage plans for parents visiting USA as these travel insurance plans offer coverage benefits that are higher and offer more benefits.

Though comprehensive coverage medical plans are relatively expensive as compared to a fixed coverage plan the benefits outweigh the cost.

The policy maximum limits in comprehensive coverage plans are higher and there are several other advantages. Access to PPO network, lower out-of-pocket expenses, and more.

See our detailed explanation of the differences between:

Comprehensive Coverage, and Fixed/Limited Coverage benefits plans.

We have created a checklist for visitors’ medical insurance please read it to get insights.

Where should you buy visitor insurance for parents?

Travel insurance for parents can be bought either from their home country before they travel OR from the USA.

Always ensure that the policy start date is from the date of their departure flight. In case your parents are already in the USA and they don’t have travel insurance then you can still buy coverage from US-based insurance providers.

We have done a detailed analysis of buying travel insurance from our home country vs. the USA

We recommend buying travel insurance from the USA because of several advantages.

If you live in the USA and are buying travel insurance for parents visiting the USA then you must consider the following:

- USA-based travel insurance is more likely to be recognized in hospitals

- USA-based travel insurance plans are regulated by the State Department of Insurance

- You can get hold of travel insurance companies’ customer service easily in the USA

- Follow-up on claims settlement is easier to coordinate within the USA

We have compiled a complete guide to buying USA travel medical insurance.

Always ensure to:

- Purchase insurance from reputable insurance providers

- Purchase insurance with access to the PPO network

- Purchase from an insurance provider that offers multiple options to compare plans

- Purchase an insurance plan that meets your needs and is not necessarily a cheap plan

- Avoid buying plans listed as the best seller, most sold, etc. from online marketplaces

- These plans may be good but they may not meet your medical emergency needs

- Take time to understand the details and read the fine print

- Buy visitors’ insurance that covers emergency medical evacuation (part of the plan or as an add-on)

Should you buy a single policy for both parents and an individual policy?

If both your parents are visiting the USA, you will not enjoy many benefits of combining two visitors’ health insurance policies into one.

Though you will not experience any monetary benefits from buying separate policies, it will come in handy if either of your parents has to leave early or want to cancel either one of the visitors’ insurance plans.

How much policy maximum is appropriate?

Depending on their age and length of stay, choose the policy maximum. As a golden rule, the more the policy maximum, the better it will be for your aged parents. A policy maximum of $100,000 is an appropriate amount.

For 70 years and above – Most companies will offer a maximum of $50,000 and a few companies can provide coverage ranging from $60,000, $100,000, and $250,000.

For 80 years and above – You will face many restrictions if your parents are above 80 years.

Parents’ Pre-Existing Conditions will be covered by Visitors’ Insurance?

Pre-existing conditions coverage benefits are generally not available under visitor insurance plans. The obvious reason is the high cost of treatment and insurance companies wanting to limit their exposure to these high costs.

Here is a helpful guide on choosing visitors insurance for parents with pre-existing conditions.

Pre-existing medical conditions are a concern especially when older parents visit the USA. Some Visitor’s insurance plans offer coverage benefits for the acute onset of pre-existing conditions. This is not the same as covering the conditions themselves and you should be aware of this.

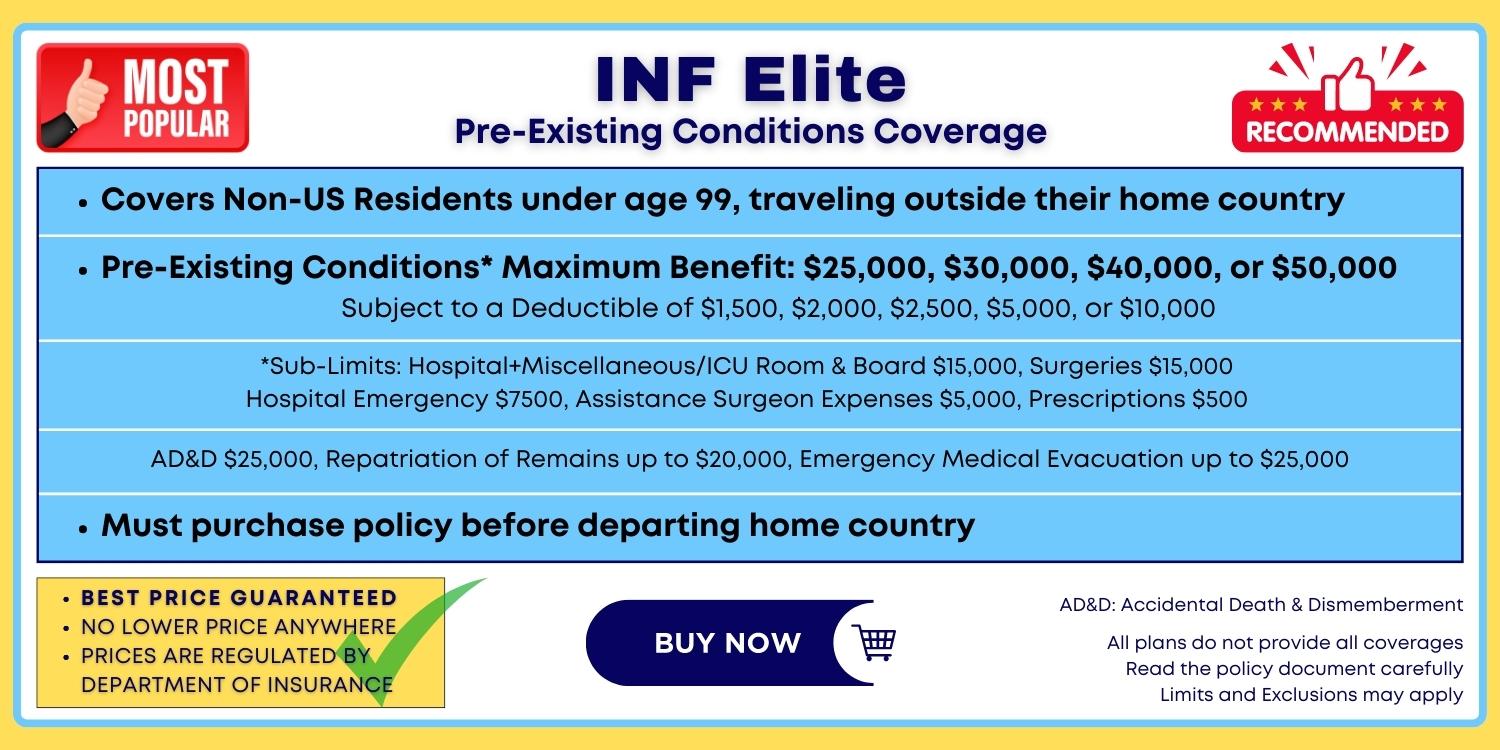

There are some plans that offer coverage for pre-existing conditions. These plans come with several conditions and it is important to know them and read about these plans. The premium for such plans will be high as compared to other medical insurance plans/visitors insurance plans.

Will Visitors’ Insurance cover all medical expenses?

In insurance parlance, there is a term called eligible medical expenses. What this means is that if the health insurance plan covers a condition or incident then the medical expenses will be covered within the limits prescribed in the plan.

So a simple answer to the question of will all medical expenses be covered is no. It is extremely critical for you to read and understand the plan you are buying and if certain elements can be added top-on to the plan that are not covered in it already.

For Example, Emergency Medical Evacuation may not be covered as a standard but you may be able to add on this coverage for an extra cost over the premium.

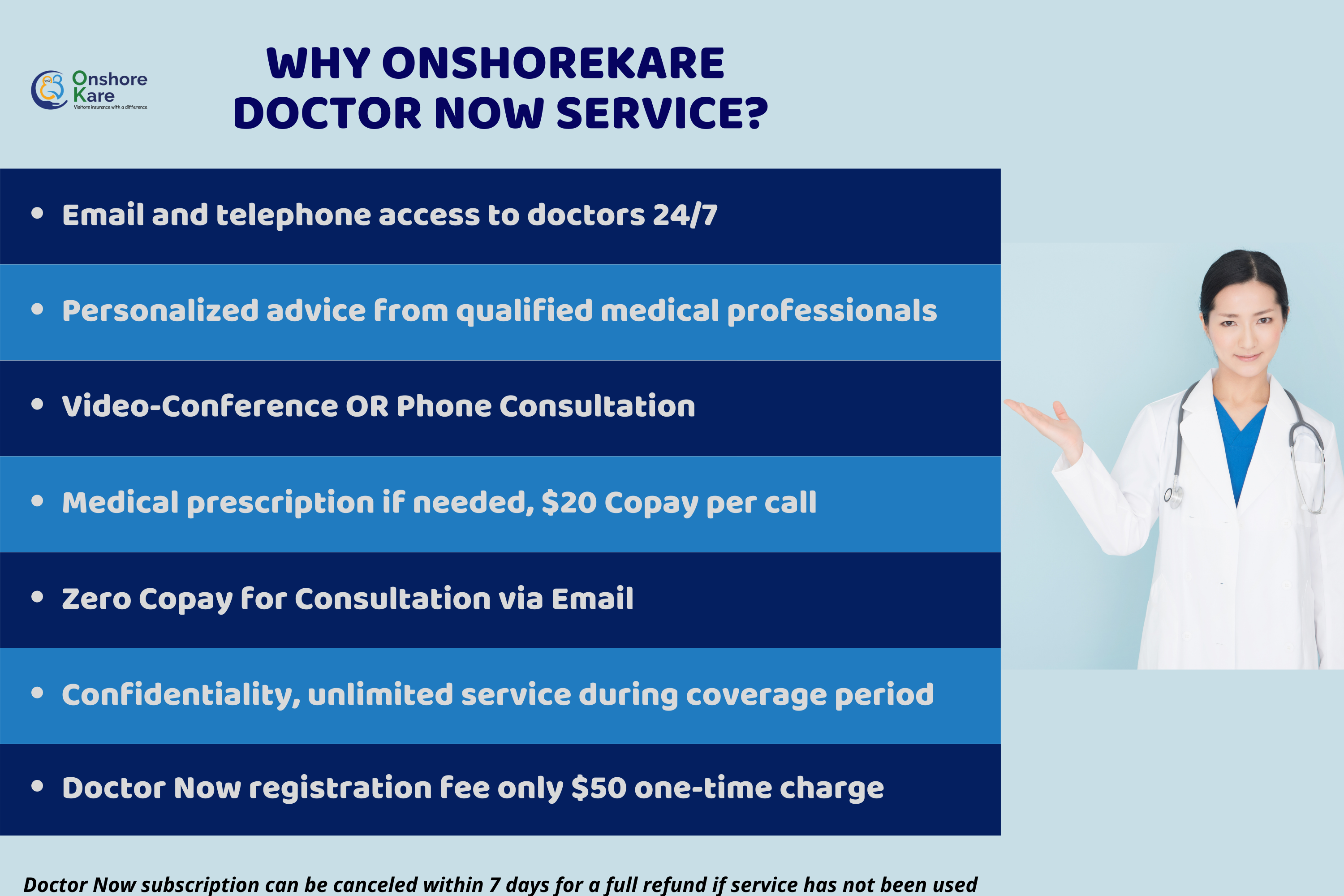

Telemedicine and travel insurance for parents visiting USA!

With parents visiting USA some of the common medical issues which are not emergency situations add to unnecessary medical expenses. You can look for an option to add telemedicine to your international travel insurance plan.

Visiting parents can get an online video or telephone conference with a qualified medical doctor and get a common diagnosis and prescription as appropriate. These prescription drugs can be bought from a local pharmacy.

OnshoreKare provides Doctor Now service along with the plans as an add-on service:

Which is the best visitor insurance company in the USA?

The Best Visitors Insurance Company is a subjective term. The following insurance companies provide the top selling travel medical insurance plans to visitors to the USA:

- IMG Global Travel Insurance

- Seven Corners Travel Insurance

- Trawick International Travel Insurance

- WorldTrips – Tokio Marine Travel Insurance

- INF Travel Insurance

Please click on the links and read our detailed review of each insurance company listed above.

Some of the best visitor insurance plans for parents visiting USA are:

Patriot America Plus Travel Insurance

- After the deductible, the plan pays 100% up to the policy maximum

- Coverage for non-U.S. citizens traveling to the U.S.

- Coverage is available from 5 days to 365 days, renewable up to 24 months

- Deductible options from $0 to $2,500

- Policy maximum up to $500,000

- Coverage for acute onset of pre-existing conditions up to policy maximum

- United Healthcare PPO Network

Patriot Platinum Travel Medical Insurance

- After the deductible, the plan pays 100% up to the policy maximum

- Travel medical insurance for individuals, families, and groups

- Coverage is available from 5 days up to 365 days, renewable up to 36 months

- Deductible options from $0 to $25,000

- Maximum limits from $1,000,000 to $8,000,000

- Coverage for the sudden and unexpected recurrence of pre-existing conditions

Atlas America Travel Insurance

- After the deductible, the plan pays 100% up to the policy maximum

- Coverage is available from 5 days to 364 days

- Policy Maximum up to $2 Million

- $500 for Lost Checked Luggage

- Emergency Medical Evacuation

- Emergency Dental is covered

- United Healthcare PPO Network

Safe Travels USA Insurance

- The plan pays 80% of the first $5,000 of eligible expenses, then 100% up to the policy maximum

- Covers doctor visits, x-rays, prescriptions, hospital, surgery, ambulance

- Coverage for Unexpected Recurrence of a Pre-Existing Medical Condition

- Emergency medical treatment of pregnancy up to $1,000

- Mental or nervous disorders up to $2,500

- Physiotherapy/Chiropractic $50 per visit per day up to 10 visits

- Dental treatment – for injury or emergency alleviation of pain $250

Safe Travels USA Cost Saver

- The plan pays 80% of the first $5,000 of eligible expenses, then 100% up to the policy maximum

- Covers doctor visits, x-rays, prescriptions, hospital, surgery, ambulance

- Emergency medical treatment of pregnancy up to $1,000

- Mental or nervous disorders up to $2,500

- Physiotherapy/Chiropractic $50 per visit per day up to 10 visits

- Dental treatment – for injury or emergency alleviation of pain $250

- Trip Interruption up to $5,000 for a ticket home (does not cover trip cost)

- Minimum 5 days of coverage purchase – up to one year

- Renewable – the policy can be renewed for up to 24 consecutive months

Cover America Gold Comprehensive Plan

- Comprehensive Coverage plan

- After the deductible, the plan pays 100% up to the policy maximum

- Provides coverage for acute onset of pre-existing conditions

- Coverage from 5 days to 365 days

- $15 copay for urgent care depending on policy maximum

- Border Protection, Missed Connection, Loss of Passport & Theme Park Coverage

Frequently Asked Questions (FAQs):

Can I buy health insurance for my parents in the USA?

Yes, a US citizen, an immigrant, a permanent resident, or a person currently residing in the USA on a work visa can fill out the application form on behalf of their parent and pay the company using a debit or credit card.

Can visitors to the US get health insurance?

No temporary visitors to the USA are not eligible to get local health insurance in the USA. Visitors’ Insurance is what can be obtained as an alternative.

Which travel insurance is best for the USA?

There is no one-size-fits-all policy that is best. You must buy a travel insurance plan that best meets your needs. Visitors Insurance offers add-ons to plans that can be customized to cater to your needs. Do a detailed comparison of plans before narrowing down on one you want to buy.

What happens when parents travel without insurance?

For those, who have signed a sponsorship document or are a guarantor – you’re liable to pay for the medical bills of the parents. To get more information, it’s best to contact a legal advisor.

Is medical insurance required for a US tourist visa?

It’s not mandatory currently to have medical insurance for a US tourist visa but it’s helpful as medical care in the USA is extremely expensive.

Which type of insurance to buy for parents who are likely to stay at home most of the time?

Irrespective of what your parents are planning to do, unprecedented events can occur at any location at any point in time. If your parents are more likely to stay indoors, it’s advisable to buy a higher policy deductible or less policy maximum for travel medical insurance.

Can my parents carry their prescription drugs with them when they travel?

Yes, they can. We have compiled a detailed guide on how to travel with prescription drugs, take a look.

Conclusion:

Visitor Insurance for parents visiting USA seems like a complicated task, it does require some amount of research and effort to buy visitor medical insurance. Being proactive helps in this research to ensure you get the most suitable plan for your parent’s needs. It’s even more complicated for parents with pre-existing conditions, acute onset plans are needed at a bare minimum.

Hopefully, this article helps you, you can also generate a quote on our website and reach out to us for any more questions.