ICICI Lombard Travel Insurance For USA – Complete Guide

This ICICI Lombard travel insurance USA review explains the travel insurance plans from their portfolio and delves into buying travel insurance from India or the USA.

Buying Travel Insurance from India or the USA? Here is what the leading publications from India are saying:

OnshoreKare was recently covered in these leading publications from India. The coverage was related to travel insurance for visitors and parents visiting the USA.

These articles discuss buying travel insurance from India or the USA, you may find it useful.

So, let’s embark on this insightful journey together to unravel the world of ICICI Lombard and understand more about their travel insurance plans for the USA.

Understanding Travel Insurance From ICICI Lombard General Insurance Company

ICICI Lombard General Insurance Company is a renowned name in the general insurance industry in India. It belongs to the ICICI Group, India’s largest banking and financial services group.

ICICI Bank belongs to the same group. If you have worked in India before coming to the USA you may have had a salary account with ICICI Bank and may have used the services of their group companies in India.

ICICI Group offers both life and general insurance products in India. The ICICI Lombard Travel Insurance for USA travel offers a range of comprehensive travel insurance plans designed to cater to the diverse needs of individuals and protect them against an unfortunate event or incident.

ICICI Lombard travel insurance provides:

- Coverages and plans to suit every individual’s needs

- Travel insurance plans of ICICI Lombard offer coverage from as young as 3 months old up to the age of 85 years

- Coverage is provided without any medical check-up for policy issuance

- The policy covers individual safety and

- Also, provide value-added services for the individual family members back home

One notable feature is the option for travel health insurance policy coverage without requiring a medical check-up for individuals up to 85 years old, making it accessible and convenient for travelers.

By understanding the nuances of ICICI Lombard USA Travel Insurance, you can make informed decisions to ensure a worry-free travel experience.

Types Of ICICI Lombard Travel Insurance Plans

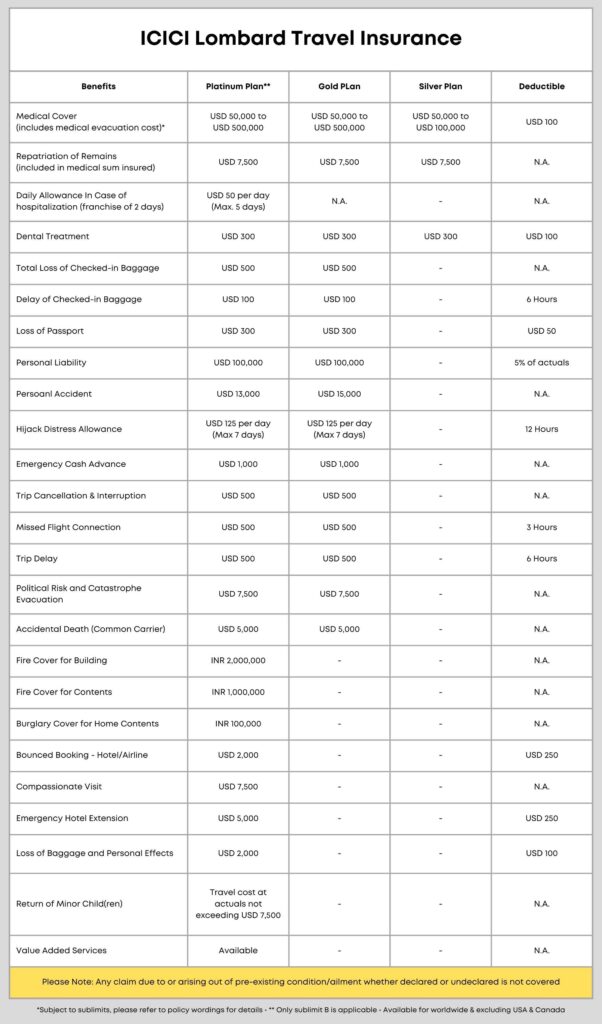

ICICI Lombard international travel insurance provides the following types of plans:

- Leisure Travel Plan: Platinum Plan, Gold Plan & Silver Plan

- Senior Citizen Plan

- Gold Multi-Trip Policy

- Asia Plan

We will be looking at the details of the Leisure Travel Plan and Senior Citizen Plan in this article and what the insurance policy covers.

Which are the Best Travel Insurance Plans available from USA-based Insurance Providers?

ICICI Lombard Travel Insurance – Coverage Options And Benefits Offered

ICICI Lombard Travel Insurance offers a range of coverage options and benefits to ensure travelers have peace of mind during their journeys.

Leisure Travel Insurance Plan

Medical Coverage:

- Medical Cover with medical evacuation costs: Sum Insured from $50,000 to $5,00,000

- Repatriation of remains:

- Covers repatriating the remains back

- As well as local burial or cremation in the country where the death shall occur

- Daily Allowance in case of hospitalization*: Covered in case of hospitalization for more than 2 days

- Dental Treatment: Covers the cost of treatment to natural teeth in case of injury

- Personal Accident: Compensation paid in case of accidental – death or permanent total/partial disability Personal Liability: Compensation for legal liability incurred by the insured for involuntarily causing bodily injury or property damage to third parties

- Accidental Death (Common Carrier): Compensation is paid in the event of:

- Death or

- Permanent total/partial disability

- While traveling in a common carrier

Note: With ICICI Lombard travel insurance pre-existing conditions are not covered

* Applicable to selective plans under International Travel Insurance

Non-Medical Coverage:

- Total Loss of Checked-in Baggage:

- Reimbursement for the loss suffered:

- Due to permanent loss of checked-in baggage

- Whilst in the custody of the Common Carrier

- Reimbursement for the loss suffered:

- Political Risk & Catastrophe Evacuation:

- The company will pay the cost of:

- The insured’s return to the Country of Residence, or

- The nearest place of safety

- In case the insured needs to immediately evacuate the country

- The company will pay the cost of:

- Compassionate Visit:

- In case of Insured’s hospitalization for more than 5 days

- Payment of traveling and lodging & boarding expenses for a family member or relative

- Delay of Checked-in Baggage:

- Allowance for incidental expenses

- Incurred due to a delay of checked-in baggage for more than 6 hours

- Loss of Passport:

- Reimbursement of expenses incurred in obtaining an emergency certificate to:

- Prosecute journey to the resident country, as well as

- The cost incurred towards the prescribed application fee for a duplicate passport

- Reimbursement of expenses incurred in obtaining an emergency certificate to:

- Trip Cancellation & Interruption:

- Reimbursement of the non-refundable prepaid payments:

- For the trip cancellation or interruption due to:

- Medical problems

- Acts of terrorism or

- Natural disasters

- For the trip cancellation or interruption due to:

- Reimbursement of the non-refundable prepaid payments:

- Trip Delay: Reimbursement of additional expenses incurred if the trip is delayed for more than 6 hours

- Bounced Booking:

- Reimbursement of additional expenses incurred:

- Due to bounced booking of an airline or hotel,

- Solely at the instance of the common carrier and accommodation provider respectively

- Reimbursement of additional expenses incurred:

- Emergency Cash Advance: Emergency cash allowance given in case of accidental loss of all or almost all travel funds

- Emergency Hotel Extension: Payment of the actual additional expenses for lodging and boarding incurred

- In case the insured trip is delayed due to

- Natural calamities,

- Acts of terrorism, or

- Medical emergencies

- In case the insured trip is delayed due to

- Loss of Baggage & Personal Effects: Reimbursement for loss incurred due to loss of Checked In Baggage or personal effects outside the airport

- Missed (Flight) Connections: Reimbursement of the extra expenses

- Incurred due to missing a connecting flight

- Due to an aircraft delay of more than 3 hours

- Hijack Distress Allowance: Compensation payable

- In case of hijack of air or sea common carrier

- For more than 12 hrs while on your trip abroad

- Return of Minor Child(ren): Compensation for

- The cost of an economic class air ticket

- For the unattended minor child in a foreign land

- Home Insurance ( Fire cover for Building and Contents, Burglary Cover for Contents): Compensation for

- The losses incurred due to damage to your home or

- Its contents from fire and allied perils or

- Any loss of home contents on account of burglary

- Whilst on your trip abroad

See Visitors Insurance Plans For Parents Visiting the USA from USA-based providers. Get a free quote and compare plans.

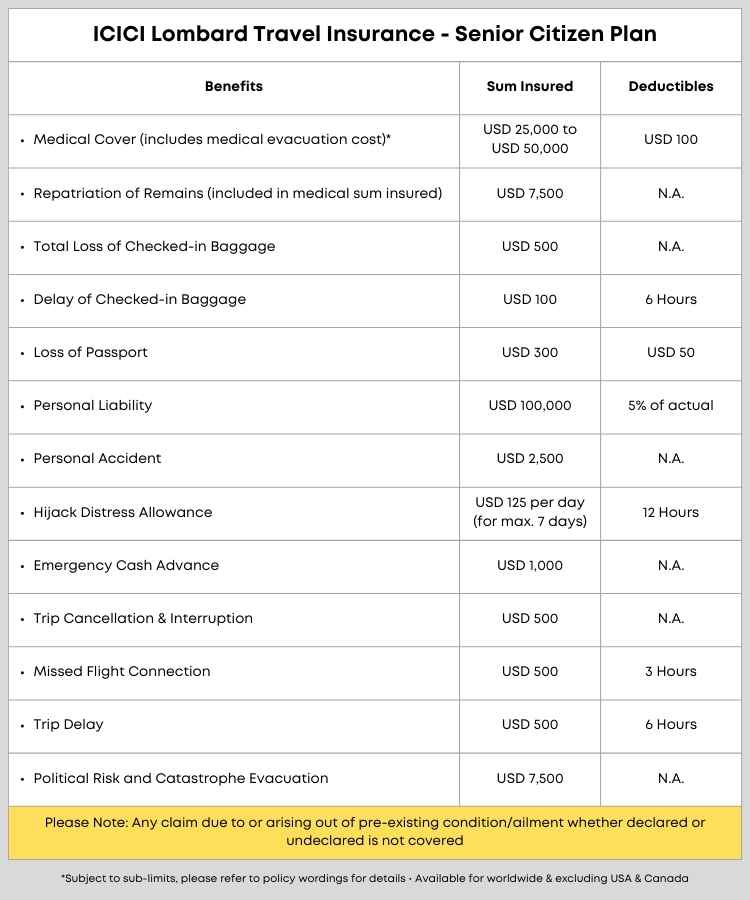

ICICI Lombard Travel Insurance – Senior Citizens Travel Insurance Plan

Tailored specifically for senior citizens in the age group from 71 to 85 years old, this international travel insurance product offers comprehensive coverages to ensure protection while traveling worldwide.

Other plans to consider for Senior Citizens:

Value Added Services*

Medical Concierge Services for dependents in India

- Telephone Medical Information

- Medical Service Provider Referral

- Appointments with Local Doctors for Treatment

- Home Nursing Care Assistance

- Monitoring Assistance

- Evacuation/Repatriation

Services Automotive Assistance Services for dependents in India

- Minor on-the-spot repair

- Breakdown Services & Towing

- Flat tire service

- Jumpstart

Lifestyle Services for Dependents in India

- Gift/Flowers Delivery Assistance

- Dining Referral and Reservation Assistance

- Business Services

- Special Events and Performance Assistance

- Home Movers Assistance

- Plumbing Assistance

- Electrical Assistance

- Pest Control Assistance

- Home Cleaning Assistance

- Electrical Gadget Repair Assistance

Note: Applicable to selective plans under International Travel Insurance

*For the above-mentioned services the liability of the Company would always remain limited to providing assistance in terms of arranging the above-mentioned services. All charges towards such services would be borne by the Insured Person

Limit Of Covered Expenses:

Sub-limit A:

Limit for any one illness and/or injury The maximum liability of the Company applicable for any Illness and/or Injury is USD 100,000 or the Sum Insured, whichever is lesser

Sub-limit B:

Limits applicable for various types of medical expenses In the case of persons aged 51 years and above, the following limits are applicable for any Illness and/or Injury :

- Hospital Room and boarding- maximum USD 1,800 per day up to 30 days

- Intensive care unit – maximum USD 3,250 per day up to 7 days

- Surgery* – maximum up to USD 15,000

- Anesthetist services – up to 25% of surgical treatment

- Medical Practitioner’s visit fees – maximum USD 100 per day per visit up to 10 visits

- Diagnostic and Radiology services – maximum USD 1,000

- Ambulance services** – maximum USD 500

- Miscellaneous expenses*** – maximum of USD 2,000

For application of the above sub-limits:

*Surgery: Includes Operation room charges, Surgeon fee, and Implant charges

**Ambulance Services: Includes Cost of transportation to hospital and Paramedic services

***Miscellaneous expenses: Includes but are not limited to the cost of medicines/ Pharmacy/ Drugs/ Supplies, nursing charges, External medical appliances as prescribed by a registered Medical Practitioner as necessary and essential as part of the treatment on actual, Blood storage & processing charges, other services which are not part of any other above-given heads

Exclusions:

- Any claim due to or arising out of a pre-existing medical condition/ailment whether declared or undeclared is not covered under the policy

- Any claim relating to Hazardous Activities, unless specifically covered in the Policy

- Any claim relating to events occurring before the commencement of the trip covered hereunder and any time after the completion of the trip at any port in the country of residence of the insured mentioned hereunder

For a full list of exclusions please refer to policy wordings on their website

ICICI Lombard Travel Insurance Reviews

Many users search for information on ICICI Lombard travel insurance review, you can get more details on:

Read their travel insurance sales brochure carefully and see what incidents covers medical expenses, and risk factors to consider where your claim amount may not be paid due to exclusions.

Application And Cancelation Process

When applying for a travel insurance policy, the process is designed to be user-friendly and efficient. You can easily purchase your travel insurance online by visiting their website and selecting the appropriate plan based on your travel needs. It is essential to carefully review the coverage options and benefits offered to ensure they align with your requirements, read the policy document carefully.

Once you have selected a plan, you can proceed with the application process by filling in your details and making the payment online.

Cancelation Process

How to cancel ICICI Lombard travel insurance? If the insured person requests it, the International Travel Insurance policy can be canceled at any time before the expiration date written in the policy, as long as the following conditions are met:

- Cancellation is only possible if there is no claim and/or before the cover expires, which could be any time between 30 days and 1 year.

- If the policy is for a single trip, the company will keep the premium for the portion of the cover that has already expired and also keep 300 Indian rupees as cancellation charges for the policy before giving the insured their money back as allowed by the policy.

- If the insured person filed a claim under any part of this policy before the date of the notice of cancellation, and that claim is still being processed or has already been accepted by the insurer for any amount, this policy cannot be canceled.

- According to the disclosure of information norm:

- the policy is null and void and all premiums paid will be forfeited to the company if there is any misrepresentation, misdescription, or non-disclosure of any material information.

- the insured can cancel this policy by giving 15 days written notice, and the company will refund the premiums on a short-term basis for the remaining Policy Period, as long as the insured hasn’t made a claim.

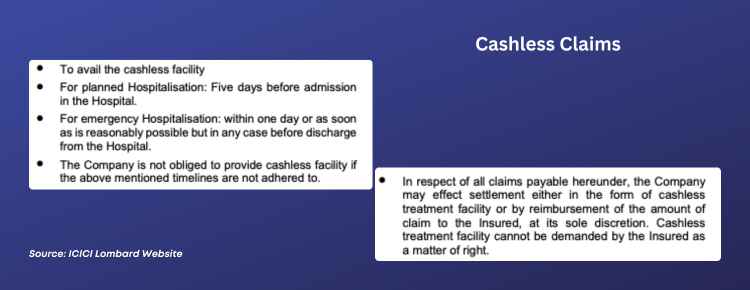

ICICI Lombard Travel Insurance – Cashless Claims

ICICI Lombard international travel insurance policy does offer cashless claims as a benefit. However, the insurance policy document mentions that it cannot be claimed as a guaranteed benefit as a matter of right.

Travel Insurance Plans with Cashless – Direct Billing Offer

- INF Elite (Pre-Existing Conditions Coverage)

- INF Elite Plus (Pre-Existing Conditions Coverage)

- INF Safe Traveler USA

- INF PremierX (Pre-Existing Conditions Coverage)

- INF Premier (Pre-Existing Conditions Coverage)

- INF Premier PlusX (Pre-Existing Conditions Coverage)

- INF Premier Plus (Pre-Existing Conditions Coverage)

- INF StandardX

- INF Standard

These are all International Visitor Accident & Sickness (IVAS) Insurance Plans. Insurance is acceptable to most participating providers and facilities, providers are likely to bill the IVAS insurance directly, i.e. “Direct Billing” most of the time. This means you may not have to pay the entire medical bill & wait for reimbursement per the terms of the plan. Some plans may come with INF-Robin Assist, which arranges for direct billing & cashless claims.

Buy Travel Insurance From India Or the USA?

While it might seem convenient to purchase insurance from India, opting for a provider based in the USA offers a multitude of benefits tailored specifically to the needs of travelers to this region.

But first, let’s delve into why choosing a US-based insurance provider is the smart choice:

- Tailored Coverage: Travel insurance policies offered by US-based providers are specifically designed to cater to the unique needs of travelers visiting the USA. This means comprehensive coverage that addresses potential medical emergencies, trip cancellations, baggage loss, and more, all tailored to the healthcare system and travel landscape of the USA.

- Ease of Communication: Dealing with a US-based insurance provider eliminates the potential of delayed response due to time zone differences, ensuring smooth and efficient communication in case of emergencies or assistance requirements. Quick and clear communication can be crucial during stressful situations, providing peace of mind to both you and your parents.

- Access to Quality Healthcare: Opting for travel insurance from a US-based provider ensures access to a vast network of trusted healthcare providers across the country. In the event of a medical emergency, your parents can receive timely and high-quality medical care without worrying about the complexities of healthcare systems in a foreign country.

- Compliance with US Regulations: US-based insurance providers are well-versed in the regulatory requirements of the country, ensuring that their policies comply with all relevant laws and regulations. This means greater transparency and reliability, safeguarding your investment in travel insurance.

- Pre-Existing Conditions: At OnshoreKare you have an option to buy travel insurance that offers coverage for pre-existing conditions or select plans with acute onset of pre-existing conditions coverage. With over 40 plans to choose from we give a wide range of choices.

Deterrents To Purchasing Travel Insurance From India For Your Parents

- Limited Coverage and Benefits: Travel insurance policies purchased from India may offer limited coverage and benefits, often failing to adequately address the specific needs and risks associated with travel to the USA. This can leave your parents vulnerable in case of emergencies or unforeseen circumstances.

- Difficulty in Claim Processing: Dealing with insurance claims from a foreign country can be a cumbersome and time-consuming process, especially when it involves navigating different legal frameworks and documentation requirements. Purchasing insurance from India may complicate the claims process, leading to delays and frustration.

- Lack of Local Support: When purchasing travel insurance from India, you and your parents may lack access to local support and assistance services in the USA. In contrast, US-based insurance providers offer dedicated support teams and resources to help travelers navigate unfamiliar terrain and address any issues that may arise during their stay.

- Recourse: Travel insurance providers based in India are not regulated or licensed in the USA. For any recourse with insurance providers, you will need to be dependent on consumer courts in India. With USA-based providers, you have the option for a legal recourse in the USA.

In conclusion, while the temptation to purchase travel insurance from India may be strong, opting for a US-based provider offers numerous advantages that far outweigh any perceived conveniences. Ensure your parents’ peace of mind and security during their visit to the USA by choosing comprehensive and reliable travel insurance from a trusted provider right here in the United States.

Conclusion

In conclusion, ICICI Lombard Travel Insurance offers a comprehensive option for travelers seeking peace of mind during their journeys, with a wide range of coverage options and benefits, including medical emergencies, trip cancellations, and baggage loss.

If you are looking at travel insurance from USA-based insurance providers and higher limits and coverage for pre-existing conditions or the acute onset of pre-existing conditions then you need to look for alternatives.