Atlas America Travel Medical Insurance Reviewed

Wish for the best but always, always prepare for the worst.

This proverb perfectly fits the context when it comes to traveling.

- You or your relative/family member could get sick and require treatment.

- And god forbid, what if you sustain an injury in a road accident? What then?

- Do you have any idea how exuberant the medical expenses can be while traveling to an international country?

Let’s hope you never have to find out, but what if you do?

No one wishes to think of the worst situation, right? However, planning for one is essential. This is where travel medical insurance comes in handy.

But why? Why invest in travel medical insurance?

- It protects you from unforeseen medical expenses.

- It acts as a friend and protector in a foreign land.

- It covers acute onset of pre-existing conditions.

- It provides financial support if you need an emergency medical evacuation.

However, the problem is that there are hundreds of travel medical insurance companies to choose from. Some offer exemplary deductibles, while others cover the Medical Evac. So how do you choose “The One”?

Let’s review the top one from your list – Atlas America Travel Medical Insurance.

Watch a short video

Atlas America Travel Medical Insurance – Reviewed

Atlas America offers a wide range of travel insurance plans to people visiting the USA or traveling beyond their home country borders. Ranging from visitors, tourists, travelers to students and ex-pats, there are travel medical insurance plans for any and everybody.

- But how good are those plans?

- What all is covered?

- Are these really as top-class as the company claims them to be?

Read on to find out.

Any travel medical insurance is reviewed based on a certain set of parameters:

- Medical Benefits and Sum Insured

- Claims Process

- Terms of Claims

- And Most Important of All – How Easy Is It to Get in Touch With an Agent?

Let’s review Altas America on each and every one of these parameters.

Medical Benefits and Sum Insured

This one is essential since hospitalization expenses vary from country to country. Atlas America offers medical benefits as follows:

- Maximum coverage of $50,000, $100,000, $200,000, $500,000, $1,000,000 or $2,000,000 for age 14 days – 64 years based on the travel insurance plan you choose.

- Maximum medical benefits coverage of $50,000 or $100,000 for ages 65-79 years.

- For travelers above the age of 80 years, the maximum coverage is limited to $10,000.

Please Note: The overall maximum limit applies per person, per certificate period, and of course, per injury/illness.

Claims Process

This is where Atlas America shines a little brighter than most travel insurance options. Their claim process is not only easy but also quicker than most fish in the travel insurance pond. So if you submit the relevant paperwork timely (within 60 days from the date of medical service availed), your claim process will be smooth sailing.

Terms of Claims

The terms of the claim vary from plan to plan. However, if you’ve attached the following documents, you’ll be good to go:

- Completed claims form

- Copy of the insured’s passport

- Copies of all medical receipts, bills, and itemized services

- Cover letter comprising brief information about the insured, his/her illness/accident, and the treatment received

How Easy Is It to Get in Touch With an Agent?

Another area where Atlas America stands apart from the crowd – they have an eminent team of licensed insurance agents on board. So whether you have concerns about the existing travel insurance policy or you’re not sure which one is right for you, professional assistance is just a phone call away.

Now let’s talk features…

Eligibility

To avail Atlas America travel insurance benefits, the insured must be a visitor to the USA or an international traveler outside of the home country and above 14 days of age.

Policy Maximum

Atlas America offers various travel insurance plans. However, the maximum policy coverage goes up to US $2,000,000.

Plan Deductible

Atlas America offers a choice of deductible per certificate/renewal period in the amount of US$0, US$100, US$250, US$500, US$1,000, US$2,500, and US$5,000.

Coinsurance Amount

Coinsurance is offered only in America. And for any treatment received outside the PPO network, 20% coinsurance applies for the first $5,000 in eligible expenses.

Policy Duration

The policy duration ranges from a minimum of 5 days to a maximum of 1 year (364 days).

Coverage Benefits

Needless to say, the coverage benefits vary from plan to plan. However, most of the plans offered by Atlas America cover the following:

- Hospital room charges

- Diagnostics (X-rays, labs, and prescription drugs)

- Intensive Care Unit charges

- Local ambulance expenses

- Physician visits

- Surgeon fees

- Pre-admission tests

- Hospital emergency room charges

Pre-existing Conditions

- Atlas America offers only acute onset of pre-existing condition coverage with travel insurance plans for ages below 80 years.

- For ages below 65 years, the benefit is offered up to $25,000 per coverage period for Emergency Medical Evacuation.

- For ages 65-79, the pre-existing condition coverage is up to $100,000 for each coverage period.

- This benefit is not available for travelers above 80 years.

Here are Some of the Most Popular Travel Insurance Plans and Their Benefits

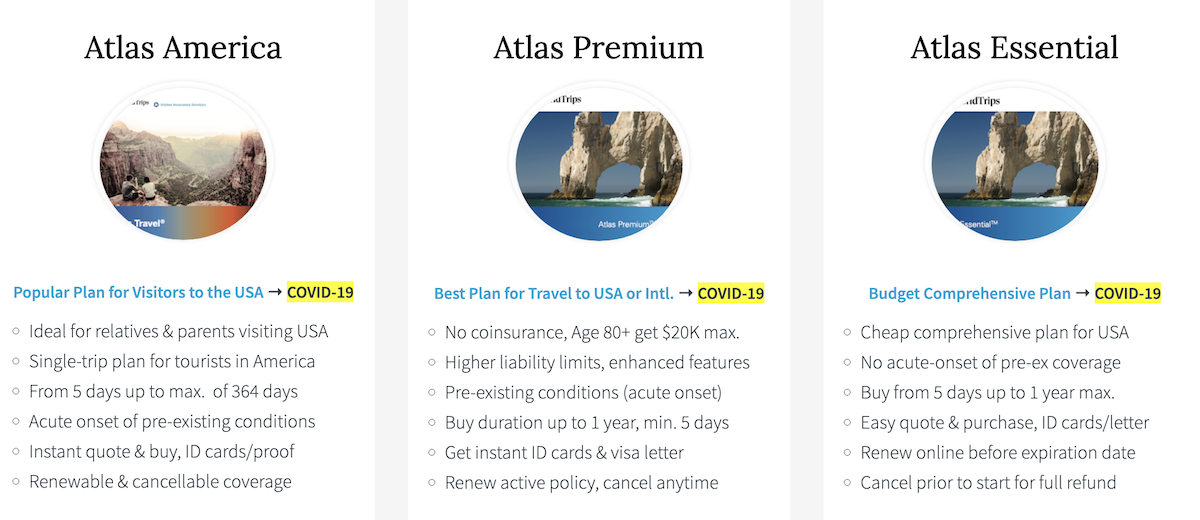

Atlas America

This single-trip travel medical insurance plan is ideal if your parents or relatives are planning to visit the United States. Benefits include:

- Coverage from 5-364 days

- Acute onset of pre-existing conditions

- Instant quote & buy, ID cards/proof

- Renewable & cancellation coverage

Atlas Premium

The Atlas Premium Insurance plan is ideal for non-US citizens visiting the USA who are looking for high-end comprehensive health insurance coverage with elite benefits. This plan offers exceptional coverage features like:-

- Overall maximum limit of and maximum coverage per injury/illness:

- $20,000 for age 80 or older

- $50,000 or $100,000 for age 65-79

- $50,000, $100,000, $250,000, $500,000, $1,000,000 or $2,000,000 for all others.

- 100% Coinsurance on eligible expenses after the deductible to the overall maximum limit

- Acute onset of a pre-existing condition for ages below 80 years

- Valid from a minimum of 5 days to a maximum of 1 year

- Get instant ID cards & visa letter

- Cancel anytime, renew the active policy

Atlas Essential

This one is for travelers looking for budget-friendly travel insurance plans with basic coverage benefits for themselves and/or their family members traveling to the USA.

- Overall maximum limit of and maximum coverage per injury/illness:

- $10,000 for age 80 or older

- $50,000 or $100,000 for age 65-79

- $50,000, $100,000, $250,000, $500,000, or $1,000,000 for all others.

- Up to 75% of coinsurance of eligible expenses after the deductible to the overall maximum limit within the PPO.

- The usual, reasonable, and customary coinsurance is available for any out-of-network payment.

- Valid from a minimum of 5 days to a maximum of 1 year

- No acute on-set of pre-existing coverage

- Cancellation available before the benefits kick-in for full refund

Final Verdict: Is It Worth the Investment?

Considering the innumerable benefits and coverage Atlas America offers, travel medical insurance is definitely worth every single penny. It offers not only the most comprehensive health and medical coverage but also a hassle-free, convenient, and quick claim process.

So if you’re thinking of travel medical insurance or visitor health insurance while travelling to the United States, think Atlas America.