Best Travel Insurance For Seniors Over 70

Best Travel insurance for seniors over 70! Yes, there are plans available and we have compiled a list of plans for you.

Medical emergencies don’t look at the age, they can strike anyone be it young or older travelers. The desire to travel and visit family does not simply vanish as we age. Travelers who are 70 years or older are not an exception.

Medical evacuation in a foreign country can cost thousands of dollars! This is where senior travel insurance becomes important.

One of the best ways to prepare for an unforgettable journey if you are a traveler over the age of 70 is to ensure you have everything necessary to remain covered.

Let’s look at the best travel insurance plans available for individuals 70 and older.

Best Travel Medical Insurance Plans for Seniors

Most travel insurance companies design plans to offer coverage for international travel but the limits may differ depending on the age of the insured.

Some travel insurance plans are better designed for seniors keeping in mind the medical care needs and offering medical benefits to ensure they get sufficient coverage.

Some of the best travel insurance for seniors over 70 are:

Best Travel Insurance Plans – Comprehensive Coverage

Evaluate Travel Insurance Plans for visitors aged 70-79 years and Plans for visitors aged over 80 years

Best Travel Insurance Plans – Limited Coverage

Best Travel Insurance Plans – Pre-Existing Conditions Coverage

See all pre-existing conditions coverage plans. You can also explore travel assistance plans with pre-existing conditions coverage.

Note:

Travel medical insurance plan limits may be lower depending on the age of the insured.

For example, a plan with policy maximum limits of up to $1,000,000 may restrict the policy maximum limits to $100,000 for age 70 or more.

Always check for the age-based coverage limits before you purchase a plan. Travel assistance plans are not insurance products.

Travel Medical Insurance for Pre-Existing Conditions Available for Seniors Over 70?

Travel insurance plans with pre-existing conditions coverage are available though the coverage amount may be restricted for age 70 and above.

Seniors are more at risk with pre-existing conditions and hence travel insurance plans have to manage a fine balance between providing adequate coverage yet limiting their risk and exposure.

For example, INF Elite covers pre-existing conditions with the following limits:

- AGE 0-69: $25,000, $30,000, $40,000, or $50,000 Maximum Benefit

Subject to a $1,500, $2,000, $2,500, $5,000, or $10,000 deductible - AGE 70-99: $20,000 Maximum Benefit

Subject to a $1,500 deductible

Why is Travel Insurance For Seniors Over the Age of 70 Important?

Travel insurance is crucial for any international travel, as it provides coverage for medical services in a foreign country.

This applies to anyone traveling internationally and not just seniors over 70. But as we age our medical risks increase thereby making it even more necessary to have protection.

Some reasons why travel insurance is important:

- Senior travelers are higher at risk. As travelers age simple activities can be riskier than they used to be when they were younger.

- Simple changes in weather and seniors run a risk of getting ill. A fall may result in an injury with broken bones

- Many travel insurance plans provide multi-lingual 24/7 assistance services which can be a life-saviour when you need to get information about medical coverage and medical services in a foreign country.

- You can get reimbursed for unforeseen medical expenses during international travel beyond the borders of your home country.

We have compiled a list of 50 travel tips for Seniors that can help them plan and have stress-free travel.

Are There Any Restrictions on Travel Medical Insurance for Seniors Traveling Abroad?

The way insurance works higher the risk lower the limits, and the higher the premium. Hence older travelers need to be very selective in the travel insurance policy they select.

The options do get limited as travelers age but the good news is that options are available.

A good comprehensive coverage plan can save money during sickness/injury, medical emergencies, or medical evacuation.

Find a reputable comprehensive coverage senior travel insurance policy to guarantee that you can obtain any necessary emergency care while traveling abroad, without burning a hole in your pocket.

Obtaining adequate travel insurance is crucial, whether you are searching for visitor’s insurance to enter the United States or international travel insurance to travel abroad.

Should you get comprehensive coverage or limited/fixed coverage? We have compiled the key differences between comprehensive coverage and limited coverage plans.

Best Medical Coverage Travel Insurance for Seniors Traveling Abroad

Domestic health plan from your home country may not cover medical services while abroad and depending on your health condition you may need medical care or medical evacuation in an emergency.

For a senior over the age of 70 typically restricts your travel insurance options, there are still plans that can protect you while you are away from home.

Travel insurance options may be restricted for individuals aged 70 or more and above, as insurance companies prioritize risk assessment based on age.

As a result, the majority of travel plans for individuals aged 70 and above have limited policy maximum options, diminished benefits, and increased premiums.

However, seniors over the age of 70 or more have access to a variety of excellent travel insurance that offers coverage with adequate limits.

Is Travel Insurance Necessary for Individuals Aged 70 and Older?

Travel insurance is essential for the medical care of seniors over 80, due to the increased risk of illness or injury.

This is particularly true when traveling to the United States as the healthcare costs in the USA are very expensive.

You need adequate medical coverage for any unfortunate incident needing emergency medical expenses. Some life-threatening situations may require emergency medical evacuation coverage.

Here are some aspects to consider when considering travel insurance for seniors:

- medical coverage limits

- emergency medical coverage limits

- emergency medical evacuation coverage

- medical expenses for doctor visits and prescription medicines

- repatriation of remains or local burial expenses

- PPO network access

- pre-existing conditions coverage limits

- trip interruption coverage

A visit to the doctor could cost hundreds of dollars without insurance, whereas an emergency room visit could cost thousands of dollars out of pocket.

Purchasing visitor’s insurance gives seniors peace of mind while traveling.

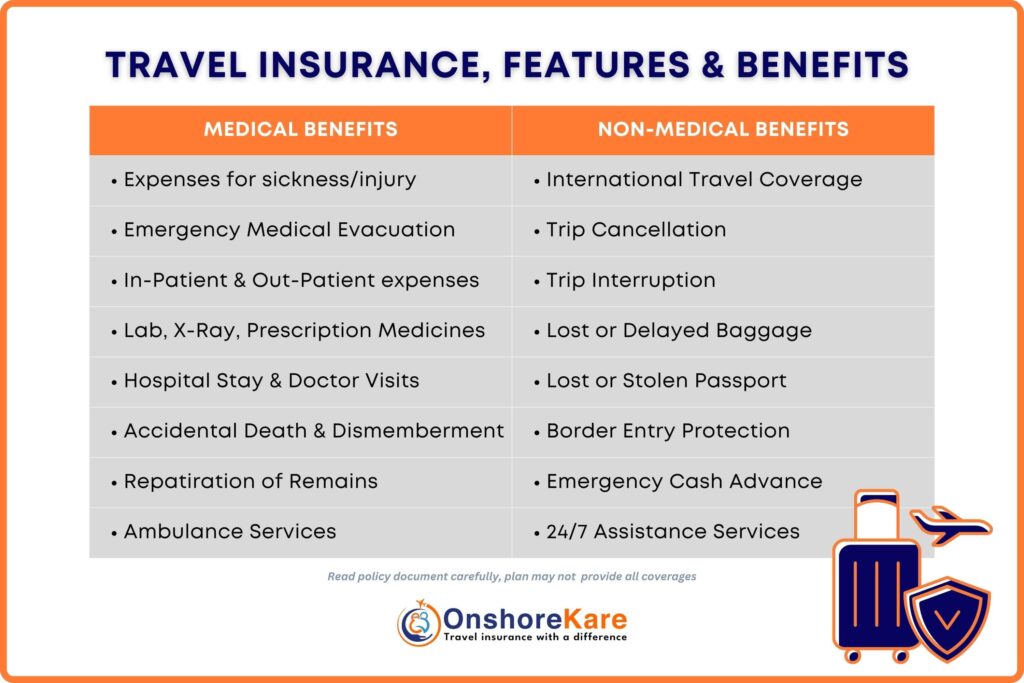

What is Covered by Travel Insurance for those Aged 70 and Older?

While traveling abroad, travel insurance for seniors over the age of 70 can provide an indispensable safeguard against the unexpected.

Travel medical insurance may, at first glance, provide coverage for urgent medical situations that arise while a senior is away on vacation.

This may necessitate hospitalization, surgical intervention, or other forms of treatment for unanticipated maladies or injuries that occur during the policy’s effective dates.

Included in travel insurance coverage are the following:

Medical Coverage Options:

- emergency medical expenses for sickness or injury

- hospitalization

- surgical procedures

- doctor visits

- emergency dental treatment

- prescriptions medicines

- critical care visits

- emergency medical evacuation

- COVID-19

- repatriation of remains or local burial

- acute onset of pre-existing conditions

- pre-existing medical conditions coverage (select plans only)

Non-Medical Coverage Options:

- lost or delayed baggage

- trip cancellation coverage

- trip interruption coverage

- trip delays

- 24/7 assistance services

- lost or stolen passport benefits

- airport premium lounge access (additional cost to the premium may apply)

- natural disaster coverage

- political evacuation

Note:

Coverage varies between travel insurance plans, particularly for seniors aged 80 and older.

Review the language of a travel insurance plan for additional information concerning coverage.

The travel insurance policy document will contain all the details.

Travel insurance plans do not provide all coverages, exclusions, and limits apply.

For some coverages, you may need travel insurance companies’ prior approval.

Emergency medical coverage available in travel insurance for those aged 70 and older?

Yes, emergency medical coverage is available in several good travel insurance plans for Seniors traveling abroad. This includes medical evacuation, eligible medical expenses, and other benefits.

My parents are visiting the USA and they are seniors over 70, which plan should I buy for them?

You can explore the plans listed in this article and select one that best meets your needs. If you need help finding a suitable plan do not hesitate to reach out to our team at +1 855 652 5565.

See what leading publications say about travel insurance for parents visiting the USA:

Conclusion

Travel should not be restricted for the young, seniors traveling abroad can do so worry-free with the protection of travel medical insurance. With the availability of travel insurance plans for seniors international travel can be fun instead of being stressful.

Travel Safe!