Safe Travels USA Comprehensive Insurance – Review

Safe Travels USA Comprehensive Insurance offers a comprehensive package designed to protect travelers during their time in the USA or worldwide.

Safe Travels USA Comprehensive Insurance is the best choice for International Travelers visiting the United States from their home country.

In this detailed article, we delve into the various aspects Exploring its Features, Eligibility Criteria, Benefits, Eligible Medical Expenses, Exclusions, and Cost Consideration.

Healthcare in the USA is very expensive and visitors to the USA should consider buying travel medical insurance to reduce the financial impact in case of unforeseen medical care needed during the visit.

See our video on YouTube on the top 10 reasons to buy Safe Travels USA Comprehensive

Safe Travels USA Comprehensive Plan

This plan is a travel medical insurance plan that provides medical coverage, emergency services, and other covered travel benefits to non-US residents who reside outside the USA and are traveling outside of their home country while visiting the United States or to the United States and worldwide

This travel medical insurance plan provides accident and sickness medical coverage with Acute Onset of Medical Conditions to non-citizens residing outside the United States and traveling outside their home country

Travelers are covered

- En route to the U.S.

- While in the U.S.

- In Countries, while on the way to the U.S. or way home

- Countries on the Itinerary

Coverage offered is from 5 days up to 364 days

- Coverage can initially be purchased for a minimum of 5 days up to a maximum of 364 days

The Travel Insurance Coverage plan is extendable for up to 364 days

- The Coverage may be extended if the plan is purchased for a minimum of 5 days

The coverage is available to visitors to the U.S. who are not permanent residents (green card holders) and are on non-immigrant visas, as well as those who have applied for permanent residency but have not yet been approved

The plan is not available to individuals who have been residing in the USA for more than 365 days prior to their Effective Date

This plan has a wide choice of deductibles ranging from $0 to $5,000

The plan provides coverage for persons through the age of 89 years

The Plan is not available to anyone aged 90 or above

The policy maximum for persons of age 80 years and above is $50,000

Sports Activity Coverage is Available

Covid-19 expenses are treated and covered as any other sickness

PPO Network

The plan participates in the First Health PPO network, which is a widely recognized PPO network all over the U.S.

However, you are free to visit any doctor or hospital of your choice outside the PPO network.

- When you go into the PPO network, the providers will charge only the network-negotiated fees, which are typically lower than their regular fees

Safe Travels USA Comprehensive Plan Benefit Coverage

The Safe Travels USA comprehensive insurance is a primary insurance plan

The benefits, coverage, and deductible options offered by the Plan include:

- Medical accident and sickness coverage

- Emergency medical and political evacuation

- Repatriation of mortal remains

- Trip interruption

- Lost Baggage

- Accidental Death & Dismemberment with up to $1,000,000 in emergency medical coverage

- Wellness visit benefit for a $125 copay

- Sudden and Acute Onset of a Pre-Existing Condition

This is a highly popular comprehensive coverage plan for those who are visiting the US for a short duration

Trawick International, the underwriter of the plan, has a legacy of 24/7 travel assistance and exemplary customer service with a 4-star rating on Trust Pilot

Safe Travels USA Comprehensive Insurance Plan Eligibility

Available only for non-U.S. residents or non-U.S. citizens, traveling to the United States or the USA and then other countries

Not available to any individual who has been residing within the U.S. for more than 365 days

Coverage is available for a minimum of 5 days to a maximum of up to 364 days

The plan is extendable for up to 364 days in total

The plan is available for ages 1 to 89 years

Safe Travels USA Comprehensive Plan Coverage Highlights

Insurance for Up to $1,000,000 in accident and sickness medical expenses

Accident and Sickness medical policy maximum choices $50,000, $100,000, $250,000, $500,000, $1,000,000

In Network deductible $0

Out-of-network deductible choices are $0, $50, $100, $250, $500, $1,000, $2,500, or $5,000

Coverage for Emergency Medical Evacuation, Repatriation of Mortal Remains or Local Burial/Cremation, Political and natural Disasters Evacuation, Medically Necessary Repatriation, Emergency Reunion, $125 wellness Benefits

PPO Network: First Health

Wellness Visit: Covered up to $125

Covers Acute Onset Of Pre-Existing Condition (Limitations apply)

COVID-19 expenses are covered and treated like any other sickness

The Benefits of Safe Travel USA Comprehensive Insurance Plan

Accident and sickness medical expenses: Up to the Policy Maximum Selected

Cardiac Condition Limit:

- For ages up to 69: $25,000 (Per Policy Period)

- For ages 70 and Over: $15,000 (Per Policy Period)

COVID-19, SARS-Cov-2 Conditions: Covered the same as any other Illness

Dental: Up to $250 Per Policy Period ( For Injury or Pain to sound natural teeth)

Medical Maximum Per Policy Period

$50,000, $100,000, $250,000, $500,000, $1,000,000

Deductible

Deductible per policy period

- In Network: $0 (Per Policy Period)

- Out of Network: $0, $50, $100, $250, $500, $1,000, $2,500, $5,000 (Per Policy Period)

For In-network coverage the insurance pays 100% in eligible medical expenses up to the selected policy maximum

Co-Insurance

Co-insurance per policy period

- In Network: 100%

- Out of Network: 80% of the first $5,000 then 100% up to the policy maximum

- Outside of USA: Up to 100%

- Prescription drug expenses are considered Out-of-Network

Urgent Care Co-Pay

$30 per incident if the $0 out of Network Deductible is chosen, There is no Co-Pay

Safe Travels USA Comprehensive Insurance Pre-existing Condition Coverage

Only Acute onset of Pre-Existing Medical Condition is covered

Safe Travels USA Comprehensive Insurance Acute Onset of a Pre-Existing Condition Coverage

The insurance plan covers sudden and acute onset episodes of pre-existing conditions up to the selected policy maximum.

This benefit covers only one acute onset episode of a pre-existing condition

Any repeat or reoccurrence within the same policy period will not be considered the acute onset of a pre-existing condition and will not be eligible for additional coverage

A pre-existing condition that is a chronic or congenital condition or that gradually becomes worse over time and/or known, scheduled, required, or expected medical care, drugs, or treatments existing or necessary prior to the Effective Date are not considered to be an Acute Onset.

Acute onset of a pre-existing condition is defined as a sudden and unexpected outbreak or recurrence of a pre-existing condition that occurs spontaneously and without Advance warning

- For Ages up to & including 69:

- The limit is Up to the Medical Policy Maximum Purchased per policy period, Except for:

- Any coverage related to cardiac Conditions or Stroke: Limited to $25,000

- The limit is Up to the Medical Policy Maximum Purchased per policy period, Except for:

- For Ages 70 and above:

- Acute Onset Benefit Reduced to $35,000 (Maximum), Except for:

- Any coverage related to cardiac Conditions or Stroke: Limited to $15,000

- Acute Onset Benefit Reduced to $35,000 (Maximum), Except for:

This is the only comprehensive insurance plan that provides $35,000 in sudden and acute onset of pre-existing conditions coverage

Well-Doctor Visit:

Up to $125 (Per Policy Period) for 1 wellness check (Restrictions Apply)

Medically Necessary Repatriation:

Up to $15000 (100%) Per Policy Period

Emergency Reunion:

$15,000 (Per Policy Period)

Optional Benefit:

24 Hour AD&D: Increases Accidental death and dismemberment Benefits to $50,000, $100,000, $250,000, $500,000

Trip Protection Benefits

Trip interruption: $5,000 (Per Policy Period)

- As reimbursement for one-way cost economy air and/or ground transportation ticket to return home due to a covered reason

Additional Benefits

Accidental Death and Dismemberment: $25,000 (Principal Sum)

Return to Home country coverage (Optional Benefit): Up to $25,000

- While on an Incidental Trip In your Home Country, (Provides Coverage during the policy period)

24/7 Non-Insurance Benefits:

- Extendable: Up to 364 days of total coverage

- Non-Insurance Assistance Services: Included

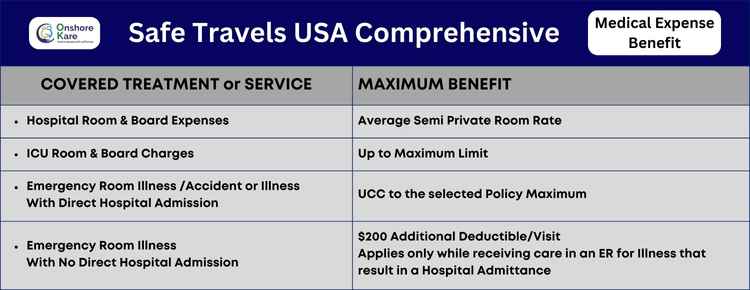

Safe Travels USA Comprehensive Insurance Medical Expense Benefits

- Hospital Room and Board Expenses: The average semi-private room rate

- Emergency Room Illness (With no direct Hospital Admission): $200 additional deductible per visit

- Emergency Room injury/Accident or Illness(With direct Hospital Admission): UCC to the selected Policy Maximum

- Ancillary Hospital Expenses: Covered

- ICU Room and Board Charge: Up to Policy Selected (Maximum Limit)

- Physician’s Non-Surgical Visits: Covered

- Physician’s Surgical Expenses: Covered

- Assistant Physician’s Surgical Expenses: Covered

- Anesthesiologist Expense: Covered

- Outpatient Medical Expenses: Covered

- Physiotherapy/Physical Medicine/Chiropractic Expenses: Limited to $50 Per Visit/Day, One Visit/day, 10 Visits per policy period

- Dental Treatment for Injury(For pain to sound natural teeth): $250 (Per Policy Period)

- Doctor Visits: Covered

- X-rays: Covered

- Prescription drugs: Covered (Subject to Network Deductible and co-insurance)

- Emergency Medical Treatment of Pregnancy: Up to 1,000 (Per Policy Period)

- Mental or Nervous Disorder: 2,500 (Per Policy Period)

- Cardiac Condition:

- For Ages Up to 69: Up to $25,000 (Per Policy Period)

- For Ages 70 and above: $15,000 (Per Policy Period)

Safe Travels USA Comprehensive Insurance Transportation Expenses

- Ambulance Service Benefits: Covered

- Emergency Medical Evacuation: 100% Up to $2,000,000 (Per Policy Period)

- Limit of $25,000 Maximum/Policy Period (For any condition covered under Acute Onset of a pre-existing condition)

- Medically Necessary Repatriation: 100% Up to $15,000 (Per Policy Period)

- Political Evacuation: $25,000 (Per Policy Period)

- Natural Disaster Evacuation: $10,000 (Per Policy Period)

- Up to $250/Day to a maximum of 5 days for reasonable expenses

Must officially be declared a disaster area by the appropriate local government authorities of the Host Country

- Emergency Reunion: $15,000 (Per Policy Period)

- Return of Minor Children or Travel Companion: $5,000 (Per Policy Period)

- Covers Traveling Companion, Minor Children, or Grandchildren

- Repatriation of Mortal Remains: 100% Up to $50,000 (Per Policy Period)

- Local Burial/Cremation: $5,000 (Per Policy Period)

Safe Travels USA Comprehensive Insurance Additional Coverage Benefits

- Hospital Confinement: $50/Night up to a maximum of $500 (Per Policy Period)

- Accidental Death and Dismemberment (AD&D) – 24 Hours

- Insured: $25,000 (Principal Sum)

- Spouse/Domestic Partner: $25,000 (Principal Sum)

- Dependent Child: $10,000 (Principal Sum)

- Seatbelt & Airbag Benefit: $5,000 (Principal Sum)

- Accidental Death and Dismemberment (Felonious Assault and Violent Crime): $50,000 (Principal Sum)

- Coma Benefit: $10,000 (Per Policy Period)

- Adaptive Home & Vehicle: $5,000 (Per Policy Period)

- Trip Interruption: $5,000 (Per Policy Period)

- Lost Baggage: $1,000 (Per Policy Period)

Safe Travels USA comprehensive insurance Optional Benefits

- Sports Activity Coverage benefits: Some Sports Covered Up to $50,000 (Per Policy Period). Read policy documents for further details

- Return to Home Country Coverage: $50,000 (Per Policy Period) (Up to 60 days – Prorated)

Safe Travels USA Comprehensive Optional Benefit Upgrades

Optional Accidental Death and Dismemberment (AD&D) – 24 Hours:

- Option 1: $50,000 (Principal Sum)

- Option 2: $100,000 (Principal Sum)

- Option 3: $250,000 (Principal Sum)

- Option 4: $500,000 (Principal Sum)

Safe Travels USA Comprehensive Cost

The premium depends on various factors like

- The plan selected ($50,000, 100,000, $250,000, $500,000, or 1,000,000)

- The age

- Coverage duration

The higher the plan limit, age, or coverage days the higher will be the premium

With added optional coverage the premium increases

The premium reduces when you opt for the higher deductible

Purchasing Safe Travels USA Comprehensive Travel Insurance

To purchase this travel insurance, you need to provide your personal and travel information,

- Select the coverage options, and

- Pay the premium.

The premium for the plan depends on the coverage options you select, such as the policy maximum, deductible, and length of coverage.

Once you purchase the plan, you will receive a confirmation of coverage and the policy documents via email.

Safe Travels USA Comprehensive Insurance – Claims

Here is the information on the claims process:

- All claims must be submitted in writing along with supporting documents and receipts

- Supporting documents include the insured’s ID, copy of passport, copies of medical bills, and any other relevant documents

- Claims can be submitted online or by mail

- The claims department will review the claim and may request additional information or documentation

- Once the claim is approved, payment will be made to the insured or the healthcare provider, depending on the situation

- If the claim is denied, the insured has the right to appeal the decision

- It is important to review the policy documents carefully and understand the coverage, limitations, and exclusions before submitting a claim

A cancellation fee of US $25 will be charged

Only unused days’ premiums will be considered refundable

If a refund is made it determines that a claim was presented on the covered person’s behalf

The covered person will be responsible for that claim

Frequently Asked Questions

Is Trawick International a good Insurance company?

Yes, Trawick International Insurance is a renowned US Travel Insurance Company.

What is the cost of Safe Travels USA Comprehensive plan

The cost of the plan starts at $69 per month for ages 45 years with a $50,000 plan and a $250 deductible. However, the premium for the plan depends on the coverage options you select, such as the policy maximum, deductible, and length of coverage.

Does Safe Travels USA Comprehensive plan cover pre-existing conditions

Yes, the plan covers pre-existing conditions. The plan offers coverage for Sudden and Acute Onset of a Pre-Existing Condition.

I am looking for Travel Insurance for parents with pre-existing conditions coverage, what plans should I consider?

For Pre-Existing Medical Conditions Coverage, we offer travel insurance plans like:

You can also consider alternatives to travel insurance in the form of travel assistance plans that offer coverage for pre-existing conditions.

Other travel medical insurance plan alternatives to Safe Travel USA Insurance?

Alternatives to Safe Travels USA Comprehensive Insurance can be Patriot America Plus and Atlas America. Review the details in this comparison of Safe Travels vs. Patriot America and Safe Travels vs. Atlas America.

Overall Review:

Safe Travels USA Comprehensive Insurance is a highly popular comprehensive coverage plan for individuals visiting the U.S. for a short duration.