Top 10 Reasons To Buy Atlas America For Parents Visiting USA

Atlas America travel medical insurance is a comprehensive insurance plan, designed to protect parents visiting the USA. Atlas America is a very popular ‘visitors insurance’ plan amongst people who purchase travel insurance for their family visiting the USA.

The Atlas America travel insurance is a comprehensive plan with flexible maximum coverage limits and deductible amounts at competitive premium amounts.

Watch A Short Video

Top 10 Reasons To Buy Atlas America Travel Health Insurance For Parents Visiting USA

When it comes to Visitor Insurance you can’t go wrong with Atlas Travel Insurance Plans. Let’s look at the details:

- Comprehensive Plan: Atlas insurance plan provides comprehensive coverage for parents visiting the USA. It includes medical expenses, emergency evacuation, and repatriation among other critical benefits.

- Pre-Existing Condition Cover: The insurance plan covers the acute onset of pre-existing medical conditions, which can be a concern for parents traveling with medical conditions. This helps avoid costly out-of-pocket expenses in the event of an emergency. Please note: the plan provides for the acute onset of pre-existing conditions only and treatment for any pre-existing condition itself is excluded from coverage.

- Easy Enrollment: Enrolling in Atlas America is quick and easy, with online application and payment options. You can purchase the plan and get instant policy documents online.

- Affordable Premiums: Atlas America offers competitive premiums, making it an accessible option amongst similar visitor insurance plans.

- Wide Network of Providers: Atlas America provides access to the United Healthcare PPO Network. Get quality medical care without worrying about out-of-pocket expenses.

- 24/7 Assistance: The insurance plan provides 24/7 assistance, including emergency medical assistance, travel assistance, and concierge services.

- No Age Limits: There are no age limits to buying Atlas America, which makes it easier to protect seniors, regardless of their age.

- Flexible Options: The insurance plan offers flexible options, including short-term cover for those visiting the USA for a short period, and long-term cover for those staying for an extended period.

- Mental Health Cover: Atlas America covers mental health expenses, providing peace of mind when traveling.

- Cost-Effective: If you are looking to purchase visitors insurance, Atlas America is a cost-effective option amongst similar plans.

Plan Highlights And Details Of Atlas America Travel Medical Insurance

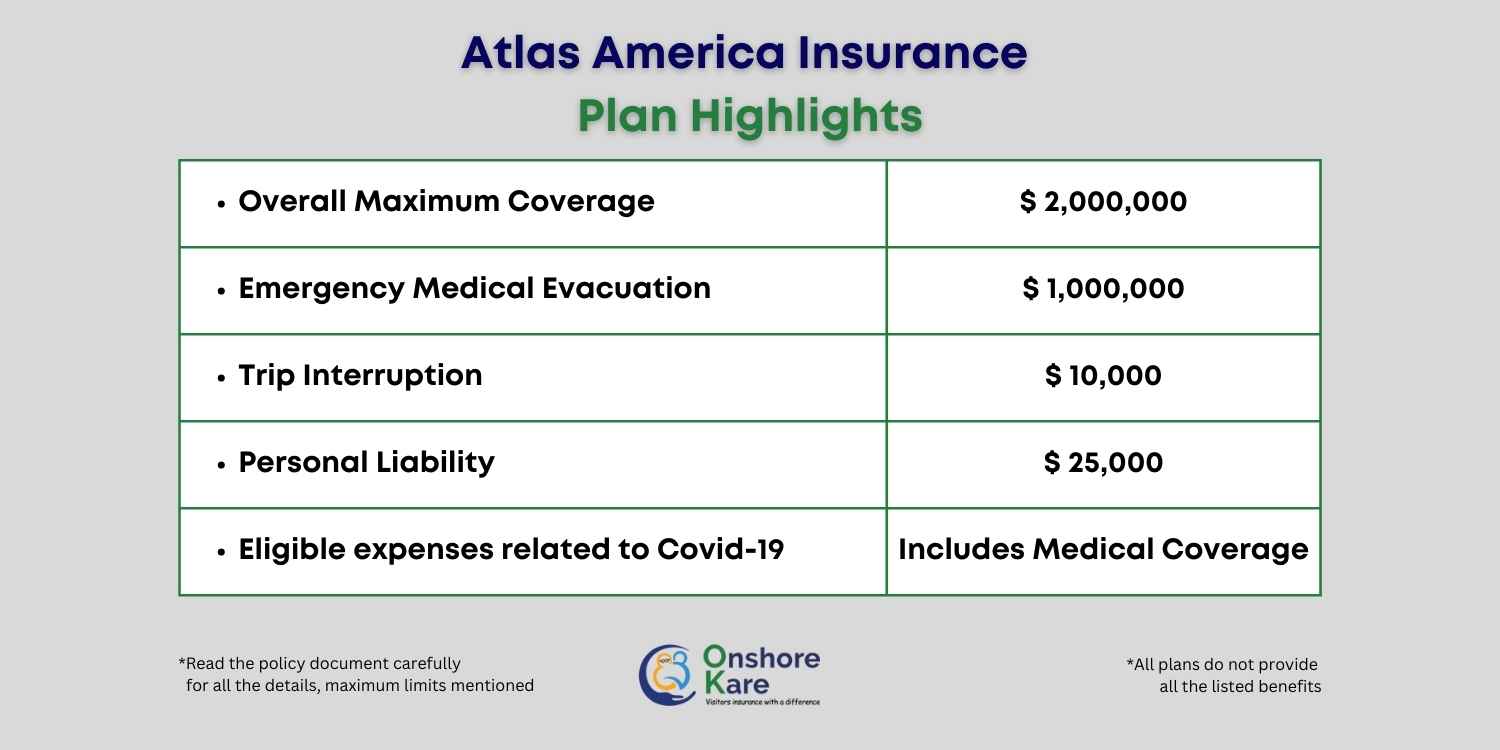

Plan Highlights Of Atlas America:

Atlas America Plan Details:

Atlas America visitor health insurance plan offers comprehensive medical coverage, international travel coverage, and travel support.

Medical Coverage for eligible expenses related to COVID-19 Included

- Administrator: WorldTrips. AM Best Rating – A++ (superior)

- Eligibility: Visitors to the USA or international travelers traveling outside their home country

- Overall maximum limit: Up to $2,000,000

- Emergency Medical Evacuation: $1,000,000

- Trip Interruption: Up to $10,000

- Personal Liability Up to $25,000

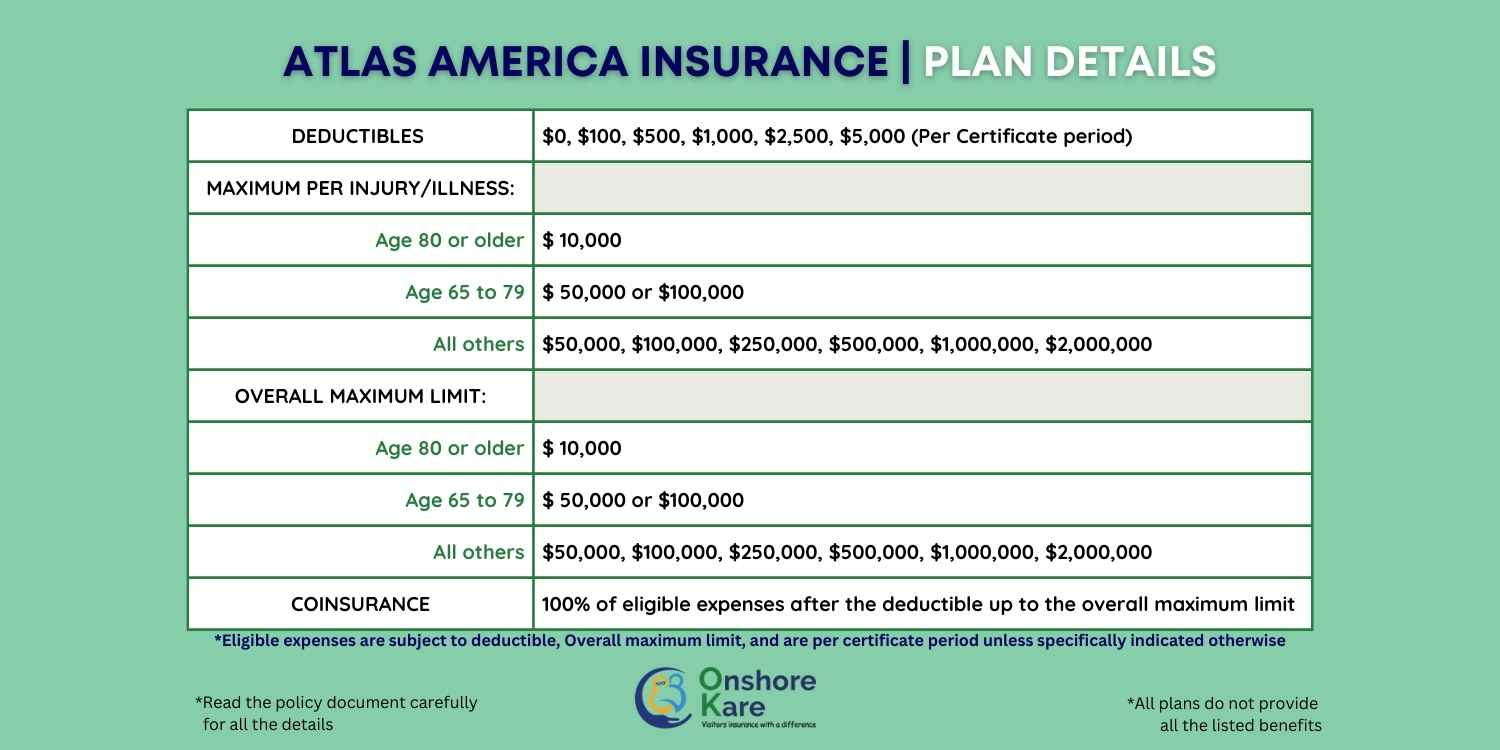

- Deductibles: $0, $100, $250, $500, $1,000, $2,500, $5,000 per certificate period

- Coinsurance: Plan pays 100% of eligible expenses after the deductible up to the overall maximum limit.

- Maximum limit per injury/illness as well as the overall maximum limit:

- For age 80 or older: $10 000

- For ages 65-79: $50,000 or $100,000.

- For all others, the range is $50,000, $100,000, $250,000, $500,000, $1,000,000, or $2,000,000.

| BENEFITS | DETAILS |

|---|---|

| A.M. Best Rating | A++ Superior Rating |

| Administrator | WorldTrips |

| Underwriter | Lloyd’s Of London |

| Eligibility | US and Non-US Residents Traveling To The USA |

| Coverage Type | Comprehensive Travel Medical Insurance |

| Policy Duration | 5 Days – 364 Days (Extendable up to 364 days) |

| Coverage Area | USA And International Coverage |

| Co-Insurance | Plan Pays 100% Of Eligible Expenses After The Deductible Up To The Overall Maximum Limit |

| Deductible | $0, $100, $250, $500, $1,000, $2,500, or $5,000 |

| Acute Onset Of Pre Existing Conditions | Up To Maximum Limit ($25,000 Maximum For Emergency Medical Evacuation) |

What Is Covered By Atlas America Travel Health Insurance Plan?

Atlas America Insurance provides non-US citizens with temporary medical insurance while they visit the US for either business or pleasure.

Individuals, families, and business visitors can all take the benefits of Atlas America’s global perks.

Atlas travel insurance is accessible for as short as 5 days and as long as 364 days, with a variety of plan maximum limits and deductible options. The plan is designed to pay for any unforeseen medical expenses incurred while you are traveling outside of your home country.

Atlas America Insurance is a very popular visitors insurance for parents visiting the USA. If the policy date is in effect, the plan covers the journey from the moment your parents leave their home country.

Below are the benefits provided by the Atlas Travel Insurance plan

Emergency Medical Evacuation

In a life-threatening situation, Atlas travel insurance covers transportation to the closest medical facility for treatment. Atlas America plan will pay the eligible medical expenses covered under your policy. This can be life-saving, see the terms in detail in the policy document.

Trip Interruption

If you are already halfway through your vacation and need to change your itinerary, return home early, or reroute your plans due to a covered reason, the Atlas travel insurance plan may pay you for the portion of your trip that was not used and may cover additional costs for last-minute travel modifications.

Return Of Minor Children

If a covered illness or injury is projected to keep you in the hospital for longer than 36 hours. Due to the fact that minors under the age of 18 will be left alone, Atlas Travel will pay for the cost of the children’s return home’s approved transportation.

Repatriation Of Remains

Atlas America travel medical insurance plan will cover the eligible medical expenses associated with the repatriation of remains in the unfortunate event of the death of the insured person while traveling abroad.

Political Evacuation

In the event that the U.S. Department of State issues a level 3 or higher travel advisory both during the policy period and after your arrival, Atlas Travel insurance will organize your alternate departure plans from your destination country and pay for any eligible expenses.

What Is The Acute Onset Of Pre-Existing Conditions? Is It Covered By Atlas America Travel Insurance Plan?

An acute onset of a pre-existing condition is a sudden and unexpected outbreak or recurrence that lasts just a short time, progresses quickly, and necessitates immediate medical attention. A chronic and congenital condition, or one that progressively becomes worse over time, is not considered an acute onset of a pre-existing condition.

For eligible medical costs, Atlas Travel offers a constrained benefit up to the lifetime maximum of the medical cover.

You might get cover for a pre-existing condition with an acute onset if you are under the age of 80. Also, there is a lifetime cap of $25,000 for emergency medical evacuation.

Read more on Visitor insurance plans with acute onset of pre-existing conditions

Other Benefits Provided By Atlas America Travel Medical Insurance Plan

| BENEFITS | COVERAGE |

|---|---|

| Emergency Medical Evacuation | Up To $1,000,000 |

| Emergency Reunion | Up To $100,000 |

| Intensive Care Unit | Up To Maximum Limit |

| Repatriation Of Remains | Equal To The Elected Overall Maximum Limit |

| Return Of Minor Children | Up To $50,000 |

| Dental Emergency | Up To $300 |

| Lost Checked Luggage | Up To $1,000 |

| Hospital Indemnity | $100 Per Day |

| Trip Interruption | Up To $10,000 |

| Accidental Death And Dismemberment | $250,000 Maximum Limit |

Atlas Travel provides coverage for unexpected medical expenses, emergency travel benefits, and multilingual travel assistance services. Other Coverage details are:

- Emergency medical evacuation – Up to $1,000,000. Not subject to deductible

- Intensive Care Unit: Coverage Up to the overall maximum limit

- Emergency Dental (Acute Onset of Pain): Up to $300. Not subject to deductible

- Emergency Room Co-Payment: For Claims incurred in the U.S. you shall be responsible for a $200 co-payment for each use of an emergency room for an illness unless you are admitted to the hospital. There will be no co-payment for emergency room treatment of an injury.

- Local Burial or Cremation: Up to $ 5,000-lifetime maximum. Not subject to deductible

- Repatriation of Remains: Equal to the elected overall maximum limit. Not subject to deductible or coinsurance

- Emergency Reunion: Up to $100,000, subject to a maximum of 15 days. Not subject to deductible

- Bedside Visit: Up to $1,500. Not subject to deductible

- Return of Minor Children: Up to $50,000. Not subject to deductible

- Pet Return: Up to $1,000. Not subject to deductible

- Political Evacuation: Up to $ 100,000-lifetime maximum. Not subject to deductible

- Trip Interruption: Up to $10,000. Not subject to deductible

- Lost Checked Luggage: Up to $1,000. Not subject to deductible

- Lost or Stolen Passport/Travel Visa: Up to $100. Not subject to deductible

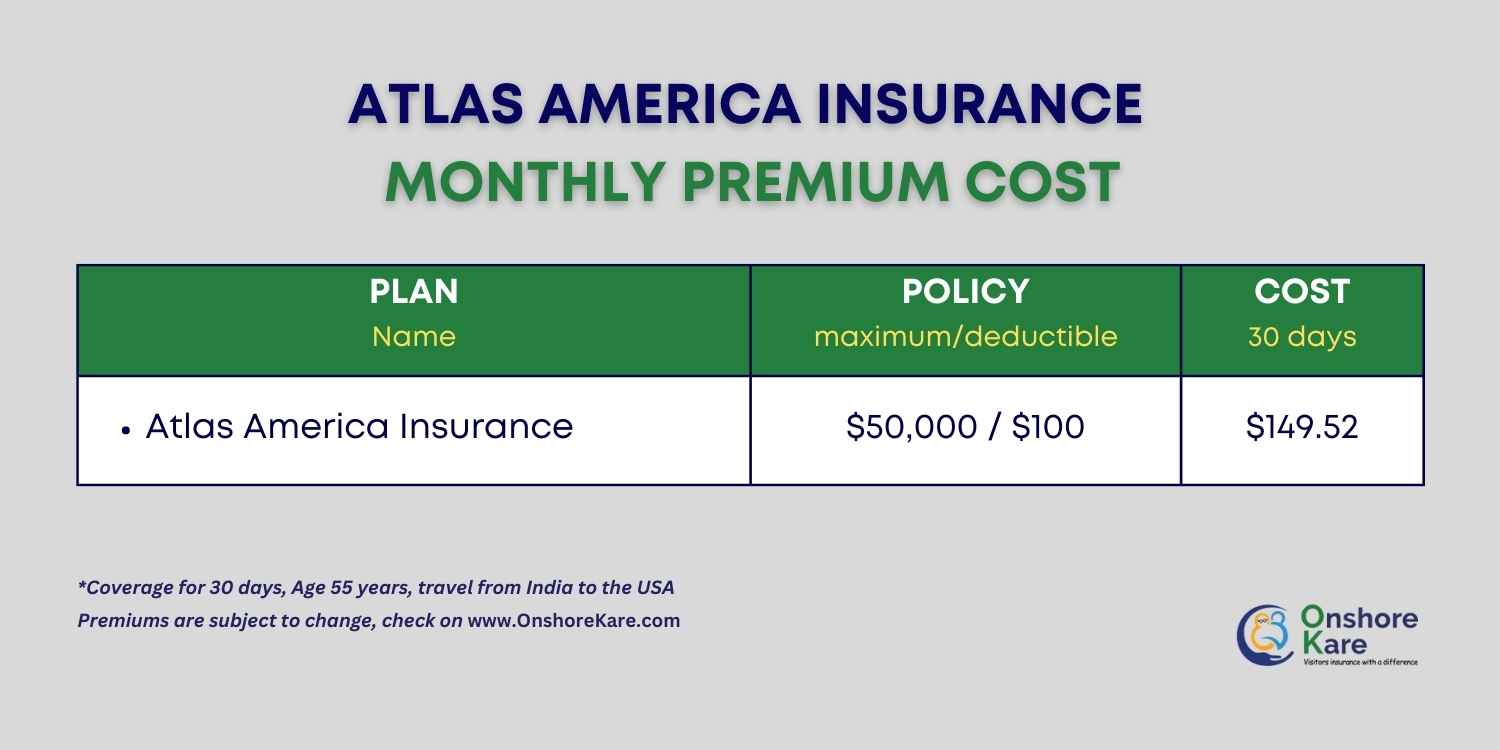

How Much Does Atlas America Plan Cost?

The cost of Atlas travel insurance depends on many factors such as overall maximum limit, plan deductibles, age of the person, and coinsurance amount.

Plan Maximum limit:

Atlas America offers various travel insurance plans. However, the maximum policy coverage goes up to US $2,000,000.

Plan Deductible:

Atlas America offers a choice of deductible per certificate/renewal period in the amount of $0, $100, $250, $500, $1,000, $2,500, and $5,000.

Age Factor:

Their premiums and upper limit rise as they get older. Everyone who is at least 14 days old can join the plan, and minor children are also eligible for coverage.

Atlas America Insurance Review

Atlas America Insurance is a-0 comprehensive travel medical insurance plan designed for US citizens and non-US citizens who are at least 14 days of age, traveling outside their home country including the USA. US citizens and US residents are not eligible for coverage within the US.

- It is underwritten by Lloyd’s and rated A “Excellent” by A.M. Best.

- Atlas America is available for any duration from 5 days to 364 days,

- Atlas America has policy maximums ranging from $50,000 to $2,000,000 and various deductibles from $0 to $5,000 per certificate period.

- Atlas America covers 100% of eligible expenses after the deductible and up to the overall maximum limit for up to 364 days of travel throughout the U.S. and abroad.

- The insurance plan provides coverage for an acute onset of pre-existing conditions for members under the age of 80, with medical expenses up to the overall policy maximum and $25,000 lifetime maximum for emergency medical evacuation.

- Atlas America participates in the United Healthcare PPO network,

- United Healcare PPO network has a wide network of physicians, hospitals, and other providers across the USA.

- The plan also offers optional coverage for AD&D, personal liability, and crisis response coverage.

- Atlas America provides coverage for COVID-19 (coronavirus) just like any other eligible medical condition that occurs after the effective date of the policy.

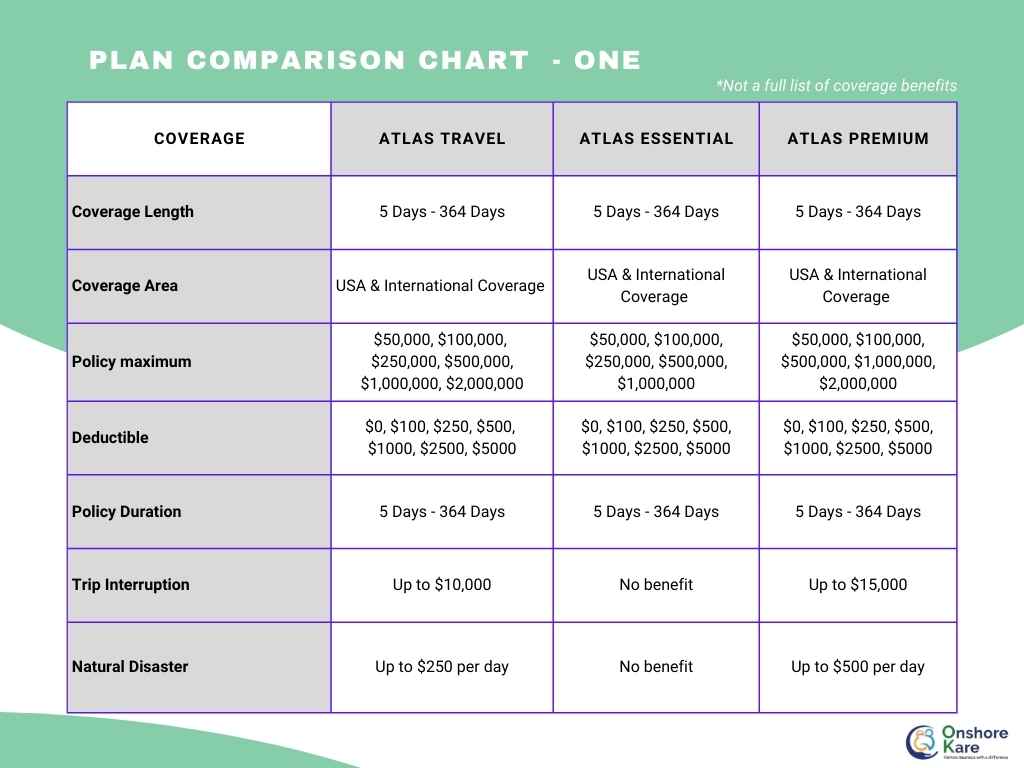

What Are Atlas Essential And Atlas Premium Travel Medical Insurance From WorldTrips?

Atlas Essential Travel Medical Insurance

For visitors looking for inexpensive travel insurance with minimal coverage benefits for themselves and/or their family members visiting the USA, this is the plan for them.

Maximum coverage per injury/illness as well as the overall maximum limit:

- Age 80 or older: $10,000.

- Age 65-79: $50,000 or $100,000.

- For all others: $50,000, $100,000, $250,000, $500,000, or $1,000,000.

Up to 75% of coinsurance of eligible expenses after the deductible to the overall maximum limit within the PPO.

For every out-of-network payment, ordinary, fair, and customary coinsurance is available.

Valid for five days at a minimum and up to one year at maximum

Pre-existing conditions are not covered acutely

Before the benefits begin, cancellations are eligible for a full refund.

Atlas Premium

For non-U.S. nationals traveling to the US who want premium, all-inclusive health insurance coverage with premier benefits, the Atlas Premium Insurance plan is the best option. The coverage features included in this plan provide:

Maximum coverage per injury/illness as well as the overall maximum limit:

- For age 80 or older: $20 000.

- For ages 65-79: $50,000 or $100,000.

- For all others, the range is $50,000, $100,000, $250,000, $500,000, $1,000,000, or $2,000,000.

After the deductible, there is a 100% coinsurance on qualified costs up to the total maximum.

Sudden development of a pre-existing ailment in people under the age of 80

Valid for five days at a minimum and up to one year at maximum

Key differences Between Atlas Travel, Atlas Essential, And Atlas Premium Travel Insurance

About The Insurance Company Of Atlas America Insurance – WorldTrips

WorldTrips offers a wide range of travel medical insurance and trip protection insurance products. WorldTrips was founded in 1998 and was acquired by Tokio Marine Holdings Inc in 2015 to increase its global reach. Numerous people, families, businesses, and service groups all over the world use WorldTrips travel medical and trip protection insurance for international travel.

The company offers a variety of travel insurance plans including trip cancellation, international health insurance, trip interruption, emergency medical, international student health insurance and dental, emergency medical transportation, and baggage insurance. They also offer plans that cover adventure sports, pre-existing medical conditions, and rental car damage.

One of the unique features of World Trips insurance company is its 24/7 travel assistance service, which is available to travelers who purchase any of their insurance plans. The travel assistance service provides travelers with a wide range of services including emergency medical and travel assistance, emergency medical transportation, and travel and security information.

We have covered WorldTrips in detail, you can read it here.

Frequently Asked Questions

Can I buy Atlas America plan for my parents visiting the USA?

Yes, you can buy Atlas America for your parents visiting the USA. It is a popular & amongst the best visitors insurance for international travel. Read about the plan in detail here.

Does Atlas Travel Insurance include any coverage for the home country?

Atlas Travel does provide coverage for the home country. For every three-month period that the member is covered, medical expenses spent in the U.S. are reimbursed up to a maximum of 15 days. This is known as incidental home-country coverage.

Is it possible to purchase an Atlas America policy now and renew it later?

Atlas America has a 365-day renewal period. You are able to reapply for fresh coverage after that period has passed.

Does Atlas America include coronavirus coverage?

Atlas America Insurance does provide covid-19 visitors insurance coverage through WorldTrips. Covid-19 is not treated by this plan like any other condition that is protected by it. This implies that you are covered up to the policy limit you chose at the time of purchase if testing or hospitalization is required for a medical reason. Since vaccinations are seen as a preventive treatment, they are not covered.

Does Atlas America Insurance provide Pre-Existing conditions coverage?

No. Atlas America provides coverage for the acute onset of pre-existing conditions only. If you need travel insurance for pre-existing conditions you can buy it here.

Who can buy Atlas Travel Medical Insurance?

Anyone who is on a visitor visa, applying to become a resident of the US, or both may purchase this plan. You are no longer qualified for this plan once you have attained residency and/or your green card.

Except as specified under home country coverage, U.S. citizens and non-citizens who are at least 14 days old are eligible for coverage outside of their home countries. Unless as allowed under home country coverage or an appropriate benefit period, U.S. citizens and residents are not eligible for coverage inside the U.S. Persons 65 to 79 years old as of the certificate’s start date are restricted to a $100,000 overall maximum limit or less. The overall maximum limit for individuals 80 years of age or above as of the certificate effective date is $10,000.

The Bottom Line

In conclusion, Atlas America is an ideal insurance plan for parents visiting the USA. With its comprehensive coverage, flexible options, and affordable premiums, it provides peace of mind.

The advantages and coverage that Atlas America provides make travel medical insurance absolutely worthwhile. It provides the most complete health and medical coverage in addition to a simple, convenient, and efficient claim process.

Hence, while considering visitor health insurance or travel medical insurance while visiting the US, consider Atlas America.