Top 10 Reasons To Buy Patriot America Plus For Parents Visiting USA

When parents visit the United States from abroad, ensuring their health and safety is a top priority. One unexpected illness or injury can lead to thousands of dollars in medical bills. That’s where Patriot America Plus Insurance comes in — a trusted, comprehensive travel medical insurance plan designed for visitors to the USA. Administered by International Medical Group (IMG) and underwritten by SiriusPoint Specialty Insurance Corporation, this plan has become a top choice for families seeking peace of mind during international visits.

Here are the top 10 reasons to buy Patriot America Plus insurance for parents visiting USA.

Before proceeding remember without travel insurance, medical bills can quickly add up, leaving you with an unexpected financial burden. That’s where Patriot America Plus travel insurance comes in.

In this article, let us find out the reasons why you should consider purchasing Patriot America Plus travel insurance for your parents’ visit to the USA.

Top 10 Reasons To Buy Patriot America Plus Travel Insurance

There are many reasons to purchase visitor insurance like Patriot America plus visitor medical insurance. Let us take a look at the most important purpose for you to consider the plan.

Comprehensive Medical Coverage In The USA

Patriot America Plus provides medical coverage for your parents while they’re in the USA. Patriot America Plus offers coverage up to $1,000,000 for eligible medical expenses including hospitalization, physician services, outpatient surgery, lab tests, X-rays, and more. With rising U.S. healthcare costs, this can be a financial lifesaver for visiting parents.

Emergency Medical Evacuation up to $1,000,000

In case of a critical health situation requiring transport to a higher-level facility, the plan provides emergency medical evacuation coverage up to $1,000,000 when pre-certified.

-

Trip Cancellation and Interruption Coverage

In addition to medical coverage, Patriot America Plus also provides trip cancellation and trip interruption coverage. If your parents’ trip is canceled or interrupted for a covered reason, such as an unexpected illness or injury, you’ll be reimbursed for non-refundable trip expenses.

Access to PPO Network (UnitedHealthcare)

The plan uses UnitedHealthcare PPO, one of the largest networks in the U.S. In-network treatment ensures 100% coverage after deductible, reducing out-of-pocket costs significantly.

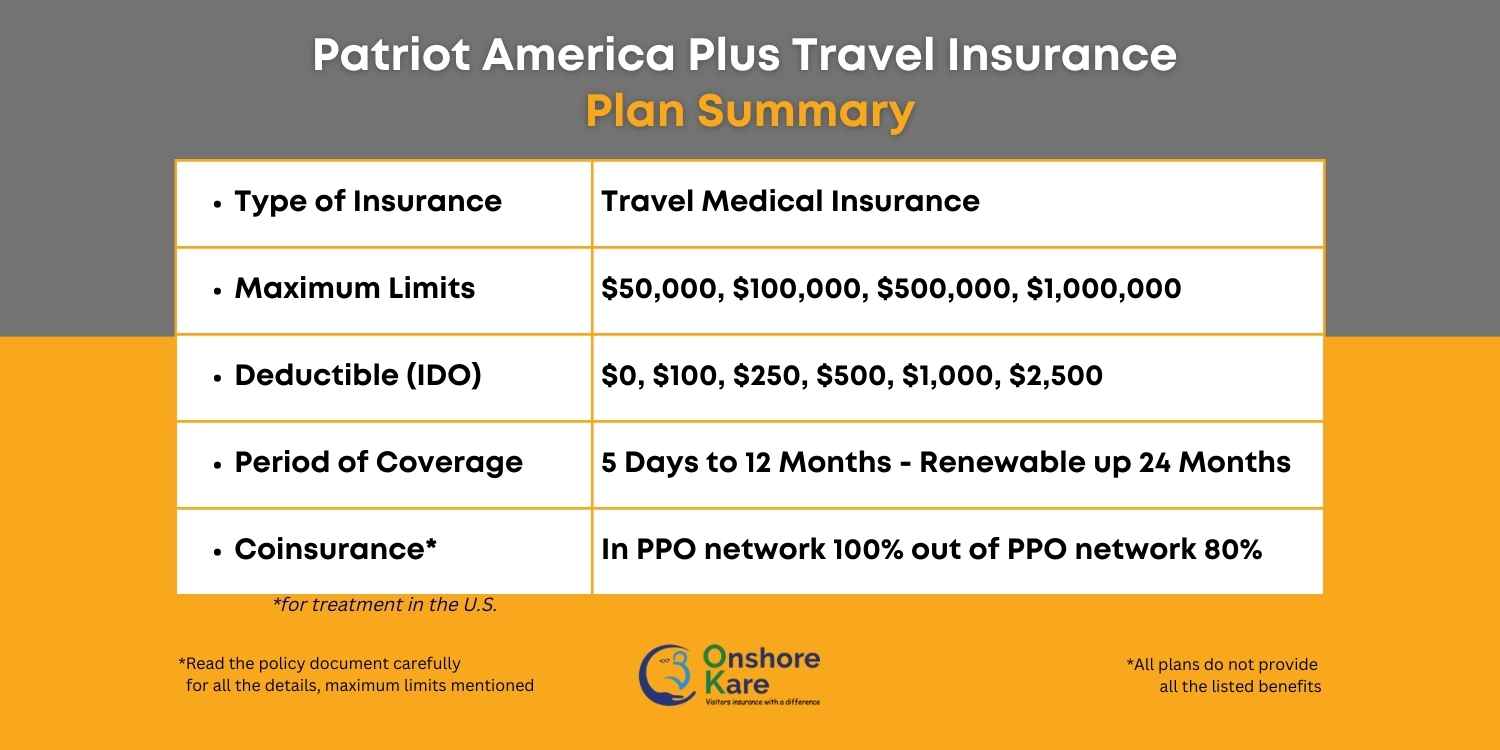

Affordable Plan Options With Flexible Limits

Patriot America Plus is available for visitors aged 14 days to 99 years and can be purchased for 5 days up to 2 years. Policy maximums range from $50,000 to $1,000,000, with deductible options from $0 to $2,500, allowing you to tailor coverage to your budget.

Multilingual 24/7 Travel Assistance

Patriot America Plus includes 24/7 assistance service, helps with emergency medical referrals, hospital admissions, translation services, and more — essential for elderly parents traveling internationally.

Acute Onset Of Pre-existing Conditions – Covered

For parents under age 70, the plan covers the acute onset of non-chronic pre-existing conditions up to the policy maximum. Emergency medical evacuation related to acute onset is also covered up to $25,000.

Additional Travel Benefits Included

Beyond medical protection, the plan also offers:

- Return of Minor Children and Pet Return in emergencies.

- Trip Interruption: Reimbursement for non-refundable trip costs

- Lost Checked Luggage: Up to $500

- Natural Disaster Evacuation: Up to $25,000

Simple Online Purchase & Instant Policy Issuance

Enrollment is quick and fully digital. Upon purchase, a printable ID card and certificate of insurance are instantly available, making it ideal for last-minute travel arrangements..

Peace Of Mind For The Whole Family

Perhaps the most important reason to buy Patriot America Plus travel insurance for your parents visiting the USA is the peace of mind it provides. Knowing your parents are protected by a comprehensive insurance plan gives everyone peace of mind, high coverage limits, and a range of other benefits, you can relax knowing that your parents are protected in case of an unexpected event.

Key Plan Details: Patriot America Plus At a Glance

| Feature | Details |

|---|---|

| Coverage Duration | 5 days to 364 days, renewable up to 2 years |

| Policy Max Limit | $50,000 to $1,000,000 (age-based limits apply) |

| Deductible Options | $0 to $2,500 |

| Coinsurance | 100% in-network (UHC PPO), 80% up to $5,000 then 100% out-of-network |

| COVID-19 Coverage | Included like any other illness |

| Pre-existing Coverage | Acute onset for age < 70, up to policy max |

| Emergency Evacuation | Up to $1,000,000 |

| Network | UnitedHealthcare PPO |

| Age Eligibility | 14 days to 99 years |

Who Should Buy This Plan?

This plan is ideal for:

- Parents or in-laws visiting the USA

- Elderly relatives with manageable health conditions

- Families wanting robust coverage without paying high premiums

- Travelers needing flexibility in policy terms

Why Patriot America Plus Stands Out

Unlike many other plans, Patriot America Plus offers a strong mix of affordability, flexibility, and reliable service. IMG’s solid reputation, 24/7 multilingual support, and global coverage give it an edge in the visitor insurance market.

About Patriot America Plus Travel Insurance Plan

The Patriot America Plus travel medical insurance plan is intended for your parents, relatives, or acquaintances who are visiting the US. It offers complete, reasonably priced visitor health insurance with advantages like hospitalization, prescription medication, and urgent care visits.

This comprehensive coverage is for you if you’re seeking a plan that will protect you whether you’re traveling for work or pleasure. Plus, you have several maximum limits and deductible options.

A minimum of 5 days and a maximum of 2 years can be chosen when purchasing the plan. For those going outside of their home country, it offers a customizable plan with a wide choice of maximum limits and deductible options.

The range of total medical benefits would be $50,000 to $500,000, and insurance deductibles might be $0 to $2500.

Examples of the emergency medical services covered by the plan include medical evacuations, acute onset of pre-existing conditions, and political evacuation.

Furthermore included is protection from travel-related coverage such as trip cancellation, lost luggage, identity theft, and natural disasters.

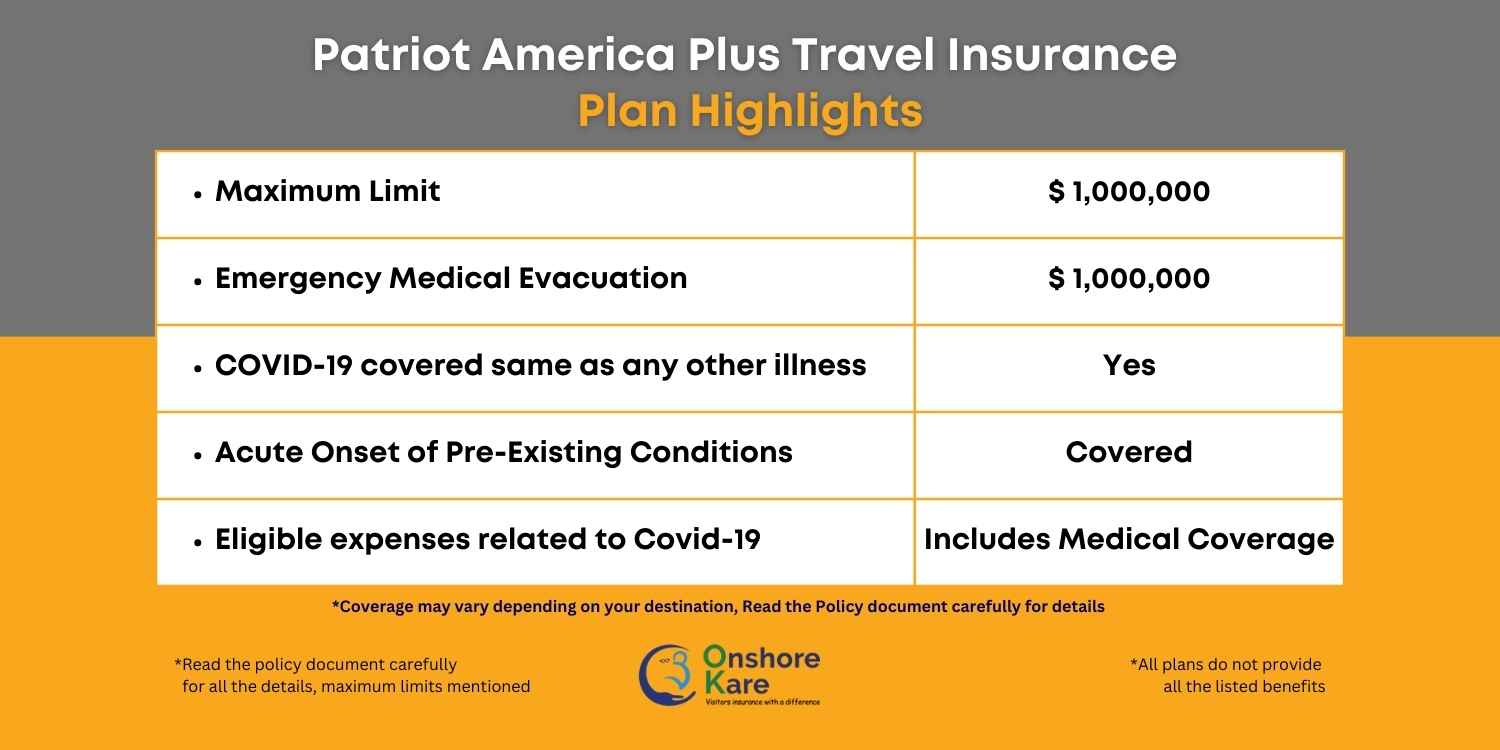

Plan highlights and details of Patriot America Plus Travel Medical Insurance plan

Plan Highlights:

The Patriot America Plus travel insurance offers a wide range of benefits to protect travelers against unexpected medical expenses, trip interruptions, and other unforeseen events that can disrupt travel plans. The plan is available for individuals or families traveling away from their home country and can be purchased for as little as five days or up to two years.

Some of the benefits offered by Patriot America Plus include coverage for emergency medical expenses, emergency medical evacuation, trip interruption, lost luggage, and accidental death and dismemberment. The plan also includes 24-hour travel assistance services to help travelers with medical emergencies, travel arrangements, and other travel-related issues.

Let us look deeper into the details and plan highlights of Patriot America travel medical insurance

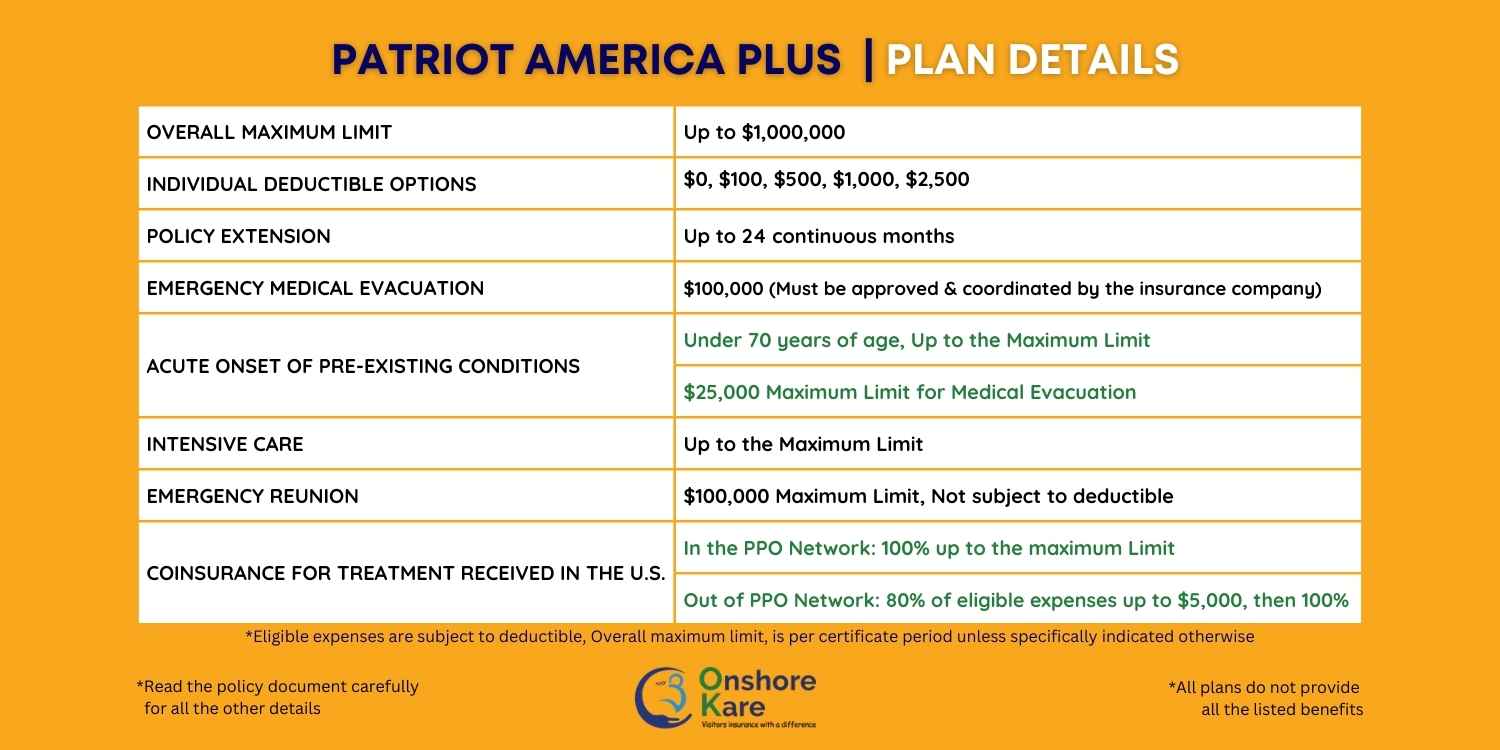

Plan Details:

- Administrator: IMG. AM Best Rating -: A-(Excellent)

- Eligibility: Visitors to the USA or international travelers traveling outside their home country

- Overall maximum limit: Up to $1,000,000

- Deductibles: $0, $100, $250, $500, $1,000, $2,500.

- Coinsurance:In-Network: The plan pays 100% up to the maximum limit. Out-of-Network: Plan pays 80% up to $5,000, then 100%

- For visitors to the US, COVID-19 is covered the same as any other sickness.

- For those under the age of 70, coverage for non-chronic Acute Onset of Pre-Existing Conditions.

- Belong to the United HealthCare PPO Network.

- Anyone between the ages of 14 days (about two weeks) and 99 years can enroll in the plan.

- The plan may be purchased for a minimum of 5 days and a maximum of 12 months, which may then be extended for a total of 2 years.

What are the benefits and coverage of Patriot America Plus travel medical insurance?

With Patriot America Plus travel medical insurance, you can modify the policy limit and deductible to suit your needs.

It is an all-inclusive package deal with many perks for international travel by families, solitary travelers, and groups of five or more.

Patriot America Plus travel insurance is specially designed for people who need temporary medical insurance while traveling for business or pleasure to the United States.

Here are the benefits and coverage provided by Patriot America Plus travel insurance

Emergency Medical Evacuation Coverage

The Patriot America Plus travel insurance offers coverage for emergency medical evacuation up to the policy maximum. Emergency medical evacuation coverage is intended to provide assistance and transportation for a medical emergency to the nearest adequate medical facility.

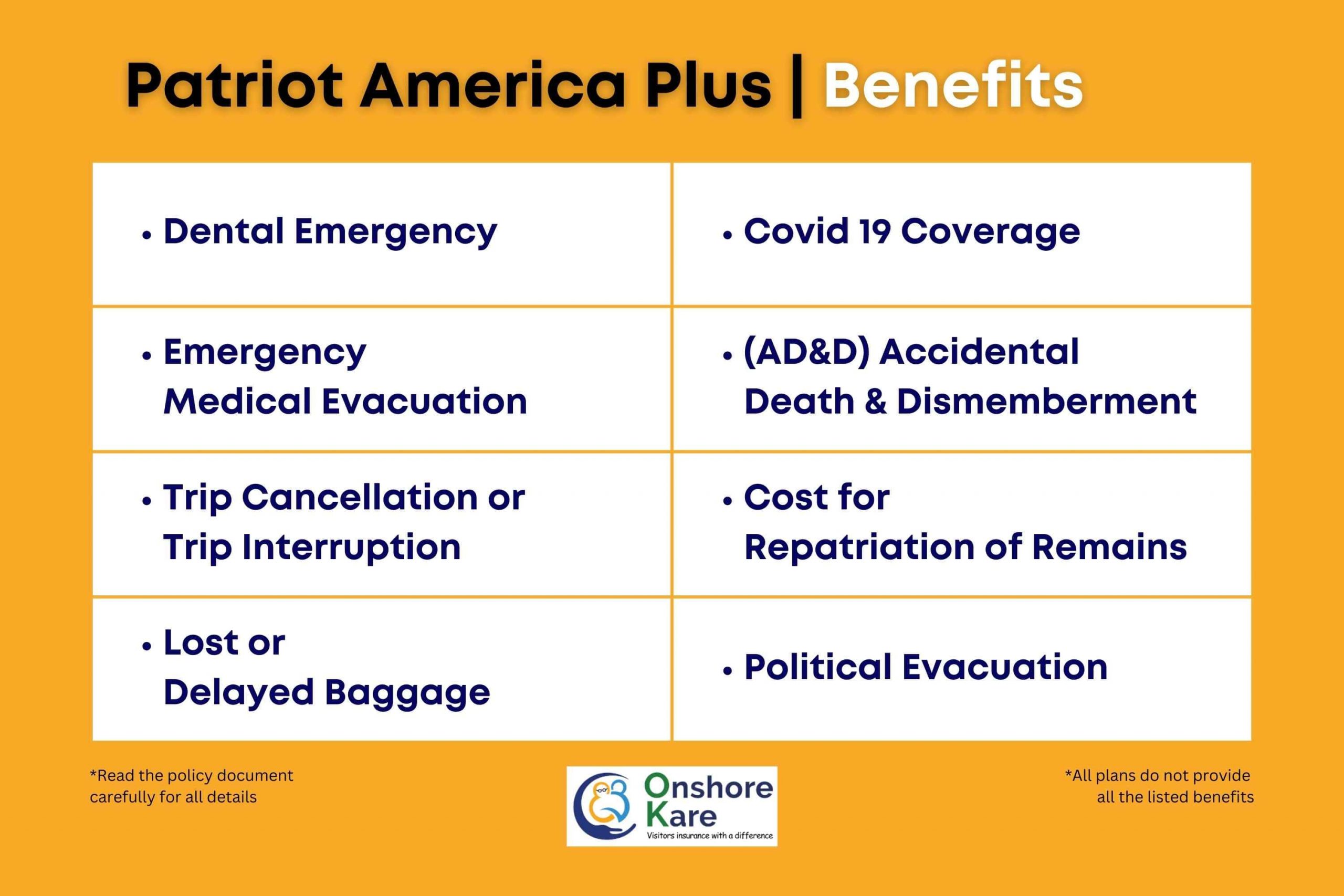

The plan includes coverage for emergency medical expenses, emergency dental expenses, and other medical-related expenses, such as prescription medication and medical supplies. In addition, the plan covers accidental death and dismemberment, repatriation of remains, and other benefits.

Emergency Dental Insurance

Patriot America Plus is a travel medical insurance that is designed to cover medical emergencies while traveling outside of your home country. However, dental coverage under this plan is limited to dental treatment resulting from an injury to natural teeth or sound and natural teeth. Emergency dental care due to an accident or injury may be covered under the plan, but routine dental care and treatment for pre-existing conditions are generally not covered.

Medical Coverage for Covid-19

Patriot America Plus travel medical insurance plans provide coverage for COVID-19, subject to the terms and conditions of the policy. The plan covers medical expenses related to COVID-19, including testing, treatment, and hospitalization, as well as medical evacuation and repatriation if necessary. However, it is important to note that coverage for COVID-19 may be subject to certain exclusions and limitations, such as pre-existing condition exclusions,

Coverage for Trip Cancellation and Trip Interruption

The plan typically includes coverage for trip cancellation due to unforeseen circumstances such as illness, injury, or death of a traveler, a family member, or a travel companion. They may also cover trip interruption due to covered reasons such as inclement weather, natural disasters, or terrorism.

PPO Hospital Network

A nationwide network of hospitals and physicians known as the First Health PPO Network provides discounted, pre-set rates for medical services. If you seek medical care from an In-Network Provider and have Patriot America Plus travel insurance, you are entitled to these discounted rates.

What does it mean by Acute Onset of Pre-existing Condition?

Acute onset of a pre-existing condition refers to the sudden and unexpected manifestation of a pre-existing medical condition that requires immediate medical attention. This means that the medical condition was not present or active before the start of the travel insurance plan, and there were no symptoms or signs of the condition before the policy became effective.

Is the acute onset of Pre-Existing Conditions Coverage provided by the Patriot America Plus insurance plan?

Patriot America Plus insurance provides acute onset of pre-existing conditions coverage. The plan covers the sudden and unexpected onset of a pre-existing medical condition, up to the policy maximum, for individuals up to age 70.

The coverage is subject to certain conditions and limitations, including a waiting period, which means that the coverage will not apply to any medical condition that manifests itself during the waiting period.

It is important to note that the acute onset of pre-existing condition coverage does not apply to all pre-existing conditions, and certain conditions may be excluded from coverage.

Do you need visitor medical insurance that covers the acute onset of pre-existing conditions? We have covered a complete guide on it.

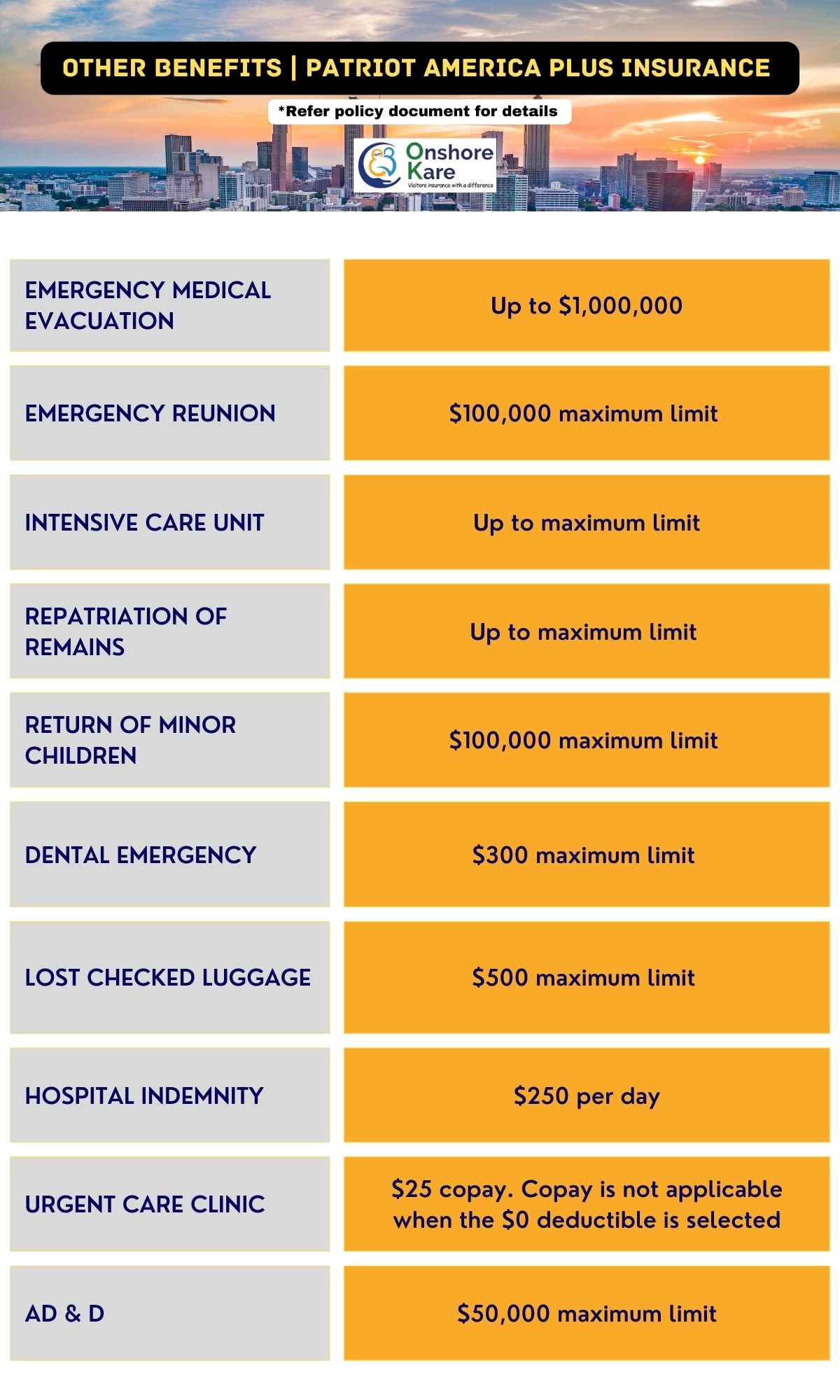

Other Coverages and Benefits of the plan

Patriot America Plus travel insurance offers emergency travel advantages, coverage for unforeseen medical bills, as well as multilingual customer service centers.

Let’s review the specifics of the additional protection offered by the Patriot America Plus travel health insurance plan.

- Emergency Medical Evacuation – Up to $1,000,000 (maximum limit)

- Covid 19 Coverage: Up to the maximum limit

- Eligible Medical Expenses: Up to the maximum limit

- Physician Visits/Services: Up to the maximum limit

- Hospital Room: Up to the maximum limit

- Intensive Care Unit: Up to the overall maximum limit

- Bedside Visit: $1,500 maximum limit. Not subject to deductible

- Outpatient Surgical/Hospital Facility: Up to the maximum limit

- Laboratory: Up to the maximum limit

- X-Ray: Up to the maximum limit

- Natural Disaster Evacuation: $25,000 maximum limit. Not subject to deductible

- Chemotherapy: Up to the maximum limit

- Walk-in Clinic: $15 copay. Copay is not applicable when a $0 deductible is selected

- Pre-Admission Testing: Up to the maximum limit

- Surgery: Up to the maximum limit

- Reconstructive Surgery: Up to the maximum limit

- Pet Return: $1,000 maximum limit. Not subject to deductible

- Lost Checked Luggage: $500 maximum limit. Not subject to deductible

How much does Patriot America Plus cost?

The cost of the plan will depend on the following variables:

Limit of the plan

If you decide to go with a higher plan maximum limits, your monthly premium will increase. You have a choice of $50,000, $100,000, $500,000, and $1,000,000 for policy maximums. (If you’re 80 or older, it’s $10,000). (Plan has age restrictions for maximum limits)

Deductible options

An insured person can select a deductible amount between $0, $100, $250, $500, $1,000, and $2,500. The premium can be lowered by selecting a higher deductible.

Age factor

One typically has to pay a greater premium or rate as one age. When a person ages, the premium rises. The plan is open to anyone who is older than 14 days.

Period of Coverage

Patriot America Plus can be purchased for any period of time between 5 days and 2 years. The longer the coverage term, the greater the premium will be because it is evaluated daily.

Other Coverage

Patriot America travel health insurance also provides other coverage for adventure sports as optional coverage.

Add-ons include Adventure Sports (up to age 65), Enhanced Accidental Death & Dismemberment (individuals only), Evacuation Plus, and Chaperone / Faculty Leader coverage riders (for groups only).

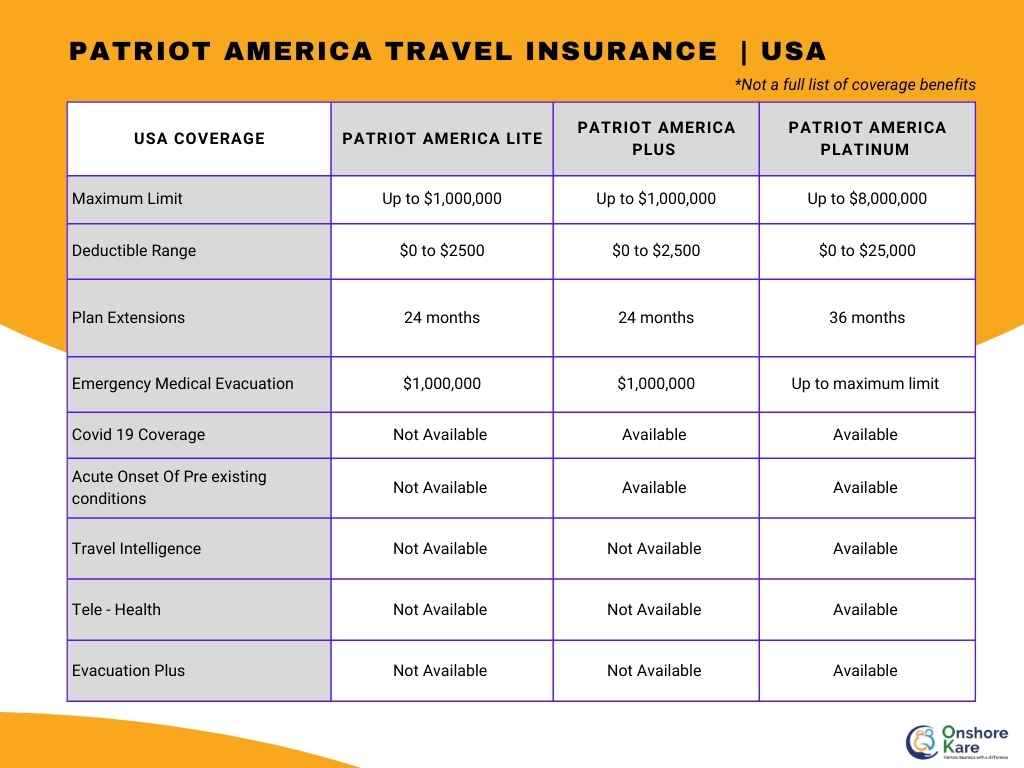

What are Patriot America Platinum and Patriot America Lite insurance plans?

These two plans are part of IMG’s Patriot Series of travel insurance plans.

Patriot America Platinum Travel Medical Insurance

Patriot America Platinum insurance provides premium, all-inclusive travel medical coverage to Non-US citizens traveling outside their home country.

You can choose a plan with a maximum limit of up to $8,000,000 and a deductible of $0 to $25,000.

Terms of purchase range from five days to three years. Aside from medical insurance, it also provides a number of other invaluable benefits, such as emergency medical evacuation, repatriation of remains, lost checked luggage, accidental death and dismemberment (AD&D), assistance with identity theft, political evacuation, natural disaster coverage, terrorism coverage, trip interruption, and many more.

Patriot America Lite Insurance

Patriot America Lite Insurance provides comprehensive international travel health insurance for non-US citizens and foreign visitors to the United States. It is a low-cost travel health insurance policy for your parents visiting the United States.

Patriot America Lite insurance has deductibles ranging from $0 to $2,500 and policy limits ranging from $50,000 to $1,000,000.

Patriot America Lite insurance purchase terms range from five days to two years. The insurance covers any new medical conditions, accidents, or injuries that occur after the start date of the policy but it does not cover any costs associated with pre-existing conditions, routine checkups, vaccinations, or pregnancy.

Key differences between Patriot America Plus, Patriot America Platinum, and Patriot America Lite Insurance Plan

Patriot America Travel Insurance coverage is also available for travel outside the USA

There are two types of Patriot travel medical insurance plans for US citizens traveling abroad:

- Patriot Lite International and

- Patriot Platinum International

They are one of the most well-liked comprehensive coverage plans. Ideal for US individuals traveling internationally with their family, young children, or by themselves.

Due to the following features, the travel insurance plans distinguish themselves from the competition and is a popular choice among travel medical insurance plans:

- One of the most affordable options for travel health insurance.

- The plans offer affordable rates depending on the individual’s circumstances and duration of stay.

- Accessibility to the Preferred Provider Network (PPO): UnitedHealth Care’s extensive PPO network.

- It is more probable that you will find a provider who is compatible with this plan if you use the PPO Network.

- This plan covers the acute onset of pre-existing conditions up to the policy’s maximum limit for policyholders under the age of 70.

- The plan’s unique feature is that it will cover travel dates provided that they were covered at the time of purchase.

- COVID-19 is covered like any other illness if it is discovered after the policy’s start date.

- The insured person can get continuous coverage due to the plan’s potential for a three-year renewal.

- Choice of a high policy maximum limit is up to $8,000,000

About the Insurance Company – IMG ( International medical group)

The Patriot Travel Series plan is offered to travelers by International Medical Group IMG. It is a highly reputed company with a TrustPilot rating of 4.6. While it provides a number of options for travelers to the US, Patriot America Plus is the most well-liked one. The company provides international benefits for international visitors traveling to the US for pleasure, business, or entertainment.

These insurance policies can be purchased by tourists, international students, international relatives, elders, and adventurers to safeguard themselves against sudden illness or injury. The visitors’ insurance plans from IMG are a fantastic option for short-term medical insurance. These plans may be extended for up to 24 to 36 consecutive months. You must, however, be at least 14 days old to be eligible.

Some benefits of the plans offered by International Medical Group include the following:

- Plans with extensive coverage to international visitors and access to a huge PPO Network

- They offer customer support and are accessible when you need them.

- IMG offers a variety of travel insurance alternatives to suit every demand.

Read our complete review of IMG in detail.

Frequently Asked Questions

How does the Patriot America Plus plan work in the PPO network?

If the deductible is met in the United Healthcare PPO network, the plan covers all eligible medical expenses up to the policy limit. The plan covers 100% of the subsequent $5,000 of qualified medical costs outside the PPO network after paying 80% of the initial $5,000. There is no deductible and a $25 copayment if you visit an urgent care facility.

Can I use the insurance at any hospital?

For best benefits, use providers in the UnitedHealthcare PPO network. Out-of-network care is also covered, but at reduced coinsurance rates.

How does Patriot America Plus travel insurance cover Covid?

If the virus is contracted after the policy’s effective date, medical care, services linked to COVID-19, and emergency medical evacuation for COVID-19 treatment may be covered. Additionally, if symptoms appear after the policy’s effective date and testing is required for diagnostic purposes, it may be covered. Quarantine benefits and COVID-19 boosters are not covered.

Is The Acute Onset Of Pre-Existing Conditions Covered? By Patriot America Plus Insurance?

Up to the age of 70, Patriot America Plus insurance offers excellent coverage for the acute onset of pre-existing conditions.

Are US citizens able to get Patriot America Plus insurance?

Patriot America Plus Insurance focuses on the insurance requirements of non-US Residents who require temporary medical insurance while visiting the US for either business or pleasure. Patriot America Plus Insurance is provided to US citizens living abroad who are temporarily visiting the US. For US nationals to be eligible for Patriot America Plus insurance, they must have lived abroad continuously for the previous six months and have an active health plan.

How do I make a claim?

Claims can be submitted through MyIMG portal with all receipts and documents. Emergency services should be pre-certified when required.

Plan Summary:

Bottom Line

Without travel insurance, visiting the US can result in a number of financial hardships in the event of an unforeseen sickness or injury. So, if you plan to buy health insurance in the form of travel insurance for your parents, this plan is a very popular & good option.

Get this comprehensive medical coverage and make their travel and stay protected!