Best Travel Insurance 2023, A Complete Guide

Insurance is about mitigating risk and spending just about the right amount of premium for the medical and trip-related coverage you need.

Insurance is one product we buy with the hope that we never have to use the product, but in case a situation arises then the coverage limits you bought should be sufficient to ensure your out-of-pocket expenses are limited.

When it comes to travel insurance companies and travel insurance plans there are several options in the market that can get confusing in terms of which is the best travel insurance plan to buy!

If you are traveling to the USA or if your parents are visiting the USA you must be looking to buy travel insurance.

We have compiled a list of some very popular travel insurance companies and their plans that will help you save time on research and decide faster.

When it comes to Travel Insurance for the USA you need to ensure that Medical Coverage is an important component of the travel insurance plan.

List of Best Travel Insurance Plans for 2023

Best Travel Insurance Plans: Comprehensive Coverage

- Patriot America Plus Travel Insurance

- Atlas America Travel Insurance

- Safe Travels USA Comprehensive Coverage

Best Travel Insurance Plans: Limited or Fixed Coverage

- Visitors Care Travel Insurance

- VisitorSecure Travel Insurance

- Inbound USA Travel Insurance

Best Travel Insurance Plans: Pre-Existing Conditions Coverage

- INF Elite Travel Insurance

- INF Premier Travel Insurance

Let’s look into each of these plans in detail

The detail on each of the plans mentioned here is a snapshot, you will be able to get all the details on these plans in their respective policy document.

PATRIOT AMERICA PLUS Travel Insurance

Key Highlights:

- After the deductible, the plan pays 100% up to the policy maximum

- The travel insurance plan offers coverage limit options of the policy maximum of $50,000, $100,000, $500,000, or $1,000,000

- Coverage for non-US citizens traveling to the USA

- Coverage is available from 5 days to 365 days, renewable up to 365 days

- Covid-19 coverage included, Acute onset of pre-existing conditions offered

Read More on Patriot America Plus Travel Insurance:

Top 10 Reasons to Buy Patriot America Plus

Patriot America Plus Travel Insurance Review

Patriot America Travel Insurance VS Atlas America Travel Insurance, which plan is better?

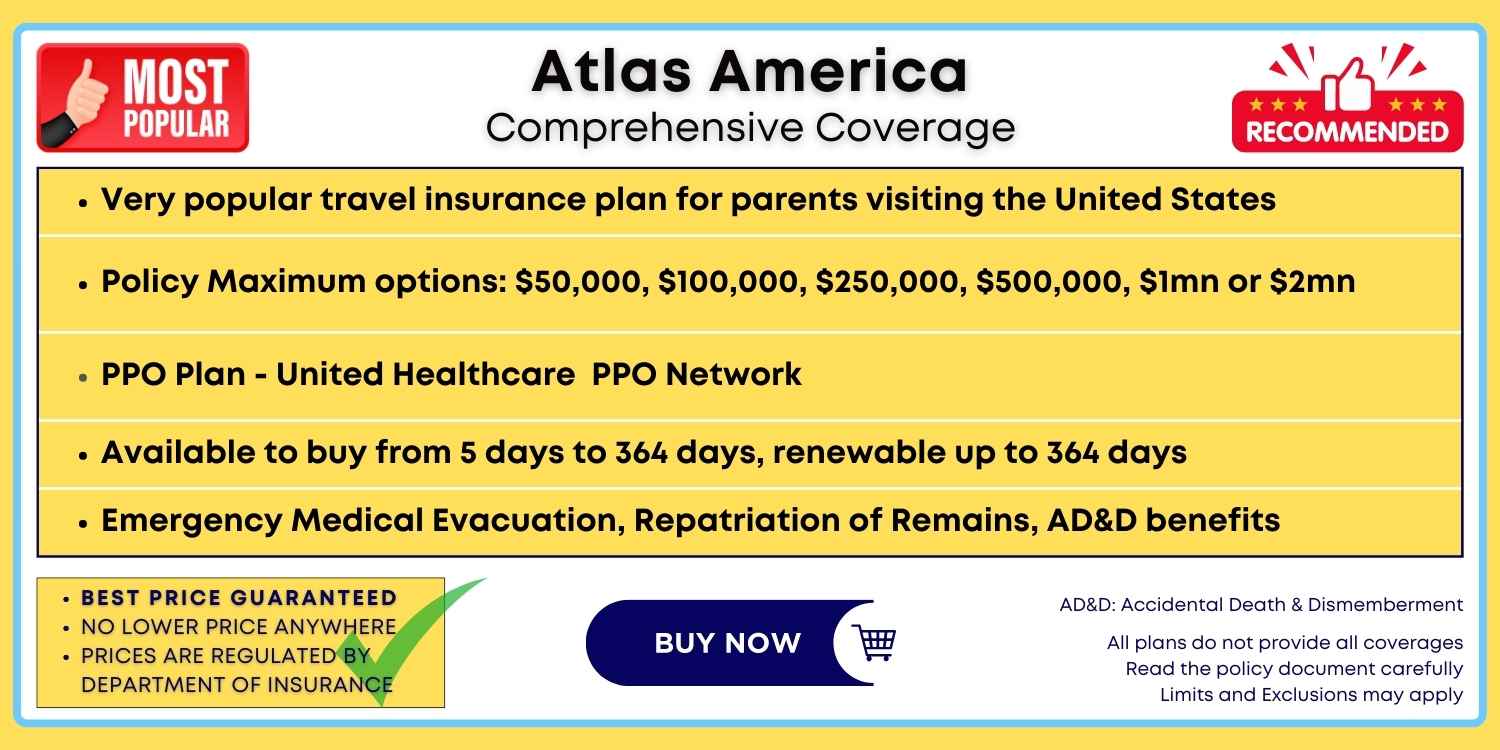

ATLAS AMERICA Travel Insurance

Key Highlights:

- After the deductible, the plan pays 100% up to the policy maximum

- The travel insurance plan offers coverage limit options for policy maximums of $50,000, $100,000, $250,000, $500,000, $1,000,000or $2,000,000

- Coverage is available from 5 days to 364 days

- $500 for Lost Checked Luggage

- Emergency Medical Evacuation, Emergency Dental are covered

Read more on Atlas America Travel Insurance:

Top 10 Reasons to Buy Atlas America Travel Insurance

Atlas. America Travel Insurance Review

Atlas America Travel Insurance vs Patriot America Travel Insurance, which plan is better?

SAFE TRAVELS USA COMPREHENSIVE Travel Medical Insurance

Key Highlights:

- Accident and Sickness Medical Insurance for persons ages 14 days up to age 89 years with Evacuation and Repatriation Benefits

- Acute Onset of Pre-Existing Conditions

- Benefits for persons while traveling to the United States and worldwide with certain restrictions to specific countries and locations

- Coverage from 5 days to 1 year and Renewable up to 2 years

Read more on Safe Travels USA Comprehensive:

Safe Travels USA Comprehensive Review

Safe Travels USA Comprehensive vs Patriot America Plus

Safe Travels USA vs Atlas America

Top Selling Comprehensive Coverage Travel Insurance Plans Compared

We have compared these 3 top selling comprehensive travel medical insurance plans, you can read them here:

Atlas America vs Patriot America vs Safe Travels USA Insurance

If you are keen to get affordable coverage then the Limited Coverage plans can be of help offering coverage options at affordable prices. These plans are easy on the premium they charge at the same time the coverage limits and coverage options are not as wide as comprehensive travel insurance policies for medical coverage and travel-related benefits.

The coverage limits for say medical expenses will be fixed per incident and are usually limited in nature. But these plans are excellent for a short visit to the USA for someone who doesn’t have any pre-existing conditions.

Best Travel Insurance Plans: Limited or Fixed Coverage

- Visitors Care Travel Insurance

- VisitorSecure Travel Insurance

- Inbound USA Travel Insurance

VISITORS CARE Travel Insurance

Key Highlights:

- Available in Lite, Plus, and Platinum options

- Limited Coverage Plan for non-US citizens

- Coverage is available from 5 days to 365 days, renewable up to 24 months

- Coverage for acute onset of pre-existing conditions up to $100,000

- Policy maximum up to $100,000

- Deductible per incident options available $0, $50 & $100

VISITORSECURE Travel Insurance

Key Highlights:

Available to international travelers traveling outside their home country including the USA

Coverage is available from 5 days to 364 days, extendable up to 364 days

Coverage age from 14 days old to 89 years

Acute onset of Pre-existing conditions and Covid-19 coverage

INBOUND USA Travel Insurance

Key Highlights:

- Available in Basic, Choice, and Elite options

- Inbound can be purchased by Non-US citizens traveling to the USA

- Coverage can be purchased for you, your partner, your kids, and/or your parents

- You must be under 99 years of age and at least 14 days old to be covered

- Coverage is available from 5 days to 364 days

- For travel to the United States and U.S. territories, Green Card holders and United States citizens, including those with dual citizenship, are not permitted to purchase this plan

- 2024 Update: this plan is no longer available, you can explore Seven Corners Visitors Choice

Best Travel Insurance Plans: Pre-Existing Conditions Coverage

- INF Elite Travel Insurance

- INF Premier Travel Insurance

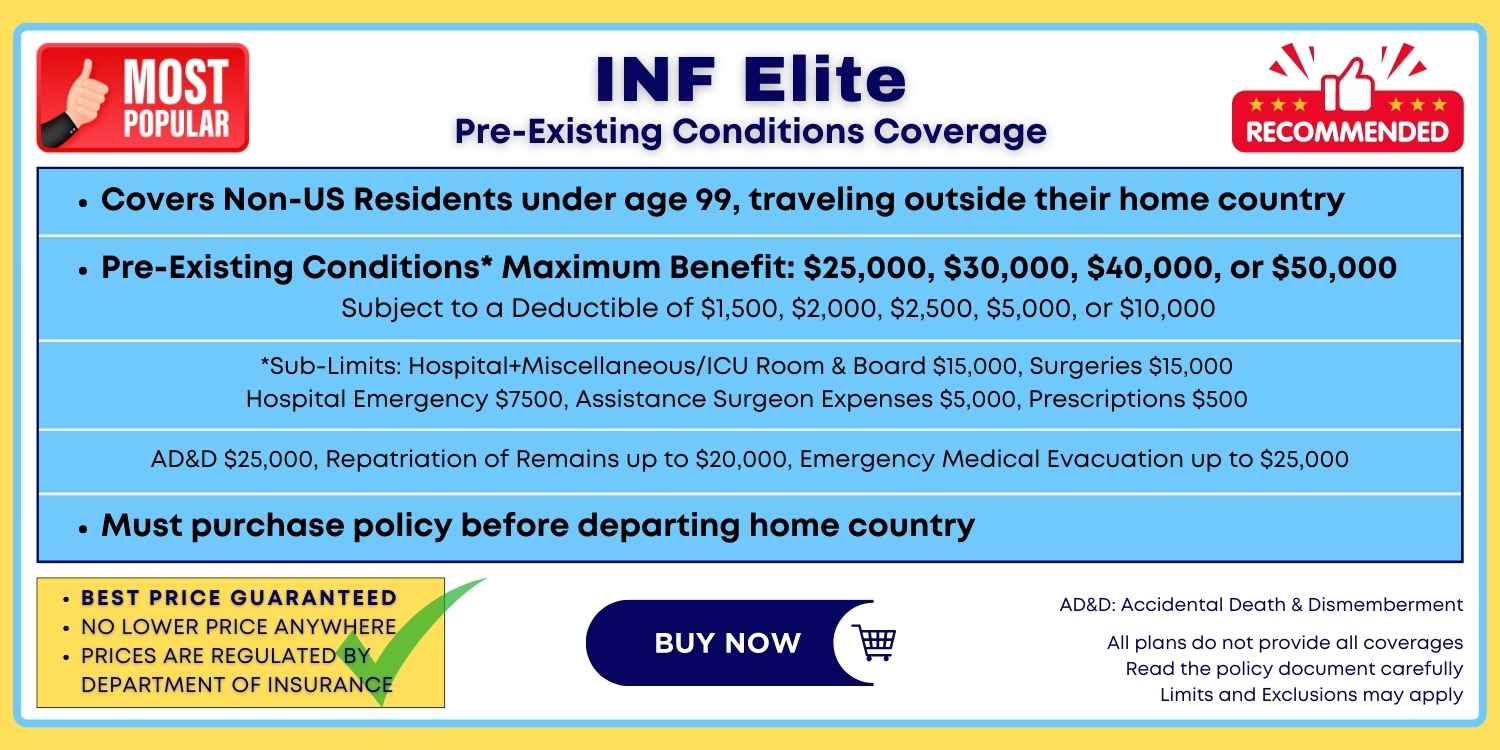

INF ELITE Pre-Existing Conditions Coverage Plan

Key Highlights:

- Covers pre-existing medical conditions. This plan covers pre-existing conditions up to limits defined in the policy terms and pays based on the percentage of the bill.

- Underwritten by Crum & Forster, SPC, the insurance benefits include coverage for non-US residents from 0 to 99 years.

- The short-term travel medical coverage extends from 90 days to 364 days.

- The maximum limit for ages 70 to 99 is $75,000

- The maximum limit for the age group up to 69, is $300,000

The plan utilizes United Healthcare Options PPO.

INF PREMIER Pre-Existing Conditions Coverage Plan

Key Highlights:

INF Premier covers pre-existing conditions, including coverage for blood tests, lab work, and hospital stays, apart from other benefits for unexpected medical incidents.

The coverage in terms of age, pre-existing condition coverage, and the number of short-term days are the same as the Elite plan.

The maximum limit under this fixed benefit plan is $ 100,000 and $ 150,000 for the age groups seventy to ninety-nine and zero to sixty-nine, respectively.

The pre-existing coverage has a maximum limit of $60,000/-. Direct billing may be available.

Pro-Tip:

When we say best travel insurance plans it means:

- these are the top-selling travel insurance plans

- travelers have found these plans to be the best to meet their travel insurance needs

- do read the policy document of the travel medical insurance plan you shortlist

- ensure it provides coverage for specific situations and incidents that you may need

- all plans do not provide all coverage, read the inclusions, exclusions, limits, etc.

- some of these plans also offer trip cancellation coverage, baggage delay coverage, medical expense coverage, reimbursement for medical expenses, and emergency medical coverage like emergency medical evacuation coverage.

- These are defined in the policy document, read it carefully

List of Best Travel Insurance Companies

There are several travel insurance companies providing travel insurance plans for the different needs of international travelers.

We have covered this topic in detail and you can read more about The Best Travel Insurance Companies for the USA

Some of the best specialist travel insurance companies are:

International Medical Group – IMG Travel Insurance Company

Amongst the best travel insurance companies on several platforms, IMG is one of the reputed and popular travel insurance providers. Some of their plans are highly popular amongst leisure travelers, frequent travelers, business travelers, and parents visiting the USA.

The Patriot Series is amongst the best-selling plans and Patriot America Plus and Patriot Platinum sell like hot cake due to their high policy maximum options and list of coverages offered.

IMG has an excellent Trustpilot rating of 4.6 stars with over 6500 reviews.

Seven Corners Travel Insurance Company

Amongst the best travel insurance companies’ rankings on several platforms, Seven Corners offers international travel insurance with their Inbound USA and Round Trip series of travel insurance plans selling very well. They offer a wide range of plans from travel medical insurance to trip cancellation coverage plans.

They have a rating of Great on Trustpilot with 3.9 stars with over 4600 reviews.

WorldTrips

Considered one of the best travel insurance companies globally, the Tokio Marine Group runs several travel insurance companies across the globe and WorldTrips in the USA is amongst the popular travel insurance providers. Their most popular plan Atlas America is a hit amongst people inviting their parents to visit the USA. With high policy maximum limits and range of coverage, the plans sell in high numbers.

Trawick International

Trawick International is highly popular for providing medical coverage for Inbound travel into the USA and international travel insurance products. Amongst the high sales producing travel insurance companies their Safe Travels USA insurance series is very popular. Safe Travel USA Comprehensive travel medical insurance coverage plan is very popular amongst the international diaspora living in the USA and inviting their family members and parents to visit them in the USA.

INFPlans

If you need travel insurance with pre-existing conditions your options for travel insurance coverage are very limited. INFPlans is amongst very few travel insurance companies providing travel insurance coverage for pre-existing conditions. INF Elite and INF Premier are amongst the high-selling travel insurance plans for parents with pre-existing conditions traveling to the USA.

There are some restrictions on the plans like a minimum purchase period of 90 days and the insurance company charges a premium much higher than even comprehensive coverage plans. But this is justified given the high risk carried by the policies. The plans on average are 3 times more expensive than plans provided by other travel insurance companies.

Frequently Asked Questions

What is the basis for ranking these plans as best?

The basis of ranking these plans is the number of sales of these plans and the wide range of coverage options they provide to international travelers. Also, the fact that these plans are designed by specialist international travel insurance providers has been taken into account.

What does travel insurance cover? Do we get medical coverage in all plans?

Travel Insurance covers your medical and travel-related expenses. Unforeseen circumstances and incidents can dent a big hole in your pocket. Travel Insurance reduces this risk. Typical medical coverages include medical expenses for a new sickness or medical costs for a new injury, acute onset of pre-existing conditions, and medical expenses to stabilize it. Some plans also include Trip Insurance built into the plan and may offer trip cancellation benefits, trip interruption, reimbursement of some trip costs with interruption insurance, baggage coverage, and trip delay coverage.

Is Travel Insurance Worth The Cost?

Travel insurance like any other insurance is bought with the hope that one may never have to use it. However unforeseen circumstances and situations are the reason why we the coverage options.

What is not covered by travel insurance?

What is covered is described in the policy document and what is not described is not covered. Typical travel insurance plans do not cover pre-existing conditions except the plans like INF Elite and INF Premier discussed in the article. Some plans cover the acute onset of pre-existing conditions but it is not standard in all plans. You also want to check if emergency services like emergency medical evacuation coverage, repatriation of remains, and AD&D benefits are available in the travel insurance plan.

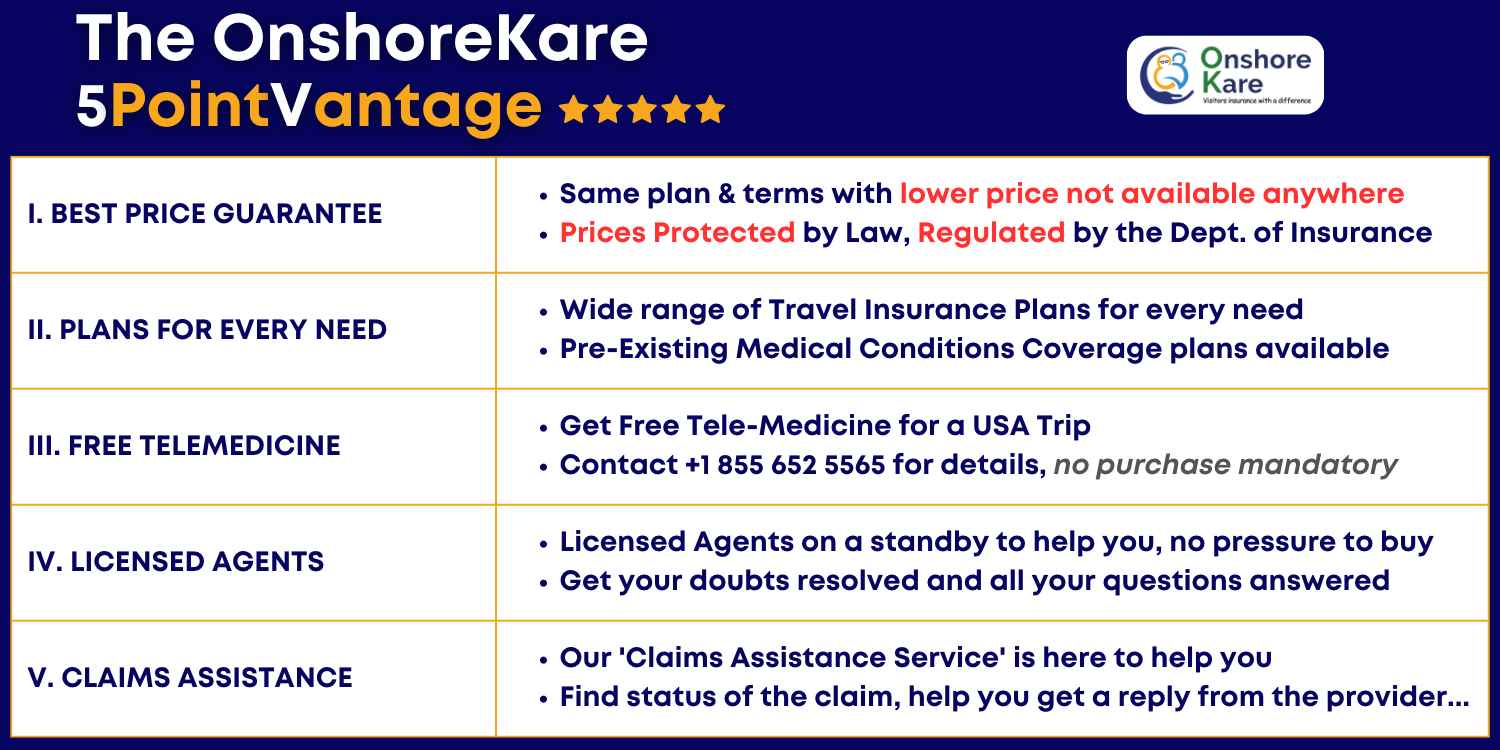

How to Choose the Best Travel Insurance Policy

Generate a Travel Insurance Quote on a marketplace like OnshoreKare, compare the plans, and buy. Having a list of coverages that you need always helps. We have covered this topic in detail on How to Find the Best Travel Insurance for travelers visiting the USA

Conclusion

We hope this list of the best travel insurance plans helps you. If you need help selecting a travel insurance plan you can reach out to us at +1 855 652 5565 or email us at info@onshorekare.com, our licensed associates will be happy to help you.

Bon Voyage!