Best Travel Insurance For Seniors Over 70

What Changes After 70 and Why Claims Fail

Most seniors only discover how travel insurance truly works after the age of 70 when they are forced to rely on it during a medical emergency.

The common assumption is simple:

If a policy is available for purchase and shows a high coverage limit, it should respond when care is needed.

In practice, that assumption often fails.

After the age of 70, travel insurance operates under a different set of rules. Coverage limits are frequently age-restricted, deductibles are higher, and eligibility criteria become more narrowly defined. These limitations are rarely visible on comparison pages and are often discovered only when a claim is already in progress.

This gap between how policies are marketed and how they actually behave is why many seniors and their families feel misled—even when the insurer is technically following the policy wording.

This guide explains how travel insurance for seniors over 70 really works, what materially changes with age, and how to make decisions that hold up when medical care—not inconvenience—is the reason a claim is filed.

Quick Answer: Can Seniors Over 70 Get Travel Insurance—and How Is It Limited?

Yes, seniors over 70 can buy travel insurance. However, usable medical coverage is often lower than advertised, deductibles are higher, and medical benefits are more narrowly defined than they are for younger travelers. The right policy depends on destination, length of stay, and medical history—not on the headline policy maximum.

For travel to the United States in particular, emergency medical and evacuation coverage should take priority over all other benefits. This conclusion is based on how senior claims are assessed in real situations, not on how plans are marketed.

Why Travel Insurance Changes After Age 70 (And How Those Changes Affect Claims)

After the age of 70, travel insurance stops being a simple comparison exercise and becomes a risk-management decision. The structure of coverage changes in ways that are subtle at purchase—but decisive at claim time.

Four changes matter most. They do not affect all travelers equally, but they consistently determine how senior claims are approved, reduced, or denied.

1. Age-Based Coverage Caps Reduce Usable Benefits After 70

Many plans advertise high maximum coverage amounts, but apply age-based caps behind the scenes. Once age is factored in, the usable medical coverage for travelers over 70 may be significantly lower than the headline limit.

This difference usually becomes visible only during a claim, when approved benefits stop well before the advertised maximum is reached.

2. Deductibles Become Mandatory and Higher for Travelers Over 70

For seniors, deductibles are often no longer optional. They are higher than those applied to younger travelers and must be paid before benefits begin.

In real terms, this increases out-of-pocket exposure during medical events that require hospitalization, diagnostics, or follow-up care.

3. Medical Benefits Become Conditional Rather Than Automatic After 70

Medical benefits that apply automatically for younger travelers may become conditional after age 70. Coverage can depend on how an event is classified, how symptoms present, and how policy definitions are applied.

This is why two travelers with similar symptoms can receive very different claim outcomes based solely on age and policy structure.

4. Premiums Increase Faster Than Protection After Age 70

Premiums rise sharply after age 70, but the increase in cost does not always correspond to broader coverage. In some cases, travelers pay more while receiving lower age-adjusted limits and stricter benefit definitions.

This disconnect explains why higher premiums do not reliably translate into safer coverage for seniors.

Together, these changes explain why many seniors feel surprised or disappointed during claims—even when the policy functions exactly as written. Understanding these shifts upfront is the only reliable way to reduce claim risk.

The Only Coverage That Truly Matters After 70

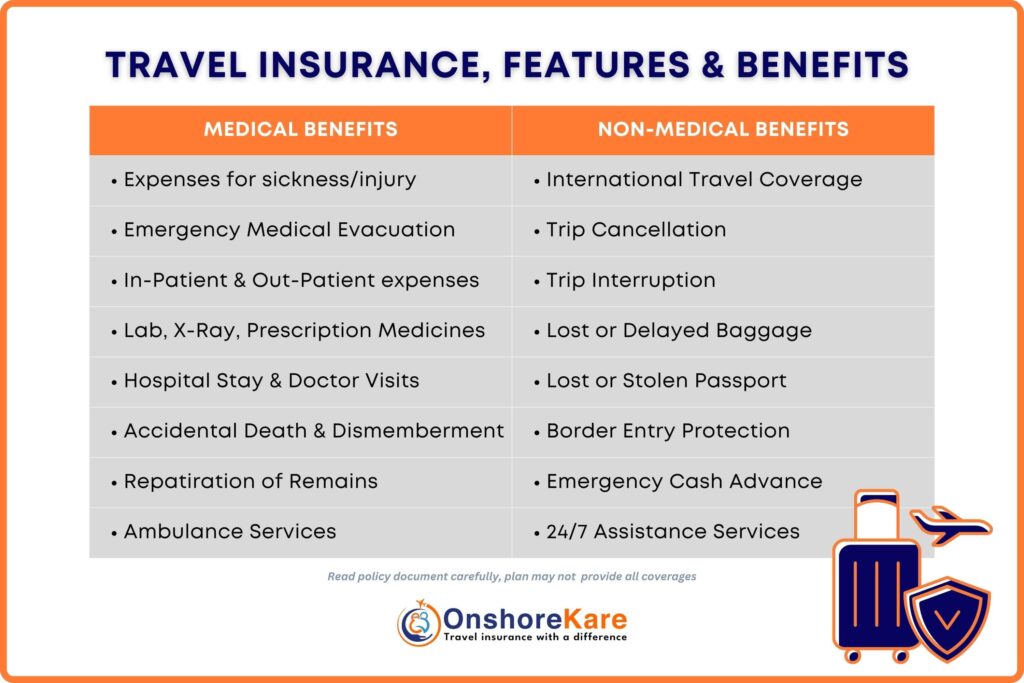

For travelers over 70, most meaningful insurance claims involve medical treatment, not travel inconvenience. Evaluating travel insurance through that lens removes much of the confusion created by marketing-heavy benefit lists.

After age 70, the likelihood of claims related to baggage delay, trip interruption, or missed connections drops sharply compared to claims involving hospitalization, diagnostics, or emergency evacuation. This is not a theoretical distinction—it reflects how senior claims actually arise and how costs accumulate.

When insurance is evaluated based on real claim outcomes rather than feature count, the decision becomes simpler and more defensible.

What Actually Drives Claim Outcomes for Seniors Over 70

| Coverage Type | Priority | Why It Matters |

|---|---|---|

| Emergency hospitalization | Critical | Represents the largest and fastest medical claims |

| Emergency medical evacuation | Critical | Costs can exceed treatment expenses, especially for serious incidents |

| Outpatient care & diagnostics | Important | Common during longer stays and follow-up treatment |

| Prescription medicines | Moderate | Often capped and limited under senior plans |

| Trip cancellation | Low | Financial inconvenience rather than medical risk |

| Baggage delay | Very Low | Minimal impact on overall outcomes |

If a plan performs poorly on hospitalization or medical evacuation, no amount of secondary benefits meaningfully compensates for that weakness. For seniors over 70, these two areas determine whether insurance functions as protection or merely as paperwork.

This is why coverage evaluation after 70 must start with medical and evacuation benefits, not with headline coverage limits or bundled travel features.

Pre-Existing Conditions: Where Most Senior Claims Fail

Pre-existing conditions are the single most common reason travel insurance claims for seniors over 70 are denied or reduced. The issue is rarely the complete absence of coverage—it is how narrowly that coverage is defined and applied at claim time.

Many seniors assume that because a condition is long-standing, stable, or well-managed, it will automatically be eligible if an emergency occurs. In practice, that assumption often does not hold.

Several realities consistently affect outcomes:

- Pre-existing condition coverage is usually capped, and those caps are often significantly lower than standard medical limits.

- Acute onset coverage applies only to sudden and unexpected events, and does not extend to known, ongoing, or recurring conditions.

- Stability does not guarantee eligibility. A condition can be stable for months or years and still be excluded based on treatment history or policy definitions.

- Severity does not override definitions. Even serious or life-threatening events are evaluated strictly against policy wording.

This is where simplified plan summaries and comparison tools are most misleading. They often highlight the presence of “pre-existing condition coverage” without explaining the restrictions that determine whether a claim will actually qualify.

For seniors over 70, understanding how a condition is classified under the policy matters more than how the condition feels medically. Claims are evaluated based on definitions, documentation, and timelines—not on intent or perceived fairness.

This is why pre-existing conditions must be evaluated deliberately and conservatively before purchase, especially for longer stays or travel to destinations with high medical costs.

Do Not Buy Travel Insurance If…

Most senior insurance problems do not happen because insurance was skipped. They happen because insurance was purchased without understanding age-based limits and exclusions.

You should not buy a travel insurance policy for a senior over 70 without a detailed review if any of the following apply:

- You are traveling to the United States

Medical costs, diagnostics, and evacuation expenses in the U.S. are materially higher, and age-adjusted limits become critical. - Your stay is longer than 30 days

Longer trips increase the likelihood of outpatient visits, follow-up diagnostics, and prescription needs that are often capped or limited. - There is ongoing, recent, or recurring medical treatment

Even stable conditions can trigger exclusions or reduced benefits depending on policy definitions and treatment history. - The traveler is over 75

Age-based caps, deductibles, and conditional benefits become more restrictive with each additional age band. - You are choosing based primarily on price or headline coverage limits

Lower-cost plans often carry the highest claim risk for seniors, especially when age caps and deductibles are applied.

Insurance cannot correct poor planning at the purchase stage. For seniors over 70, clarity before buying matters more than coverage after an emergency occurs.

How to Choose the Right Plan After 70 (Scenario, Not Price, First)

For travelers over 70, choosing travel insurance is not about finding the most comprehensive-looking plan. It is about selecting coverage that aligns with the specific risks of the trip being planned.

Age alone does not determine whether a plan will perform well. Destination, length of stay, and medical history consistently have more impact on claim outcomes than headline coverage limits or brand recognition.

When decisions are grounded in travel scenarios rather than plan marketing, unsuitable options are eliminated early and claim risk is reduced.

What Works in Practice: Matching Travel Scenarios to Plan Types

| Travel Scenario | Plan Type That Works | Why |

|---|---|---|

| Visiting USA (2–6 months) | Comprehensive Plan | Better aligned with high medical and evacuation costs |

| Short trip outside USA | Fixed-benefit plan | Predictable risk and controlled exposure |

| Known medical conditions | Defined PEC-cap plan | Clearer limits and fewer claim surprises |

| Short stay, healthy traveler | Fixed-benefit plan | Lower premium trade-off when risk is limited |

This framework removes marketing noise and replaces it with decision clarity. Rather than searching for a universally “best” plan, seniors over 70 benefit more from matching coverage structure to how and where they are traveling.

So, Which Plans Actually Work for Seniors Aged 70–79?

There is no single “best” travel insurance plan for seniors over 70. Coverage performance depends on how well a plan’s structure aligns with the traveler’s destination, length of stay, and medical profile.

That said, when selected for the right scenario, the following plans tend to perform more predictably in real senior claims than generic, price-driven alternatives.

Atlas America

Best suited for seniors visiting the United States

Atlas America plan is commonly chosen for:

- Visiting family in the U.S.

- Medium to long stays

- Seniors without complex or high-risk medical histories

Its structure is better aligned with U.S. medical costs than many fixed-benefit options, though age-based caps and deductibles still apply and must be reviewed carefully.

Safe Travels USA Comprehensive

Best for predictable, expense-based medical coverage

Safe Travel plan is often appropriate for:

- Seniors who prefer reimbursement-style coverage

- Trips where outpatient care and diagnostics are likely

- Travelers who value clearer benefit definitions over headline limits

As with all senior plans, age-adjusted limits and cost-sharing requirements apply and should be evaluated before purchase.

INF Elite / INF Elite X

Best when pre-existing conditions require clearly defined limits

These plans are typically considered for:

- Seniors managing known pre-existing conditions

- Longer stays where medical history plays a larger role

- Travelers who want defined caps rather than ambiguous exclusions

Pre-existing condition limits are clearly stated, which can reduce uncertainty at claim time, but coverage remains capped and conditional.

These examples are not blanket recommendations. Each plan includes age-based limitations, deductibles, and exclusions that must be matched deliberately to the traveler’s situation.

For a broader comparison of visitor insurance options specifically designed for travelers aged 70–79, you can explore detailed plan listings and benefits here:

Visitors Insurance for Travelers Aged 70–79 Years

Before You Buy: Read This Once

Most senior travel insurance problems do not happen because coverage was skipped. They happen because insurance was purchased without fully understanding how age-based limits apply.

For travelers over 70, insurance should never be purchased on impulse or based solely on price, brand familiarity, or advertised coverage limits.

You should always pause and review the policy carefully if any of the following apply:

- You are traveling to the United States

- Your stay exceeds 30 days

- You have ongoing, recent, or recurring medical treatment

- You are over the age of 75

In these situations, even small differences in age caps, deductibles, or benefit definitions can materially affect claim outcomes.

Insurance cannot correct poor planning at the purchase stage. For seniors over 70, careful review and scenario alignment matter more than the number printed on the policy certificate.

If you are still unsure which plan fits your situation, taking a structured risk assessment before purchasing is often more reliable than comparing plans side by side.

Take a Quick Risk Check Before You Buy

If you are unsure which type of plan fits your situation, a short risk assessment can help clarify the decision before purchase.

A structured risk check looks at:

- Destination (especially travel to the U.S.)

- Length of stay

- Age band

- Presence of pre-existing conditions

- Tolerance for deductibles and out-of-pocket costs

This approach reduces guesswork and helps narrow options based on how a policy is likely to behave during a medical claim—not how it appears on a comparison page.

You can take a quick risk check using OnshoreKare’s risk calculator to see which type of coverage aligns best with your travel profile before choosing a plan.

Frequently Asked Questions

Why do two plans with the same coverage limit behave differently after age 70?

Because the advertised maximum is not always the age-applicable limit. Age-based caps often reduce the usable medical coverage available during a claim.

Why can a stable pre-existing condition still be excluded?

Eligibility depends on policy definitions and treatment history, not stability alone. A condition can be stable and still fall outside coverage based on how it is defined.

Is emergency medical evacuation really necessary for seniors?

Yes. Evacuation costs can exceed treatment costs, especially for serious incidents or travel to destinations with limited medical facilities.

Are comprehensive plans always safer than fixed-benefit plans for seniors?

Not necessarily. Both can work when their limits, deductibles, and exclusions are clearly understood and matched to the travel scenario.