Comparing INF Premier Plus and Elite Plus which Travel Insurance Plan is right for you ?

Traveling is a thrilling adventure that can be both rewarding and enriching. It does, however, carry risks, such as flight cancellations, lost luggage, and medical emergencies. For travelers looking for pre-existing medical conditions coverage

These risks are heightened when traveling abroad, where language and cultural barriers can make navigating unexpected situations more difficult. As a result, before embarking on any international trip, it is critical to consider purchasing travel insurance.

INF Visitors Insurance is one of the leading providers of comprehensive insurance plans. One of the key benefits offered by INF visitor insurance is pre-existing condition coverage, which can provide peace of mind for travelers with pre-existing medical conditions.

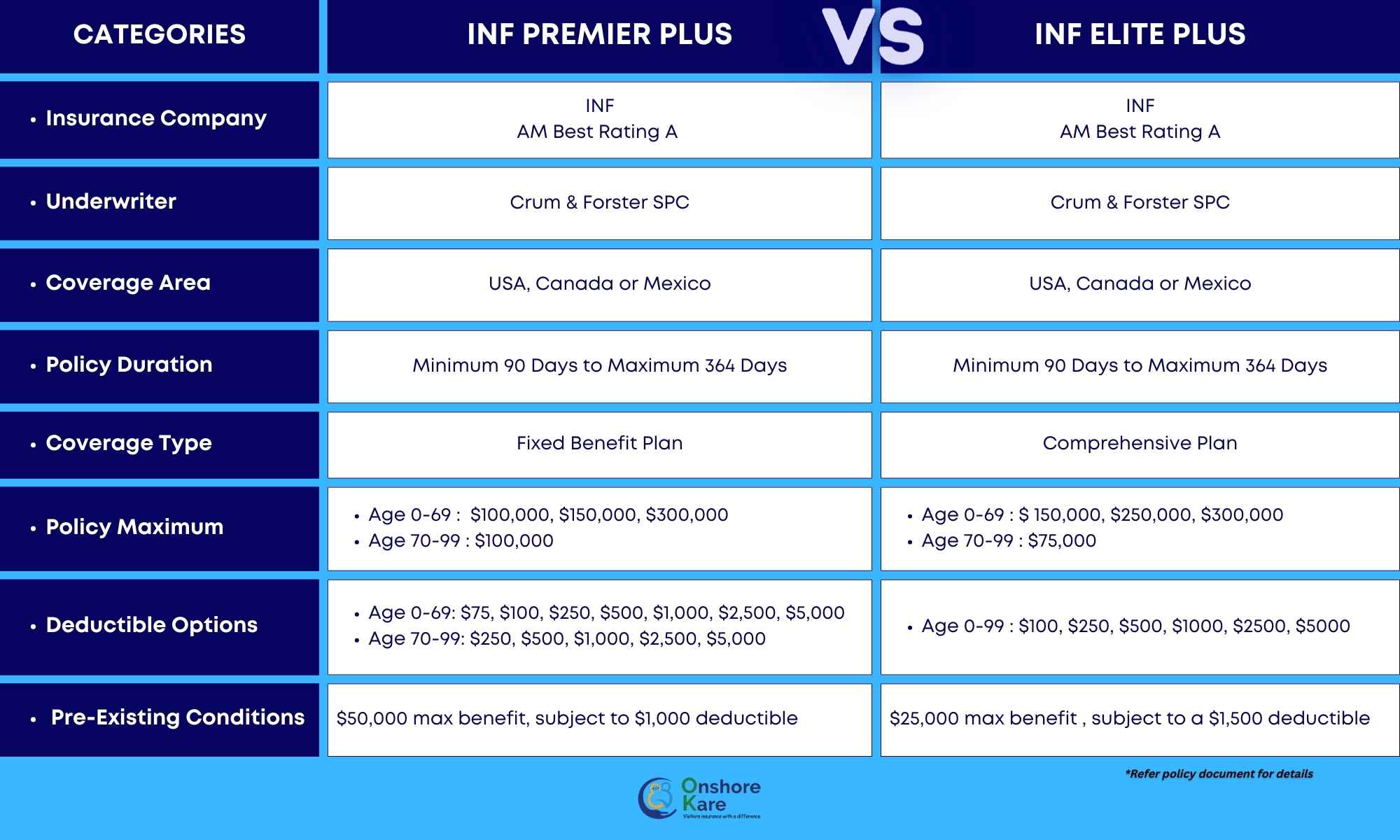

INF Premier Plus and Elite Plus are two popular travel health policies offered by INFPlans, a leading international provider of insurance products.

While both plans provide comprehensive coverage for a wide range of medical services, there are some key differences between the two that prospective customers should be aware of before making a choice.

In this article, let us discuss the similarities and differences between these two visitors insurance options to determine which plan best fits your needs.

Plan Highlights: Key differences between the two plans

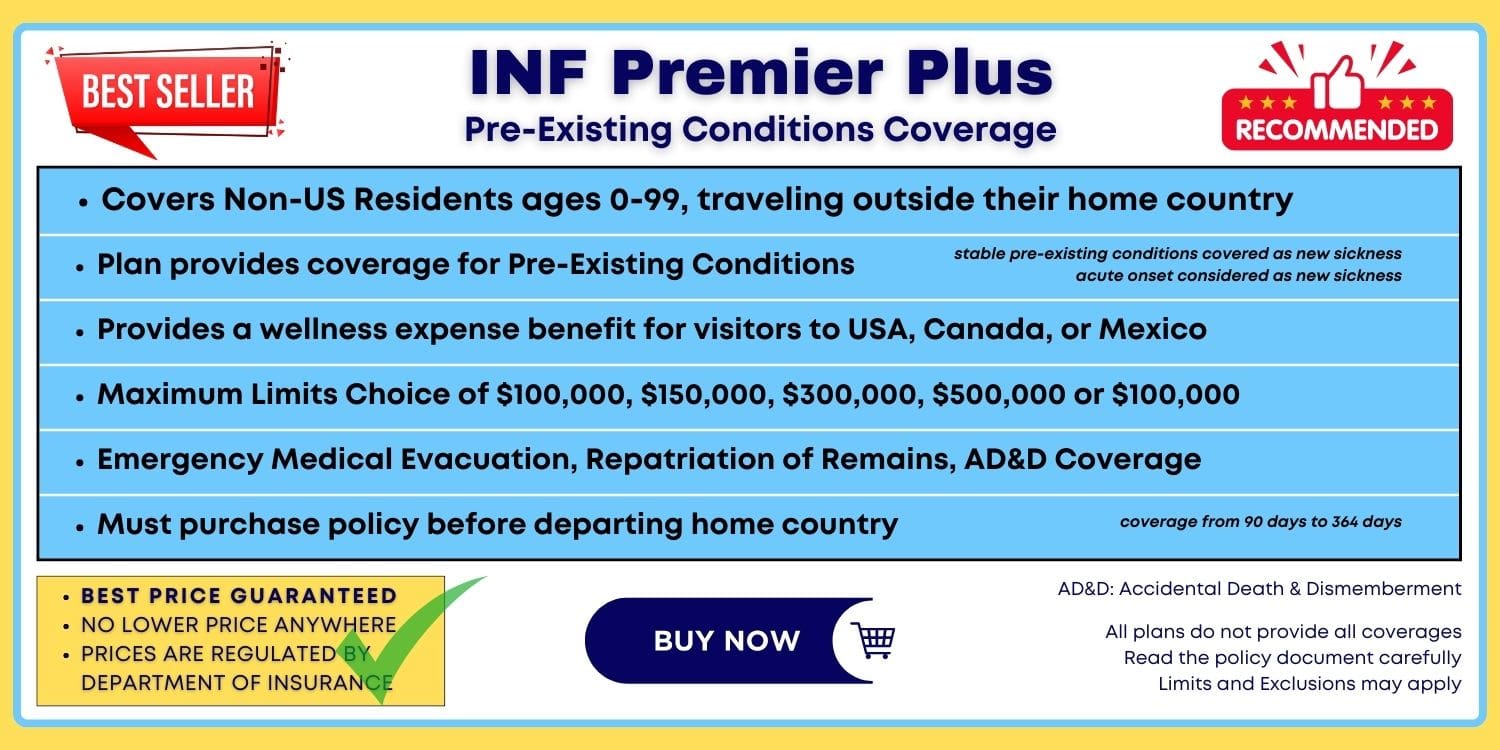

About INF Premier Plus Plan Travel Insurance:

One of the INF’s premier insurance programs for international travelers to the United States, Canada, and Mexico is the INF Premier Plus IVAS Plan, which offers wellness benefits like complete physicals, vaccinations, and regular bloodwork.

It is a fixed benefit plan and only non-US residents can purchase the INF Premier Plus IVAS Plan.

With no waiting period for benefits, the INF Premier Plus IVAS Plan covers pre-existing conditions as defined in the plan, subject to the policy’s limitations, exclusions, and maximums. The plan benefits include :

- Full pre-existing condition coverage, including doctor visits, blood tests, specialty care, urgent care visits, and hospital stays, is offered by this fixed plan from INF.

- With this plan, a minimum purchase of 90 days is necessary.

- If the plan is purchased before childbirth, before the trip starts, it will cover pregnancy and childbirth.

- It is possible for B1 visa holders traveling to the US on business to purchase this comprehensive visitor insurance plan.

- Plans include COVID-19

About INF Elite Plus Travel Medical Insurance

INF Elite Plus IVAS Plan is the first program that covers both preventive care & pre-existing conditions for travelers visiting the USA, Canada, or Mexico.

This comprehensive travel medical insurance plan is available only to non-US residents traveling outside their home country.

There is no benefit waiting period with Elite Plus IVAS, and it covers pre-ex conditions according to the plan’s definitions, subject to the policy’s limitations, exclusions, and maximums.

The preventive care benefits offered by Elite Plus IVAS can also be used for a variety of other covered medical services. The plan benefits include:

- Covers full-body physicals as well as preventive and maintenance care.

- A comprehensive plan that offers full coverage including pre-ex med conditions. This covers hospital stays, specialist care, urgent care visits, blood tests, and lab work. Pre-existing conditions are also covered for doctor visits.

- Coverage for TDAP, Flu, Vaccines, etc

- Pre-Existing Covid-19 complications are covered

- This plan must be purchased for a minimum of 90 days.

- Only non-US residents are eligible for this plan, which is not available to US citizens.

- Pre-existing stable conditions are treated as new illnesses.

- Direct billing for United Healthcare PPO providers

- Covers sickness and accidents while visiting the United States, Canada, and Mexico

- Contains a dental discount program

- Acute onset is regarded as a new illness.

- Medically necessary testing and treatment are covered under Covid-19 as any other new sickness.

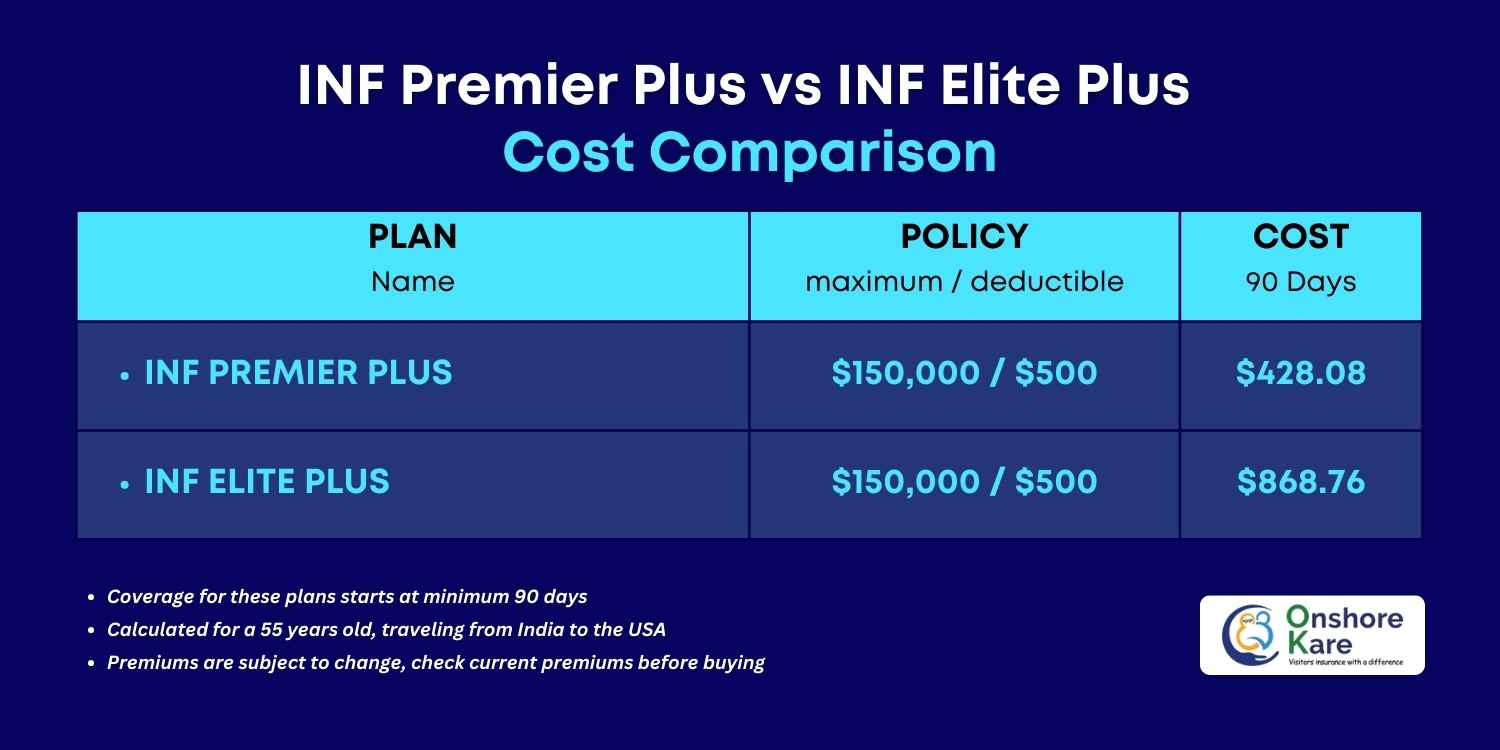

How much do the plans cost? Which plan is cost-effective?

The cost of each plan varies according to a number of factors, including age, location, and health status. However, because of its greater coverage limits, Elite Plus is generally more expensive than INF Premier Plus. Before choosing between the two plans, prospective customers should consider their budget as well as the level of coverage they require.

The premium for the same terms for INF Premier Plus and INF Elite Plus:

- INF Premier Plus policy would be $428.08

- INF Elite Plus plan is $868.76

Please keep in mind that premiums are subject to change based on a variety of factors, and insurance providers may also make changes to plan premiums.

What does it mean by Pre-existing conditions? Does INF Elite Plus and Premier Plus provide Pre-existing condition coverage?

A pre-existing condition is any medical condition that you have been diagnosed with or received treatment for before the effective date of your travel insurance policy. This can include chronic conditions such as diabetes, heart disease, or cancer, as well as any ongoing health concerns that you are managing, such as high blood pressure or asthma.

Both INF visitors insurance offers pre-existing coverage. The Elite Plus plan with a policy maximum of $150,000 covers pre-existing conditions up to $25,000 with a deductible of $1,500 for ages 0 to 69 years, and the Elite Plus plan with a policy maximum of $75,000 covers pre-existing conditions up to $20,000 with a deductible of $1,500 for ages 70 to 99 years.

While the Premier Plus plan with a policy maximum of $300,000 covers pre-existing medical conditions up to $50,000 with a deductible of $1,000 and $100,000 with a deductible of $5,000 for ages 0-69. The Premier plan travel insurance with a policy maximum of $100,000 covers pre-existing medical conditions up to $15,000 with a deductible of $1,000 and $25,000 with a deductible of $5,000 for age 70-99.

If you are looking for the best visitors insurance options for pre-existing conditions coverage, we have covered them in detail, check it out.

Why is coverage for pre-existing conditions important?

If you have a pre-existing condition, it can be challenging to find travel insurance that will cover you. Many insurance companies will either exclude pre-existing conditions altogether or charge higher premiums to cover them. This can make it difficult or even impossible to get the coverage you need when traveling abroad.

However, with INF Insurance plans, you can get coverage for pre-existing conditions, which means you can travel with confidence knowing that you have protection in case of a medical emergency.

What pre-existing conditions are covered by INF Insurance?

INF Insurance covers a range of pre-existing conditions, including but not limited to:

- Diabetes

- High blood pressure

- Heart disease

- Asthma

- Cancer

- Arthritis

- Osteoporosis

- Alzheimer’s disease

- Parkinson’s disease

- Multiple sclerosis

To determine if your specific pre-existing conditions is covered, you should review the policy documents for details.

About INF Insurance Company

INF is a travel medical insurance company that offers cutting-edge international visitor accident and sickness (IVAS) insurance options as well as providing innovative insurance products for international travelers.

For parents, relatives, students, and temporary workers traveling outside of their home country to the United States, Canada, or Mexico, INF travel insurance offers international visitor accident & sickness insurance. Full pre-existing coverage may be provided under some of INF’s plan options up to the specified maximums.

INF Insurance is a provider of travel medical insurance, travel assistance, international medical insurance, and travel insurance products. During your visit to the United States, Canada, or Mexico, INF can help you find coverage options for a pre-existing medical condition, access international visitor accident and sickness insurance, provide quality customer care, and lessen the financial burden that could result from unanticipated medical costs. INF travel insurance company is the only visitor insurance provider offering full pre-existing coverage and is committed to providing innovative insurance products.

We have covered a detailed review of INF travel insurance plans, do check it out.

Policy Maximum

A travel insurance policy maximum is the maximum amount of coverage that the insurer will pay out for eligible expenses incurred during the covered trip. This amount can range from a few thousand dollars to hundreds of thousands of dollars depending on the specific travel insurance policy.

The policy maximum may cover a variety of expenses, including medical expenses, emergency medical evacuation, trip cancellation or interruption, lost or stolen baggage, and other unexpected expenses. When purchasing travel insurance plans, it is critical to carefully review the policy maximum and other coverage details to ensure that it meets your needs and budget.

The policy maximum of the two INF insurance travel medical plans is provided below

- INF Premier Insurance Policy Maximum Limit: $300,000 (Aged 0 – 69), $100,000 (Age: 70-99)

- INF Elite Travel Insurance Policy Maximum Limit: $300,000 (Aged 0-69), $75,000 (Age 70-99)

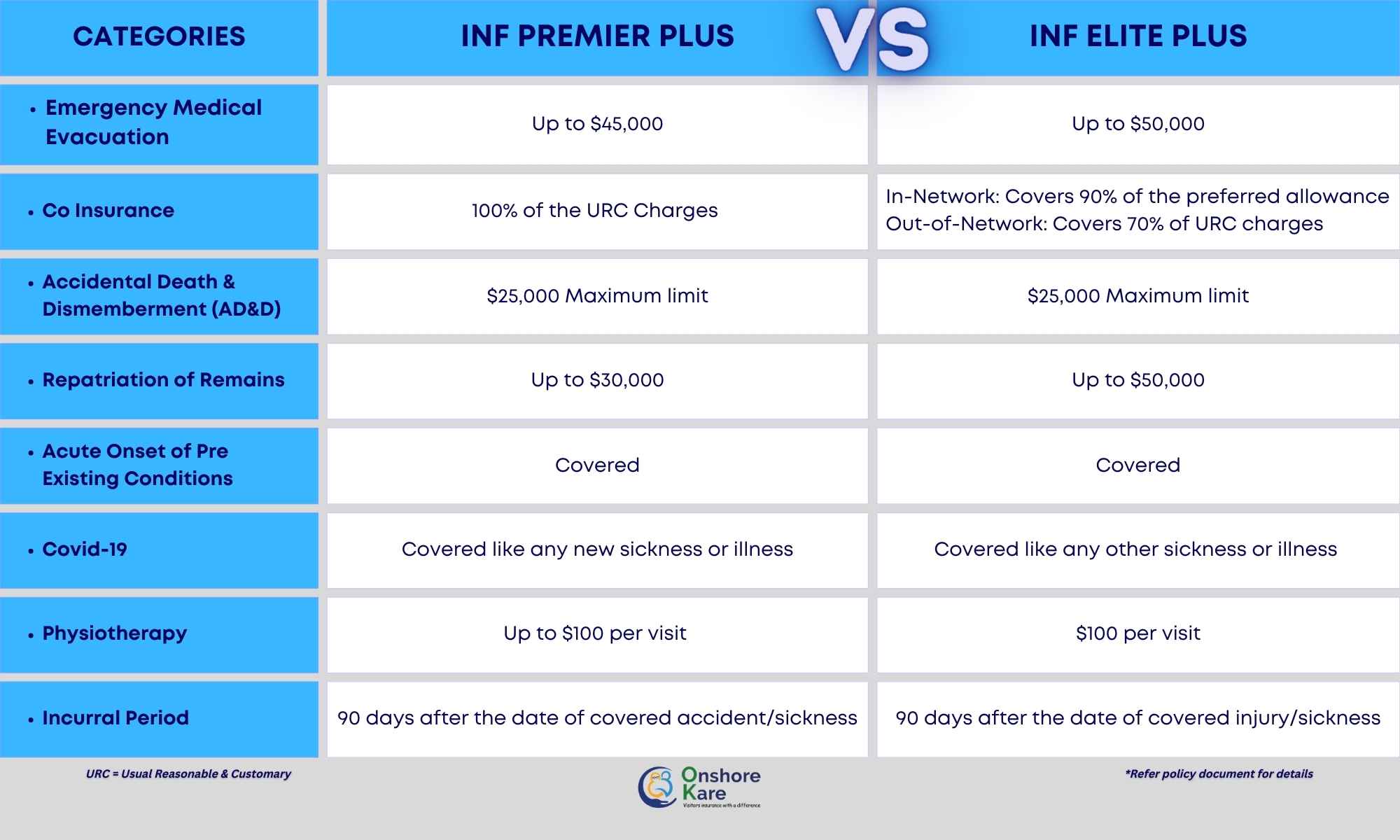

Network Provider

Both the INF insurance policy provides access to a large network of medical providers, such as hospitals, clinics, and doctors. Elite insurance, on the other hand, has a larger network than INF Premier Plus, with providers in over 170 countries. This may be an important consideration for people who travel or live in different countries on a regular basis.

Additional Advantages

Both travel medical insurance provides additional benefits in addition to medical coverage, such as emergency travel assistance and coverage for pre-existing conditions. However, Elite Plus includes some extra benefits that INF Premier Plus does not, such as coverage for maternity and newborn care, as well as coverage for alternative therapies like acupuncture and chiropractic care.

Other Coverages

Let’s take a look at the other coverages provided by the plans below

Frequently Asked Questions

Is covid covered by the INF Elite insurance plan?

For coronavirus coverage, INF Covid19 travel insurance from Elite Network will pay for any reasonable medical costs brought on by covid19/SARS-CoV-2. Medically required costs that are not covered by another plan exclusion are considered eligible medical expenses.

Is medical tourism covered by INF travel insurance plans?

Visitors to the US who are already unwell, who are currently receiving treatment in a hospital, who expect to use their insurance, who have booked medical procedures, and who are looking for ongoing care are not covered by INF insurance.

If a visitor does any of the aforementioned, coverage may be canceled, payment will be fully refunded, and all claims may be rejected. If the traveler has already reached the US, INF has a 5-day waiting period for new sickness/pre-existing coverage.

What is the acute onset of pre-existing conditions?

An acute onset of a pre-existing condition is a sudden and severe worsening of a previously existing medical condition. This means that the person previously had the medical condition, but it has suddenly become more severe, intense, or urgent.

If someone has asthma, for example, an acute onset of pre-existing conditions would result in a sudden and severe worsening of their asthma symptoms such as shortness of breath, chest tightness, and wheezing. Similarly, if a person has diabetes, the acute onset of the condition would mean a sudden and severe episode of hyperglycemia (high blood sugar) or hypoglycemia (low blood sugar) (low blood sugar).

It’s important to note that an acute onset of pre-existing conditions can occur for a variety of medical conditions, and it’s critical to seek medical attention right away if you have one, as it could be a medical emergency.

What does Acute Onset of Pre-Existing Conditions mean? Read this article for a detailed explanation of the acute onset of a pre-existing condition.

Is the acute onset of pre-existing conditions covered by INF insurance plans?

Acute onset of pre-existing conditions coverage is provided by both the INF insurance and travel medical plans.

The coverage of acute onset of pre-existing conditions under INF plans would depend on the specific policy and the terms and conditions outlined in the policy.

In general, many travel medical insurance policies, including those offered by INF, may provide coverage for an acute onset of a pre-existing condition. However, there may be certain limitations and exclusions based on the policy’s terms and conditions.

It’s important to carefully review the policy documentation and speak with a representative from INF or your insurance provider to understand the coverage provided for the acute onset of pre-existing conditions. This can help you determine whether your policy provides the coverage you need for your particular medical condition and any potential medical emergencies that may arise during your travels.

Is Covid 19 covered by INF Premier Plan Insurance?

Premier Plan Insurance’s INF Covid19 travel insurance for coronavirus coverage will pay for any necessary medical costs associated with COVID-19/SARS-CoV-2. Medically necessary costs that are not covered by another plan exclusion are considered eligible medical expenses.

Conclusion

Overall, the decision between INF Premier Plus and INF Elite Plus will be influenced by a variety of factors, such as the level of coverage required, budget, and lifestyle.

While INF Elite Plus insurance is the more comprehensive and expensive of the two plans, it may be a better option for people who need higher coverage limits or travel internationally frequently. INF Premier Plus, on the other hand, may be a good option for those looking for basic coverage at a lower cost.

Finally, prospective customers should carefully consider their individual requirements and compare the two plans to determine which one is best for them.

Always travel under the cover of insurance!