SafeVista Protect Visitor Insurance

What It Covers, Where It Stops, and Who Should Not Buy It

This guide explains SafeVista Protect visitor medical insurance for non-U.S. residents traveling to the United States.

It focuses on:

- What the plan actually covers

- Where coverage clearly ends

- The situations where this plan works well

- The situations where choosing it would be a mistake

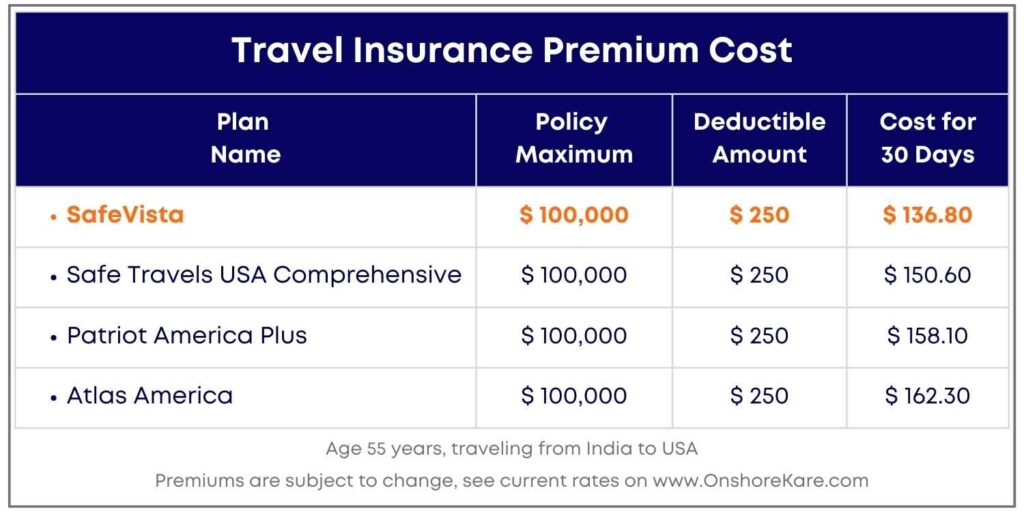

SafeVista Protect is frequently considered by visitors especially parents and long-stay travelers—because it offers strong emergency protection at a controlled premium. But like all visitor insurance plans, it operates under strict rules that are often misunderstood until a claim occurs.

This is not a sales overview.

It is a practical breakdown written to help you decide before purchase whether this plan matches your medical risk, age, and expectations.

If you are looking for:

- Routine doctor visits

- Planned treatment

- Ongoing management of medical conditions

Visitor Medical Insurance in the U.S. Is Not Optional—But Choosing the Wrong Plan Is Worse

Traveling to the United States without medical insurance is not a calculated risk.

It is an unbounded financial exposure.

In the U.S., a single emergency room visit—without admission—can cost more than an international round-trip flight. Add imaging, observation, or specialist consultation, and costs escalate quickly into five figures. For visitors, there is no negotiated safety net, no government subsidy, and no obligation for providers to reduce charges after the fact.

This is why visitor international travel medical insurance is not a “nice to have” for parents, relatives, or long-stay travelers. It is a basic financial safeguard.

However—and this is the part most travelers miss—buying the wrong type of visitor insurance can be almost as damaging as buying none at all.

Most dissatisfaction, claim disputes, and refund requests do not happen because insurers are acting unfairly. They happen because travelers purchase plans that were never designed for their situation and then expect them to behave like U.S. domestic health insurance.

Visitor insurance is not:

- Comprehensive healthcare

- Ongoing medical management

- A substitute for employer or ACA-based plans

- Coverage for predictable or planned treatment

It is emergency-focused, rule-driven coverage designed to limit catastrophic exposure—not eliminate medical costs entirely.

Plans like SafeVista Protect are built with clear boundaries:

- They prioritize sudden, unexpected medical events

- They impose strict definitions around pre-existing conditions

- They shift more responsibility to the insured through deductibles and network rules

None of this is hidden—but most travelers do not read policies with claim outcomes in mind.

The result is predictable:

- Claims denied due to misunderstanding of acute onset rules

- Unexpected out-of-pocket costs from high deductibles

- Shock when routine care is excluded

- Frustration that could have been avoided before purchase

This guide exists to prevent that outcome.

Before discussing what SafeVista Protect includes, it is essential to understand what kind of insurance this is, what problem it is designed to solve, and where its limits are non-negotiable.

If those limits do not align with your medical reality, no amount of premium savings will make this plan the right choice.

Quick Verdict: Should You Even Be Considering SafeVista Protect?

SafeVista Protect is not a general-purpose visitor health plan. It is a risk-limiting emergency medical plan with clearly defined boundaries.

SafeVista Protect can make sense if all of the following are true

- The traveler is a non-U.S. resident visiting the United States

- The primary concern is unexpected emergencies, not routine care

- Any pre-existing conditions are stable, with

- No recent hospitalizations

- No recent symptom flare-ups

- No medication changes before travel

- The traveler is comfortable with

- Deductibles

- PPO network rules

- Defined exclusions

- The goal is strong emergency protection at a controlled premium, not maximum coverage at any cost

In these scenarios, SafeVista Protect can perform exactly as intended.

You should not choose SafeVista Protect if any of the following apply:

- You expect

- Routine doctor visits

- Follow-ups

- Diagnostic testing that is not urgent

- You are traveling specifically to

- Address a known medical issue

- Monitor an existing condition

- Undergo planned or semi-planned treatment

- The traveler has

- Recent hospitalizations

- Actively managed conditions

- Ongoing symptoms, even if “controlled”

- You assume visitor insurance works like

- Employer-sponsored U.S. health insurance

- Medicare

- Comprehensive domestic health plans

In these situations, dissatisfaction is not a possibility—it is likely.

One sentence that matters more than the rest

If you are relying on coverage for predictability rather than unpredictability, SafeVista Protect is the wrong plan.

That is not a criticism of the plan. It is a mismatch of intent.

Why this verdict is intentionally strict

Most visitor insurance disputes happen before the policy ever comes into play—at the moment expectations collide with policy definitions.

This section exists to prevent that collision.

If this verdict disqualifies you, that is not a failure. It is a cost-saving outcome.

Who SafeVista Protect Is Designed For (And Who It Isn’t)

Visitor insurance works best when it is matched to traveler profile, not hope. SafeVista Protect is built for a specific type of visitor and fails predictably outside that scope.

This Plan Is Typically a Good Fit For

SafeVista Protect is generally appropriate for

- Parents or elderly family members visiting children in the United States

Especially when the primary concern is protection against sudden medical emergencies rather than ongoing care. - Visitors staying for weeks or months, not short tourist trips

Longer stays increase exposure to unexpected illness or accidents, which is exactly what this plan is designed to address. - Travelers who want access to U.S. hospitals through a PPO network

Using in-network providers can materially reduce out-of-pocket costs when care is required. - Visitors seeking solid emergency coverage without paying premium-plan prices

This plan balances coverage and cost by shifting responsibility through deductibles and defined limits. - Travelers who understand that visitor insurance is supplemental risk coverage, not comprehensive healthcare

Expectations here matter more than coverage limits.

When purchased by travelers in these categories, SafeVista Protect usually performs as intended.

This Plan Is Usually a Poor Fit For

SafeVista Protect is often the wrong choice for

- Travelers with recent hospitalizations or active treatment histories

Even if a condition feels “under control,” recent medical activity materially increases claim risk. - Visitors expecting routine checkups, follow-ups, or planned procedures

These services are outside the scope of emergency-focused visitor insurance. - Anyone assuming visitor insurance works like U.S. domestic health insurance

It does not. Misunderstanding this is the most common source of frustration. - Travelers with unstable, progressive, or actively monitored medical conditions

Acute onset provisions do not substitute for true pre-existing condition coverage.

Buyers optimizing only for premium price

Low upfront cost often correlates with higher exposure at claim time.

The Pattern Behind Most Complaints

Most negative experiences with visitor insurance do not stem from insurer behavior. They stem from plan–traveler mismatch.

SafeVista Protect does exactly what it is designed to do. Problems arise when it is asked to do what it was never built for.

Understanding this distinction before purchase is the single most effective way to avoid claim disputes later.

What SafeVista Protect Covers—and What It Deliberately Excludes

SafeVista Protect is designed for unexpected medical events. Its coverage is structured around emergencies, not everyday healthcare.

Understanding this distinction before purchase is critical. Most claim disputes begin when travelers assume coverage exists for services that were never intended to be included.

What SafeVista Protect Typically Covers

This plan generally provides coverage for

- Emergency medical treatment due to sudden illness or accidental injury

Including situations that require immediate evaluation, stabilization, or intervention. - Hospitalization and inpatient care

When admission is medically necessary as part of emergency treatment. - Diagnostic services related to emergencies

Such as imaging, lab work, and physician evaluations tied directly to the emergency event. - Access to a U.S. PPO hospital and provider network

Using in-network providers can significantly reduce out-of-pocket expenses when care is required. - Urgent care visits, subject to defined copays

Appropriate for non-life-threatening but urgent medical situations. - Telehealth consultations

For basic medical concerns when an in-person visit is not required or practical.

This coverage structure is typical of emergency-focused visitor medical insurance and is not unique to SafeVista Protect.

What SafeVista Protect Does Not Cover

Equally important are the exclusions. SafeVista Protect does not cover

- Routine or preventive medical checkups

Including wellness visits or non-urgent consultations. - Elective or planned medical treatments

Even if the procedure becomes more urgent after arrival. - Long-term, ongoing, or predictable medical care

Including chronic condition management. - Services not directly tied to a covered emergency

Follow-up care may be limited or excluded once the emergency phase ends.

These exclusions are intentional. They allow the plan to remain affordable while focusing resources on high-cost, unpredictable events.

The Mistake That Leads to Most Frustration

Buying emergency insurance while expecting everyday healthcare is the fastest way to be disappointed.

SafeVista Protect is not incomplete—it is purpose-built. The problem arises when travelers try to use it outside its intended scope.

If your travel plans include predictable medical needs, this plan is not a workaround. You need a different type of coverage.

Acute Onset Coverage: The Single Biggest Source of Claim Denials

SafeVista Protect does not cover pre-existing conditions in the way many travelers assume.

Instead, it offers limited coverage for acute onset of pre-existing conditions—and only when very specific criteria are met.

Most denied claims under visitor insurance do not fail because coverage is missing.

They fail because the medical episode does not meet the insurer’s definition of acute onset.

If you misunderstand this section, nothing else in the policy will save you.

What “Acute Onset” Actually Means

For an episode to qualify as acute onset, it must be

- Sudden

- Unexpected

- Severe enough to require immediate medical attention

- Not part of a known progression of an existing condition

This is a narrow exception, not a broad safety net.

What Must Be True for a Claim to Qualify

To even be considered for coverage under acute onset provisions:

- Symptoms must appear suddenly

- There must be no warning signs before travel

- There must be no prior treatment or evaluation for the same symptoms

- Immediate medical treatment must be medically necessary

Insurers verify this by reviewing:

- Medical records

- Prescription history

- Prior consultations

- Symptom timelines

Severity alone does not determine eligibility.

What Almost Never Qualifies

The following scenarios are commonly assumed to be covered—but usually are not

- Symptoms that existed before travel, even if mild

- Gradual worsening of a known condition

- Ongoing or chronic condition management

- Preventive or precautionary visits

- Planned or semi-planned treatment

If an episode can be linked to prior symptoms, monitoring, or progression, it is typically excluded—regardless of how serious it becomes.

Why This Is Where Most Claims Fail

Travelers often believe:

“If it’s an emergency, it must be covered.” That assumption is wrong.

Acute onset coverage depends on timing, history, and medical documentation, not just urgency or hospital admission.

Many denied claims involve real emergencies. They are denied because the event does not meet the policy definition.

The Non-Negotiable Reality

Acute onset coverage is not a substitute for true pre-existing condition coverage.

If a traveler has

- Recent symptoms

- Medication changes

- Ongoing monitoring

- Prior evaluations related to the condition

Then relying on acute onset provisions is a gamble, not a strategy.

Understanding this before purchase prevents the most expensive surprises later.

Policy Limits, Deductibles, and the Trade-Off Most Travelers Misjudge

SafeVista Protect does not succeed or fail on coverage language alone. Its real-world usefulness depends on how you select policy limits, deductibles, and network usage.

Most travelers spend more time comparing premiums than understanding exposure. That is backwards.

Key Coverage Elements and How They Work

| Feature | How It Works |

| Policy Maximum | Typically ranges from $50,000 to $1,000,000, depending on age and selection |

| Deductible | Multiple options available; higher deductibles reduce premiums |

| In-Network Co-Insurance | Lower out-of-pocket costs when PPO providers are used |

| Out-of-Network Co-Insurance | Higher costs based on usual and customary charges |

| Urgent Care Copay | Fixed copay when using in-network urgent care facilities |

| Age-Based Limits | Maximum coverage options decrease at higher ages |

None of these elements are unusual. What matters is how they interact during a claim.

The Common Mistake That Costs the Most

Many travelers choose high deductibles to reduce premiums, assuming they will only face catastrophic emergencies.

Then a moderate emergency occurs:

- ER visit

- Imaging

- Observation stay

- No admission

The total bill falls below the deductible, and the insurer pays nothing.

Lower premiums feel good at purchase time.

Lower deductibles feel good at claim time.

Policy Maximums: The Ceiling Is Not the Cost

Another misunderstanding:

“If I choose $100,000 coverage, that’s what I’ll pay.”

Incorrect.

The policy maximum is the insurer’s maximum payout, not your total financial exposure.

You are responsible for:

- Deductibles

- Co-insurance

- Non-covered services

- Charges above usual and customary rates (especially out-of-network)

A low maximum combined with high out-of-pocket costs can still leave significant unpaid balances.

How to Choose Rationally

You should select deductibles and limits based on:

- Age

- Length of stay

- Medical history

- Ability to absorb unexpected expenses

Choosing purely on price is not cost control—it is risk transfer back to yourself.

SafeVista Protect gives flexibility. It does not remove the need to think.

PPO Networks: How Costs Change Based on Where You Receive Care

SafeVista Protect provides access to a PPO (Preferred Provider Organization) network.

This matters more than most travelers realize.

Using in-network providers is not a technical detail—it directly determines how much of the bill you are responsible for.

How PPO Networks Actually Work

When you receive care within the PPO network:

- Providers have pre-negotiated rates with the insurer

- Charges are discounted before co-insurance is applied

- Your out-of-pocket responsibility is generally lower

When you receive care outside the network:

- No negotiated discounts apply

- Reimbursement is based on usual and customary charges

- You may be billed for the difference between:

- What the provider charges, and

- What the insurer considers reasonable

This difference is known as balance billing, and it is entirely your responsibility.

Why This Matters During Emergencies

In a true emergency, choice is limited. You go to the nearest appropriate facility.

However, follow-up care, diagnostics, and specialist visits often occur after stabilization, when network decisions become possible.

This is where many travelers unintentionally move out-of-network and increase costs—sometimes dramatically.

What Travelers Commonly Get Wrong

- Assuming all hospitals are treated the same

- Assuming emergency status guarantees in-network pricing

- Ignoring network status once the immediate crisis passes

None of these assumptions are safe.

Understanding how PPO networks work before travel is one of the simplest ways to reduce out-of-pocket expenses under SafeVista Protect.

The Practical Takeaway

SafeVista Protect’s network access is a real advantage—but only if it is used correctly.

Network awareness is not optional.

It is part of the cost-sharing design of the plan.

Additional Benefits (Useful, but Not Why You Buy This Plan)

SafeVista Protect includes several secondary benefits that support emergency situations.

They add value, but they should never be the primary reason you choose this plan.

These benefits are capped separately, subject to conditions, and triggered only in specific scenarios.

Included Secondary Benefits

SafeVista Protect typically provides:

- Emergency medical evacuation

Coverage for transport to the nearest appropriate medical facility when local care is insufficient. - Repatriation of mortal remains

Coverage for return of remains to the home country in the event of death. - Trip interruption benefits, under specific conditions

Limited coverage if travel is interrupted due to a covered medical emergency. - Accidental death and dismemberment (AD&D)

Fixed benefits for qualifying accidental events.

These benefits are standard across many visitor insurance plans and are designed to address extreme situations—not routine disruptions.

Why These Should Not Drive Your Decision

Secondary benefits

- Do not apply in most claims

- Have strict triggers and caps

- Do not compensate for gaps in medical coverage

- Do not override exclusions or acute onset rules

Choosing a plan because of evacuation or AD&D benefits while ignoring deductible structure, network rules, or pre-existing condition limitations is a common—and expensive—mistake.

How to Think About These Benefits Correctly

Treat these benefits as

- Backup protection, not core coverage

- Useful when needed, irrelevant otherwise

- A complement to emergency medical insurance, not a replacement

If these benefits are your primary concern, SafeVista Protect is not being evaluated for the right reason.

Bottom Line: When SafeVista Protect Makes Sense—and When It Doesn’t

SafeVista Protect is a purpose-built visitor medical insurance plan.

It does exactly what it is designed to do—and it predictably fails when used outside that design.

SafeVista Protect makes sense when

- The traveler is a non-U.S. resident visiting the United States

- The primary risk is unexpected medical emergencies

- Pre-existing conditions, if any, are stable with no recent activity

- The traveler understands and accepts

- Deductibles

- Co-insurance

- PPO network rules

- The goal is to limit catastrophic financial exposure, not eliminate medical costs entirely

In these situations, the plan can be effective and cost-efficient.

SafeVista Protect does not make sense when

- Medical needs are predictable rather than unpredictable

- The trip involves:

- Planned evaluations

- Monitoring of known conditions

- Routine or follow-up care

- The traveler expects:

- Broad pre-existing condition coverage

- Low out-of-pocket costs for moderate claims

- The purchase decision is driven primarily by premium price

In these cases, dissatisfaction is not a risk—it is an outcome.

The Reality Most Buyers Ignore

Visitor insurance is not about maximizing coverage on paper.

It is about matching risk to rules.

SafeVista Protect trades flexibility for affordability.

That trade-off is acceptable only when the traveler’s medical profile aligns with it.

If it doesn’t, no amount of coverage explanation will change the result at claim time.

Before You Choose This Plan: Answer These Honestly

Before purchasing SafeVista Protect, stop and answer the following questions without rationalizing.

If you hesitate on more than one, this plan is likely not the right fit

For further assistance, please contact our customer service team at +1 855 652 5565.

Quick Risk Self-Check

1. Has the traveler had any hospitalizations, ER visits, or specialist consultations in the last 6–12 months?

If yes, relying on acute onset coverage is risky.

You can calculate your risk before travelling abroad.

2. Have there been any recent symptom flare-ups, medication changes, or dosage adjustments?

If yes, an emergency related to that condition may be excluded.

3. Will the traveler need routine doctor visits, follow-ups, or monitoring during the stay?

If yes, this plan will not cover those costs.

4. Would a $5,000–$10,000 out-of-pocket expense cause financial stress?

If yes, choosing a high deductible to save premium may backfire.

5. Are you assuming emergency admission guarantees coverage regardless of medical history?

If yes, that assumption is incorrect.

How to Use This Checklist

- 0–1 risk flags:

SafeVista Protect may be a reasonable option. - 2 or more risk flags:

You should evaluate plans with broader pre-existing condition coverage instead of relying on acute onset provisions.

This is not about being cautious.

It is about aligning insurance design with medical reality.

The Cost of Ignoring This Step

Skipping this self-check does not save time.

It transfers risk to the moment you can least afford it—during a medical emergency.

A five-minute review before purchase can prevent:

- Claim denials

- Unexpected bills

- Weeks of appeals and stress

That trade-off is worth making.

FAQs (Answered Without Reassurance or Sales Language)

How do insurers decide whether an episode qualifies as acute onset?

Insurers review medical records, prescription history, prior consultations, symptom timelines, and any evidence of progression. An emergency requiring hospitalization can still be denied if symptoms or treatment existed before travel.

Can a claim be denied even if hospitalization was required?

Yes. Hospital admission alone does not establish eligibility. Coverage depends on whether the episode meets the policy’s definition of acute onset and whether exclusions apply.

Does out-of-network care affect eligibility or only cost?

Eligibility generally remains the same, but reimbursement is based on usual and customary charges. This often results in significantly higher out-of-pocket costs due to balance billing.

How does deductible choice affect claim outcomes?

Higher deductibles lower premiums but increase the likelihood that moderate claims are paid mostly or entirely out of pocket. Deductible choice directly affects whether the insurer pays anything at all.

Is SafeVista Protect suitable for travelers with stable pre-existing conditions?

Possibly—but only if there have been no recent symptoms, medication changes, evaluations, or treatment. Acute onset coverage is conditional and does not replace full pre-existing condition coverage.

Does this plan cover follow-up visits after an emergency?

Follow-up care may be limited or excluded once the emergency phase ends, depending on medical necessity and policy terms. Visitor insurance is not designed for extended care sequences.

Mismatch between traveler expectations and policy definitions—particularly around acute onset of pre-existing conditions and deductible exposure.