Edit Content

About Us

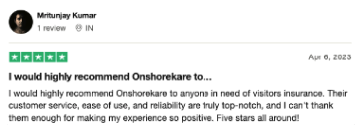

Get Magik Insurance Services Inc. – OnshoreKare.com

License# 0M14328

Contact info

- 35463 Dumbarton Ct, Newark, CA 94560, United States

- +1-855-OK-ALL-OK / +1-855-652-5565

- info@onshorekare.com

Edit Content

About Us

Get Magik Insurance Services Inc. – OnshoreKare.com

License# 0M14328

Contact info

- 35463 Dumbarton Ct, Newark, CA 94560, United States

- +1-855-OK-ALL-OK / +1-855-652-5565

- info@onshorekare.com