Traveling from China to the USA? Get Covid Insurance

With the increase in Covid-19 cases recently in China, it is highly recommended for Chinese citizens consider adequate travel medical insurance which provides Covid 19 coverage if they are traveling to the USA.

Each year, thousands of Chinese citizens leave China for the United States to work, explore, study, or visit relatives.

In this article, let us find out some of the top travel medical insurance plans that provide Covid 19 coverage and how to get the best plan for Chinese citizens traveling to the USA.

Travel Health Insurance For Chinese Visitors To USA

As you must be aware of the high medical costs in the United States, but that shouldn’t stop you from being there and making your dream come true.

There are many reputed travel insurance companies that provide plans at affordable price. These plans cover fixed amounts of medical expenses, emergency medical evacuation, and even pre-existing conditions for Chinese citizens who are traveling to the USA for any purpose.

There are two types of travel medical insurance plans: Fixed benefit or Comprehensive plans.

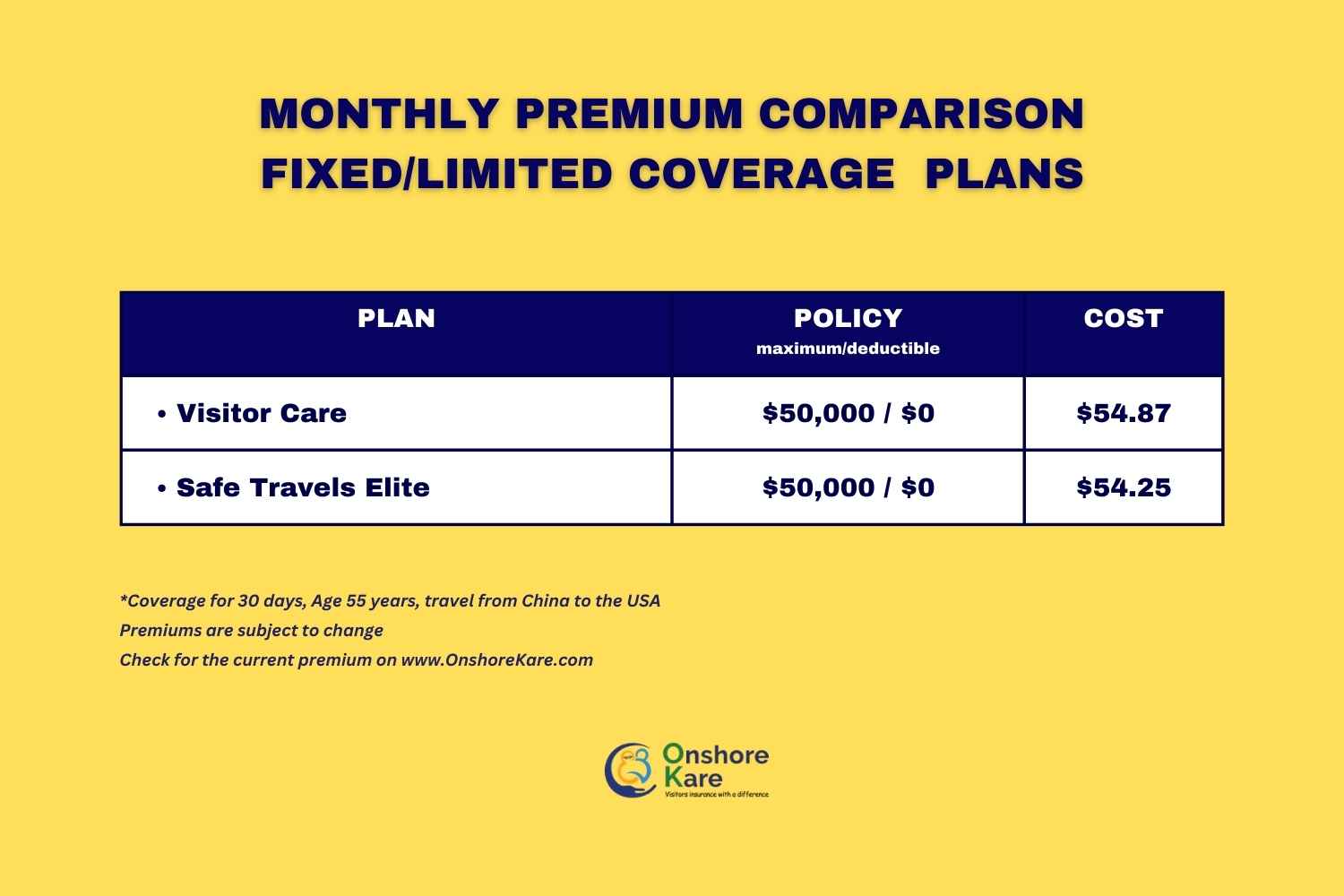

Popular limited-benefit plans for Chinese visitors to the USA at affordable price

Visitor Care Insurance plans

- Administrator: IMG Global

- Coverage Type: Limited Coverage

- Medical benefits Options: Upto $100,000

Benefits of Visitor Care Insurance plan

- Limited Coverage Plan for non-US citizens

- Coverage is available from 5 days to 365 days, renewable upto 24 months

- Coverage for acute onset of pre-existing conditions up to $100,000

- Policy maximum up to $100,000

- Deductible per incident options available $0, $50 & $100

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid-19

Safe Travels Elite Insurance plans

- Administrator : Trawick International

- Coverage Type: Limited Coverage

- Medical benefits Options: Upto $100,000

Benefits of Safe Travels Elite Insurance plan

- Limited Coverage Plan for non-US citizens

- Coverage is available from 5 days to 365 days, renewable upto 24 months

- Coverage for acute onset of pre-existing conditions up to $100,000

- Policy maximum up to $170,000

- Deductible per incident options available $0, $50 & $100, $200

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid-1

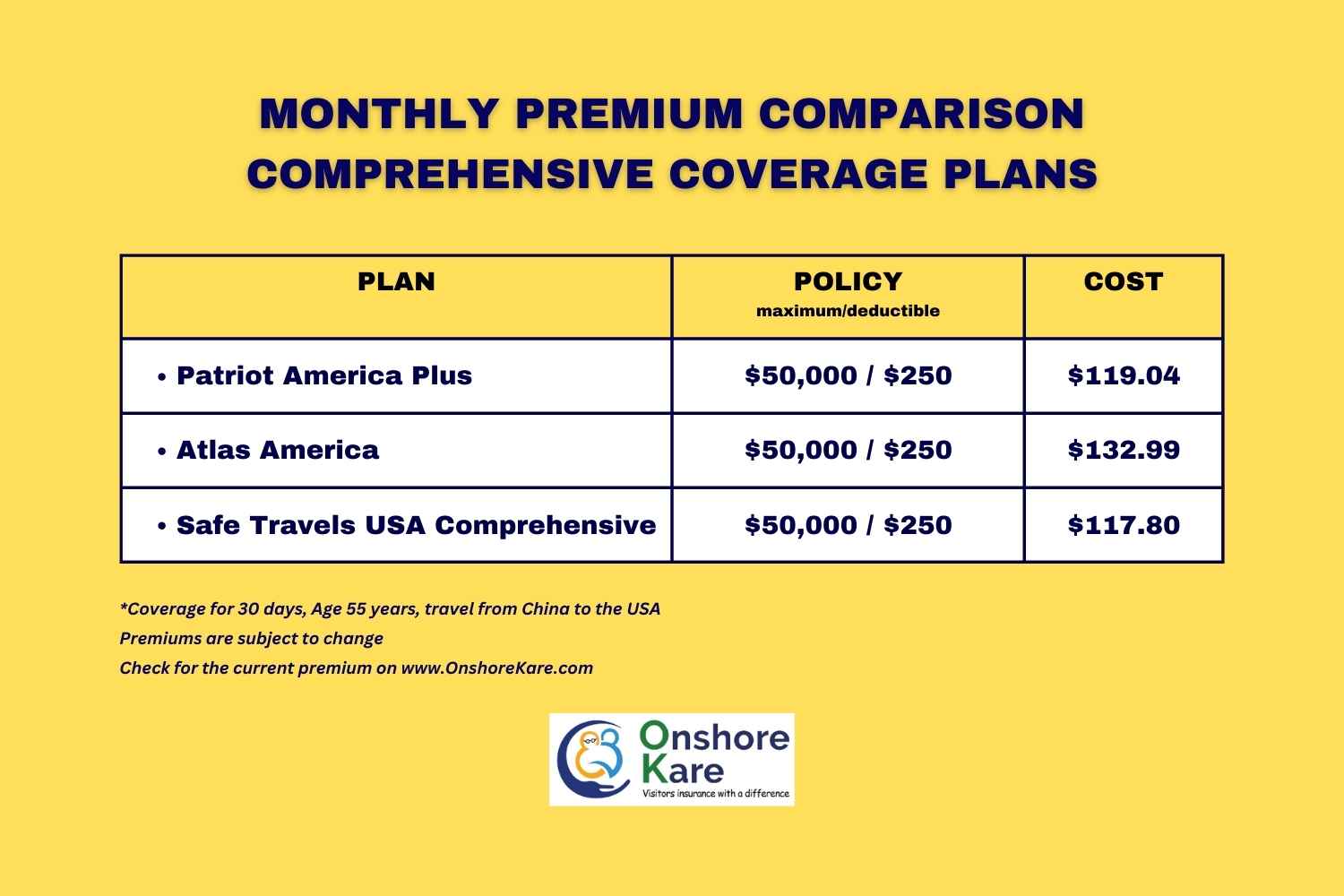

How much do the plans cost?

What is the best Travel Health Insurance for Chinese Visitors to the USA?

Here are some of the best travel insurance plans which provide comprehensive coverage including Covid 19 coverage for Chinese travelers to the USA :

Patriot America Plus

- Administrator: IMG Global

- Coverage Type: Comprehensive plan

- Medical benefits Options: Upto $1,000,000

- Covid 19: Covered like any other sickness

Benefits of Patriot America Plus Travel Insurance Plan

- Comprehensive Coverage Plan

- Coverage is available from 5 days to 365 days, renewable upto 24 months

- Coverage for acute onset of pre-existing conditions up to $1,000,000

- Policy maximum up to $1,000,000

- Deductible per incident options available $0, $100, $250, $1000, or $2500

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid-19

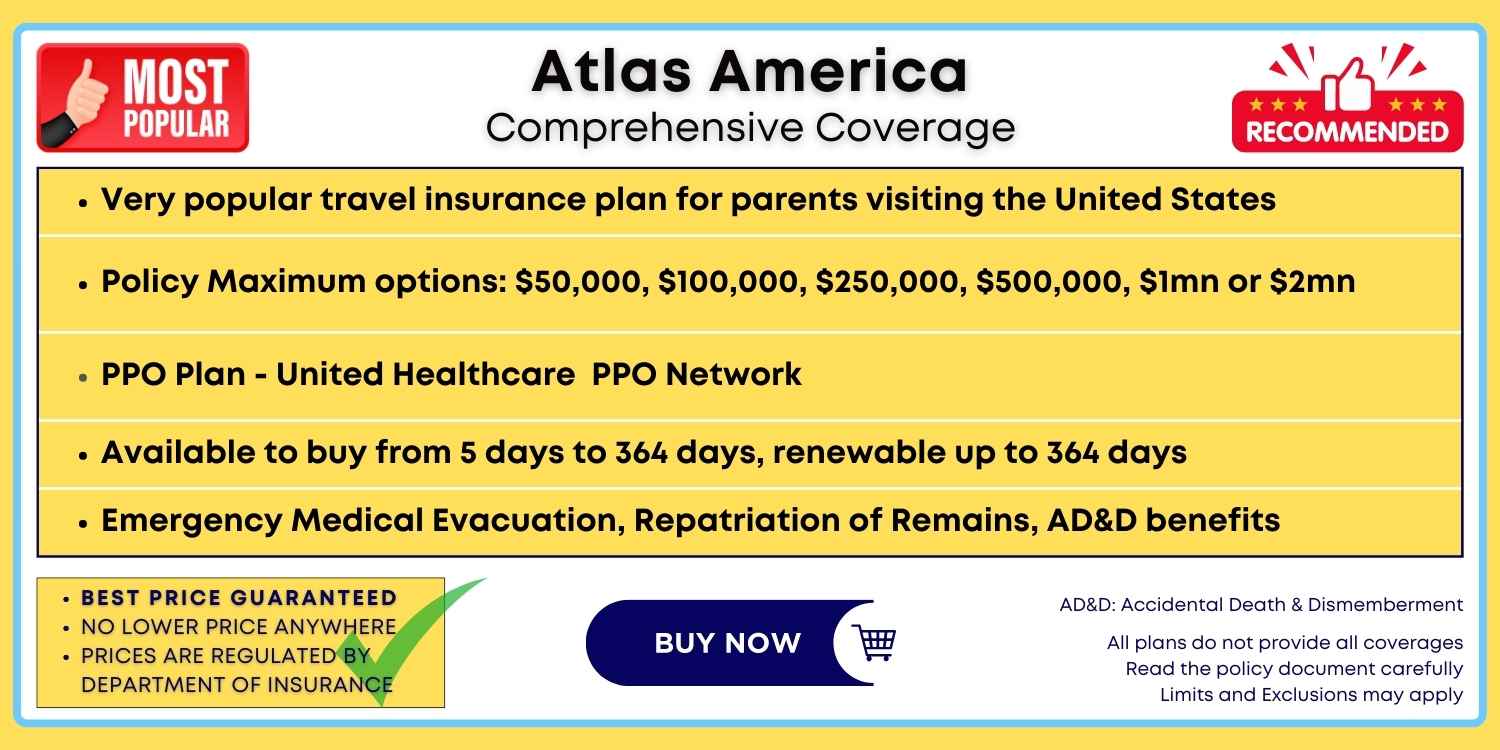

Atlas America Travel Insurance Plan

- Administrator: WorldTrips

- Coverage Type: Comprehensive plan

- Medical benefits Options: Upto $1,000,000

- Covid 19: Covered like any other sickness

Benefits of Atlas America Travel Insurance Plan

- Comprehensive Coverage Plan

- Coverage is available from 5 days to 365 days, renewable upto 12 months

- Coverage for acute onset of pre-existing conditions up to $1,000,000

- Policy maximum up to $1,000,000

- Deductible per incident options available $0, $100, $250, $500, $1000, $2500, $5000

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid-19

Safe Travels USA Comprehensive Travel Insurance

- Administrator : Trawick International

- Coverage Type: Comprehensive plan

- Medical benefits Options: Upto $1,000,000

- Covid 19: Covered like any other sickness

Benefits of Safe Travels USA Comprehensive Travel Insurance Plan

- Comprehensive Coverage Plan

- Coverage is available from 5 days to 365 days, renewable upto 12 months

- Coverage for acute onset of pre-existing condition up to $1,000,000

- Policy maximum up to $1,000,000

- Deductible per incident options available $0, $100, $250, $1000, $2500, $5000

- Coverage for Hospitalization, ER, Urgent Care, Dr. Office Visits, Prescription Drugs, Covid-19

How much do the Travel Insurance Plans cost?

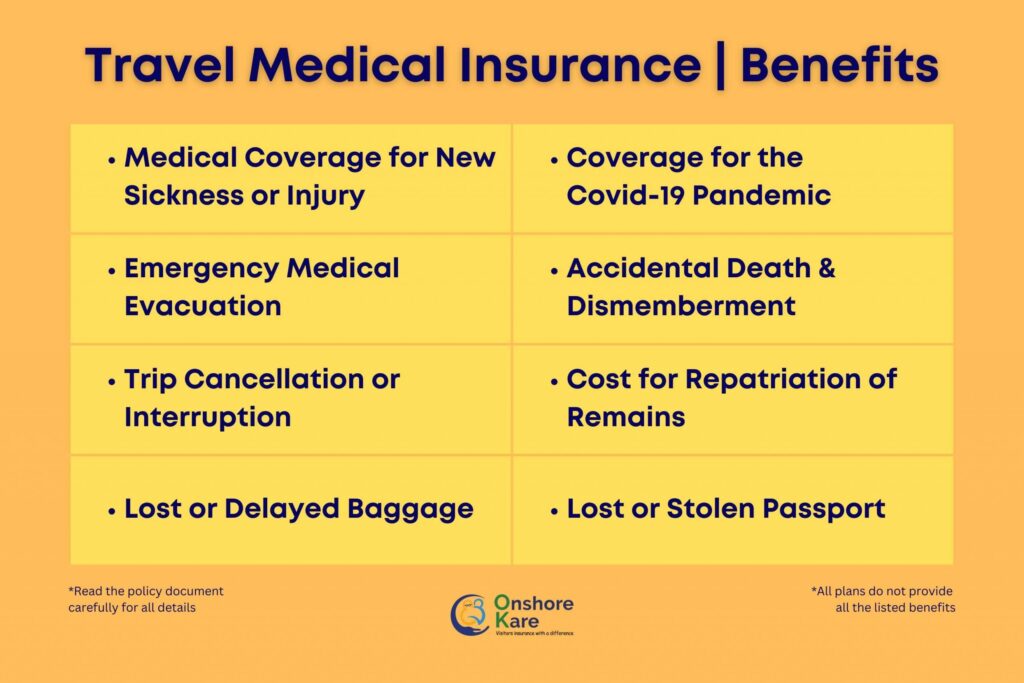

What Are The Benefits of Travel Insurance from China to the USA?

Extensive Medical Coverage:

Travel insurance pays for essentially all medical expenses, including hospital stays, doctor visits, and the acute onset of non-chronic pre-existing conditions coverage.

Secures the Whole Family:

If you’re thinking about taking your family to the United States, don’t be concerned. Fill out the form collectively as a family to receive coverage for every member.

Coverage for COVID-19:

Knowing that an insurance plan will also cover COVID-19 costs is very reassuring during this period of the COVID pandemic.

Baggage Loss:

There is a 70% probability of losing luggage when traveling. Some travel insurance policies also include coverage for lost luggage.

Multiple Plans:

There are a variety of fixed benefits and comprehensive travel insurance options available for Chinese visitors to the USA.

What are the affordable travel insurance plans for visiting the USA with COVID-19 coverage?

Travel Insurance from Trawick International

With their Safe Travels USA Insurance, Trawick International provides visitor medical insurance with covid coverage. Even travelers over 70 years old with pre-existing medical issues can benefit from the Safe Travels USA Comprehensive package. To get Safe Travels USA Covid19 travel insurance policies and receive coverage as soon as the following day, compare your options online from a reputable online marketplace like OnshoreKare. After purchasing Trawick travel insurance, customers can download a letter confirming that Covid19 sickness is covered by Safe Travels USA visitors insurance.

Read a complete review of Trawick International travel health insurance.

Visitors’ Medical Insurance from Seven Corners

For tourists to the USA, Travel Medical Plus Insurance provides the best health insurance. The COVID-19 disease, SARS-Cov-2 virus, and any mutation or variant of SARS-CoV-2 are covered under the Seven corners visitor health insurance treatment benefit.

Read a complete review of Seven Corners travel health insurance.

Covid 19 insurance from International Medical Group (IMG)

The travel insurance from International Medical Group (IMG) includes coronavirus coverage for the USA. Like any other sickness, COVID-19 is covered by the Patriot America Plus and Patriot Platinum insurance plans from IMG. Up to the policy’s maximum, COVID is covered by the Patriot America Plus Insurance and Patriot America Platinum Insurance.

Read a complete review of IMG travel health insurance.

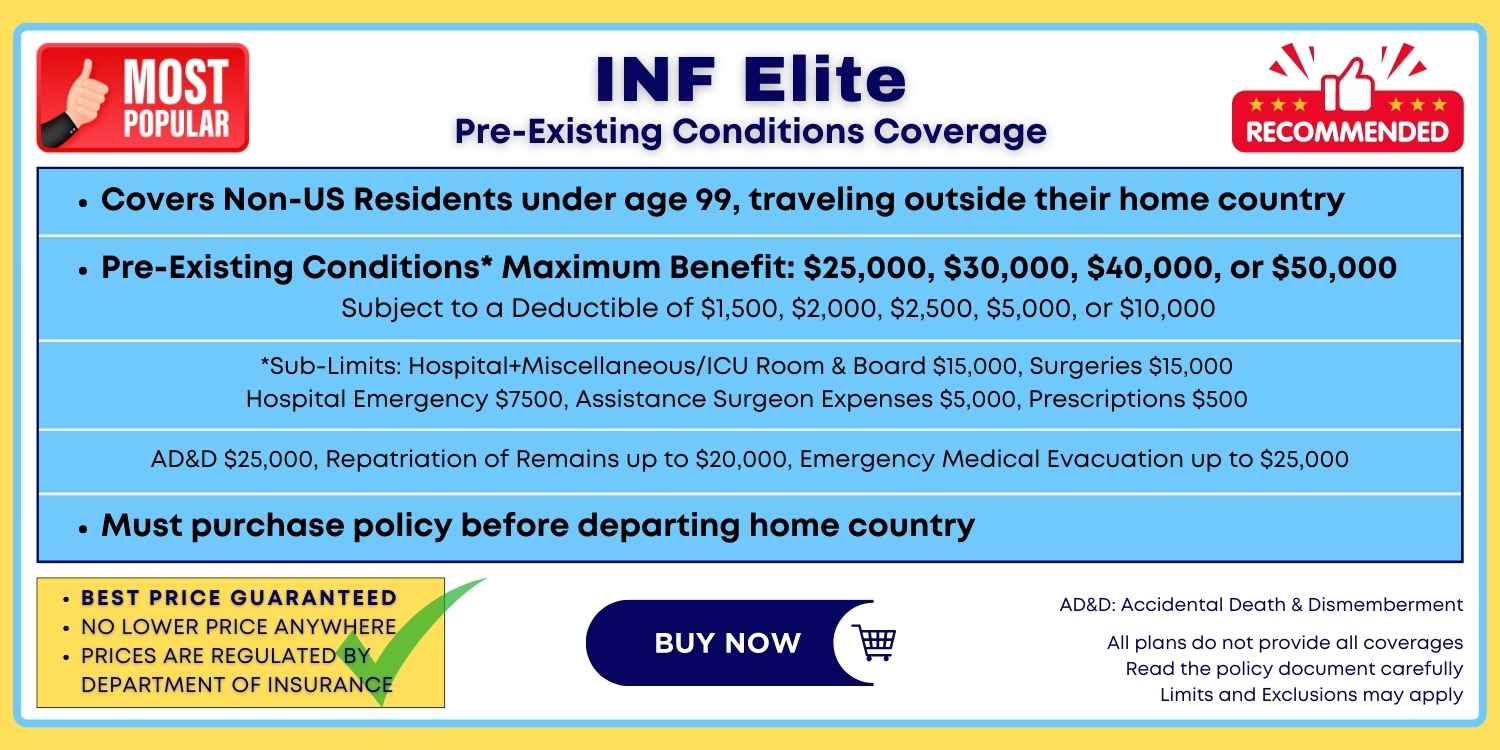

INF Insurance plan

Coronavirus is covered by INF travel insurance and they also offer coverage for any other newly discovered illness. Their plans are available to visitors who are not US citizens or residents. So if you are a Chinese citizen traveling from mainland China or any other region to the USA you should consider their plans. If you have a family member accompanying you then buy travel health insurance for all.

The pre-existing COVID-19 issues are covered by the INF Premier and INF Elite plans.

- INF Elite

- INF Premier

Read a Complete Review of INF Travel Insurance.

How To Choose The Best Visitor Medical Insurance for Chinese Visitors to the USA?

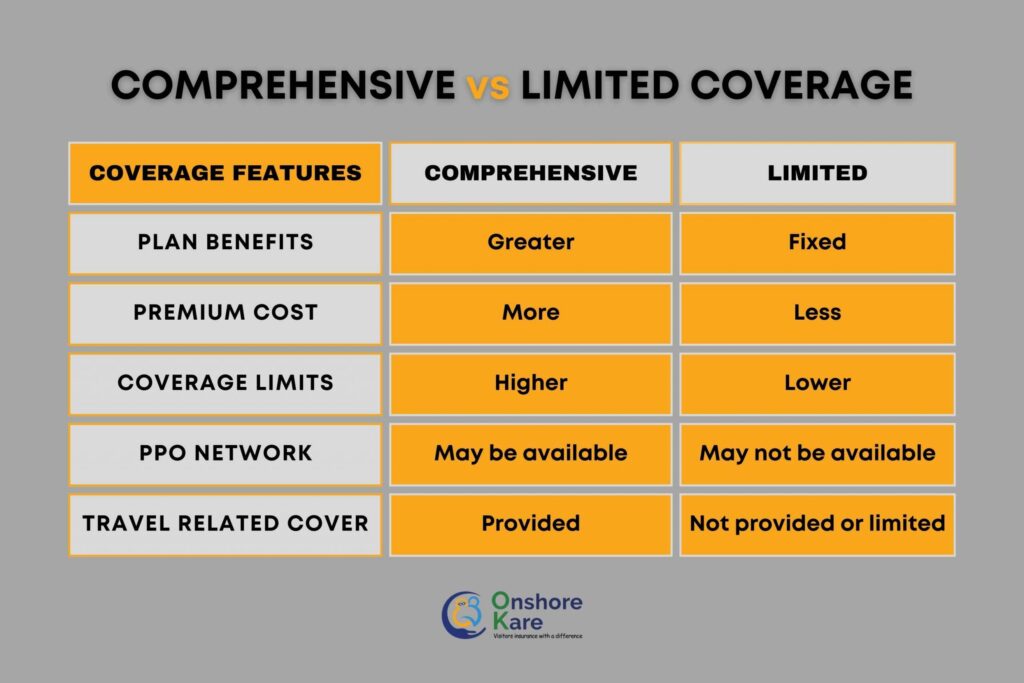

There are a few considerations you should make while signing up for travel health insurance for the USA. The first decision is whether you want to enroll in a fixed-benefit or comprehensive plan.

Difference between Fixed Benefits and Comprehensive Travel Insurance Plans

Plans with fixed benefits are more economical but only provide the fundamentals. Although comprehensive plans are more expensive, you will receive a greater range of coverage. Regardless of the sort of plan you select, travel insurance is absolutely necessary to guarantee your entire financial security and safety.

Examine each plan’s coverage as well. There is a good risk you will fall ill or require medical attention if you intend to stay in the United States for an extended period of time. When that happens, travel insurance for Chinese visitors will save the day.

For Chinese citizens traveling to the USA, we advise you to choose travel insurance with comprehensive coverage plans because they provide better and more advantageous coverage advantages.

The advantages of comprehensive coverage medical plans outweigh the costs even if they are more expensive than fixed coverage policies.

Comprehensive coverage plans have larger policy maximum limits in addition to a number of other benefits. Reduced out-of-pocket costs, PPO network access, and more.

We have covered a detailed explanation of the differences between Comprehensive Coverage, and Fixed/Limited Coverage benefits plans.

Why is it important to consider Travel Insurance with Covid Coverage?

Beyond anyone’s control, the COVID pandemic has hampered worldwide travel. This has emphasized how crucial it is to have the best travel insurance, which may assist in covering the cost of travel delays as well as any unforeseen medical bills incurred by the traveler during international travel.

In the event of a medical emergency or accident, most travelers’ travel medical insurance policies can shield them from financial hardship. If a traveler tests positive for Covid19, certain travel insurance plans also cover quarantine costs. In fact, some nations need Covid quarantine travel insurance when issuing trip permits. Financial protection for travel-related costs like trip cancellation, trip delay, baggage loss, and medical evacuation is provided through travel insurance with a focus on trip expenses.

Some travel insurance policies offer the “Cancel for Any Reason” (CFAR) option, which entitles the holder to a reimbursement of up to 75% of the trip’s costs. Without travel insurance, the traveler will be stranded and liable for all associated charges if they have to cancel their trip due to a medical emergency. If tourists are faced with unforeseen problems while traveling, having dependable travel insurance will ensure that they may recover some of the trip costs.

Additional Tips For Travel Medical Insurance Plans for Chinese Visitors To the USA

If you intend to go from China to the USA, you should be aware of the need of purchasing sufficient visitor medical insurance. Even while you may attempt to utilize your regular medical insurance or buy travel insurance in China from a business in your home country, U.S. health providers frequently decline foreign coverage, so you would have to pay out of cash.

The expense of healthcare in the US can be very high when compared to China. A single night in the hospital can cost you several thousand dollars.

Accidents and illnesses can occur at any time and anywhere. Visitor medical insurance coverage can protect you in the case of an illness or injury while you are visiting the US. Determine the best travel insurance for Chinese tourists to the USA based on your age, health, and preferred coverage.

Frequently Asked Questions

Can Chinese visitors obtain health insurance in the US?

Visitors to the US may have travel or short-term plans. As a citizen of China, you are eligible to apply for either limited or comprehensive plans. If you are a dual citizen of the US and China, and China is your home country or primary residence, you can get US travel insurance for your short-term stay in the US by selecting China as your home country or primary residence and the US as your citizenship.

Which travel insurance is most suitable for Chinese visitors?

There are numerous plans that can cover you for anything from 5 days to 364 days or longer. These include Comprehensive and Limited benefit plans. While comprehensive policies rarely have these sub-limitations, limited benefit plans offer coverage with pre-established limits. The ‘Safe Travels USA Comprehensive’ is a plan that offers some coverage for the acute onset of a pre-existing condition if you’re seeking a plan that offers visitor medical coverage for a pre-existing disease.

Regardless of your citizenship, Patriot America Plus can offer coverage outside of the country of your residence. Therefore, you may want to think about Patriot America Plus for coverage for your trip to the US if you have dual citizenship between the US and China and your primary residence is in China.

Does a travel insurance policy provide Trip Protection Coverage for Covid19 Expenses?

The travel insurance plans do provide trip protection features for covid19 expenses that you would need to add when buying the policy. This insurance will pay for any costs incurred as a result of a trip delay caused by Covid19. For additional information about this policy, you should get in touch with the insurance company.

Why is the important for Chinese visitors to purchase travel insurance while traveling?

Healthcare in China is a mix of public and private services. Nearly 95% of the population has some form of basic public health coverage. However, only a portion of the cost associated with personal medical treatment is covered by the public plan. Therefore it is important to buy travel health insurance to protect yourself or your family members or senior travelers from unforeseen circumstances.

Does travel insurance from China cover the Covid19 illness?

For travel to China, there are a few USA Covid travel insurance plans that include Covid19 as a new sickness.

International travelers can shop online and compare the finest Covid travel insurance options. These US Covid travel insurance policies are accessible to Chinese tourists visiting the US, as well as to US nationals and residents going overseas and non-US people visiting other countries.

In the event that I come into contact with someone who is Covid positive, is there a plan that offers lodging or benefits for quarantine?

One of the plans that offer $2000 in quarantine benefits is the Safe Travels Explorer plan due to Covid. There are additional plans, such as Safe Travels Explorer Plus and Safe Travels Voyager, that offer this benefit. These all offer lodging perks of up to $2000.

Do I require travel insurance to cover the Covid19-related quarantine?

It is wise to have travel insurance that includes Quarantine coverage because many countries now require Covid19 testing before entry. If you test positive for Covid19 and must spend 14 days in quarantine, you must have this quarantine benefit. The many Covid19 travel insurance policies with the Quarantine benefit can be viewed by travelers. Both US citizens and non-US citizens who are traveling abroad have access to travel insurance choices.

What am I protected for if I have a travel medical insurance policy with Covid19 coverage?

The costs of the quarantined room/hotel room, expenses related to the treatment, and if one is staying in a hotel room for quarantine, proof of the unavailability of hospital beds must be shown if you have a travel health insurance plan with Covid19 coverage, if you have contracted Covid19, and if you are getting treatment from a qualified physician. Please see the policy documents for additional information.

How can I submit a claim for China travel insurance?

You can file a claim for your China travel insurance by emailing the insurance provider the completed claim form and a scanned copy of your medical bill and any supporting receipts. After receiving the bill, the insurance company reimburses the customer for the expenses.

The doctor’s provider can send the insurance company a direct bill, and they can pay the doctor directly if the hospital provider and the insurance company agree to direct billing.

Do I need to purchase travel insurance for china if I’m planning to visit China?

Travel Insurance for China visits is not mandatory. Authorities and immigration officers do not ask for a travel insurance plan when you enter China. But if you plan on visiting China you should consider the benefits of travel health insurance.

If you are visiting China from a foreign country you are exposed to the high volume of covid-19 cases being reported from major cities by the Chinese government. Local authorities are seeing a huge number of cases and are overloaded with patients. Any treatment needed by foreign visitors could quickly become expensive. Travel Insurance for a china trip will come in handy in such a scenario.

Plans for travel-related medical insurance provide coverage for unexpected medical expenses for medical treatment, and medical emergencies as well as additional benefits like a trip interruption, trip cancellation insurance, and emergency evacuation.

Should I buy Travel health insurance for the china trip before or after I reach there?

If you plan to visit China we recommend getting travel insurance for china and doing so before you enter China.

The same advantages are also included in your trip cancellation insurance option, which also pays for other travel-related costs and your journey to China.

When is the best time if I want to travel to China?

We recommend seeing northern China during September and October and Southern China and Hong Kong in November and December. China’s climate is one of the extremes: hot summers in most parts of the country, bitter winters in the north, and comfortable winters in the south.

If you want to travel to all major cities in China, please keep your wits about you. Pickpockets love large crowds and distracted foreigners.

Bottom Line

We hope this article has helped you understand the international benefits and the importance of travel medical insurance with covid coverage to Chinese citizens traveling to the USA.

Make sure you go through the policy’s terms and conditions before purchasing any of the plans. If you need any help with questions related to the plan do not hesitate to contact our customer service team.

Travel safe!