United Healthcare Visitor Insurance Plans For USA

United Healthcare visitor insurance plans offer access to the United Healthcare PPO Network in the USA.

Over 90% of international travelers to the United States don’t have enough travel health insurance for emergencies. Having the right travel health insurance plan can change everything. Travel insurance gives you peace of mind when enjoying your trip.

When selecting a visitors’ insurance plan for the USA, choosing one that offers access to a PPO Network is beneficial.

Travel health Plans within a PPO network can provide easier access to a wide range of healthcare providers, potentially lowering out-of-pocket costs.

Don’t let unforeseen medical emergencies or unanticipated trip cancellation surprises spoil your trip to the United States.

What Is United Healthcare Visitor Insurance?

- United Healthcare Visitors Insurance is a type of travel health insurance

- These travel health insurance plans are designed for visitors to the United States

- These are travel medical insurance plans offered by reputed insurance providers

- These travel insurance plans provide coverage for unexpected medical expenses

- United Healthcare services include medical emergencies

- These travel insurance plans also provide coverage for non-medical expenses like unanticipated trip cancellations, trip interruptions, and other travel-related risks

- Travel insurance plans are available for individuals, families, and groups

Key Features Of United Healthcare Visitors Insurance:

UHC Visitor Insurance plans are available for USA visitors.

Their SafeTrip travel insurance plans come in the following options:

- SafeTrip Travel Medical Plus

- SafeTrip Travel Medical

- SafeTrip Travel protection plans

The Benefits Offered By SafeTrip Travel Medical Insurance Are:

Medical:

- Accident and sickness medical expense up to $1mn

- Age restrictions on policy maximum apply offering very low coverage limits for those over 70

- Emergency dental treatment

- Palliative dental treatment

Evacuation

- Medical evacuation, medical repatriation, emergency reunion, natural disaster, and security evacuation, return of the dependent child(ren), return of remains, natural disaster and security evacuation

Trip Protection

- Trip cancellation, cancel for work reasons, trip interruption, trip delay, and delay benefits including baggage coverage, medical emergency, medical evacuation, medical repatriation, emergency reunion, and assistance services

There are other additional coverage offered like rental car coverage options, emergency transfer of funds, legal referrals, and extreme sports activities coverage.

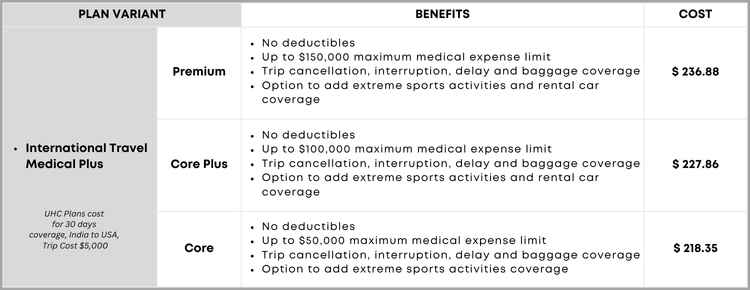

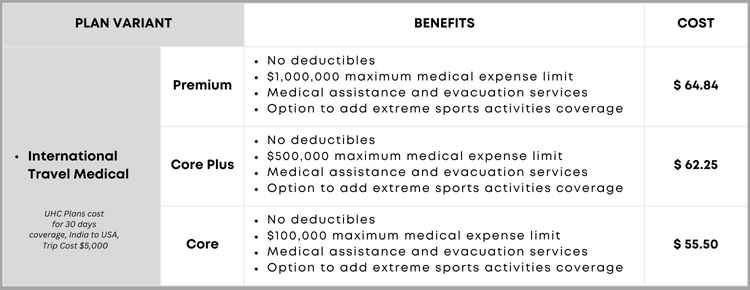

UHC Travel Medical Insurance Plans – Cost

Travel Medical Insurance Plans

Travel medical insurance typically covers unexpected medical needs and other coverage options for unexpected health care costs including:

- Emergency Medical Coverage: Covers medical emergency expenses due to unforeseen illnesses or injuries

- Hospitalization Coverage: Includes expenses for hospital stays and related treatments during a medical emergency

- Doctor Visits: Travel medical insurance also covers fees for doctor visits

- Prescription Drugs: Reimbursement for prescription drugs may also be covered

- Emergency Medical Evacuation: Travel insurance covers transportation costs if you need to be evacuated to another medical care facility

- Repatriation of Remains: In the unfortunate event of the death of the insured, travel insurance covers the cost of returning the remains to the home country

- Accidental Death and Dismemberment (AD&D): Provides benefits in the event of accidental death or loss of limbs

- Trip Interruption: Coverage for costs incurred due to trip interruption

International travel medical insurance plans may also cover other benefits such as baggage loss/baggage delay/trip delays/loss of travel documents, with options to add extreme sports and rental car coverage.

Please note that all travel medical insurance plans do not provide all coverage options, read the policy document to understand the inclusions and exclusions in the policy document.

Why Buy Visitor Insurance?

Travel medical insurance also known as visitor insurance provides several benefits and offers peace of mind:

- Health insurance from your home country may cover you for domestic travel only

- Domestic health insurance may not cover you while traveling to other countries

- You need to consider international travel medical insurance when traveling internationally

- Healthcare costs in the USA are extremely high

- International travel medical insurance helps protect your financial investment in the trip and covers unexpected medical expenses

- Exclusive travel insurance plans that cover pre-existing medical conditions are available with OnshoreKare

Key Features Of Plans With United Healthcare PPO Network:

- Extensive Network: Access to a large network of doctors, hospitals, and specialists within the United Healthcare PPO Network

- Direct Billing: Many providers in the network offer direct billing, reducing the need for upfront payments (they can bill the travel health insurance company directly)

- Lower Costs: Typically lower out-of-pocket costs when using in-network providers

Visitors Insurance With United Healthcare PPO Network

Here are some travel medical insurance options:

Atlas America Insurance:

Coverage for medical expenses, emergency medical evacuation, repatriation, and more.

Access to the United Healthcare PPO Network for easier provider access.

Travel insurance coverages underwritten by Lloyd’s of London

| PPO Network | United Healthcare PPO Network |

| Policy Maximum | Age Up To 64: $50,000, $1,00,000, $250,000, $500,000, $1,000,000 or $2,000,000 Age 65 to 79: $50,000 or $1,00,000 Age 80 or older: $10,000 |

| Deductible | $0, $100, $250, $500, $1,000, $2,500, or $5,000 Per certificate period |

| Coinsurance | 100% of eligible medical expenses, after the deductible, Up to the overall maximum limit |

| Urgent Care | $15 Copay, Waived with $0 deductible, For those under 80 years old |

| Acute Onset Of Pre-existing Conditions | Up to the overall policy maximum limit |

| Emergency Medical Evacuation | Up to $1,000,000 |

| Extendable | Up to 12 Months |

| Rated By A.M. Best | A “Excellent” |

| Underwriter | Lloyd’s Of London |

| Plan Administrator | WorldTrips |

Patriot America Plus:

Comprehensive coverage for medical emergencies, hospital stays, doctor visits, and more.

Includes coverage for acute onset of pre-existing conditions.

Uses the United Healthcare PPO Network.

| PPO Network | United Healthcare PPO Network |

| Policy Maximum | Through Age 65: $50,000, $100,000, $500,000, or $1,000,000 Ages 65 to 69: $50,000 or $100,000 Ages 70 to 79: $50,000 Ages 80 and older: $10,000 |

| Deductible | $0, $100, $250, $500, $1,000, $2,500 Per insured person |

| Coinsurance For treatment received in the U.S | In the PPO Network: The Plan pays 100% Out of the PPO Network: The plan pays 80% of eligible expenses up to $5,000, then 100% |

| Urgent Care | $25 Copay, waived with $0 deductible |

| Walk-In Clinic: | $15 Copay, waived with $0 deductible |

| Acute Onset Of Pre-existing Conditions | Up to the maximum limit For those under 70 years of age |

| Emergency Medical Evacuation | Up to $1,000,000 |

| Extendable | Up to 24 months (maximum) |

| Rated By A.M. Best | A |

| Underwriter | SiriusPoint Speciality Insurance Corporation |

| Plan Administrator | International Medical Group (IMG) |

More United Healthcare Visitors Insurance Plans For USA

Many reputed insurance providers are offering international travel insurance plans with the benefits of United Healthcare PPO Network access.

More plans from various global providers:

| INSURANCE PLAN | COVERAGE AREA |

|---|---|

| Atlas Essential America | For Visitors To the USA |

| Visitors Protect | For Visitors To the USA |

| CoverAmerica-Gold | For Visitors To the USA |

| Atlas America Premium | For Visitors To the USA |

| Patriot America Lite | For Visitors To the USA/Worldwide |

| Seven Corners Travel Medical Basic – USA | For Visitors To the USA/Worldwide |

| Patriot Platinum America | For Visitors To the USA/Worldwide |

| Seven Corners Travel Medical Choice – USA | For Visitors To the USA/Worldwide |

Choosing The Right Plan

When selecting a visitor insurance plan, consider the following factors:

- Coverage Limits: Ensure the plan provides adequate coverage for potential medical expenses

- Duration Of Coverage: Match the policy duration with your travel dates to avoid gaps in coverage

- Pre-existing medical conditions: coverage of acute onset of pre-existing medical conditions

- Policy Exclusions: Be aware of any exclusions or limitations in the policy to avoid surprises during claims

Choosing The Right Plan For Your Needs

- Consider your age, health, and travel plans when selecting a visitor insurance plan

- Think about the level of coverage you need and your budget

- Compare different plans and providers to find the best option for you

How To Purchase Visitor Insurance Plans With United Healthcare PPO Network Access

Visitors’ insurance plans can be easily purchased online.

You can purchase from a travel insurance marketplace or a travel insurance company directly.

A travel insurance marketplace gives you the advantage of comparing plans from different insurance providers.

It is crucial to compare different plans, read the policy details thoroughly, and choose the plan that best meets your specific needs. Check for insurance and non-insurance components of coverage.

Look for plans that offer the flexibility and comprehensive coverage you require for peace of mind during your travels. Once you shortlist a plan you can check for the reputation of the insurance company.

You can purchase the plans online. The process is straightforward, and you will need to provide some basic information about yourself and your travel plans.

If you need help shortlisting the right visitors’ insurance plan for your needs our licensed customer service reps are available at +1 855 652 5565.

Types Of United Healthcare Visitor Insurance Plans

- United Healthcare offers various visitor health insurance plans, including fixed benefits and comprehensive plans

- Fixed benefit plans provide limited coverage for specific medical expenses, while comprehensive plans offer more extensive coverage

- Some plans may also include additional benefits, such as trip cancellation and baggage coverage

Key Benefits Of United Healthcare Visitor Insurance

- Access to their PPO network, which offers cost-effective medical expenses

- Coverage for unexpected medical expenses, including doctor visits, hospital stays, and surgeries

- Trip cancellation and interruption benefits to protect your financial investment

- Baggage coverage and travel assistance services

What To Look For In A Visitor Insurance Plan

- Look for plans that offer comprehensive coverage, including medical, trip cancellation, and baggage benefits

- Check the policy’s maximum coverage limit and deductible

- Consider the plan’s pre-existing condition coverage and any exclusions or limitations

- Check the plan’s network and provider list

Understanding Pre-Existing Conditions

- Pre-existing conditions may be excluded or limited in some visitor insurance plans

- Some plans may offer coverage for pre-existing conditions, but may require additional documentation or underwriting

Travel Health Insurance Considerations

- Consider the level of medical coverage you need and your budget

- Think about the plan’s network and provider list

- Check the plan’s pre-existing condition coverage and any exclusions or limitations

International Travel Medical Insurance Options

- United Healthcare offers international travel medical insurance options for travelers outside of the US

- These plans provide coverage for unexpected medical expenses and may offer additional benefits

Trip Cancellation Insurance

- Trip cancellation insurance can provide financial protection in case of unexpected trip cancellations or interruptions

- Some plans may offer trip cancellation benefits, while others may require an additional premium

Reviews And Ratings

- Check online reviews and ratings from other customers to get an idea of the plan’s quality and service

- Look for plans with high ratings and positive reviews

Frequently Asked Questions

What is the difference between fixed benefits and comprehensive plans?

- Fixed benefit plans offer a set amount of coverage for specific medical services, with lower premiums but higher out-of-pocket costs if expenses exceed limits

- Comprehensive plans cover a percentage of total medical costs, typically have higher premiums, and offer broader coverage with lower out-of-pocket expenses

Comprehensive Coverage Vs Fixed Coverage Plans: What Type of Visitors’ Insurance Coverage Should You Buy?

How do I file a travel insurance claim?

- Claims can be filed online or by phone, and United Healthcare offers 24/7 customer support. Ensure to file a complete request, these are the top 5 reasons why claims are denied.

What is pre-existing condition coverage?

- Pre-existing condition coverage refers to insurance coverage for medical conditions that existed before the start date of an insurance policy.

- This can include chronic illnesses, past surgeries, or ongoing treatments

- In the context of visitors insurance, some plans may cover the “acute onset” of pre-existing conditions, meaning sudden and unexpected flare-ups of a pre-existing condition

- However, coverage for routine management of these conditions is usually limited or excluded.

- It’s important to carefully read the policy terms to understand how pre-existing conditions are covered

- OnshoreKare offers exclusive travel insurance plans that cover pre-existing medical conditions

Conclusion

Securing a visitor insurance plan with access to the United Healthcare PPO Network can significantly enhance your travel experience in the USA.

These plans offer extensive coverage, cost savings, and access to a vast network of healthcare providers, ensuring you receive the care you need when you need it most.

Before embarking on your journey, take the time to select the right plan to protect your health and financial well-being during your stay in the United States.

United Healthcare Visitor Insurance offers a range of plans and benefits to protect your financial investment and health while traveling.

Consider your needs and budget when selecting a plan, and don’t hesitate to reach out to a licensed insurance agent for guidance.