CoverAmerica Gold vs. Patriot America Plus – which travel medical insurance plan is better?

CoverAmerica Gold vs. Patriot America Plus will help you evaluate the best plan for your travel insurance needs.

Travel insurance is one of those things that you don’t know you need until you need it. But once you find yourself in a situation where you could use a travel medical insurance plan, it’s really important to have a good medical coverage plan in place.

CoverAmerica Gold and Patriot America Plus are two popular travel insurance plans available today.

However, each of these travel health insurance plans has many commonalities and some different features and/or limitations that make them better suited for certain travelers.

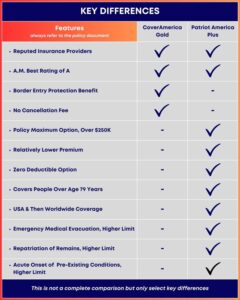

Key Highlights: CoverAmerica Gold vs. Patriot America Plus Travel Medical Insurance Plans

CoverAmerica Gold and Patriot America Plus are two of the best travel insurance policies for U.S. travelers, even though there are several visitor insurance plans available.

Both are well-respected, all-inclusive foreign travel medical insurance policies with a sterling reputation. Both plans cover COVID-19 as well.

There are significant variances between these two plans, despite their many similarities. The following comparison chart may assist you in selecting the appropriate plan for your needs.

About CoverAmerica Gold Comprehensive Travel Insurance

Comprehensive Travel Medical Insurance is provided by the CoverAmerica – Gold travel insurance plan. It provides good coverage to the insured both in the United States and for international travel from the United States to specified other nations.

To answer the question of insurance for parents traveling to the United States, the CoverAmerica Gold plan should be considered while evaluating travel insurance for the United States.

Generally, parents who travel abroad are concerned about pre-existing condition coverage. This plan’s comprehensive benefits package includes coverage for the acute onset of pre-existing conditions.

The plan pays for medical expenses in case of a new sickness or injury or for any other eligible incident.

Watch our YouTube video on The Top 10 Benefits of CoverAmerica Gold

Watch our YouTube video on The Top 10 Reasons to Buy Patriot America Plus

About Patriot America Plus Comprehensive Travel Insurance

Patriot America Plus meets the insurance needs of non-U.S. residents who require comprehensive coverage for temporary medical insurance while visiting the United States for business or pleasure.

Individuals, families, business travelers, and groups of five or more travelers can access the plan’s comprehensive worldwide benefits 24 hours a day, seven days a week.

The Patriot America Plus plan is offered for a minimum of five days and a maximum of two years, with a wide range of plan maximum limits and deductible options.

The Patriot America Plus plan is designed to cover your unforeseen medical expenses.

In addition, the Patriot America plan provides exceptional perks and services to fulfill your international travel requirements.

You will have access to international, multilingual customer support centers, claims administrators who handle claims in practically every language and currency, and highly qualified coordinators of emergency medical services and international treatment available 24 hours a day, 7 days a week. This service is available to you no matter where you purchase the plan from.

This is a highly popular visitor insurance for parents visiting the USA. The plan extends coverage right from the time your parents leave the home country if the policy date is effective.

Read our travel insurance reviews on each of these plans:

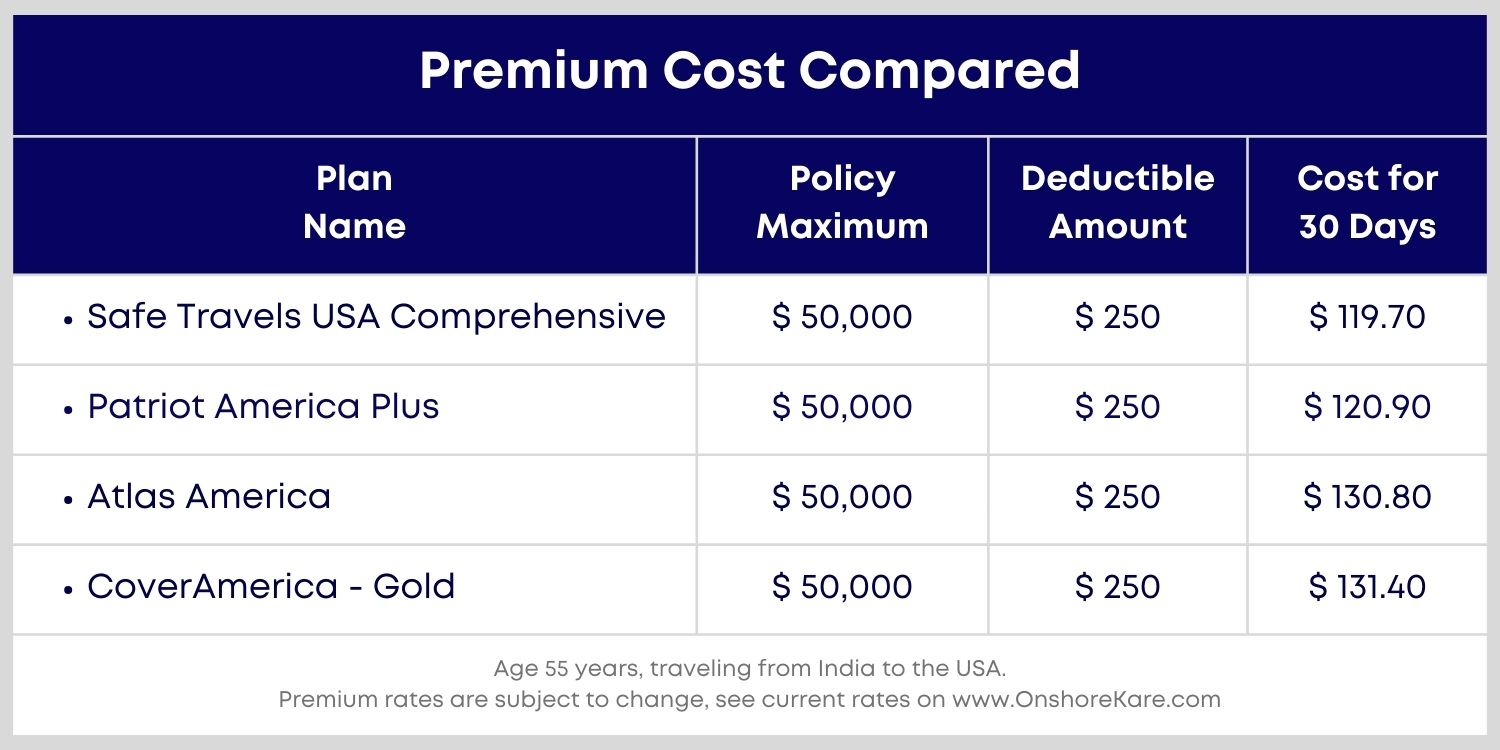

Travel Insurance Cost? Which plan is cost-effective?

The plans are competitively priced when it comes to similar comprehensive coverage plans. See the example below of the difference in premium between CoverAmerica Gold and Patriot America Plus:

The premium for the same terms for Atlas America Insurance and Safe Travels USA Comprehensive Insurance, two other highly popular plans:

- Atlas America Insurance policy would be $130.80

- Safe Travels USA Comprehensive plan is $119.70

See details of Atlas America and Safe Travels USA Comprehensive plans.

Please note that premiums are subject to change depending on several factors and the insurance providers may also make changes to plan premiums.

Covid 19 Coverage

Cover America Gold Comprehensive travel insurance offers coverage for COVID-19 expenses and treatment as any other illness/sickness as per policy terms.

Patriot America travel insurance offers COVID-19 coverage as any other illness or injury and meets the policy terms for an illness (illness occurred after the policy effective date).

If covid-19 was acquired before the policy effective date then the plan will not provide covid coverage.

So as far as Covid-19 is concerned the insured person is covered by both travel medical insurance plans during the policy period.

Pre-Existing Conditions Cover

These travel medical insurance plans extend coverage for the acute onset of pre-existing conditions.

Acute onset of pre-existing conditions is an important element to note if you have parents visiting the USA and you are looking for travel insurance with pre-existing conditions coverage then these plans won’t meet your requirements.

Most travel medical insurance plans are not designed to cover a pre-existing condition but only to cover emergency medical expenses when abroad.

See travel insurance plans that cover pre-existing medical conditions! at OnshoreKare we offer travel insurance plans for the needs of every international traveler. The following plans offer coverage for pre-existing conditions:

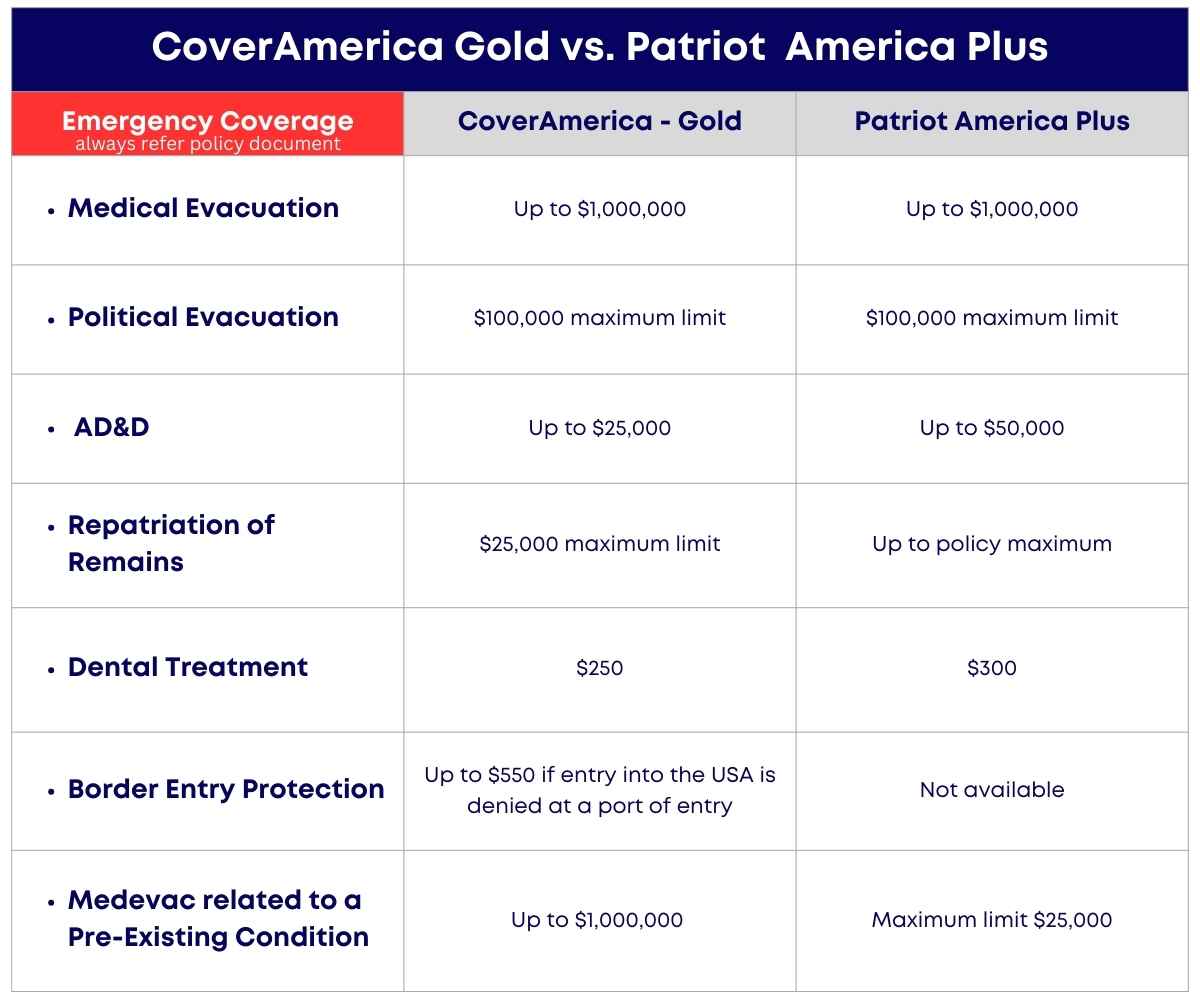

Patriot America Plus travel medical Insurance covers the Acute Onset of Pre-Existing Conditions under 70 years of age, up to the maximum limit. $25,000 maximum limit for medical evacuation

CoverAmerica Gold travel medical insurance coverage of Acute Pre-Existing Conditions is up to the policy maximum coverage for ages up to 70 years. For those over 70 years, up to 79 years get the acute onset of pre-existing conditions coverage up to $30,000.

What is an Acute Onset of pre-existing conditions?

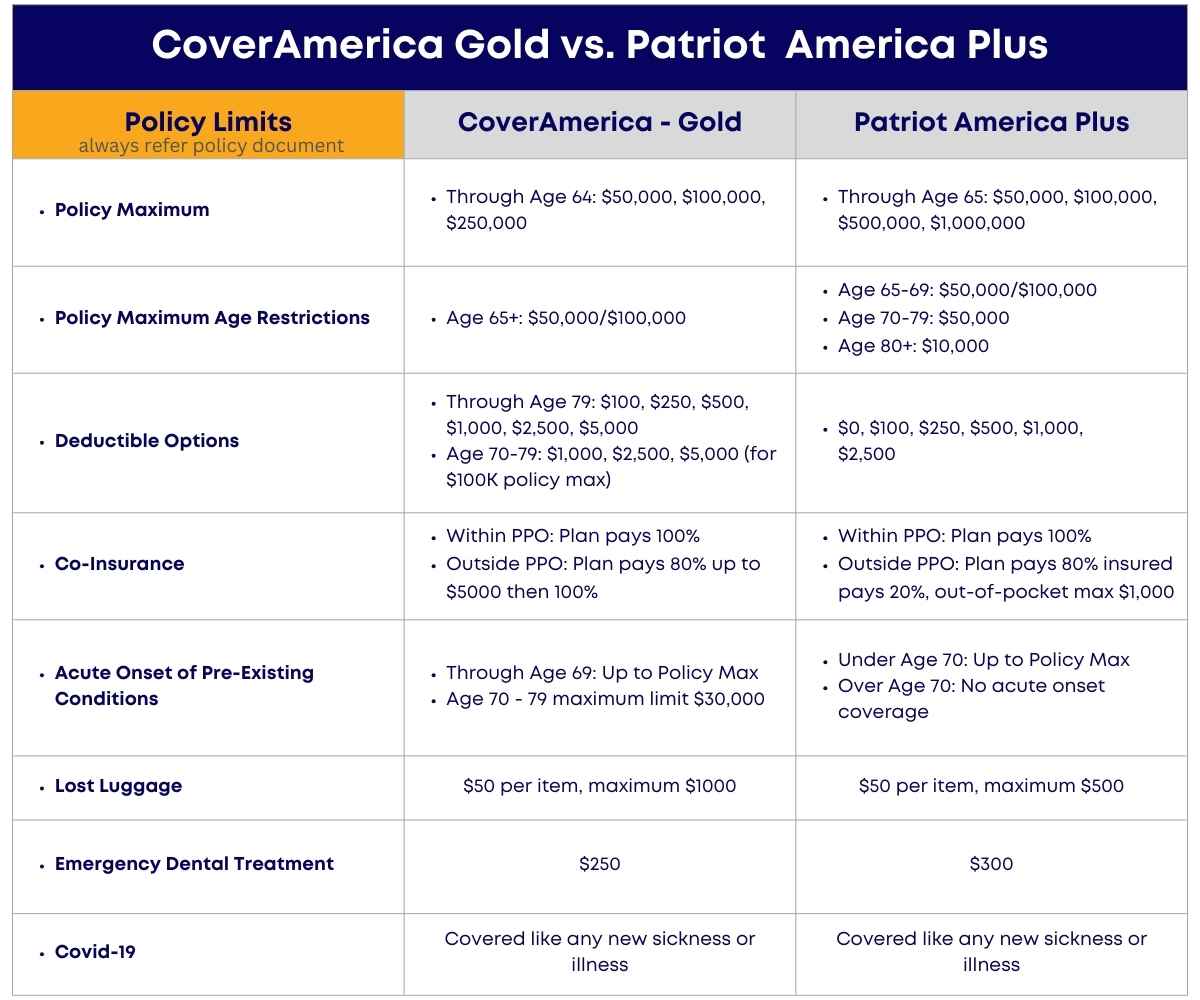

Policy Maximum:

Policy maximum coverage comparison of these comprehensive coverage plans:

- CoverAmerica Gold Policy Maximum Limit: $ 250,000

- Patriot America Plus Policy Maximum Limit: $ 1,000,000

Patriot America Plus provides a 4 times higher option as a max coverage option under its travel medical insurance policy.

CoverAmerica Gold travel medical insurance policy offers 5 options on a policy maximum

- Option 1. Policy Maximum of $50,000

- Option 2: Policy Maximum of $100,000

- Option 3: Policy Maximum of $250,000

The policy maximum for Senior Travelers is much less.

- Insurance policy maximum coverage for Age 65 and older: $50,000 or $100,000

Patriot America Plus offers 4 options on policy maximum:

- Option 1. Policy Maximum of $50,000

- Option 2: Policy Maximum of $100,000

- Option 3: Policy Maximum of $500,000

- Option 4: Policy Maximum of $1,000,000

The policy maximum for Senior travelers is much less.

- Insurance policy maximum:

- Age 65 to 69: $50,000 or $100,000

- Age 70 to 79 $50,000

- Age 80 and older $10,000

Patriot America Plus provides more coverage options and higher policy maximum limits. How does this help the insured person? Higher policy maximum limit coverage means the plan pays for treatment up to that amount or limits as defined in the policy terms. Both plans provide up to $1,000,000 in medical evacuation limits.

Other Coverages

Travel health insurance plan pays for any covered illness or injury as eligible medical expenses. Any incident that is defined as covered in the policy document will also be paid for or reimbursed to you as per the terms and limits in the policy document.

Let’s take a birds-eye view of coverages: CoverAmerica Gold vs. Patriot America Plus travel health insurance coverage limits:

The benefits of the plans being under the IMG umbrella

International Medical Group (IMG) Travel Insurance is one of the reputed insurance providers based out of Indianapolis. We have covered IMG in detail.

Some of the benefits of plans offered by International Medical Group are:

- Comprehensive plans offer coverage and access to a wide PPO Network

- They offer customer assistance and service so you can always have access when you need

- IMG offers a wide variety of travel insurance plans for every need

- Visitors Protect plan from IMG covers pre-existing medical conditions

Frequently Asked Questions:

Can I buy CoverAmerica Gold for my parents visiting the USA?

Yes, you can buy CoverAmerica Gold for your parents visiting the USA. CoverAmerica Gold Insurance Review provides more details on the plan.

Is Patriot America Plus a good travel insurance plan?

Yes, you can buy Patriot America Plus, it is one of the highest-selling travel medical insurance plans. The plan provides options to get policy maximum coverage as high as $1,000,000 and a few good options for deductibles. The overall coverage offered is adequate for any situation that one can think of.

Which is a better plan, CoverAmerica Gold or Patriot America Plus?

A better plan depends on your travel insurance needs. CoverAmerica Gold is designed for travelers coming into the USA and has some unique features in the plan. Whereas, Patriot America Plus offers wide coverage and higher limits. Both plans are administered by International Medical Group (IMG) and underwritten by Sirius International.

Sirius International has excellent ratings and when it comes to travel insurance you want to go with the best plan administrators and underwriters and buy from a reputed travel insurance marketplace like OnshoreKare.

Which other plans can I consider apart from CoverAmerica Gold and Patriot America Plus?

We have covered some of the best-selling plans and you can read about them:

Patriot America Plus vs. Safe Travels USA Comprehensive Travel Insurance

Atlas America vs. Safe Travels USA Comprehensive Travel Insurance

Conclusion

Travel Medical insurance policy is one of the top considerations when we travel especially when we have family members visiting the USA.

Both CoverAmerica Gold and Patriot America Plus are very popular plans for international visitors to the USA. The health care/medical care coverage offered under the plans is good and can offer cover for any kind of medical conditions that may need attention.

Always travel under the cover of insurance!