Patriot America Plus Reviews For International Travelers

Patriot America Plus reviews amongst the subscribers of the plan are very positive. Patriot America Plus remains one of the best travel insurance plans for 2024 and is high in demand for parents visiting the USA.

The plan covers non-U.S. citizens, non-U.S. residents, and Foreign nationals who are visiting the United States for business or pleasure and require temporary medical insurance.

Is this plan suitable for your travel or your parents visiting the USA? This Patriot America Plus review will help you with information to help you decide.

The plan provides access to international, multilingual customer service centers in almost every language. If needed, 24-hour access to highly qualified coordinators of emergency medical services and international treatment.

Watch a short video

Travel Insurance from International Medical Group (IMG)

IMG Patriot America Plus is part of the Patriot Series of travel insurance products:

Coverage Inside The USA:

Coverage Outside The USA

- Patriot Lite International

- Patriot Platinum International

IMG also provides a travel insurance plan for pre-existing conditions coverage:

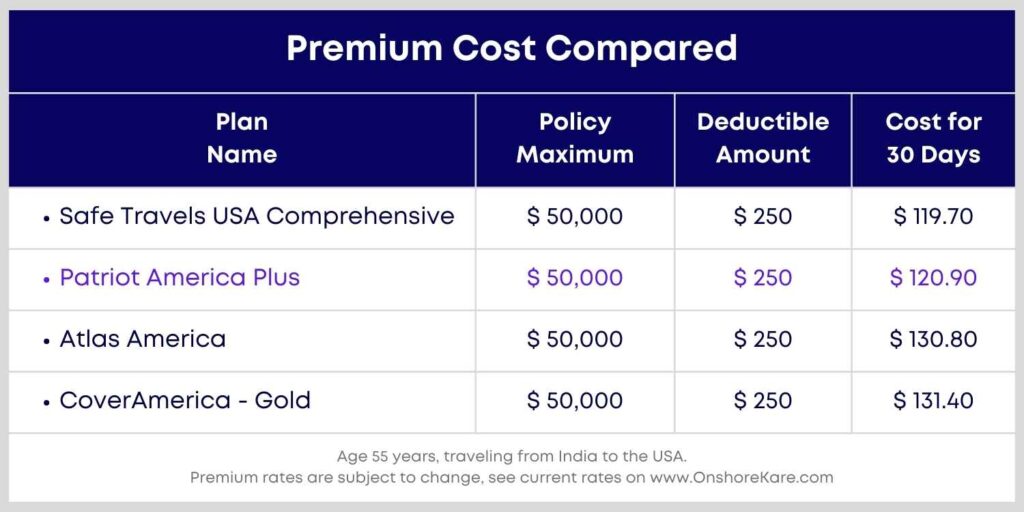

Cost Of Travel Medical Insurance Coverage

Patriot America Plus Insurance cost is very competitive as compared to its peer group of travel medical insurance products:

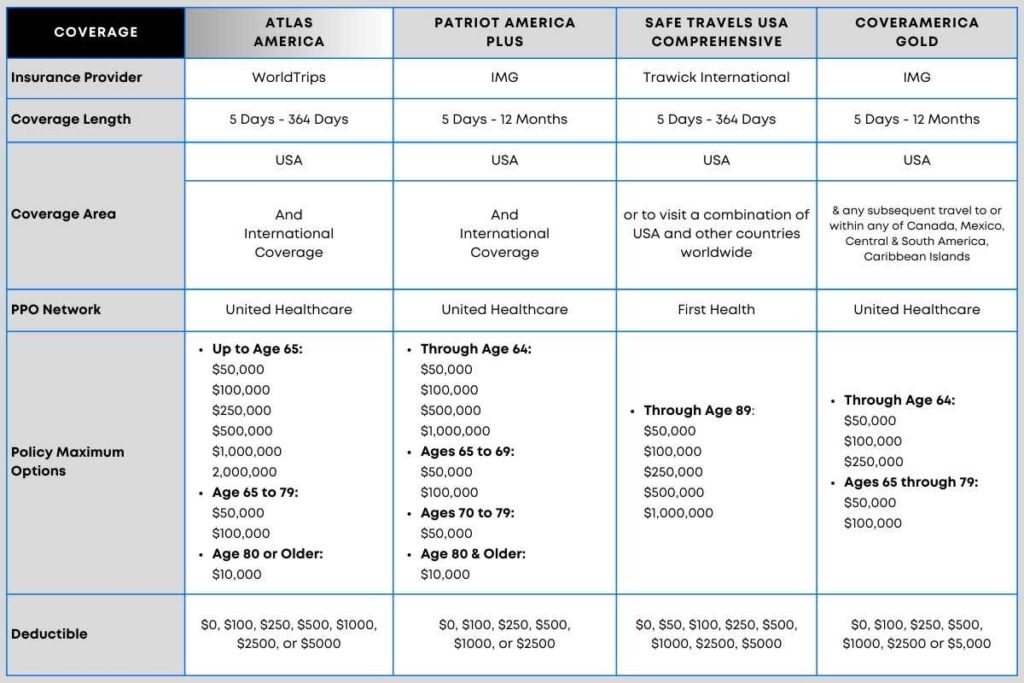

A detailed comparison of Patriot America Plus Travel Medical Insurance:

- Atlas America vs Patriot America Plus

- Safe Travels USA Comprehensive vs Patriot America Plus

- CoverAmerica Gold vs Patriot America Plus

The Plan Is Ideal For:

- Parents Visiting USA

- International Travelers Visiting the USA

- Non-US citizens traveling to the USA

- Vacations/Holidays

- Visitors/New Immigrants

- Employers/Business Travelers

- Ideal for Traveling Outside of your Home Country

Top 10 reasons To Buy Patriot America Plus Travel Insurance

It is one of the most popular comprehensive coverage plans for visitors to the USA.

Here are the top 10 reasons to buy Patriot America Plus travel travel medical insurance plan:

- One of the most popular comprehensive coverage plans for visitors to the USA

- Plan provides access to the United Healthcare PPO Network

- Provides the acute onset of pre-existing condition coverage

- With travel dates included you get protection starting from your home country

- Free look-in period, you can cancel the plan within 3 days for any reason without any penalty

- Get continuous coverage as the plan is renewable for up to 24 months

- Option of high policy maximum limit of up to 1 million dollars

- Trip cancellation, lost baggage, identity theft, and natural disaster coverage provided

- The plan provider is International Medical Group, a reputed provider with a 4.6 Trustpilot rating

- Emergency Medical Evacuation benefits limits up to $1mn

*Read the policy document for details of coverage inclusion, exclusion, limits, restriction

See how this plan compares to other similar travel insurance coverage plans.

Highlights Of Patriot America Plus Insurance

- Coverage for inside the U.S.

- Individuals, Families, and Groups (five or more travelers) are eligible to buy

- Acute Onset of pre-existing condition coverage

- Short-term travel medical coverage

- Available for a minimum of 5 days up to a maximum of 2 years

- Freedom to seek treatment with a hospital or doctor of your choice

- Covid-19 coverage for travelers to the U.S.

About Patriot America Plus Travel Insurance Plan

The Patriot America Plus Insurance Plan is an optimum-cost, all-inclusive travel medical insurance plan for international visitors to the United States.

The plan can be purchased for a minimum of 5 days and a maximum of 2 years. It offers a flexible plan with a huge range of maximum limits and deductible options for people traveling outside their home country.

The plan offers short-term medical protection for individuals, families, and large groups of five or more travelers

From $50,000 up to $500,000 would be the range of total medical benefits and Insurance deductibles can range from $0 to $2500.

A medical evacuation, acute onset of a pre-existing condition, or political evacuation are all examples of the types of emergency evacuations covered by the plan.

Protection against travel-related coverage like trip cancellation, lost bags, identity theft, and natural disasters is also included.

The plan also provides first-rate services and benefits to accommodate your diverse requirements throughout the world.

You will have access to qualified coordinators of emergency medical services and international treatment around the clock, as well as access to international, multilingual customer service centers.

There is a free-look period with this IMG Global travel medical insurance plan. The premium is fully refundable if you cancel your policy at any time prior to the effective date.

If you haven’t made any claims, you can cancel your plan even after it’s started. However, you will be charged a $50 cancellation fee and will only be refunded the full month’s premiums.

This plan is highly recommended for non-US citizens who are traveling to the US.

When Visiting The United States, Why Choose Patriot America Plus Insurance?

Patriot America Plus allows you to tailor your policy to your needs by adjusting the policy maximum and deductible. It’s an all-inclusive deal, packed with comprehensive benefits for solo adventurers, families, and groups of five or more going abroad.

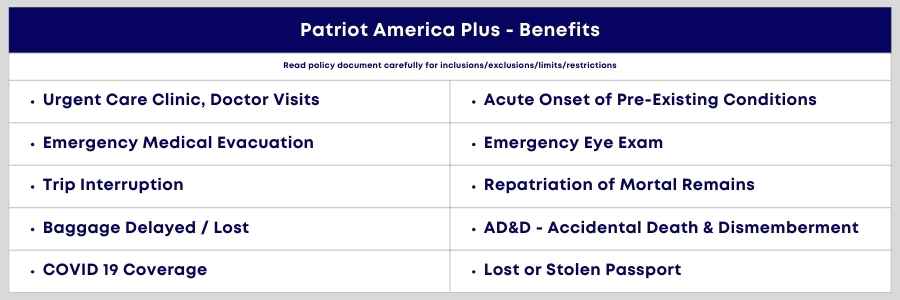

Benefits of the plan :

In-patient, outpatient, and urgent care services are all covered by the plan. As a bonus, the plan covers accidental death and dismemberment, trip interruption, repatriation, emergency medical evacuation, and the acute onset of non-chronic pre-existing conditions.

Pre-Existing Conditions :

Acute onset of nonchronic pre-existing conditions under 70 years old is covered up to the chosen plan maximum limits if treatment is obtained within 24 hours.

If you need travel insurance for pre-existing conditions coverage, there are options available.

PPO Hospital Network :

United HealthCare PPO Network allows you to look up network providers like hospitals, doctors, urgent care centers, and more.

Covid-19/SARS-Cov-2 Coverage :

Coverage of Eligible Medical Expenses Related to COVID-19

Adventure Sports Rider :

Optional coverage for extreme sports is available for those up to the age of 65.

- Ages 60 – 64: $15,000 (maximum limit)

- Ages 50-59: $30,000 (maximum limit)

- Through age 49: $50,000 (maximum limit)

Enhanced AD&D (Accidental Death and Dismemberment) Rider :

Optional Enhanced AD&D Rider is for individuals only and is available for the primary insured person only. The rider is available with a minimum purchase of 3 (Three) months of medical and AD&D rider coverage. his coverage is in addition to the AD&D already included in the plans.

Chaperone/Faculty Leader Replacement Rider :

This rider is available for groups of five or more travelers only. Evacuation Plus Rider and Chaperone/Faculty Leader Replacement Rider allows you to tailor your protection to fit your specific requirements.

Mobile Device Protection :

This protection provides coverage for the repair or replacement of your cell phone if it is lost, stolen, or accidentally damaged during your trip.

What Are The Benefits And Coverage Of Patriot America Plus Insurance?

Patriot America Plus offers temporary medical coverage abroad. Those who do not permanently call the United States home but require medical care in the country are recommended to sign up for this plan.

When seeing a provider in the plan’s network, your co-pay will be eliminated. Urgent care services have a $25 copay and no deductible. You can purchase the plan for as little as 5 days and as long as 12 months, with the option to renew for an additional year.

Benefits of the plan include :

- Pays for inpatient care, outpatient care, emergency care, and prescription medication for individuals, families, and small businesses.

- Walk-In Clinic: $15 Copay

- Urgent Care: $25 Copay, No Deductible

- Coverage for Acute Onset of Pre-Existing Conditions for visitors to the United States who are younger than 70.

- Coverage for COVID-19-related difficulties

The plan also provides first-rate services and benefits to accommodate your diverse requirements throughout the world. You have access to highly qualified coordinators of emergency medical services and international treatment around the clock, as well as to international, multilingual customer service centers.

How Much Does Patriot America Plus Cost?

Compare Travel Insurance to see the cost. The following variables will affect the price:

Limit of the plan :

If you choose a higher maximum benefit for your plan, your monthly premium will increase accordingly. In terms of policy maximums, you can pick between $50,000, $1,00,000, $500,000, and $1 million. ($10,000 if you’re 80 or older)

Deductible :

Select a deductible amount between $0, $100, $250, $500, $1,000, and $2,500. The premium can be lowered by selecting a higher deductible.

Coinsurance and Coverage Details

- In-Network: The plan pays 100% of eligible expenses within the PPO network

- Out-Of-Network: Outside the PPO network, the plan pays 80% of eligible expenses up to $5,000 and then 100% up to the maximum limit

Age factor :

As one gets older, one usually has to pay a higher premium or rate. The premium increases as one get older. Anyone with more than 14 days old can sign up for the plan.

Days of Coverage :

You can purchase Patriot America Plus for any length of time between 5 days and 2 years. Because the premium is calculated on a per-day basis, the longer the coverage period, the higher the premium will be.

Other coverage :

Adventure Sports (up to age 65), Enhanced Accidental Death & Dismemberment (individuals only), Evacuation Plus, and Chaperone / Faculty Leader coverage riders are all available as add-ons (for groups only).

You can generate a no-obligation quote here.

IMG Patriot America Plus Insurance – Summary Of Benefits

Plan Information

- Plan Maximum Limits Per Period of Coverage, Options: $50,000, $100,000, $500,000

- Individual Deductible Options: $0, $100, $250, $500, $1,000, or $2,500

- Emergency Medical Evacuation Benefits: $1,000,000

- Coinsurance for Treatment received within the U.S.:

- In the PPO Network: 100% up to the maximum limit

- Out-Of-Network: The plan pays 80% of eligible medical expenses up to $5,000, then 100%

- Coinsurance for treatment received outside the U.S.

- No Coinsurance

- Acute Onset of Pre-Existing Conditions:

- Up to the maximum limit

- Available for under 70 years of age

- $25,000 maximum limit for medical evacuation

- Covid-19 Coverage: Same as any other illness or injury

- Eligible Medical Expenses: Up to the maximum limit

- Physician Visits/Services: Up to the maximum limit

- Urgent Care Clinic: $25 Copay

- Walk-In-Clinic: $15 Copay

- Hospital/Room & Board: Average semi-private room rate up to the maximum limit.

- Intensive Care: Up to the maximum limit

- Bedside Visit: $1,500, maximum limit

- Remote Transportation: $5,000 per period, $20,000 lifetime maximum

- Supplemental Accident: $300 per covered accident

- Prescription Drugs & Medications: Up to the plan maximum limit, (may not exceed $250,000)

- Emergency Reunion: $1,000,000 maximum limit

- Natural Disaster: $25,000 maximum limit

- Political Evacuation and Repatriation: $100,000 maximum limit

- Return of Minor Children: $100,000 maximum limit

- Identity Theft: $500 maximum limit

- Interfacility Ambulance

- Lost Luggage: $50 per item, $500 maximum limit

- Natural Disaster: $250, per day

- Personal Liability: $25,000 combined maximum limit

- Pet Return: $1,000 maximum limit

- Terrorism: $50,000 maximum limit

- Return Travel: $10,000 maximum limit

What Does It Mean By Acute Onset Of Pre-Existing Condition?

The term “acute onset of pre-existing conditions” describes what it means when a previously established medical condition suddenly got worsens. The onset or reappearance of symptoms suddenly, with the condition worsening rapidly and necessitating immediate medical attention.

Acute onset of pre-existing conditions does not include those that are chronic, congenital or worsen over time. Any condition that the Insured did not have on the Effective Date but developed suddenly after that date is not considered to have had an “acute onset.”

However, the sudden onset of a pre-existing condition is covered by some travel insurance policies. Acute onset of a pre-existing condition refers to a medical episode brought on by the condition that occurs suddenly and without warning.

A medical event must develop suddenly and without warning, if it is to be considered acute onset (either confirmed by a physician or by the obvious presence of symptoms). Acute onset typically describes a medical condition that develops rapidly, worsens rapidly, and resolves quickly.

Acute onset of a pre-existing condition is the sudden and unanticipated reappearance of a pre-existing condition that is short-lived, rapidly progresses, and necessitates immediate medical care.

Is The Acute Onset Of Pre-Existing Conditions Covered By Patriot America Plus?

Yes, the sudden onset of a pre-existing condition is covered by this policy. When a non-chronic pre-existing condition experiences an acute onset and treatment is received within 24 hours, the insured will be covered up to the policy maximum.

The maximum cost of emergency medical evacuation is $25,000. The age of insured person must be less than 70 years old.

The Insured Person will be reimbursed eligible medical expenses up to the amount shown in the Benefit Summary for Eligible Medical Expenses incurred during the Period of Coverage.

For an Acute Onset of Pre-existing Condition if the Insured Person suffers or experiences an acute onset of Pre-existing Condition for which immediate Treatment is essential and necessary to stabilize the Pre-Existing Condition.

Is Covid Covered By Plans Offered By IMG (International Medical Group)?

- Most IMG insurance policies do cover COVID-19 treatment if it is deemed medically necessary.

- This means you won’t have to pay for any of the exams your doctor deems necessary. If hospitalization is required, it will be covered.

- One of their most popular all-inclusive plans, Patriot America Plus, includes coverage for COVID-19 and treats it like any other illness. The Patriot America Plus does not cover pre-travel screenings or vaccinations.

Tips for Purchasing the Plan

To send the necessary insurance documents, the application will need the

- Visitor’s name

- Date of birth

- Home country and address

- Email address

- A passport number can be entered if you have one

- To complete the purchase, a credit card number and expiration date will be needed.

- A confirmation email with links to download the ID card, Visa Letter, and Certificate wording will be sent to the address provided on the application immediately after submission.

Frequently Asked Questions

What exactly is Patriot America Plus? Is it good insurance?

One of the most sought-after all-inclusive packages is the Patriot Series of Plans from the International Medical Group (IMG). Travelers to the United States often choose this visitor insurance policy.

Depending on the policy you select, you may also have the option of choosing a policy with no deductible and full coverage up to the policy maximum.

Patriot America Plus Insurance is one of the highest-selling plans, especially for parents visiting the USA. One of the important benefits of this plan is access to a PPO Network (UnitedHealthcare is the PPO network for this plan).

Visitors from outside the United States who are in need of short-term medical insurance while visiting the United States for business, school, or pleasure may want to purchase Patriot America Plus.

The underwriter for Patriot America Plus is SiriusPoint Specialty Insurance Corporation, which has an A- “Excellent” rating from A.M. Best.

Who qualifies to apply for Patriot America Plus coverage?

Non-U.S.residents traveling to the United States qualify to get coverage from this plan.

Does Patriot America Plus cover adventurous sports?

For a supplementary fee, those under the age of 65 can purchase the Adventure Sports Rider. As long as they are pursued no other reason, the below lifetime maximums apply to activities like abseiling, BMX, bungee jumping, parachuting, wildlife safaris, and windsurfing. Refer to the Certificate to see the list of activities that are covered

- For Age 0-49 years : $50,000 certificate period

- For Age 50-59 years : $30,000 certificate period

- For Age 60-64 years : $15,000 certificate period

What is the process for filing a claim?

Before submitting a claim for payment, it is recommended that you make a copy of all relevant documents and keep it on your person.

- Get the Claim Form and fill it out.

- Please include photocopies of all pages of your passport.

- If you paid cash for a service, please include all relevant bills and receipts.

- All of the above must be submitted no later than 90 days after your provider visit.

Read more about the claims process for travel insurance.

How is this plan different from Atlas America Travel Insurance?

We have covered this in an article, you can read about the differences between the plans.

Bottom Line

The benefits and coverage that Patriot America plus provides outweigh the price of the plan. This temporary medical insurance would be great for your parents or relatives visiting the USA.

We hope this article has helped you understand the international benefits and the coverage that Patriot America Plus provides to non-US residents traveling to the USA for a short period of time.

Make sure you go through the policy’s terms and conditions before purchasing the plan. If you need any help with questions related to the plan do not hesitate to contact our customer service team.

Have a nice trip!