Costco Travel Insurance Review

This Costco Travel Insurance review will help you understand the offering and explore if it is a good alternative for you.

When planning a vacation, securing comprehensive travel insurance is crucial for peace of mind. Many Costco members might wonder if Costco offers travel insurance and what it entails.

This article delves into the Costco travel insurance plan, examining its features, benefits, and costs to help you make an informed decision. If you are a Costco member you can avail an insurance policy for your travel from Costco.

What Is Costco Travel Insurance?

Costco travel insurance cover provided through a partnership with Cover-More, Inc., a renowned travel insurance company known for its extensive coverage and customer service.

This partnership allows Costco to offer travel insurance to its members.

It benefits Costco members as they have access to travel insurance plans that cater to various travel needs, including international travel, domestic travel, and cruise vacations.

Such tie-ups are common AAA members can benefit from options with AAA Travel Insurance, provided in association with Allianz.

Types Of Costco Travel Insurance Plans

Here are the main types of plans available:

- Domestic Trip Protection Plan: Offers coverage for domestic travel within the United States

- International Trip Protection Plan: Perfect for international travel from the USA.

- Coverage For Cruises: Specifically designed for cruises to cover your vacation, providing specialized coverage for cruise-related incidents.

- Rental Cars Coverage: Insurance coverage for rental cars

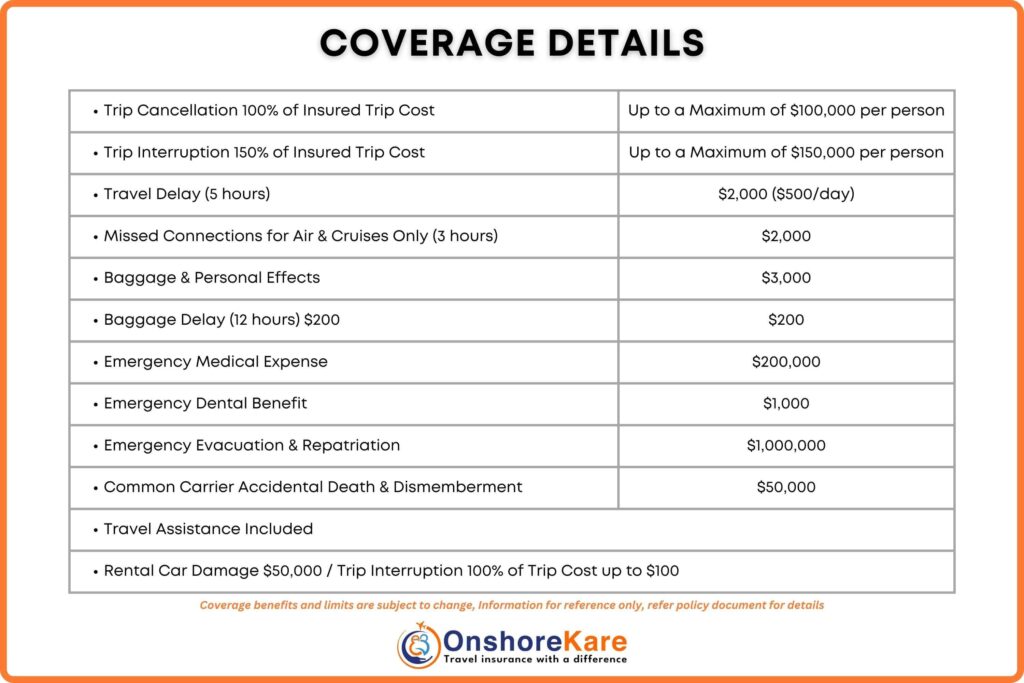

Features And Benefits Of Costco Travel Insurance

Here are the key features and benefits:

| Benefit | Domestic Plan | International Plan |

|---|---|---|

| Trip Cancellation | Up to 100% of non-refundable trip cost due to covered reasons such as severe weather, illness, death, or financial insolvency | Up to 100% of non-refundable trip cost due to covered reasons such as severe weather, illness, death, or financial insolvency |

| Trip Interruption | Up to 150% of trip cost, covering unused expenses and additional transportation to return home or rejoin the trip | Up to 150% of trip cost, covering unused expenses and additional transportation to return home or rejoin the trip |

| Travel Delay | $2,000 ($500/day) for accommodation, meals, or transportation if delayed for 5+ hours for covered reasons | $2,000 ($500/day) for accommodation, meals, or transportation if delayed for 5+ hours for covered reasons |

| Missed Connection (Air & Cruise) | $1,000 for lodging, meals, and unused trip costs due to a delay of 3+ hours for covered reasons | $2,000 for lodging, meals, and unused trip costs due to a delay of 3+ hours for covered reasons |

| Baggage & Personal Effects | $1,000 for loss, theft, or damage to luggage and personal articles ($500/item limit) | $3,000 for loss, theft, or damage to luggage and personal articles ($500/item limit) |

| Baggage Delay | $200 for essential items like clothing and toiletries if baggage is delayed for 12+ hours | $200 for essential items like clothing and toiletries if baggage is delayed for 12+ hours |

| Emergency Medical Expense | $100,000 for sickness or injury while traveling | $200,000 for sickness or injury while traveling |

| Emergency Dental Expense | $1,000 for emergency dental treatment | $1,000 for emergency dental treatment |

| Emergency Evacuation & Repatriation | $500,000 for physician-ordered medical evacuation to your home or hospital of choice. Repatriation of remains included | $1,000,000 for physician-ordered medical evacuation to your home or hospital of choice. Repatriation of remains included |

| Accidental Death & Dismemberment (Common Carrier) | $50,000 for loss of life, limbs, or sight due to a covered accident while on a common carrier | $50,000 for loss of life, limbs, or sight due to a covered accident while on a common carrier |

| Rental Car Damage | $50,000 for damages to rental cars due to covered incidents like accidents, theft, or weather events (excludes certain countries) | $50,000 for damages to rental cars due to covered incidents like accidents, theft, or weather events (excludes certain countries) |

| Cancel For Any Reason (CFAR) | Recover up to 50% of the trip cost for cancellations not covered under standard reasons. Must be purchased within 21 days of initial trip payment and more than 30 days prior to departure | Recover up to 50% of the trip cost for cancellations not covered under standard reasons. Must be purchased within 21 days of initial trip payment and more than 60 days prior to departure |

| Travel Assistance Services | Includes 24/7 support for medical payments, evacuation, prescription replacement, and more | Includes 24/7 support for medical payments, evacuation, prescription replacement, and more |

| Pre-Existing Condition Waiver | Available if plan is purchased within 21 days of initial trip payment and traveler is medically able to travel at the time of purchase | Available if plan is purchased within 21 days of initial trip payment and traveler is medically able to travel at the time of purchase |

1. Trip Cancellation And Interruption

If you need to cancel your trip due to unforeseen circumstances such as illness, family emergencies, or other covered reasons, you can be reimbursed for the non-refundable portion of your trip costs.

Similarly, if your trip is interrupted, you can receive compensation for additional travel expenses incurred to return home.

Trip interruption coverage provides reimbursement for unused trip costs in cases of emergencies, injuries, or illnesses while traveling.

2. Emergency Medical Expenses

Coverage for emergency medical expenses incurred during your trip. This includes costs for hospitalization, surgeries, doctor visits, and medications.

Having this coverage is crucial, especially for international travelers, where medical expenses can be significantly higher.

3. Rental Car Insurance

Another valuable feature is rental car insurance. This coverage protects you from financial liability in case of rental car damage or theft. It’s an essential benefit for those planning to rent a car during their trip, providing peace of mind and saving you from potentially high out-of-pocket costs.

Rental card damage up to $50,000 is covered in the travel insurance plan. So if you are purchasing a travel insurance plan from Costco then can get a rental car damage upgrade instead of purchasing

4. Trip Delay

If your trip is delayed due to reasons such as bad weather, natural disasters, or airline strikes. Insurance covers additional expenses for meals, accommodation, and transportation during the delay.

This ensures you are not left stranded or out of pocket due to unforeseen delays.

5. Baggage Loss And Delay

Covers the cost of lost, stolen, or damaged baggage. Additionally, if your baggage is delayed, the insurance provides compensation for essential items you need to purchase until your baggage arrives. This benefit is especially useful for international travelers who may face longer delays in baggage arrival.

6. Pre-Existing Conditions Waiver

For those with pre-existing medical conditions, you can get a waiver if you purchase your insurance within a specified time frame from your initial trip payment.

This means you can still receive coverage for medical issues related to your pre-existing conditions, provided certain conditions are met.

7. Emergency Assistance Services

Includes access to emergency assistance services 24/7. This service can help with various issues that may arise during your trip, such as medical referrals, travel information, and coordination of emergency transportation.

Access to these services ensures that help is just a phone call away, no matter where you are.

8. Emergency Evacuation And Repatriation

A maximum coverage limit of up to $1,000,000 for emergency evacuation and repatriation. This benefit can help in case of emergency medical evacuation or the case of an unfortunate death of the insured.

Coverage Terms And Exclusions

Understanding the full coverage terms and exclusions of any travel insurance policy is essential to protect you.

Specific terms and exclusions that you need to be aware of:

Covered Situations

- Medical emergencies: Coverage for emergency medical expenses, including hospitalization and emergency evacuations.

- Trip cancellation and trip interruption: Reimbursement for non-refundable trip costs due to covered reasons.

- Baggage issues: Compensation for baggage delay or baggage loss.

- Travel delays: Coverage for additional expenses during delays.

- Rental car damage: Protection for rental car damage or theft.

Exclusions

- Pre-existing conditions: Unless a waiver is obtained, coverage for pre-existing conditions may not be available.

- High-risk activities: Activities such as extreme sports may not be covered.

- Intentional acts: Incidents caused by intentional acts or illegal activities are not covered.

- Travel to certain destinations: Coverage may be limited or excluded for travel to specific high-risk destinations.

Limited Medical Coverage

While substantial emergency medical coverage is provided, it is important to note that it may not cover every medical situation.

Routine check-ups, elective procedures, and certain types of medical care might not be included. Travelers should carefully review the medical coverage terms to understand what is and isn’t covered.

Insurance Policy Exclusions

Insurance policies typically include exclusions that outline scenarios where coverage will not apply. Common exclusions in a Costco travel insurance plan might include:

- Pandemic-related cancellations: May not cover cancellations due to pandemics or epidemics.

- War and terrorism: Incidents related to war or acts of terrorism might not be covered.

- Self-inflicted injuries: Injuries resulting from self-harm or reckless behavior.

How To Purchase Costco Travel Insurance

You can buy travel insurance online through the Costco Travel website or by visiting a Costco warehouse.

Here are the steps to follow:

- Visit the Costco Travel Website: Go to the Costco Travel website and navigate to the travel insurance section.

- Choose Your Plan: Select the travel insurance plan that best suits your needs. Consider factors such as the length of your trip, destinations, and any additional coverage you might require.

- Get a Quote: Enter your trip details to receive a quote. This will give you an estimate of the Costco travel insurance cost based on your specific trip.

- Purchase Your Plan: Once you are satisfied with the coverage and cost, proceed to purchase the insurance policy. Make sure to review the terms and conditions carefully before finalizing your purchase.

Are there alternatives?

Yes, there are several options available in the open market:

- Travel medical insurance options

- Trip Insurance plans including coverage for Cruises

- Travel assistance plans with pre-existing conditions coverage

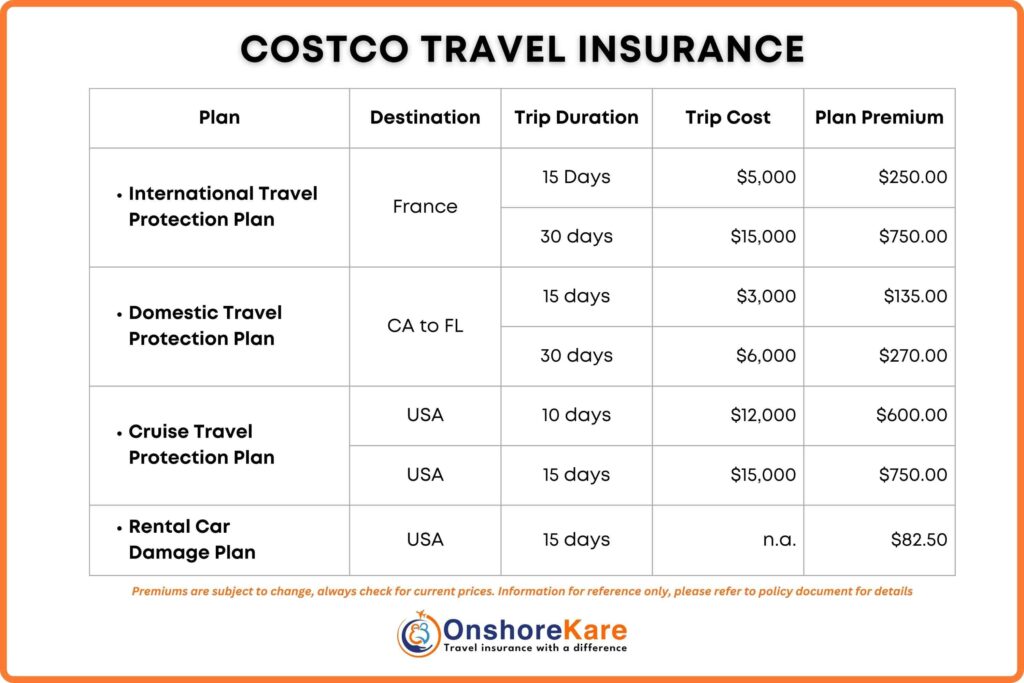

How Much Does Costco Travel Insurance Cost?

Costco travel insurance premiums:

The cost can vary significantly depending on several factors including the type of plan you choose, the total trip cost, the duration of your trip, and the age and health of the travelers.

- On average, travel insurance costs range from 4% to 10% of the total trip cost.

- For example, if your trip costs $5,000, you can expect to pay between $200 and $500 for travel insurance.

- Factors such as higher coverage limits, additional riders for specific risks, and optional upgrades (like rental car damage upgrades) can also affect the premium.

Coverage Details:

Before you finalize an insurance option, it’s essential to obtain a quote specific to your trip details & potential risks.

This will help to understand the exact cost and ensure it fits within your budget while providing adequate coverage.

Factors Influencing The Costco Travel Insurance Cost

The cost varies based on several factors, including the type of plan, trip duration, destination, and age of the travelers. Generally, travel insurance costs range from 4% to 10% of the total trip cost.

Here are some factors that influence the cost:

- Trip Length: Longer trips typically result in higher insurance costs.

- Destination: International travel insurance is usually more expensive than domestic travel insurance due to higher medical and evacuation costs abroad.

- Age of Travelers: Older travelers may face higher premiums due to increased health risks.

- Coverage Amount: Higher coverage limits for medical expenses, trip cancellations, and other benefits can increase the premium.

Why Choose Costco Travel Insurance?

The insurance coverage from. Costco comes with several advantages:

1. Exclusive Member Benefits

Costco members often enjoy exclusive travel deals and buy insurance from one single platform i.e. Costco Travel. This can result in significant savings compared to purchasing insurance through other providers.

2. Comprehensive Coverage

Plans offer comprehensive coverage, including trip cancellation, medical expenses, insurance for rental cars, and more. This ensures you are well protected against various travel-related risks.

3. Trusted Provider

By partnering with Cover-More, Inc., Costco ensures that its members receive high-quality travel insurance from a reputable company known for its excellent service and reliable coverage.

4. Easy Purchase Process

Purchasing Costco travel insurance is simple and convenient, whether you choose to buy online or in-store. The process is user-friendly, and customer support is available to assist with any questions or concerns.

5. Coverage for International Travelers

For those traveling abroad, the plans provide essential coverage, including emergency medical expenses and evacuation services. This is particularly important as medical costs can be exorbitant in some countries, and having insurance ensures you won’t be burdened with unexpected expenses.

6. Flexibility and Customization

Plans offer flexibility and can be customized to meet your specific needs. Whether you are looking for basic coverage or more comprehensive protection, you can find a plan that fits your requirements and budget.

7. Strong Customer Support

Robust customer support, ensuring that you can get help whenever you need it. Whether you have questions before purchasing a policy or need assistance while traveling, Costco’s customer service is there to provide support.

You can compare plans & prices from different providers and Costco travel insurance costs before purchasing.

Tips For Choosing The Right Travel Insurance

When selecting a travel insurance policy, it’s essential to consider your specific needs and travel plans. Here are some tips to help you choose the right travel insurance:

1. Assess Your Travel Needs

Consider the nature of your trip, including the destination, duration, and activities you plan to undertake. This will help you determine the level of coverage you need. For example, if you’re traveling abroad, ensure you have adequate medical coverage and emergency assistance services.

2. Compare Different Plans

Take the time to compare various insurance plans offered by Costco. Look at the coverage details, benefits, exclusions, and costs. This will help you find a plan that offers the best value for your money.

3. Read The Fine Print

Carefully review the terms and conditions of the travel insurance policy. Pay attention to the exclusions and limitations to understand what is and isn’t covered. This will help

you avoid any surprises in case you need to make a claim.

4. Check For Pre-Existing Conditions Coverage

If you have any pre-existing medical conditions, ensure that the travel insurance policy offers coverage for them. Look for plans that include a pre-existing conditions waiver and understand the requirements for obtaining this coverage.

5. Consider The Cost

While cost should not be the only factor in your decision, it is important to consider your budget. Look for a travel insurance plan that offers comprehensive coverage at a reasonable price. Remember, the cheapest plan may not always provide the best protection.

6. Look For Additional Benefits

Some travel insurance plans come with additional benefits such as rental car protection, trip delay coverage, and baggage loss compensation. Consider these extras when choosing a plan, as they can provide added peace of mind.

Conclusion

In conclusion, this is a valuable option for Costco members looking to protect their travel investments. With comprehensive coverage, competitive pricing, and the backing of a trusted provider like Cover-More, Inc. Best is to buy a plan immediately after your initial trip payment.

Costco offers peace of mind for both domestic and international travelers. Before purchasing, it is essential to review the full coverage terms and exclusions to ensure the policy meets your specific needs.

By doing so, you can enjoy your next trip with confidence, knowing you are well-protected against unforeseen events.

Whether you are planning a family vacation, a solo adventure, or a business trip, having reliable travel insurance is essential. Their range of plans to suit different needs ensures that you can travel with peace of mind.

So, for your next trip, consider the benefits of Costco travel insurance and make an informed decision to protect yourself and your loved ones.

If you need a travel medical insurance option then you need to consider alternatives.