Patriot America Plus Review – August 2023

Patriot America Plus is a travel medical insurance plan that provides comprehensive coverage for both medical coverage and other travel-related coverage and includes emergency medical services for visitors to the United States during their travel and temporary stay outside of their home country.

Key Features Of This Best-Selling Temporary Medical Insurance Plan

- Patriot America Plus insurance is a comprehensive coverage temporary health insurance

- Patriot America Plus is designed to address the needs of non-US residents requiring temporary medical insurance coverage while traveling to the U.S. for pleasure or business

- The plan is available to individuals, Families, and Groups ( five or more travelers) traveling to the U.S.

- Patriot America provides a wide range of plan maximum and deductible options for eligible medical expenses

- The plan is available for a minimum of 5 (five) days up to a maximum of 2 (two) years

- Patriot America is available 24 hours a day and offers a complete package of international benefits

- Patriot America offers excellent benefits and services to meet global travel needs to process claims worldwide like:

- Access to international, multilingual customer service centers

- Claims administrators

- In virtually every language and currency

- In times of need, of emergency medical services and international treatment, you have 24-hour access to highly qualified coordinators

| Plan | Comprehensive Coverage Plan |

| Administrator | by IMG – International Medical Group |

| Plan Underwritten by | Sirius Specialty Insurance Corporation |

| A.M. Best Rated | A |

| PPO Network | United Healthcare PPO Network |

| Covers | Non-US Citizens(traveling) |

| Covers | Green Card Holders |

| Covers | U.S. citizens living abroad, briefly visiting the U.S. (As long as their country of residence is outside the U.S.) And they intend to return to their country of residence |

Get acquainted with the Top 10 Reasons to Buy Patriot America Plus for Parents Visiting USA

This plan is a complete package. Other similar plans with international benefits are:

- Atlas America Comprehensive Coverage Plan

- Safe Travels USA Comprehensive Coverage Plan

- INF Elite Plan for Pre-Existing Conditions Coverage

Please note: Atlas America and Safe Travels USA Comprehensive provide coverage for the acute onset of pre-existing conditions. INF Elite needs to be purchased for a minimum of 90 days.

Patriot America Plus Travel Insurance Plan Includes

Inpatient and outpatient services like:

- Emergency Room Intensive Care

- Urgent Care Clinic

- Physicians Visits

Emergency Services like:

- Local Ambulance

- Return of Mortal Remains

- Return of Minor Child

- Natural Disaster Evacuation

Other Services Like:

- Lost Luggage

- Identity Theft

- Dental Treatment

- Emergency Eye Exam

- Prescription Medication

- Pet Return

- Accidental Death and Dismemberment

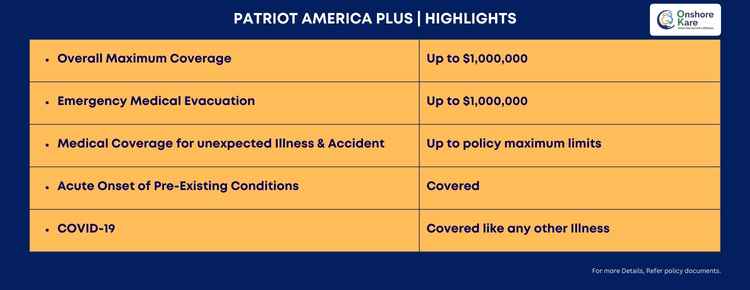

Patriot America Plus Highlights

- Maximum limits from $50,000 up to $1,000,000

- Emergency Medical Evacuation coverage up to $1,000,000

- Medical coverage for unexpected illness and accidents up to policy maximum limits

- Offers Acute Onset of Pre-Existing Conditions coverage

- COVID-19 covered the same as any other illness

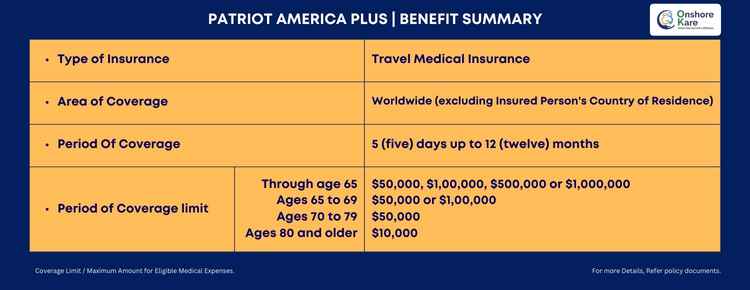

Patriot America Plus Travel Medical Insurance Benefits Summary

- Type of Insurance: Travel Medical Insurance

- Minimum Age For Coverage: Must be 14 days old

- Coverage Duration: 5 days up to 12 months

- Renewable: Up to 24 months of continuous coverage

- Area of Coverage: Worldwide (excluding the insured person’s country of residence)

- Maximum Limits: $50,000, $100,000, $500,000, $1,000,000

- Period Of Coverage Limit: As indicated in the declaration

- Through age 65: $50,000, $100,000, $500,000, or $1,000,000

- Ages 65 to 69: $50,000 or $100,000

- Ages 70 to 79: $50,000

- Ages 80 and older: $10,000

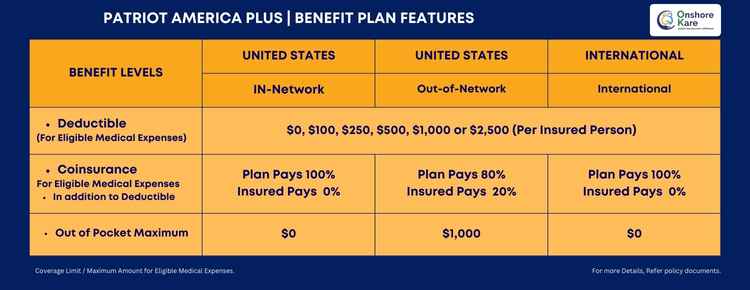

- Individual Deductible Options: $0, $100, $250, $500, $1,000, $2,500 (Per insured person)

- Coinsurance:

- For treatment received in the U.S.:

- In the PPO Network: The Plan pays 100%

- Out of the PPO Network: The plan pays 80% of eligible expenses up to $5,000, then 100%

- For treatment received in the U.S.:

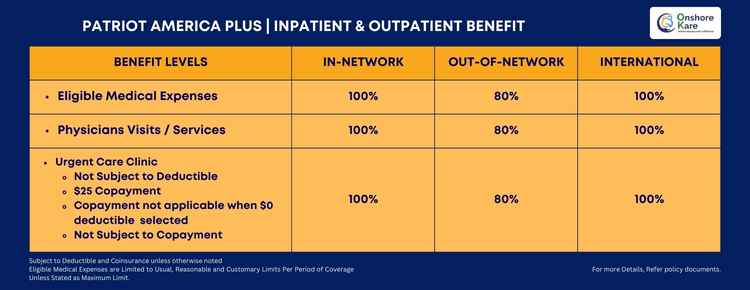

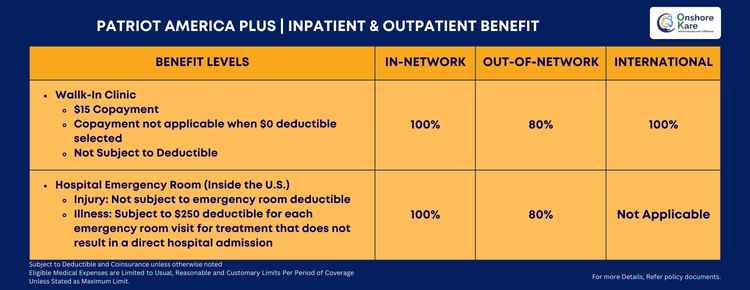

Inpatient Or Outpatient Services

- Eligible Medical Expenses: Up to the maximum limit

- Physicians Visits/Services: Up to the maximum limit

- Urgent Care: Urgent Care Clinic

- $25 Copay

- Co-pay is not applicable when a $0 deductible is selected

- Not subject to deductible

- Walk-In Clinic: $15 Copay

- Co-pay is not applicable when a $0 deductible is selected

- Not subject to deductible

- Hospital Emergency Room (Inside the U.S.):

- Injury: not subject to emergency room deductible

- Illness: Subject to a $250 deductible for each emergency room visit for treatment that does not result in direct inpatient hospital admission. up to the maximum limit

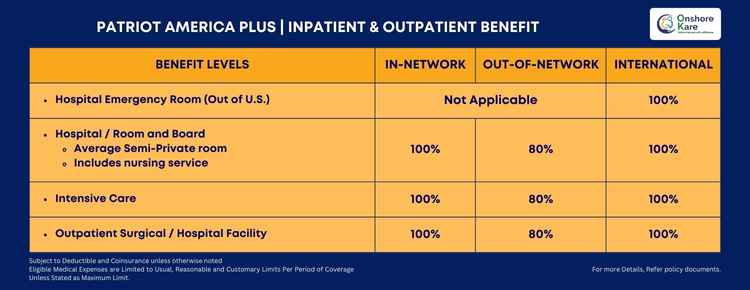

- Hospital Emergency Room (Outside the U.S.): Up to the Maximum limit

- Hospital Room And Board: Average semi-private room rate

- Up to the maximum limit

- Includes nursing service

- Intensive Care: Up to the Maximum limit

- Outpatient:

- Outpatient Surgical/Hospital Facility: Up to the maximum limit

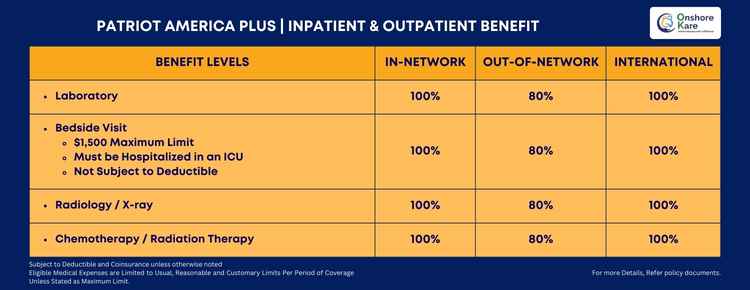

- Laboratory: Up to the maximum limit

- Bedside Visit: $1,500 maximum limit

- Must be hospitalized in an intensive care unit

- Not subject to deductible

- Radiology/X-ray: Up to the Maximum Limit

- Chemotherapy/Radiation Therapy: Up to the maximum limit

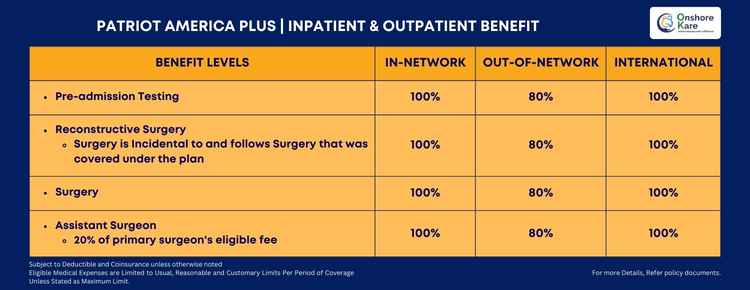

- Pre-Admission Testing: Up to the maximum limit

- Surgery: Up to the maximum limit

- Reconstructive Surgery: Up to the maximum limit

- Surgery is incidental to and follows surgery that was covered under the plan

- Assistant Surgeon: 20% of the primary surgeon’s eligible fee

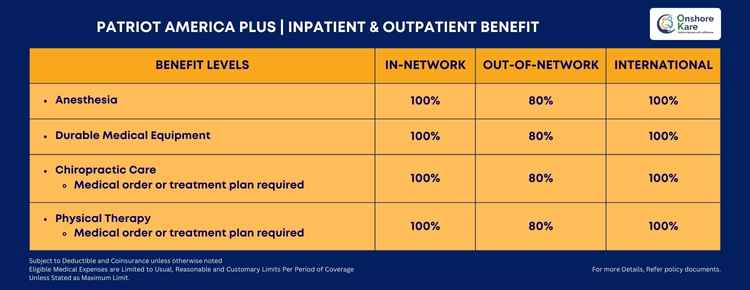

- Anesthesia: Up to the maximum limit

- Durable Medical Equipment: Up to the maximum limit

- Chiropractic Care: Up to the maximum limit

- Medical order or treatment plan required

- Physical Therapy: Up to the maximum limit

- Medical order or treatment plan required

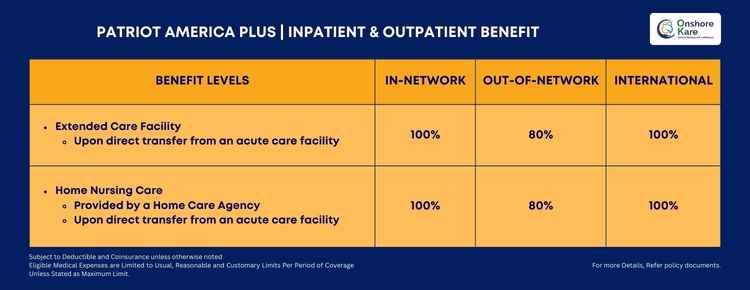

- Extended Care Facility: Up to the maximum limit

- Upon direct transfer from an acute care facility

- Home Nursing Care: Up to maximum limits

- Upon direct transfer from an acute care facility

NOTE:

Inpatient or Outpatient are subject to deductible and coinsurance unless otherwise noted Eligible medical expenses are limited to usual. reasonable and customary limits per period of coverage unless stated as the maximum limit.

Prescription Drugs and Medication

- Prescription Drugs and Medications: Up to the plan maximum limits

- May not exceed $250,000 per period of coverage

- Dispensing limit per prescription: 90 days

Emergency Services

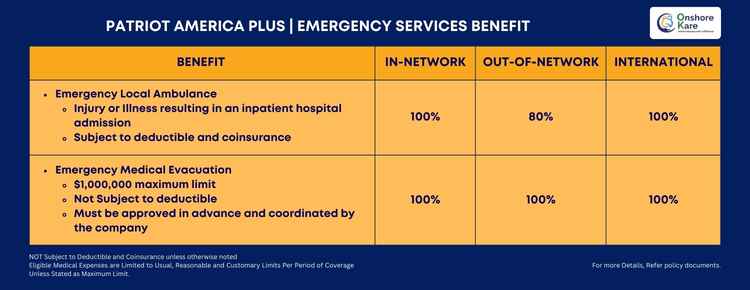

- Emergency Local Ambulance: Up to the maximum limit

- Subject to deductible and coinsurance

- Injury or Illness resulting in an inpatient hospital admission

- Emergency Medical Evacuation: $1,000,000 maximum limit

- Not subject to deductible

- Must be approved in advance and coordinated by the company

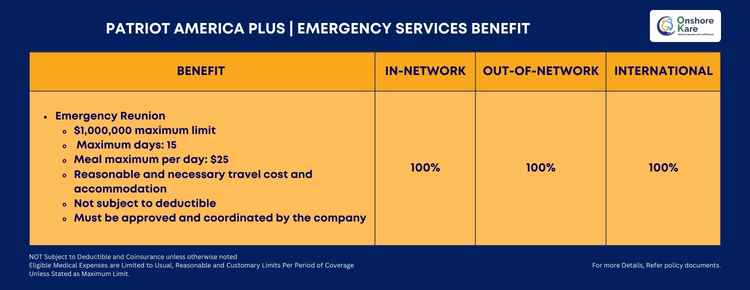

Emergency Reunion: $1,000,000 maximum limit

- Maximum days: 15

- Meal (maximum per day): $25

- Reasonable and necessary travel costs and accommodations

- Not subject to deductible

- Must be approved in advance and coordinated by the company

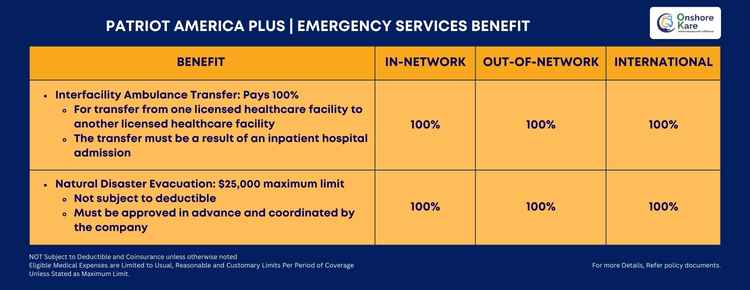

- Interfacility Ambulance Transfer: Pays 100%

- For transfer from one licensed healthcare facility to another licensed healthcare facility

- The transfer must be a result of an inpatient hospital admission

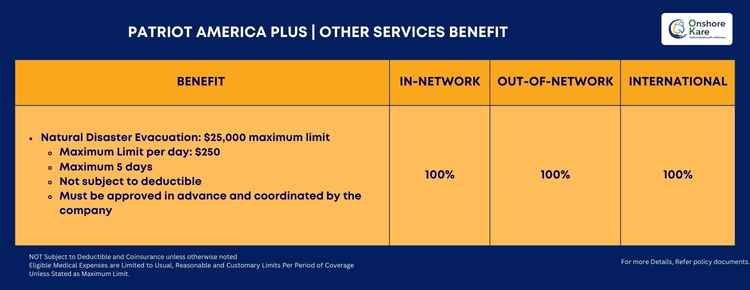

- Natural Disaster Evacuation: $25,000 maximum limit

- Not subject to deductible

- Must be approved in advance and coordinated by the company

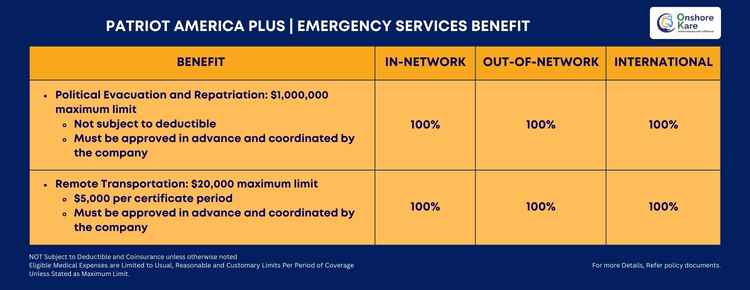

- Political Evacuation and Repatriation: $1,000,000 maximum limit

- Not subject to deductible

- Must be approved in advance and coordinated by the company

- Remote Transportation: $20,000 maximum limit

- $5,000 per certificate period

- Must be approved in advance and coordinated by the company

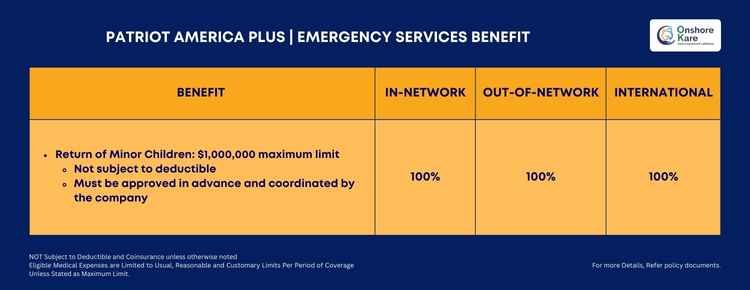

Return of Minor Children: $1,000,000 maximum limit

- Not subject to deductible

- Must be approved in advance and coordinated by the company

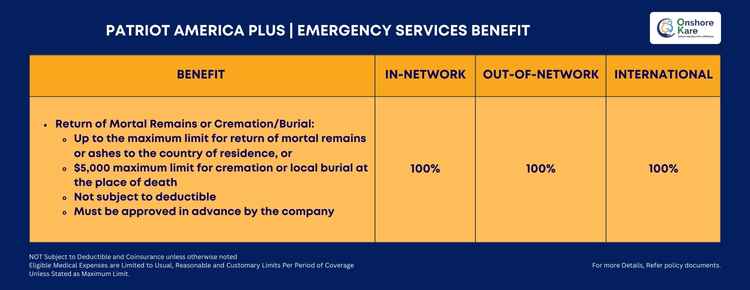

- Return of Mortal Remains or Cremation/Burial:

- Up to the maximum limit for the return of mortal remains or ashes to the country of residence, or

- $5,000 maximum limit for cremation or local burial at the place of death

- Not subject to deductible

- Must be approved in advance by the company

Other Services

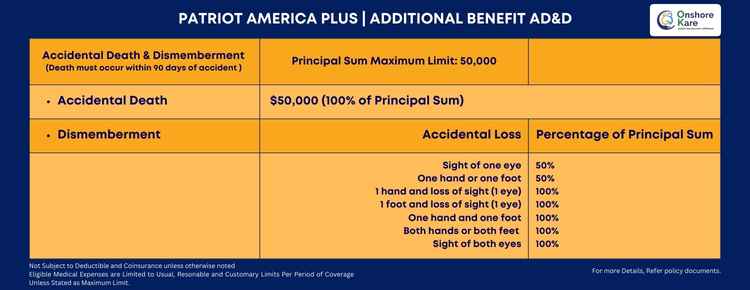

Accidental Death and Dismemberment: $50,000 principal sum

- Death must occur within 90 days of the accident

- Not subject to deductible

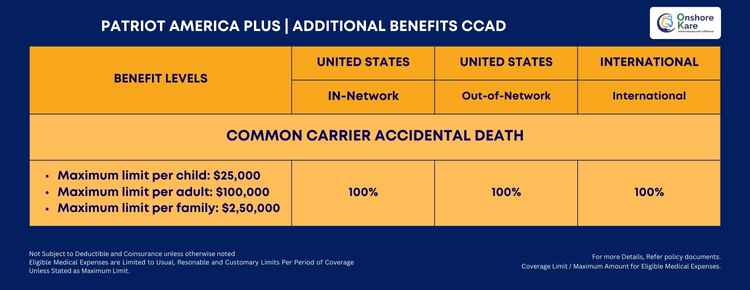

Common Carrier Accidental Death:

- $25,000 per injured child

- $100,000 per injured adult

- $250,000 maximum limit per family

- Not subject to deductible

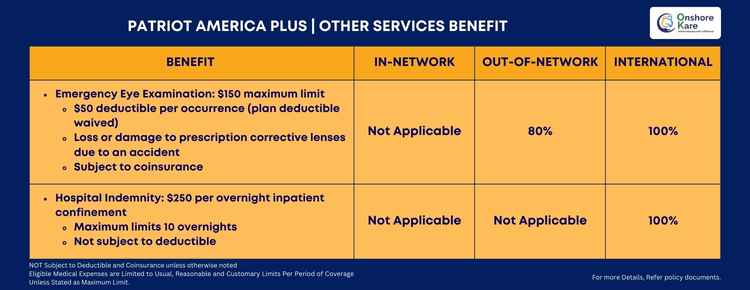

- Emergency Eye Examination: $150 maximum limit

- $50 deductible per occurrence (plan deductible waived)

- Loss or damage to prescription corrective lenses due to an accident

- Subject to coinsurance

- Hospital Indemnity: $250 per overnight inpatient confinement

- Maximum limits 10 overnights

- Not subject to deductible

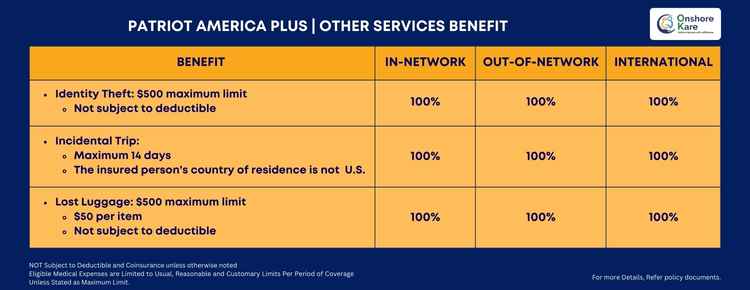

- Identity Theft: $500 maximum limit

- Not subject to deductible

- Incidental Trip:

- Maximum 14 days

- The insured person’s country of residence is not the U.S.

- Lost Luggage: $500 maximum limit

- $50 per item

- Not subject to deductible

Natural Disaster:

- Maximum Limit per day: $250

- Maximum 5 days

- Not subject to deductible

- Must be approved in advance and coordinated by the company

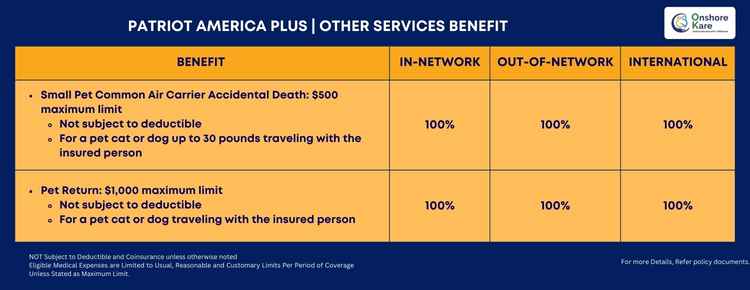

- Pet Return: $1,000 maximum limit

- Not subject to deductible

- For a pet cat or dog traveling with the insured person

- Small Pet Common Air Carrier Accidental Death: $500 maximum limit

- Not subject to deductible

- For a pet cat or dog up to 30 pounds traveling with the insured person

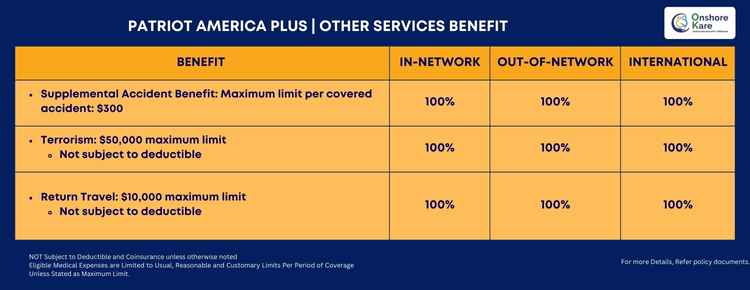

- Supplemental Accident Benefit: Maximum limit per covered accident: $300

- Terrorism: $50,000 maximum limit

- Not subject to deductible

- Return Travel: $10,000 maximum limit

- Not subject to deductible

Personal Liability:

- $25,000 combined maximum limit

- Injury to a third person: $100 per injury deductible

- Damage to a third person property: $100 per damage deductible

- No coverage for injury to a related third party or damage to a related third person’s property

- Secondary to any other insurance

Dental Benefits

Traumatic Dental Injury:

- Up to the maximum limit

- For treatment at a hospital facility due to an accident

- Additional treatment for the same injury rendered by a dental provider will be paid at 100%

- Subject to deductible and co-insurance

Dental Treatment:

- $300 maximum limit

- Due to dental accident or unexpected pain to sound natural teeth

- Subject to deductible and coinsurance

COVID-19 Benefits

- COVID-19/SARS-Cov-2 Coverage: Same as any other illness or injury(subject to all other terms and conditions of Patriot America Plus Insurance)

Pre-Existing Condition Coverage

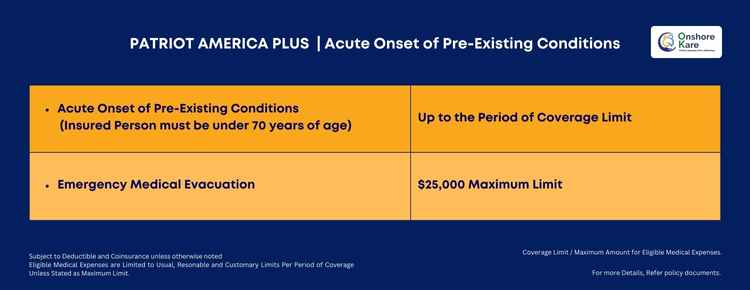

Covers Acute onset of pre-existing conditions: Up to the maximum limit

- $25,000 maximum limit for emergency medical evacuation

If you experience a sudden and unexpected outbreak or recurrence of a Pre-Existing Condition, this coverage provides:

- The necessary emergency care for any medical emergency is:

- Life-threatening or

- Requires immediate medical treatment

To be eligible for limited coverage and benefits for Acute Onset of Pre-Existing Condition as per the insurance company the following conditions and restrictions must be met at the time of Acute Onset of Pre Existing Condition:

- The insured person must be under 70 years of age

- The insured person must be traveling outside their country of residence

- Treatment must be obtained within 24 hours of the sudden and unexpected outbreak or recurrence

- The pre-existing condition must have been stabilized for at least 30 days prior to the effective date without a change in treatment

- The insured person must be traveling outside their country of residence

- The insured person must not be traveling against or in disregard of the recommendations, established treatment programs, or medical advice of a physician or the healthcare provider

Adventure Sports Rider

The adventure sports rider provides coverage for injuries sustained during certain extreme sports

Lifetime maximum amounts are listed below:

- $50,000: Age 0-49 years

- $30,000: Age 50-59 years

- $15,000: Age 60-64 years

Insurance Cost

The cost of Patriot America Plus insurance varies depending on several factors, including the age of the traveler, the length of insurance coverage, the plan limit, and the deductible

The higher the plan limit, the higher the premium, while the higher the deductible, the lower the premium

The cost Patriot America Plus insurance can be obtained by providing the travel dates and passport details of the traveler.

Purchase Patriot America Plus Travel Insurance Plans

- We provide the IMG Patriot America plan, get instant free no-obligation quotes

- You can make an instant purchase online on our Travel Insurance Marketplace

- You can also compare plans

- No medical exam needed

- The application requires:

- Date of Birth

- Passport Number

- Name

- Home Country Address

- Travel Dates

What Coverage And Benefits Are Offered By Patriot America Plus Insurance

The following are the coverage and benefits offered by Patriot America Plus Insurance:

- Medical Coverage: Provides medical coverage for medically necessary, usual, reasonable, and customary charges only. The plan offers policy maximums from $50,000 to $1,000,000.

- Emergency Medical Evacuation: The plan covers emergency medical evacuation up to the policy’s maximum

- Coverage for Adventure Sports: The plan offers coverage for adventure sports

- COVID-19 Coverage: The plan offers COVID-19 coverage, including acute onset of pre-existing conditions

- Coverage for Accidental Death and Dismemberment: The Plan provides coverage for accidental death and dismemberment

- Coverage for Repatriation of Remains: The plan provides coverage for the repatriation of remains

- Cancellation: If you cancel your coverage, you will be required to pay a $50 cancellation fee, and only full-month premiums will be considered for refunds. If you have filed claims, your premium is nonrefundable

- Plan Options: The Insurance has three plan options: Patriot Lite America, Patriot Plus America, and Patriot Platinum America. Each plan has different maximum limits, deductibles, and coinsurance options

- Coinsurance: Coinsurance for in-network services is 100%, while coinsurance for out-of-network services ranges from 80% up to $5,000 to 90% up to $5,000, depending on the plan

Patriot America Plus Travel Insurance – Common Questions

1. What is Patriot America Plus?

It is a visitors’ insurance plan and is one of the most popular comprehensive plans available in the market.

2. Is Patriot America Plus a good insurance for travel to the United States?

This is a popular insurance plan for travel to the U.S.

3. What does Patriot America Plus insurance cover?

The insurance plan provides coverage for medical expenses, emergency medical evacuation, repatriation of remains, accidental death and dismemberment, and more

4. How much does Patriot America Plus insurance cost?

The cost depends on factors such as the age of the traveler, the length of insurance coverage, the plan limit, and the deductible. The higher the plan limit, the higher the premium, while the higher the deductible, the lower the premium

5. How can I buy Patriot America Plus insurance?

To buy, you will need the travel dates and passport details of the traveler, including the name, date of birth, passport number, and travel dates. For five or more travelers consider Group Travel Insurance

6. Is Patriot America Plus insurance refundable if I cancel?

If you cancel your coverage, you will be required to pay a $50 cancellation fee, and only full-month premiums will be considered for refunds. If you have filed claims, your premium is nonrefundable

7. Does Patriot America Plus cover COVID-19?

Yes, Patriot America Plus offers COVID-19 coverage, including acute onset of pre-existing conditions

8. What is the coverage for Emergency Medical Evacuation?

Patriot America Plus covers emergency medical evacuation up to the policy maximum

9. Is there coverage for Adventure Sports?

Yes, Patriot America Plus offers coverage for adventure sports

Patriot America Plus Insurance Review

Patriot America Plus is an in-demand and one of the best-selling plans for parents visiting the USA.

This plan could be an excellent choice for you based on:

- It is a comprehensive travel medical insurance plan

- The plan is suitable for non-U.S. residents traveling to the USA

- The plan is underwritten by SiriusPoint Specialty Insurance Corporation

- Rated A (Excellent) by A.M. Best

- It offers policy maximum options from $50,000 to $1,000,000

- It offers deductible options ranging from $0 to $2,500

- Covers medical expenses, emergency medical evacuation, repatriation of remains, & more

- Covers acute onset of pre-existing conditions up to the policy maximum for ages below 70

- It provides the option to purchase the plan online and offers extension and renewal options

- The plan has 100% coinsurance for in-network services up to the policy maximum

Overall, our review is very positive and is considered a reliable and comprehensive option for visitors to the USA. It offers a range of coverage options, and flexibility in terms of policy duration, and is backed by reputable insurance providers i.e. International Medical Group (IMG).

We always recommend reviewing the specific terms and conditions of the policy you plan to purchase and consult with the insurance provider for detailed information.

At OnshoreKare we have licensed agents who can help you clear your doubts and address any questions you may have, you can reach them at +1 855 652 5565 or email info@onshorekare.com.