Atlas America Insurance Information And Benefits

Atlas America insurance is a popular travel medical insurance plan specifically designed for Non-US Citizens (Foreign Nationals) traveling outside their home country, visiting the United States.

It offers a range of benefits, including coverage for unexpected medical expenses, emergency medical evacuation, and more, ensuring travelers have peace of mind during their stay in the U.S.

Atlas travel insurance plan has proven to be a massive hit amongst parents, international students, and foreign tourists visiting the USA and internationally. It is one of the best selling temporary medical insurance plan.

The Atlas America insurance plan provides coverage for unexpected medical expenses, Emergency Travel Benefits, and multilingual Travel Assistance Services.

Watch a small video on Atlas America Insurance

Who Can Buy Atlas America Insurance?

This short-term medical insurance plan is best suited for:

- Parents visiting children in the U.S.

- Tourists and leisure travelers

- Business professionals on short-term assignments

- Parents, Relatives, or, In-Laws visiting the USA

- Foreign Tourists visiting the USA

- Individuals traveling to the USA for Business or Pleasure

- International travelers traveling outside their home country

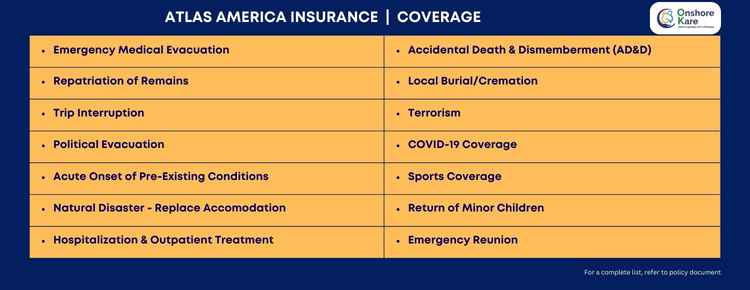

Core Benefits Of Atlas America Insurance

Detail the primary benefits offered by the Atlas America plan, providing specific information and examples where applicable.

- Policy Maximums:

- Ages 14 days to 64 years: $50,000 to $2,000,000

- Ages 65 to 79: $50,000 or $100,000

- Age 80 and above: $10,000

- Deductible Options:

- $0, $100, $250, $500, $1,000, $2,500, or $5,000 per certificate period

- Coinsurance:

- 100% coverage of eligible expenses after the deductible, up to the overall maximum limit

- Emergency Medical Evacuation

- Coverage up to $1,000,000 for emergency medical evacuation

- Acute Onset of Pre-Existing Conditions

- Coverage for acute onset of pre-existing conditions up to the policy maximum for individuals under age 80

- COVID-19 Coverage

- COVID-19 is treated like any other eligible medical condition if contracted after the policy effective date

- Additional Benefits

- Emergency Dental Treatment:

- Up to $300 for sudden dental pain relief

- Emergency Dental Treatment:

- Emergency Room Services:

- $200 co-payment for each use of emergency room for illness, unless admitted to the hospital

- Urgent Care Visits:

- $15 co-payment for each visit; co-payment is waived for members with a $0 deductible

- Prescription Medication:

- Coverage for eligible prescriptions

- Trip Interruption:

- Up to $10,000 for trip interruption due to covered reasons

- Lost Checked Luggage:

- Up to $1,000 for lost checked luggage

- Accidental Death and Dismemberment (AD&D):

- Up to $25,000 for accidental death and dismemberment

Policy Flexibility: Purchase, Extension, and Cancellation

Provide information on the flexibility of the Atlas America Insurance policy.

Purchase:

- Available for purchase online with instant confirmation

- No medical examination required

Extension:

- Policies can be extended online before expiration, up to a maximum of 364 days

Cancellation:

- Pro-rated refunds available for unused coverage, minus a $25 cancellation fee, provided no claims have been filed

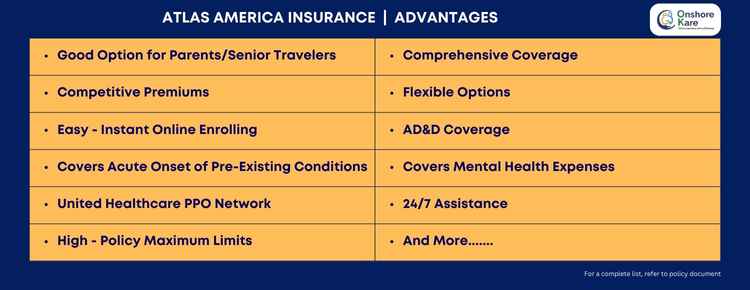

Why Choose Atlas America Insurance Plan – Advantages

Atlas America provides important travel assistance features and services such as:

- Doctor and Hospital Referrals

- Translation assistance while being treated

- Assistance in replacing lost prescriptions

- Service for Lost Luggage

- In a crisis (like a terrorist attack)

This plan is provided by WorldTrips– a leading travel insurance provider based in the USA. They provide 24/7 customer service for Atlas America Members and provide assistance in making emergency travel arrangements in the event of

- Medical Emergencies

- Political Evacuation

- Natural Disasters

To know more about the reasons to buy Atlas America Travel Insurance visit see this video on our YouTube channel: 10 reasons to buy Atlas America Travel Insurance

How To Purchase Atlas America Insurance

Guide readers through the process of obtaining the insurance.

- Obtain a Quote:

- Visit the OnshoreKare website or authorized distributors

- Select Coverage Options:

- Choose policy maximum, deductible, and coverage dates

- Complete Application:

- Provide necessary personal and travel information

- Make Payment:

- Pay securely online using a credit card

- Receive Documentation:

- Instantly receive policy documents and ID cards via email

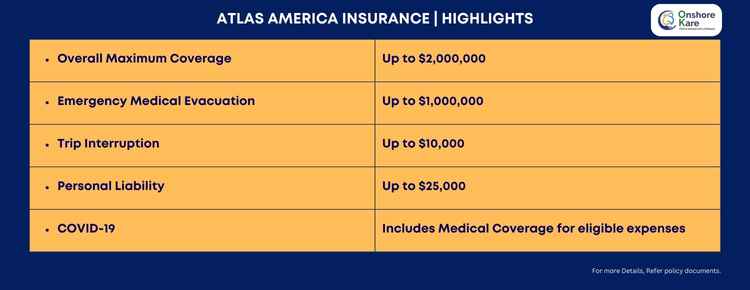

Atlas America Insurance Highlights

- Overall Maximum Coverage: Up to $2,000,000

- Emergency Medical Evacuation: Up to $1,000,000

- Trip Interruption: Up to $10,000

- Personal Liability: Up to $25,000

- COVID-19: Includes medical coverage for eligible medical expenses related to COVID-19

What Is Atlas America Insurance?

Atlas America is a comprehensive visitors health insurance plan for international travelers (Non-US citizens) traveling outside their home country, or traveling to the USA.

It provides coverage for medical expenses, emergency medical evacuation, and other travel and emergency services and customizable deductibles and policy maximum

The Atlas insurance plan provides international coverage to overseas travelers and offers important benefits like

- Emergency Medical Evacuation

- Hospital Room & Board

- Local Ambulance

- Pet Return

- Acute Onset of Pre-Existing Condition

- Repatriation of Remains

- Travel Delay

- Lost Checked Luggage

- Lost or Stolen Passport/Travel Visa

- Accidental Death & Dismemberment

- And More…

Atlas America Insurance Plan Other Travel Assistance Services

- Emergency Travel Arrangements

- Dispatch of Physicians

- Prescription Drug Replacement

- Credit Card/Traveler’s Check Replacement

- Translation Assistance

Flexible Features

This atlas insurance plan has flexible features:

- Coverage Duration: The plan can be purchased for a minimum of 5 days, It can be extended for a minimum of 1 day up to 364 days.

- Policy Return: If you have to return back before the policy effective date you get a refund for the unused portion

- A $25 cancellation fee applies and is deducted as long as no claim is submitted from the original effective date of the policy

- Deductible Options: $0, $100, $250, $500, $1,000, $2,500, and $5,000

- Policy Maximum: range from $50,000 to $2,000,000

Eligibility

- U.S. Citizens and Non-U.S. Citizens traveling outside their home country

- U.S. Citizens and Residents are not eligible for coverage within the U.S.

- The minimum age for coverage is 14 days

- The minimum coverage period is 5 days

- The maximum coverage period is 364 days

- Not available to individuals residing in the U.S. for more than 365 days

- The overall maximum limit for ages under 65 years is $50,000 to $2,000,000

- The overall maximum limit for ages 65 to 79 is $100,000

- The overall maximum limit for age 80 or older is $10,000

Atlas America Schedule of Benefits and Plan Details

Atlas America Plan Details

- Plan Administrator: WorldTrips

- Underwriter: Lloyd’s of London

- Deductibles(Per certificate period): $0, $100, $250, $500, $1,000, $2,500, or $5,000

- Overall Maximum limit:

- Age 80 or Older: $10,000

- Age 65 to 79: $50,000, or $1,00,000

- All Others: $50,000, $1,00,000, $250,000, $500,000, $1,000,000, or $2,000,000

- Coinsurance: 100% of eligible expenses after the deductible up to the overall maximum limit

- NOTE: Eligible expenses are subject to deductible, Overall maximum limit, and are Per certificate period unless specifically indicated otherwise

Participates In The United Healthcare Preferred Provider Organization (PPO) Network

Key Points:

- Access to the United Healthcare PPO network, offering a wide range of physicians and hospitals across the U.S.

- Direct billing arrangements with in-network providers, reducing out-of-pocket expenses

- Negotiated rates with in-network providers, leading to potential cost savings

Atlas America participates in the United Healthcare PPO Network (At United Healthcare PPO Network you can access many Physicians, Hospitals, and Providers in most parts of America)

- If you visit an In-Network provider they generally bill the insurance company directly and charge you only pay the network-negotiated fees (typically lower than their regular fees)

Atlas America Insurance Plan – Get Instant Quotes And Purchase Instantly

The Plan has a unique feature as compared to other visitors’ insurance plans. The insurance policy’s effective date can be the same day it is bought.

Atlas America visitors’ health insurance plan provides instant quotes and you can purchase Atlas America insurance policy instantly.

Coverage for this plan can be purchased instantly online:

Certificate Effective Date

Insurance is effective on the later of:

- If application and payment is made online or by fax

- The moment the company receive your application and correct premium

- If application and payment is made by mail

- 12:01 am U.S. Eastern Time on the date the company receive an application and correct premium

The moment you depart from your home country

12:01 am U.S. Eastern Time on the date requested on the application (if correct premium is received by the company)

Certificate Termination Date

Insurance terminates on the earliest of:

- 11:59 pm U.S. Eastern Time on the last day of the premium (For which premium is paid)

- 11:59 pm U.S. Eastern Time on the date requested on the application

- The moment you arrive upon your return to your home country (unless you have started a benefit period or are eligible for home country coverage)

Atlas America Insurance Cost

The cost of the plan varies depending on the coverage length, deductible, and policy maximum.

- Costs will increase with a lower deductible or increase with a higher deductible

- The cost of the insurance plan starts at $1.49 per day

- On average, the premiums range from as little as $2.00 per day to as much as $4.00 per day

- You can generate a quick free no obligation quote and compare it with other plans

Please note that the premium costs depend on several factors including the age of the person insured.

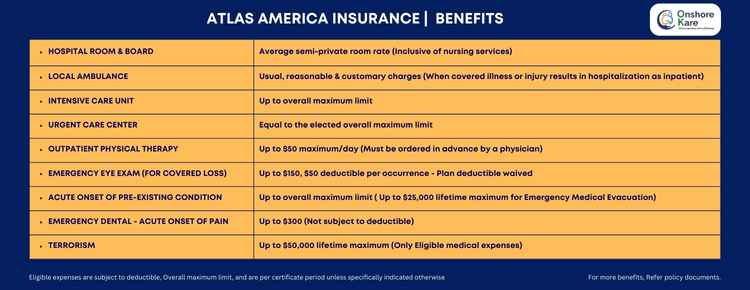

Atlas America Insurance Benefits

- Hospital Room & Board: Average Semi-Private Room Rate (Includes Nursing Charges)

- Local Ambulance: Usual Reasonable & Customary charges (Provided covered illness or injury results in Hospitalization as Inpatient)

- Emergency Room Co-payment:

- Claims Incurred in the U.S: $200 co-payment for each use of the emergency room for an illness (Unless you are admitted to the Hospital)

- NOTE: There is no co-payment for emergency room treatment of an injury

- Claims Incurred Outside the U.S.: No co-payment

- Claims Incurred in the U.S: $200 co-payment for each use of the emergency room for an illness (Unless you are admitted to the Hospital)

- Urgent Care Center Co-Payment:

- Claims Incurred in the U.S: $15 co-payment for each visit

- Co-payment is waived for members with a $0 Deductible

- Claims Incurred Outside the U.S.: No co-payment

- Intensive Care Unit(ICU): Up to the overall maximum limit

- Outpatient Physical Therapy & Chiropractic Care: Up to $50 Per Day (Maximum) –

- Emergency Dental (Acute Onset Of Pain): Up to $300 (Not Subject to Deductible)

- Emergency Eye Exam for a Covered Loss: Up to $150, ($50 deductible per occurrence (Plan deductible is waived)

- Acute Onset of Pre-Existing Condition: Up to the overall maximum limit

- $ 25,000-lifetime maximum for Emergency medical evacuation

- Terrorism: Up to $50,000 Life Time Maximum (Eligible Medical Expenses Only)

- All other Eligible Medical Expenses: Up to the overall maximum limit

Atlas America Insurance International Coverage

Emergency Medical Evacuation:

The Plan covers eligible expenses necessary to transport the insured from an initial treatment facility to the nearest hospital – Qualified in treating the insured life-threatening condition

Insurance also covers

- Transportation

- Lodging

- Meal Cost

For a relative to join the insured after a covered emergency medical evacuation (Up to the Lifetime limit)

Repatriation of Remains

Arranges for and cover eligible costs associated with the repatriation of remains In case of the unfortunate event of death while traveling abroad

Return of Minor Children

The plan covers eligible transportation costs for covered children under the age of 18 to return home

- If the insured is expected to be hospitalized for more than 36 hours (For covered injury or illness)

- And these covered children under the age of 18 will be left unattended

Terrorism

The Plan offers coverage for eligible medical expenses resulting from a terrorist attack if the country the insured is visiting is not under a level 3 or higher travel advisory

Note: Coverage excludes countries or regions for which the U.S. Department of States has issued a level 3 or higher travel advisory (60 days prior to your arrival date)

Political Evacuation

During the coverage period If the insured arrives at the destination country and the U.S. Department of States issues a level 3 or higher travel advisory for that Destination Country then Atlas America coordinates alternate departure arrangements from that country ( Also covers associated costs )

Natural disaster – Replacement Accommodations

If a natural disaster occurs on an insured person’s trip causing the insured to become displaced from the planned and paid accommodations

Provides a maximum of $250 per day for 5 days as a relief to help cover the costs of alternative accommodations

Hospitalization and Outpatient Treatment

Atlas Travel Insurance Plan provides coverage for eligible costs associated with hospitalization (Including ICU & Out Patient Treatment) if a covered illness or injury requires hospitalization

Sports Coverage

The Plan offers coverage for eligible injuries and illnesses that could occur while participating in many popular vacation sports.

Certain extreme sports are excluded from coverage (Read policy wording for specific exclusions)

Complications of Pregnancy

The Plan offers coverage for complications of pregnancy during the first 26 weeks of gestation

Crisis Response

The Plan offers:

- Up to $10,000 or

- Up to $1,00,000 (if additional coverage is selected)

To offset costs associated with kidnapping such as:

- Ransom

- Crisis Response Expenses

- Loss of Personal Belongings

Personal Liability

The Plan offers:

- Up to $25,000 or

- Up to $1,00,000 (if additional coverage is selected)

To offset the following types of court-entered eligible judgments or approved settlements incurred by the insured:

- Damage or loss of a third party’s personal property

- Damage or loss of a related third party’s personal property

- Third-Party Injury

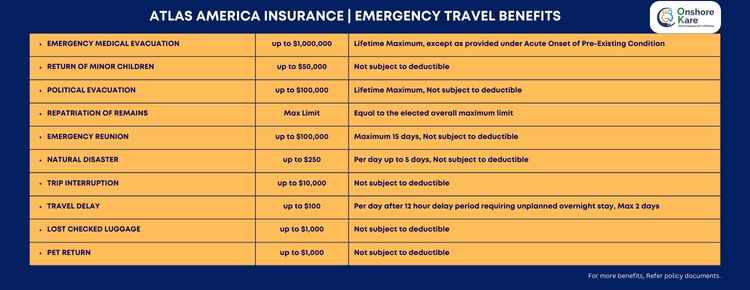

Emergency Travel Benefits

- Emergency Medical Evacuation: Up to $1,000,000 Lifetime Maximum (Except as provided under Acute Onset of a Pre Existing Condition)

- Not Subject to a deductible or overall maximum limit

- Repatriation of Remains: Up to the elected overall maximum limit

- Local Burial or Cremation: Up to $5,000 Lifetime maximum ( Not Subject to deductible)

- NOTE: This limit is for this benefit only and is not included in or subject to the overall maximum limit

- Emergency Reunion: Up to $100,000 Maximum 15 days

- Bedside Visit: Up to $1,500

- Return of Minor Child: Up to $50,000

- Political Evacuation: Up to $1,000,000

- Trip Interruption: Up to $10,000

- Lost Checked Luggage: Up to $1,000

- Lost or Stolen Passport/Travel Visa: Up to $100

- Travel Delay: Up to $100 (after 12 hour delay period) – unplanned overnight stay Maximum 2 days

- Natural Disaster (Replace Accommodation): Up to $250/Day for 5 days

- Hospital Indemnity: $100/day (Inpatient Hospitalization)

- Personal Liability:

- Up to $ 25,000-lifetime maximum

- Up to $25,000 Third-Person Injury

- Up to $25,000 Third Person Property

- Up to $2,500 Related Third-Party Property

- Border Entry Protection: Up to $500 (If traveling on a valid B-2 Visa & Denied entrance at the U.S. Border)

Accidental Death & Dismemberment:

Excludes loss due to common carrier

- Lifetime maximum: $5,000

- Death: $5,000

- Loss of 2 limbs: $5,000

- Loss of 1 Limb: $2,500

Age 18 through 69:

- Lifetime maximum: $12,500

- Death: $12,500

- Loss of 2 limbs: $12,500

- Loss of 1 Limb: $6,250

Ages 70 Through 74:

- Lifetime maximum: $6,250

- Death: $6,250

- Loss of 2 limbs: $6,250

- Loss of 1 Limb: $3,125

Ages 75 and Older:

- $250,000 Maximum Benefit to any one family or group

- (Not subject to a deductible or overall maximum limit)

Under age 18:

- Lifetime maximum: $25,000

- Death: $25,000

- Loss of 2 limbs: $25,000

- Loss of 1 Limb: $12,500

Common Carrier Accidental Death:

- Under Age 18: $10,000

- Ages 18 through 69: $50,000

- Ages 70 through 74: $25,000

- Ages 75 and older: $12,500

- Subject to a maximum of $250,000 any one family or group

- (Not subject to a deductible or overall maximum limit)

Crisis Response:

Ransom, Personal Belongings, and Fees and Expenses

- Up to $10,000 Per Certificate Period

Optional Crisis Response Rider with Natural Disaster Evacuation:

- Up to $90,000 Per Certificate Period

- Up to $10,000 Maximum for Natural Disaster Evacuation

Acute Onset of Pre-Existing Conditions Coverage

Atlas America Insurance Offers coverage for the Acute Onset of Pre-Existing Conditions:

- Under the age of 80 years coverage up to the policy maximum limit for medical expenses

- $25,000 if offered in emergency medical evacuation

Acute onset of pre-existing conditions is described as some unforeseen emergency occurring without warning for which treatment is to be taken in the next 24 hours.

When does the Acute Onset of Pre-Existing Conditions Benefit Apply?

The Acute onset of pre-existing conditions benefit will only apply if:

- The Insured is under 80 years of Age

- The Insured is traveling outside his Home country

- The Acute onset of pre-existing condition directly or indirectly does not relate to a chronic condition or congenital condition

- The Insured must not be traveling with the intent of obtaining treatment for the pre-existing condition

- The Insured must not be traveling against the medical advice of a physician or healthcare provider

- Treatment must be obtained within 24 hours of the sudden & unexpected outbreak or recurrence

Concerned about Pre-Existing Conditions?

See the best travel insurance plans for visitors that cover pre-existing conditions.

What Is the Acute Onset of Pre-Existing Conditions?

Acute onset of a pre-existing condition is defined as a sudden and unexpected outbreak or recurrence that is of short duration, is rapidly progressive, and requires urgent care.

When is Pre-Existing Condition not considered an Acute Onset of a Pre-Existing Condition?

A Pre-existing condition that is chronic or congenital, That gradually becomes worse over time is not an Acute onset of a pre-existing condition

If your parents are having pre-existing conditions then choosing US travel Medical Insurance for parents with pre-existing conditions must be your prime concern.

Home Country Coverage

Incidental Home Country Coverage

This short-term health insurance plan covers medical benefits related to a new illness or injury incurred during an incidental trip back to a member’s home country.

For the incidental home country coverage to be effective insured must have purchased a minimum of 3 months duration.

If the Home Country is other than the U.S.:

- Medical expenses incurred in the insured home country are covered up to a maximum of 30 days

Benefit accrued under a single three-month period do not accumulate to another month

NOTE: This coverage shall be void if the insured member returns to their home country for obtaining treatment for any illness or injury that began while traveling.

Claim Filing

File a claim by completing & Submitting a claimant’s Statement & Authorization form

- You may submit the form and necessary attachments Online

- You have the option to download the claim form and submit it alongside proof of claim via postal mail (Address mentioned on the policy form)

- Attach proof of claim like payment receipts, Itemized bills to support your claim

See the Top 5 Reasons Why Travel Insurance Claims are Denied.

Atlas America plans Worldwide Travel And Medical Assistance

The plan offers travel and medical services, Available 24/7 and 365 days/year.

Medical Monitoring

Provides consultation with attending medical professional during hospitalization

Establishing a single point of contact for family members (To get ongoing updates on the members’ medical status )

Provider Referrals

Contact Information in the destination country for:

- Pharmacies

- Western-Style Medical Facilities

- Medical and Dental Practices

Travel Document Replacement

Provides assistance for obtaining replacement:

- Passports

- Visas

- Travel Related Documents

- Birth Certificates

- Airline Tickets

Lost Luggage Assistance

Provides tracking service for items lost in transit:

- Luggage

- Other Items

COVID-19 Coverage

Atlas America cover coronavirus and provides coverage for COVID-19 like any other eligible medical condition that occurs after the policy’s effective date.

Atlas America Cancellation and Refund Policy

To cancel the policy and receive a refund or premium, Submit a written cancellation request before the policy’s effective date.

If you cancel your policy after the policy effective date:

- Members are eligible for a premium refund, only if no claim is made

- A $25 cancellation fee applies

- Only the unused portion of the plan cost will be refunded

Other Plans to Consider

Other popular travel insurance plans that you can consider are:

- Patriot America Plus

- Safe Travels USA Comprehensive

- INF Elite (Pre-Existing Conditions Coverage)

A detailed comparison of Atlas America vs Patriot America Plus vs Safe Travels USA provides insights into details of each of these popular travel medical insurance plans.

Conclusion

In conclusion, Atlas America is an ideal insurance plan for foreign citizens who want to visit the USA for various purposes. With its comprehensive coverage, flexible options, and Covid-19 compliance, Atlas America insurance can help you stay protected during your stay in the USA.