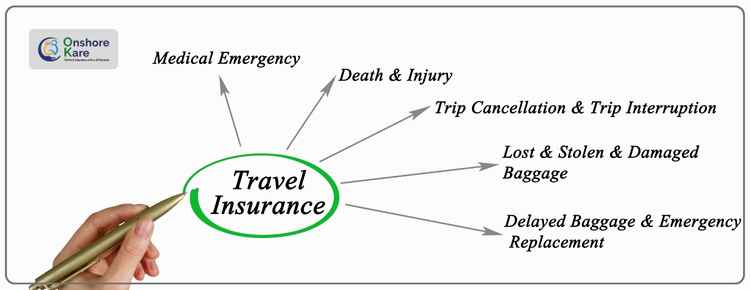

What Does Travel Insurance Cover?

Wondering what Travel insurance covers, It covers unforeseen losses incurred while traveling, either internationally or domestically, Travel insurance can help protect your medical expenses abroad that normal health insurance does not cover.

Most health insurance plans do not provide full coverage in foreign countries and some health insurance Plans provide no coverage at all.

Travel insurance is elective, This means it is up to you to decide if you need it. Consider getting travel insurance it’s meant to help you travel with peace of mind.

TIP: Read the fine print of your travel insurance policy to know exactly what it covers.

You can watch this short video

What Is Typically Covered By Travel Insurance

It covers a range of risks and financial losses associated with traveling. The coverage can vary depending on the policy, Here are some of the common types of travel insurance coverage:

- Trip Cancellation or Interruption Insurance

- Medical Insurance

- Emergency Evacuation Insurance

- Baggage and personal Items Loss

- Travel Accident Insurance

- Travel Medical Insurance

- Package Travel Insurance

- Identity Theft resolution services

- School activity coverage

- Destination wedding coverage

- Adventure sports coverage

- Pet health as a reason for cancellation or delay

- Hunting or Fishing activities as the reason for cancellation or delay

- Missed flight connection

Read your policy carefully to understand what is and is not covered, as well as any exclusions and limitations that may apply.

What Is Travel Insurance?

In simple words, Travel Insurance is an insurance product and is designed to provide protection and assistance that could happen while traveling. Travel insurance covers unforeseen financial losses associated with traveling either internationally or domestically. Travel insurance is not like an auto insurance elective, meaning you can decide if you need it.

Basic policies generally cover:

- Emergency medical expenses

- Trip cancellation, and or

- Delayed luggage

Comprehensive travel insurance plans encompass protection against cancellation fees or lost deposits relating to the cancellation of the insured person’s trip for a range of unforeseen and unexpected illnesses or injuries, natural disasters and bad weather, strikes and riots, hijacking, and family emergencies.

Do I Need Travel Insurance?

If you are on a trip and something goes wrong, and if you don’t have travel insurance coverage, Imagine the serious hit it is going to give to your savings account. Flight cancellations, Lost baggage all of this can cost a lot to get rectified.

On the other hand, if you have travel insurance you know that your trip is protected. This helps you put your mind at ease. But what exactly does travel insurance cover? Let’s find out in detail.

You Might Consider Travel Insurance Coverage:

- If you can’t afford to cancel and then rebook an expensive or long trip

- If your health insurance doesn’t cover international costs

What Does Travel Insurance Covers?

Travel Insurance covers a range of possible damages and losses, depending on the coverage you choose.

Policies generally provide coverage for three things. Protecting your financial expenses, protection for your well-being, and protection for your personal belongings.

Here are the main types of coverage provided by travel insurance, Most plans typically cover a range of trip protection including baggage delay or loss, Emergency medical coverage and evacuation, accidental death and dismemberment, trip cancellation, delay or interruption, and more

Here’s a closer look at each one:

Trip Cancellation Or Interruption Coverage

Trip cancellation or interruption coverage is a type of travel insurance that can help protect you financially if you need to cancel or interrupt your trip due to a covered reason like an injury or injury of you or a traveling companion.

- Trip cancellation coverage applies to trips canceled before they begin,

- Trip interruption coverage applies to trips cut short after they begin

Both types of coverage can reimburse you for prepaid, non-refundable travel expenses, such as airline tickets, hotel stays, and excursion bookings

Accidental Death And Dismemberment

Accidental death and dismemberment insurance provides coverage for for death or losing a limb or eyesight.

It is not the same as life insurance policy because Death from illness, Suicide, or natural causes is not covered.

Injury Or Sickness

Travel insurance can cover medical expenses related to injury or sickness that occur while traveling. it works in addition to your health insurance and can help supplement medical costs if you get sick or injured before or during your vacation.

Baggage Delay

If your bag is delayed, Baggage delay insurance reimburses the cost of essentials, such as phone chargers, toiletries, and clothes that you need to purchase.

To receive coverage, your baggage must be delayed for a certain number of hours. It depends on the policy. typically the range is 6 to 24 hours.

Baggage Loss

If your checked bag is lost, stolen, or damaged during a covered trip insurance for baggage loss reimburses the cost of your suitcase and belongings.

Emergency Medical Evacuation And Repatriation

Its important to get a travel medical insurance and emergency medical evacuation when traveling internationally. If you are injured or become ill while traveling the benefits offered by these plan can cover your medical costs including doctors fees and hospital costs.

If you have a medical emergency that can’t be treated at a nearby medical facility and you need medical evacuation. This benefit covers the transport costs to another hospital or if necessary in some cases to your home country. It also included the transportation of remains

Missed Connection

The Missed connection coverage is a type of travel insurance that can help reimburse you for expenses incurred if you miss a flight, cruise, or other transportation connection due to an unexpected event covered by the policy

Missed connection coverage is generally a part of a comprehensive travel insurance plan that includes a variety of coverage types, such as trip cancellation insurance and emergency medical benefits

If a missed connection benefit is not available with a travel insurance company’s basic plan, you might have the option to select it as an optional coverage

Additionally, missed connection coverage is usually an added feature on a travel insurance policy package, and not all companies have the same terms

It’s important to note that missed connection coverage doesn’t cover every situation

For example, missed connection coverage typically won’t cover missed connections due to passenger oversleeping, spending too much time sightseeing, or other issues that are the traveler’s fault

Reinstate Frequent Traveler Awards

Many travelers often pay for a trip with airline miles or hotel points, but at times the trip gets canceled, in such a scenario this benefit covers any fees required to redeposit your rewards back to your frequent traveler’s account

Trip Cancellation Coverage

Reimburses non-refundable trip costs If you have to cancel your trip for a covered reason such as illness, injury, or other unforeseen events.

Covered reasons covered include:

- Sickness of a family member

- Death of a family member

- Stolen passport or visa

- Natural disaster

- Airline strike

- Loss of employment

- Inclement weather

- Jury duty

Trip Delay Coverage

Most companies offer travel delay coverage, For any common carrier delay, Trip delay covers costs associated with transportation, lodging and lodging. It also reimburses any prepaid, nonrefundable trip costs.

Depending on the your policy, Trip delay coverage takes effect after a specific period of time. Usually Ranges from 5 to 12 hours.

Trip Interruption Coverage

In case you have to cut your trip short and return home for a covered reason, Trip interruption benefits reimburses you for unused nonrefundable trip costs.

Covered reasons include but not limited to:

- A family members sickness

- Death of a family member

- Natural disaster

- Inclement weather

- Terrorism

| SR/No | Optional Coverage |

|---|---|

| 1 | Pre-Existing Conditions |

| 2 | Cancel For Any Reason |

| 3 | Travel Assistance |

| 4 | Quarantine Accommodations |

| 5 | Rental Car Collision Damage Waiver |

Extras You Can Add To A Travel Insurance Policy

Travel insurance does not cover everything, you have the option to add extras to your policy for an extra charge.

Check if your plan offers the following types of coverage. If your plan does not offer these optional coverages and if you feel the need you can add it to your basic plan to make it a more inclusive policy to cover you and offer peace of mind as you travel.

Determine your specific needs and find a plan that fits your needs.

Ask your travel insurance provider if you have any questions, educate yourself about all the options before choosing one.

Optional coverage includes:

- Cancel For any reason

- Rental car collision damage waiver

- Pre-existing conditions

- Quarantine Accommodations

Let’s look at each one in detail

Cancel For Any Reason

If you decide not to go on a trip you’ve booked you lose your prepaid, nonrefundable expenses. To avoid this you must purchase cancel for any reason policy separately. This reimburses you for prepaid, nonrefundable expenses.

- The insurance company does not need a reason. Cancellations are to be done within a specific time frame (At least 48 to 72 hours before you depart).

- Cancel for any reason policies are more expensive and only reimburse you a percentage of your travel costs.

- You do not get 100% of your prepaid expenses back, but you usually get back 50% to 75% of your prepaid expenses back depending on the policy.

- This comes with a condition that you must have purchased the policy within 10 to 21 days of the initial payment.

Rental Car Collision Damage Waiver

A rental car collision damage waiver is worth considering if you are traveling to a foreign country. Rental car insurance protects you from having to pay for the damage or theft if:

- Your rental car is damaged

- Your rental car is stolen

Rental car insurance policies vary and may cover collisions, theft, vandalism, and other incidents. A CDW only covers damage to rental car and do not cover liability-related expenses such as other people’s property.

Pre-Existing Conditions

If you need coverage for pre-existing conditions, you must purchase a policy within the specific time frame specified.

To be eligible for a pre-existing conditions waiver you must purchase the policy within the time period specified by the travel insurance provider which is 10 to 21 days.

Quarantine Accommodations

This coverage can be a concern for travelers during the COVID-19 pandemic.

- This coverage is part of trip delay insurance. Some travel insurance providers offer coverage for quarantine expenses while some others do not.

- Coverage for quarantine expenses varies depending on the policy and there may be exclusions and limitations listed in the policy.

- Read the policy carefully and consider purchasing a policy offering quarantine coverage if you are concerned about quarantine accommodation.

Travel Assistance

Most travel insurance plans offer travel assistance with their policies and are included with travel insurance policies, but they can also be purchased separately.

Remember travel assistance is not insurance but it is travel a service that provides travelers with support and assistance during their trip.

Here are some examples of travel assistance services:

- Emergency medical assistance

- Travel planning assistance

- Legal assistance

- ID theft assistance

- Emergency message relay

- Bail bond referrals

What Does Travel Insurance Not Cover?

Travel insurance policies typically have exclusions and limitations that may vary depending on the policy. Here are some common things that travel insurance may not cover

- Pre-existing conditions: Many travel insurance policies exclude coverage for pre-existing medical conditions unless you purchase a policy with a pre-existing medical condition exclusion waiver.

- Fear of travel due to a pandemic, outbreak, or other reasons: Standard travel insurance plans typically do not cover cancellations due to fear of travel, even if you are headed to a pandemic hotspot and are worried about getting sick.

- Illegal activities: Travel insurance policies generally do not cover losses or damages that result from illegal activities such as operating a motorcycle or scooter without a valid license

- High-risk activities: Many travel insurance policies exclude coverage for high risk activities such as sky diving, bungee jumping, and scuba diving

- Known storms, epidemics, acts of war, and travel restrictions imposed by government authorities: Travel insurance policies usually do not cover losses or damages that result from Known storms, epidemics, acts of war, and travel restrictions imposed by government authorities

- Unattended belongings: Travel insurance policies generally do not cover losses or damages that result from leaving your belongings unattended.

How To Pick The Right Policy For Your Trip

Choosing the right travel insurance policy can be a daunting task, but it’s important to make sure you have adequate coverage for your trip. Here are some tips to help you pick the right policy for your trip:

- Evaluate the financial risks you face when traveling

- Examine what coverage you already have

- Get quotes for trip insurance online

- Consider buying a comprehensive travel insurance policy

- Know what’s covered

- Compare plans before purchasing

- Consider the relative importance to you of each type of coverage

It is important to do your research and choose a policy that fits your needs and budget.

Single Trip vs. Annual plan

Single-trip and annual travel insurance policies offer different types of coverage and limits, which one to choose depends upon your travel plans.

Here are some key differences between single trip and annual travel insurance policies:

Single Trip Travel Insurance:

If you travel only once or twice a year, single trip insurance may be more affordable and provide higher coverage limits

- It covers one specific trip, usually for a set number of days

- Provides coverage for trip cancellation, medical emergencies, travel delays, and luggage

- May offer higher coverage limits for each type of coverage

- May be more affordable than annual travel insurance if you only travel once or twice a year

- Maybe a better choice if you’re planning one big vacation or if you’re traveling with children

Annual Travel Insurance:

If you are a frequent traveler annual travel insurance may be more affordable and provide adequate coverage for medical emergencies

- Covers multiple trips within a specified time frame, usually one year

- Typically focuses on medical emergencies, while individual plans offer more robust travel-related coverages such as baggage or trip interruption

- May offer lower coverage limits for each type of coverage

- May be more affordable than single-trip insurance if you travel frequently

- Maybe a better choice if you take several short trips, including business trips and weekend getaways

Individual vs Family

You can choose between individual and family plans.

Individual Travel Insurance:

It covers one person and is ideal for solo travelers. It provides coverage for medical emergencies, trip cancellations, lost baggage, and other travel-related issues

Family Travel Insurance:

It is designed to cover families traveling together. It usually covers one or two adults and children under 18 years old, depending on the plan and provider.

To qualify, family members must be living at the same address. It provides coverage for medical emergencies, trip cancellations, lost baggage, and other travel-related issues.

- Benefits of Family Travel Insurance: It can be more affordable than purchasing individual policies for each family member. Provides more comprehensive coverage for families traveling together.

- Limitations of Family Travel Insurance: May not cover all family members if they are not living at the same address. May have lower coverage limit than individual policies.

Primary And Secondary Coverage

The Primary and secondary coverage are terms used to describe the order in which insurance policies pay out in the event of a claim

Primary Coverage:

If you have a travel insurance policy with primary coverage, it means the policy will pay out first in the event of a claim, regardless of whether you have other insurance policies that could cover the same loss.

Primary coverage is often more comprehensive and may offer higher coverage limits than secondary coverage.

Secondary Coverage:

If you have a travel insurance policy with secondary coverage, it means that the policy will only pay out after you have exhausted any other insurance policies that could cover the same loss

- Secondary coverage is often less expensive than primary coverage, but it may offer lower coverage limits and may have more exclusions and limitations

- It’s important to note that whether your travel insurance policy provides primary or secondary coverage depends on the policy itself

- Some policies offer primary coverage for certain types of coverage, such as emergency medical coverage, while offering secondary coverage for other types of coverage, such as trip cancellation coverage

- It’s important to read the policy carefully to understand what type of coverage it provides and how it will pay out in the event of a claim.

How To Purchase Travel Insurance

Travel insurance may be purchased from travel agents, insurance companies, travel suppliers (airlines or cruise lines), or insurance brokers.

Many travel booking sites sell travel insurance but they just offer one plan or a few plans. You do not have all the plans to choose from.

Before you buy a travel insurance policy, it’s a good idea to compare quotes from multiple insurance providers. Most travel insurance companies offer free quotes on their website.

You can save your valuable time by visiting a travel insurance comparison website like OnshoreKare.com that compares quotes from multiple companies. you can also generate free multiple quotes till you are satisfied.

To get your free no-obligation quote you can:

- Click on the given link and generate a free no-obligation quote from leading providers.

- Compare travel insurance quotes from leading providers.

- Comparing multiple quotes ensures you are getting adequate coverage and spending the right amount required to get the coverage.

- Finally, you can buy online through our safe and secure link

- Get your confirmation of coverage instantly online via email.

Frequently Asked Questions

What Is The Most Common Travel Insurance Claim

The most common travel insurance claim is for medical Emergencies

Does Travel Insurance Cover Cancellations

Cancellation coverage is included in most travel insurance policies

What Is The Difference Between Travel And Trip Insurance?

Travel medical policies include benefits for medical expenses such as doctor or hospital visits, medical evacuation coverage and repatriation

Trip Insurance covers the financial investment of an international or domestic trip.

Does Travel Insurance Cover Covid?

Yes, travel insurance typically covers COVID-19 related expenses, including emergency medical expenses, trip cancellation or interruptions due to COVID-19, and medical evacuation due to COVID-19. Coverage can vary depending on the policy.

Does Travel Insurance Cover Weather?

May cover weather-related issues, but it depends on the policy and the specific circumstances. Most plans provide coverage for inclement weather, which means any severe weather condition that delays the scheduled departure of a common carrier may be covered on your plan, subject to the terms and conditions of the specific plan.

However, it will not cover you for weather-related travel issues caused by a named storm if you bought your coverage after that storm was forecasted and named

Does Travel Insurance Cover Missed Flights?

It may cover missed flights, but the coverage and benefits can vary depending on the policy and the reason for the missed flights.

It may cover you provided it is not your fault or your airline’s fault. But if you miss a connecting flight because of travel delays caused by the airlines or your fault such as oversleeping, or spending too much time sightseeing, then you won’t be covered.

In order to make a claim you need to provide supporting evidence to show that missed your flight due to, matters out of your control.

Does Travel Insurance Covers Hurricanes?

Yes, travel insurance can provide coverage for travelers during hurricane season, However, it is important to note that travel insurance only covers unforeseen events. This means that travelers must buy their policy before a tropical storm is named in order for coverage to apply. Here are some situations in which travel insurance can provide coverage for hurricanes:

- If the lodging at your destination is destroyed by a hurricane and you have to cancel your trip

- If you’re at your destination, a hurricane strikes, and the government says you have to evacuate

- If you’re injured in a hurricane while traveling, your medical expenses can be covered

- If your own home is made uninhabitable by a hurricane and you have to cancel or interrupt your trip

Not all travel insurance companies or plans cover storm-related cancellations and interruptions the same way, it is important to read Plan Documents carefully before you buy travel insurance.

Does Travel Insurance Cover Pregnancy?

Yes, some travel insurance policies can cover pregnancy-related issues, but it depends on the policy and the specific circumstances. Read your policy carefully to understand what is covered or what is not covered, as well as any exclusions and limitations that may apply.

It is highly recommended to contact the insurance provider to clarify the coverage related to pregnancy.

Does Travel Insurance Cover Stolen Phone?

Yes, travel insurance generally covers stolen mobile phones. Most comprehensive travel insurance policies include coverage for luggage and personal effects, including mobile phones, and the coverage tends to be capped at around $750-$1,500 per item.

Some policies may not cover certain situations such as electronic failures, water damage, or cracked screens. Review the details of your policy to know what is covered and what is not.

Generally you have to have a police report filed within 24 hours of the incident. You must have a receipt to prove when you purchased it, and that it was your mobile phone.

What Does Flight Insurance Cover?

It specifically covers the cost of your nonrefundable flight in the event of unexpected circumstances. Flight insurance typically covers:

- Flight Delay

- Trip cancellation or interruption

- Lost, damaged, or stolen luggage

- Medical reasons

However, flight insurance has lower plan limits, leaving some gaps in coverage. Its cost comes with coverage limitations.

How Much Does Flight Insurance Cost?

The cost of flight insurance varies depending on the plan you select, your total trip cost, your age, and the length of your trip. However, the cost of flight insurance is generally low compared to the cost of the flight itself.