Complete Review of INF Travel Insurance Policies

Here is a complete review of INF Travel Insurance policies. For senior travelers, one of the biggest concerns is the pre-existing conditions. INF visitor insurance plans is one insurance company that provides pre-existing condition coverage benefits.

When you are planning a memorable trip to meet family, enjoy great food, see amazing landscapes, and fond snippets to recollect at leisure back home? OR do you have visitors from overseas coming to meet you in the USA? Remember, Healthcare in the United States is very expensive.

Beware, even the best-planned trips may hit an unprecedented snag. Accidents and health conditions have a knack for happening without any forewarning and may lead to unforeseen medical expenses.

You need travel medical insurance for protection to save burning a big hole in your pocket and paying all medical expenses out-of-pocket.

Travel Medical Insurance and Pre-Existing Medical Conditions

Travel Insurance and Trip Insurance are often referred to interchangeably but there are key differences. A travel medical insurance policy or visitor insurance provides a safety net against any unforeseen health issues and medical expenses to get them treated. Travel medical insurance plans are designed for international travelers to provide for medical expenses during such mishaps.

Know the difference between comprehensive and limited coverage travel insurance plans.

No one wants to fall sick while traveling, and an injury or illness can prove to be devastating during a trip. Emergency medical situations can occur during travel and are often unpredictable in nature, eligible medical expenses are covered by travel insurance.

Visitors’ insurance is recommended to save on unforeseen medical expenses that you may encounter during travel. Buy visitors’ insurance from a reputed insurance company with the best rating and travel worry-free.

Travel insurance plans that cover pre-existing conditions:

Travel Assistance plans that cover pre-existing conditions:

Now that we know the importance of Visitor Insurance, the next question that comes to mind is, where does one get the best travel medical insurance?

Why INF Travel Medical Insurance?

Knowing that specialist care, hospital stays, or urgent care visits due to a medical emergency are part of your medical coverage benefits listed in your visitors’ insurance policy, offers peace of mind to international travelers.

Most travel insurance plans offer the acute onset of pre-existing conditions coverage benefits. If you need pre-existing conditions to be covered then your options are very limited. INF visitors insurance offers travel insurance with coverage for pre-existing conditions to visitors to the United States.

INF visitor insurance plans are quite popular with parents visiting the USA.

INF Visitors Insurance is a reputed company that offers visitor insurance. The INF Visitor insurance plans are popular among parents visiting the USA. INF Visitors Insurance proudly promises “ Coverage You Want. Peace of Mind You Need.” INF Plans, an Insure Tech Company founded in 1988, specializes in international travel medical insurance.

INF visitors insurance is widely considered for purchase for parents visiting the USA, when parents are visiting for an extended period of time i.e. over 90 days.

The innovative international medical and INF visitors insurance products they offer include pre-existing coverage plans (INF Elite and INF Premier Plan), coverage for travelers of all ages up to 99 years, dental and vision coverage for travelers, and telemedicine benefits.

INF Insurance Plans for Visitors

INF insurance provides unique and innovative accident and sickness insurance to individuals visiting the United States, Mexico, and Canada. It would be worthwhile to take a quick look at their exclusive plan offerings:

INF Elite Insurance reviews:

INF Elite insurance is a comprehensive travel medical insurance plan, that provides excellent coverage for international travelers visiting the U.S., Mexico, and Canada.

This plan is one of the few travel medical plans that cover pre-existing medical conditions.

The plan is available to non-US residents.

The plan is not available to U.S. residents.

Coverage needs to be bought for a minimum of 90 days and needs to be purchased before leaving the home country. Notable features:

-

INF Elite plan is a comprehensive insurance plan

-

INF Elite plan covers pre-existing conditions

-

INF Elite plan will cover pre-existing conditions to the limit as per the policy terms and

-

Pay for medical expenses based on the percentage of the bill

-

INF Elite plan is underwritten by Crum & Forster, SPC

-

The insurance benefits include coverage for non-US residents from Age 0-99 years

-

The short-term travel medical coverage extends from 90 days to 364 days

The policy maximum limits are:

-

Age 0-69: $150,000, $250,000, $300,000, $500,000, or $1,000,000

-

Age 70-99: $75,000

-

Age 0-69, Pre-existing condition maximum benefits: $25,00, $30,000, $40,000 or $50,000

-

Age 70-99, Pre-existing condition maximum benefit: $20,000

-

-

PPO Network: The plan offers the United Healthcare PPO Network

The INF Elite Plus plan details include wellness medical expenses benefits in addition to the benefits listed above.

INF Premier Plan, Detailed Description

The INF Premier plan is a fixed plan (limited coverage plan). The premier plan covers pre-existing conditions, including coverage for blood tests, lab work, and hospital stays, apart from other benefits for unexpected medical incidents. Notable features:

-

INF Premier plan is a limited coverage insurance plan (fixed plan)

-

INF Premier plan covers pre-existing medical conditions

-

INF Elite plan will cover pre-existing conditions to the limit as per the policy terms and

-

Pay for medical expenses based on the percentage of the bill

-

INF Elite plan is underwritten by Crum & Forster, SPC

-

The insurance benefits include coverage for non-US residents from Age 0-99 years

-

The short-term travel medical coverage extends from 90 days to 364 days

The policy maximum limits are:

-

Age 0-69 years: $150,000, $250,000, $300,000, $500,000, or $1,000,000

-

Age 70-99 years: $75,000

-

-

PPO Network: The plan offers the United Healthcare PPO Network

The coverage in terms of age, pre-existing condition coverage, and the number of short-term days are the same as the Elite plan.

The policy maximum limit under this fixed benefit plan is $ 100,000 and $ 150,000 for the age groups seventy to ninety-nine and zero to sixty-nine, respectively.

The cover pre-existing conditions benefit has a maximum limit of $60,000/-. Direct billing may be available.

Read: Is IMG Travel Insurance Worth It?

INF Traveler USA Plan Details

Offers coverage for non-us residents ages 0 to 99 years

-

Short-term travel medical coverage (90 days to 364 days)

-

Traveler USA plan is underwritten by Crum & Forster, SPC

-

Maximum limits under this plan are $75,000 for ages seventy to ninety-nine

-

For the age group zero to sixty-nine, the options are $150,000, $250,000 or $300,000

-

The plan utilizes United Healthcare Options PPO and includes direct billing

INF Standard Plan Details

Any non-US resident from ages 0(zero) to 99(ninety-nine) traveling outside the home country is eligible for this plan.

-

For travelers visiting the United States, Canada, or Mexico.

-

INF Standard plan is only available to non-US residents.

-

The plan is not available to US residents.

-

It can be renewed online up to 12 months after the initial involvement period.

-

Short-term travel medical coverage length spans a tenure of 30 days to 364 days.

-

Maximum limits range from $50,000 to $100,000 to $150,000.

-

INF Standard plan is underwritten by Crum & Forster, SPC

-

Direct billing may be available from providers.

-

The Standard plan has no coverage for pre-existing conditions.

-

The plan contract includes coverage for dental, prescription drugs, vision issues such as eye irritation, pregnancy and childbirth, chiropractic care, and urinary tract infections.

-

Includes eligible Emergency medical evacuation, Repatriation of remains benefits, and Accidental death and dismemberment benefits.

It is important to note that this plan is only available for visitors before coming to the USA.

INF-BMI Travel Assist Plans Details

BMI Travel Assistance provides travel and medical assistance for international trips with no deductible or copayments.

Medical and travel assistance is arranged by the 24/7 BMI assistance team as per the limits in the plan.

-

BMI Travel Assistance provides medical assistance for COVID-19

-

It Provides medical assistance for pre-existing conditions.

-

It Provides medical assistance for Acute onset of pre-existing conditions

To avail of this plan, the beneficiary must always and without exception contact the emergency center, who in turn will coordinate a virtual appointment by Telemedicine.

Based on the opinion provided by the medical department, if the beneficiary presents symptoms related to COVID-19, the Assistance Centre will coordinate the relevant medical consultation according to the safety and health protocols of each country.

Hospital expenses for COVID-19 and mechanical respirator fees will be covered under the coverage limit indicated in the voucher.

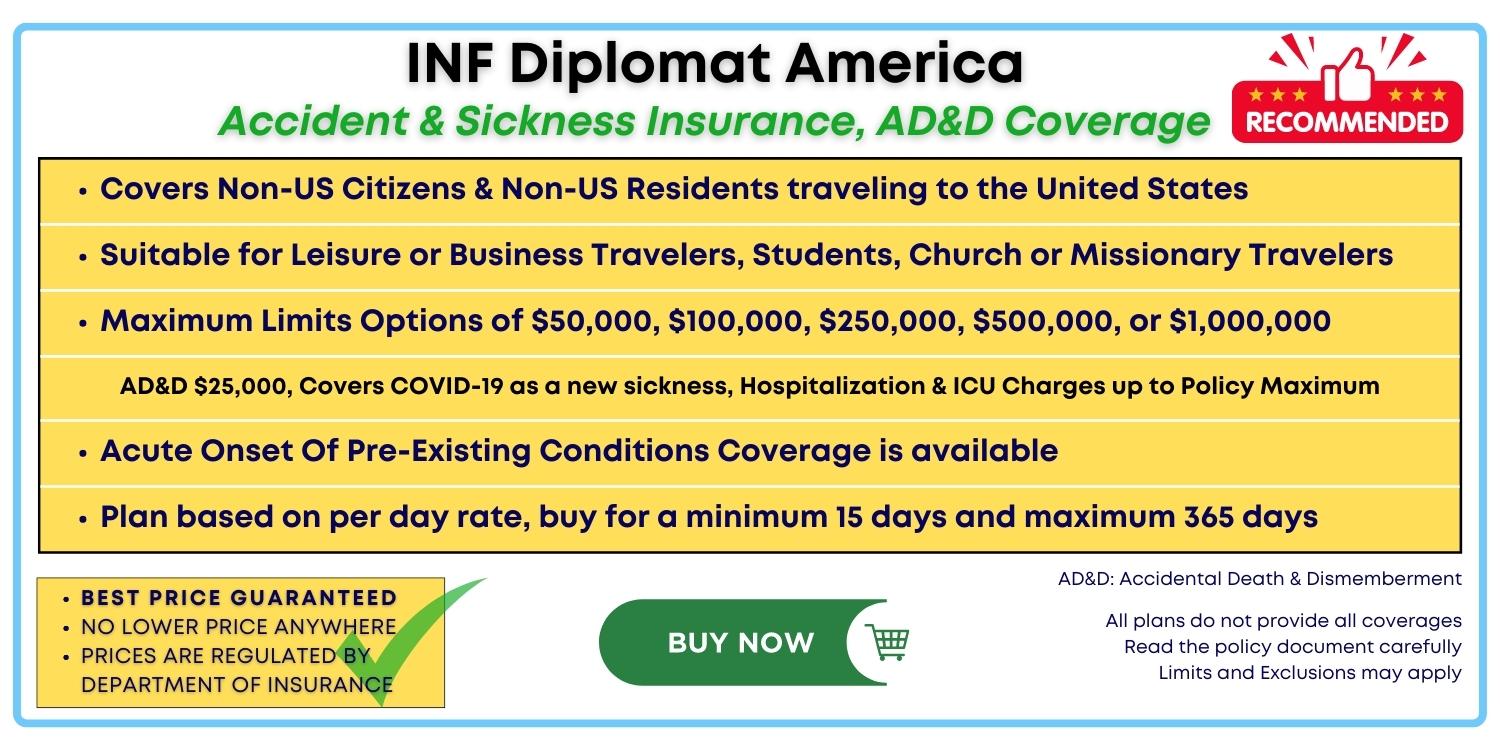

Diplomat America Plan Details

This plan is designed for non-US citizens visiting the US and US ex-pats visiting the US. Parents and relatives visiting the U.S.

-

Diplomat America covers COVID-19 as a new sickness.

-

Emergency medical evacuation and repatriation are covered up to a limit of $500,000.

-

Return of mortal remains: $50,000

-

Emergency medical reunion: $50,000

-

Return of a minor child is covered up to a limit of $50,000.

-

Political and Natural Disaster: $50,000

-

Accidental Death and Dismemberment: $25,000

-

Interruption of Trip: 5,000

-

Loss of Baggage: $50 per article (Maximum up to $250)

This plan also covers emergency dental treatment and athletic and hazardous activity.

The Common Denominators in the INF Plans

Most of the plans that INF offers have the following common features:

- The plans cover non-US citizens traveling to the US, Canada, or Mexico

- Emergency Medical Evacuation benefits

- Accidental Death and Dismemberment benefits

- COVID-19 is treated as any other sickness

- Plans may have pre-existing conditions coverage

- Telehealth is provided by MDLIVE (for visits to the US only)

- Careington International coordinates dental, vision, hearing, and prescription discounts

INF Plans and Pre-Existing Conditions Coverage

One of the most important benefits most travelers require is coverage for pre-existing medical conditions. Pre-existing conditions coverage makes INF plans unique compared to other travel insurance options.

The acute onset of pre-existing conditions is covered by INF’s comprehensive plans. Some plans even cover the routine check-ups associated with pre-existing conditions.

Pre-existing conditions coverage essentially means that for a traveler covered under the INF Elite and Premier plans, issues for which a doctor’s treatment has been received in the past year will be considered pre-existing.

Similarly, if medication for a condition were started last year, it would be considered pre-existing. In other words, common issues like BP and Diabetes that are stable are covered as new sicknesses.

Cancellation Policy at INF

A refund of the premium will be considered only if INF Health Care receives the cancellation form before the effective date of coverage. After that date, the premium is considered fully earned and non-refundable

Unlike other insurance companies that give a prorated refund, there is no cancellation after the policy’s effective date at INF.

Due to this enrolling for 2 to 3 months and then renewing would be a better option than enrolling for six months or more at a stretch. However, if you need to cancel the plan for any reason after the start date, you need to remember that there will be no refunds issued.

INF Plans generally cost more than the plans offered by other insurance plans from companies like IMG, Seven Corners, and others. The reason is the benefit of pre-existing conditions coverage benefits listed in their plans.

Learn about the Top 5 Reasons why Travel Insurance Claims are rejected.

Extension of INF Plans

INF’s Elite, Premier, and Standard plans can be extended up to a maximum of 364 days. It is a hassle-free process that is available online.

Why INF is a Good Choice for Travel Medical Insurance?

INF has provided innovative options for visitor insurance to millions of travelers to the United States for more than 30 years. There is a commitment to providing innovative insurance products, quality customer care, and supporting members when they need it the most. INF offers some of the most comprehensive travel medical insurance plans with complete coverage. They offer fixed benefit plans and comprehensive benefit plans.

Let us have a look at their notable features:

- Their 30-year-old track record

- Expertise in visitors’ insurance

- 24-hour customer care service

- Exclusive plan offerings

- Simpler experience with built-in technology

- No paperwork – instant ID secure purchase

- Offers plans covering pre-existing conditions

- Telemedicine services

- Discount card for vision, dental, and hearing included in plans

Now let’s take a look at the areas not aligned with customers’ needs:

- After the effective policy date, there is no option for cancellation

- The minimum coverage duration is 90 days on most plans

- Insurance plans may have a higher premium due to pre-existing conditions coverage

The benefits that they provide are good for international travelers. INF truly offers the ease that international travelers look for in insurance plans. The advantages and coverage benefits listed above are proof of the intent to make medical travel insurance as customer-friendly as possible.

INF visitors insurance plans are best suits travelers to the United States with chronic or other pre-existing conditions.

How Do the Premiums on INF Plans Compare With Other Travel Insurance Providers?

There are several options in the marketplace for travel insurance and there is no one size fits all solution.

The premiums for INF Plans as discussed earlier in the article tend to be higher than other service providers due to the nature of coverage provided.

If you or your parents are healthy with no pre-existing conditions, travel medical insurance coverage choices are plenty for seniors looking for alternatives to INF Plans.

We have tried to provide you with complete and accurate details, make sure you compare travel insurance quotes before deciding.