Travel Insurance Best Rates And Coverage Limits – 2024

Get the Travel Insurance best rates and coverage limits by using strategies recommended in this article.

Traveling internationally is an exciting venture, but it comes with its share of risks.

From medical emergencies to unexpected trip cancellations, unplanned events can disrupt your travel plans and lead to significant financial losses.

Securing the best travel insurance rates with comprehensive coverage is essential for any traveler.

This guide will not only help you find the best rates for travel insurance, provide insights into coverage limits, and offer strategies for saving money while ensuring adequate protection.

It also lists some of the most popular travel insurance companies and plans.

Strategies To Get Travel Insurance Best Rates

Securing the best travel insurance rates involves thorough research, comparison, and strategic planning. Here are some strategies that you can use:

Travel Medical Insurance Or Trip Insurance:

Travel insurance is frequently used for travel medical insurance and trip insurance synonymously, but there are differences.

You need to assess your needs and then decide which type of plan will meet those needs better.

You also have the option of going for trip assistance plans that function similarly to travel insurance plans.

Compare Travel Insurance Companies

- Shop Around: Use a travel insurance comparison website to evaluate different travel insurance companies, their plans, and offerings.

- Read Reviews: Look for customer reviews, claim settlement ratios, and coverage options.

- Read The Fine Print: Ensure you understand what each policy covers and excludes. Pay attention to coverage limits and specific conditions.

Consider Your Needs

- Single Trip vs. Annual Travel Insurance: If you travel frequently, an annual policy may be more cost-effective than purchasing single-trip coverage each time.

- Assess Coverage Needs: Choose a policy that matches your travel plans.

- Protect Trip Costs: If you need trip cancellation coverage then opt for trip insurance with CFAR to protect your trip costs. CFAR will help you get reimbursed for non-refundable trip costs.

- Emergency Medical Incidents: if you are concerned about emergency medical coverage or medical emergencies then opt for travel medical insurance.

- High-Risk Activities: If you’re planning an adventure trip, ensure your policy includes extreme sports coverage.

Buy Early

- Purchase Travel Insurance Early: Buying insurance as soon as you book your trip can provide immediate coverage for trip cancellation and other early travel risks. Purchase travel insurance directly after you make your trip reservations, that way it does not get missed out.

- Early Purchase And Cancellation Of Plan: A good and reputed travel insurance provider will offer a cancellation before the policy effective date for a full refund for free or a nominal cancellation fee. You can refer to the cancellation terms in the policy document.

Explore

Bundle Insurance Policies

- Combine Policies: If more than 1 person is traveling say you and a family member then it may be beneficial to buy a single travel insurance policy.

If the travel itinerary is going to be different or there is a chance that one person may return before the other then go for a separate travel insurance policy for each person.

- Buy Group Plans: If the family member count is more than 5 or you are traveling in small or large groups it may be cost-beneficial to buy a group travel insurance.

Key Factors Affecting Travel Insurance Cost

Several factors influence the cost of travel insurance:

- Destination: Traveling to certain destinations can be more expensive to insure, especially if they have higher medical costs or are prone to natural disasters.

- Age: Older travelers typically pay more due to higher health risks.

- Duration: Longer trips usually cost more to insure.

- Coverage Limits: Higher coverage limits lead to higher premiums.

- Pre-existing Conditions: You generally need to pay a higher premium if you need coverage for pre-existing medical conditions

If you are considering trip insurance then the trip cost becomes a major factor in the premium pricing. The higher the total trip cost, the more expensive the insurance.

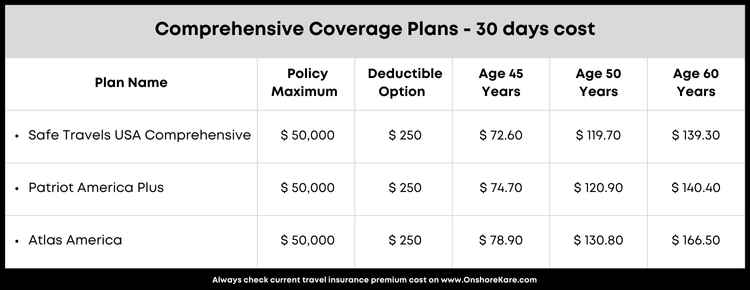

Best Comprehensive Coverage Travel Medical Insurance Plans

While there is a wide choice of travel medical insurance plans the following are the best sellers and most popular travel insurance plans:

Travel Medical Insurance Coverage And Non-Medical Coverage

- The medical expense coverage includes any new sickness or injury during travel.

- All these travel insurance plans offer PPO Network – Preferred Provider Network access.

- Popular PPO Networks include UHC: United Healthcare PPO Network and First Health PPO Network.

- The travel insurance cover option ranges from $50,000 to $1,000,000, depending on the insured’s age and choice of coverage.

- Coverage includes inpatient and outpatient treatments, prescription drugs, and emergency medical treatment for pregnancy, hospitalization, and more…

- The travel insurance coverage includes the acute onset of pre-existing conditions up to the policy maximum. This benefit and limits depend on the insured’s age and choice of coverage.

- The travel insurance cover includes emergency medical evacuation and repatriation of mortal remains.

- COVID-19 is treated like any other illness under these travel insurance plans, ensuring that medical expenses related to testing and treatment for COVID-19 are covered.

- Additional benefits include trip interruption coverage, baggage delay coverage, flight delay coverage, and accidental death and dismemberment (AD&D).

Please review each plan and its coverage, limits, and exclusions before deciding which plan best fits your needs. You can do this by generating a free quote and comparing plans.

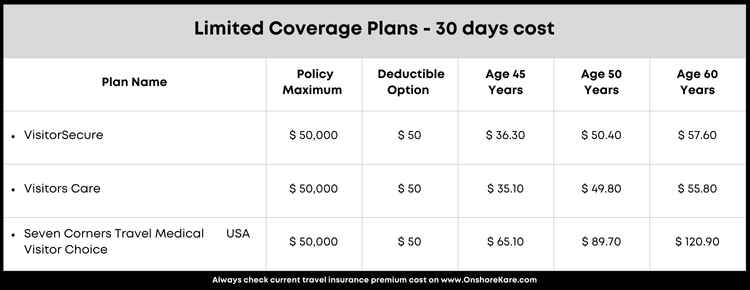

Best Limited Coverage Travel Medical Insurance Plans

- Limited coverage plans typically offer minimal adequate protection for travelers, often only covering the bare essentials such as emergency medical expenses and trip cancellation.

- These plans may have strict limitations on what is covered, such as the maximum amount paid per incident or including activities in coverage.

- Due to their limited coverage, travelers may still be at risk for higher out-of-pocket expenses as compared to comprehensive travel insurance.

- Limited coverage travel insurance is often cheaper than more comprehensive plans, making them a tempting option for budget-conscious travelers. The lower premiums help keep the overall trip cost within a reasonable budget.

- It’s important for travelers to carefully review the coverage and limitations of these plans before purchasing to ensure it meets their specific needs and provides enough protection for their trip.

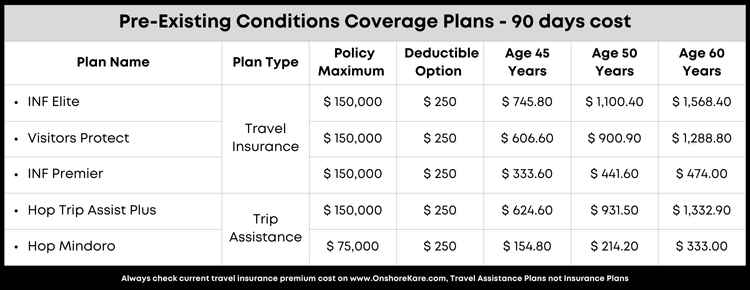

Best Travel Insurance Plans For Pre-Existing Conditions Coverage

~ Hop plans are travel assistance plans and not travel insurance products

- Availability of Comprehensive Coverage or Limited Coverage Travel Insurance Plans:

- INF Elite is a comprehensive coverage plan

- INF Premier is a limited-coverage plan

- The minimum purchase period for travel insurance plans that cover pre-existing conditions is 90 days and need to buy the plan before departing the home country

- These travel insurance plans are a great option for parents visiting the USA

- The coverage amount for seniors over 70 may be limited, do check the policy document for coverage amounts

Comprehensive Coverage: What To Look For

When selecting a travel insurance policy, aim for comprehensive coverage that includes:

Medical Coverage

- Emergency Medical Coverage: Ensure your policy covers emergency medical care abroad, including hospital stays, doctor visits, and medication.

- Medical Evacuation Coverage: This is crucial if you’re traveling to a remote area where local medical facilities are inadequate. Emergency medical evacuation coverage can be a savior in life-threatening situations.

- Pre-existing Medical Conditions: Coverage for pre-existing conditions is available in a select few policies but with a minimum coverage duration of 90 days.

Trip Cancellation And Interruption

- Trip Cancellation Coverage: This should cover a broad range of reasons, including illness, injury, and unforeseen events like natural disasters.

- Interruption Coverage: Ensure it covers the unused portion of your trip and additional expenses incurred to return home.

Baggage And Personal Belongings

- Baggage Delay Coverage: This covers the cost of essential items if your baggage is delayed.

- Lost Luggage Coverage: Reimburses you for lost, stolen, or damaged luggage and personal items.

Rental Car Coverage

- Rental Car Damage Coverage: Covers damage to the rental car due to accidents, theft, or vandalism.

- Rental Car Damage: Ensure your policy includes this if you plan to rent a car during your trip.

Additional Benefits

- Accidental Death and Dismemberment: Provides financial compensation for severe injuries or death.

- Emergency Transportation: Covers the cost of transportation to a medical facility or back home.

- Trip Delay: Reimburses you for additional expenses if your trip is delayed.

Top Travel Insurance Companies

Choosing a reliable travel insurance company is crucial. Here are some of the best travel insurance companies known for their coverage options and customer service:

International Medical Group (IMG)

- Comprehensive Coverage: Offers a wide range of plans, including coverage for medical emergencies, trip cancellations, and lost luggage.

- Annual Plans: Ideal for frequent travelers with annual coverage options.

- Strong Customer Service: Known for excellent customer support and a straightforward claims process.

World Trips

- Customizable Plans: Offers flexible plans tailored to different travel needs.

- High Coverage Limits: Generous coverage limits for medical expenses and trip interruptions.

- Global Network: Access to a vast network of medical providers worldwide.

Trawick International

- Family-Friendly Plans: Offers plans that cater to families with coverage for children at no extra cost.

- Comprehensive Benefits: Includes coverage for trip cancellations, medical emergencies, and rental car damage.

- Strong Reputation: Highly rated for customer satisfaction and claims handling.

Seven Corners

- High Medical Coverage: Known for excellent medical coverage, including emergency evacuation and medical expenses.

- Customizable Plans: Offers plans for different types of travelers, including business travelers and expatriates.

- 24/7 Assistance: Provides 24/7 travel assistance and support.

INF Plans

- Pre-Existing Conditions Coverage: Ideal for travelers who need travel medical insurance with pre-existing medical conditions coverage for traveling to North America

- Flexible Plans: Allows you to extend your coverage while traveling

- Cashless: Some plans from INF plans offer a direct billing option

Hop Plans

- Pre-Existing Conditions Coverage: Ideal for travelers who need travel assistance plans with pre-existing medical conditions coverage

- Flexible Plans: Allows you to extend your coverage while traveling

- Trip Protection Plans: Travel assistance plans function more like trip protection plans and are not travel insurance products they offer a lot of similar benefits.

Tips For Business Travelers

Business travelers have unique needs when it comes to travel insurance. Here are some tips to ensure you get the best coverage:

Choose Comprehensive Plans

- Interruption Coverage: Look for policies that cover trip interruptions due to business reasons.

- Rental Car Coverage: Ensure your policy includes rental car damage coverage, as business trips often involve car rentals.

Consider Annual Plans

Annual Travel Insurance:

- An annual travel insurance plan can be more cost-effective and convenient if you travel frequently for work or leisure.

- If you make travel purchases annually for a one-trip overseas then a single-trip insurance policy will be more suitable.

Coverage For Expensive Items

- Business Equipment: Ensure your policy covers loss or damage to business equipment like laptops and mobile phones.

Frequently Asked Questions

Which insurance company is best for travel insurance?

There are several good travel insurance companies offering best-rated travel insurance plans. The best way to find a travel insurance plan that meets your needs is to generate a quote, compare plans, and then buy travel insurance that meets your specific needs.

You can read reviews of the specific company once you shortlist a plan, this will save you time during your travel insurance shopping. At OnshoreKare we offer plans from top-rated companies.

What is a good rate for travel insurance?

Travel insurance can add to the total trip cost and can be anywhere between 5-10% of the trip cost. The cost can significantly go up if you opt for a travel insurance plan that covers pre-existing medical conditions.

What is the best cheapest travel insurance?

When it comes to travel insurance you can consider limited coverage plans as they are more affordable. We have compiled a list of the top 5 reliable yet cheap travel insurance plans.

How to get a discount on travel insurance?

Travel insurance premiums are regulated by the Department of Insurance in the USA. This ensured fairness in insurance cost to each customer. A Travel insurance provider cannot offer you discounts on premiums, you can however buy group plans if traveling in groups of 5 or more or opt for affordable plans or exclude coverage that you don’t need to ensure costs are lower.

Where is the best place to get travel insurance?

The best place to buy travel insurance would be a marketplace like OnshoreKare where you can compare plans and buy one that meets your needs. The Times of India and The Economic Times have covered OnshoreKare.

In case of help, there are licensed associates available at +1 855 652 5565 to assist you with your questions and concerns.

Who is the most trusted insurance company?

There are several trusted insurance companies in the travel insurance space like IMG, World Trips, Trawick International, and Seven Corners.

Which company’s travel insurance is best?

A travel insurance plan that meets your needs is the best. There are several popular best-sellers like Patriot America Plus, Atlas America, and Safe Travels USA Comprehensive.

Where can I get the best travel insurance?

You can get the best travel insurance at www.OnshoreKare.com

Conclusion

Securing the best travel insurance rates and comprehensive coverage is essential for any traveler.

By understanding your coverage needs, comparing travel insurance companies, and utilizing strategies to save money, you can ensure that you’re well-protected during your international trips.

Remember, the right travel insurance plan can make all the difference in providing peace of mind and financial protection while you explore the world.