Best Senior Travel Insurance for 2023

Retirement has numerous benefits, one of them being getting time for travel and exploration. We recommend buying international travel insurance if you want to travel internationally or even if you travel domestically, buy coverage for additional peace of mind.

Comparing plans from reputed travel coverage providers is a must to remember in your travel checklist. Regardless if you are an experienced traveler or an infrequent traveler.

If you are in your 60s or over and planning to travel, or are planning an international trip for your parents who are 60 and older do not forget to buy international health insurance.

In this article, let us find out the best travel insurance for seniors in more detail.

How to Choose Travel Insurance for Seniors?

When shortlisting travel insurance plans it is critical to evaluate whether emergency medical expenses are covered, whether pre-existing medical conditions are taken into account, and how much medical coverage will cost. Additionally, you might want to consider your spending plan and determine how frequently you intend to travel.

Purchasing an Annual Travel Insurance Plan OR Multi-Trip Coverage might not be a good idea if you’re planning short trips multiple times in a year.

Consider Single-Trip Plans if you’re trying to save money and choose cheap coverage options that only cover the essentials, such as travel delay and trip cancellation coverage. You may need to buy additional coverage or add-ons to the policy to ensure you are covered for any eventuality.

Things to consider while choosing the Best Travel Insurance for Seniors

Consider the following factors when choosing the top insurance companies which cover medical expenses while traveling abroad:

Senior Travel Insurance Cost:

Choose insurance providers that offered both basic and comprehensive medical coverage at reasonable prices.

Medical Coverage & Travel-Related Coverage:

For some benefits, such as trip cancellation coverage and emergency evacuation, choose insurance providers who offer lower and larger medical coverage amounts.

Pre-Existing Medical Conditions:

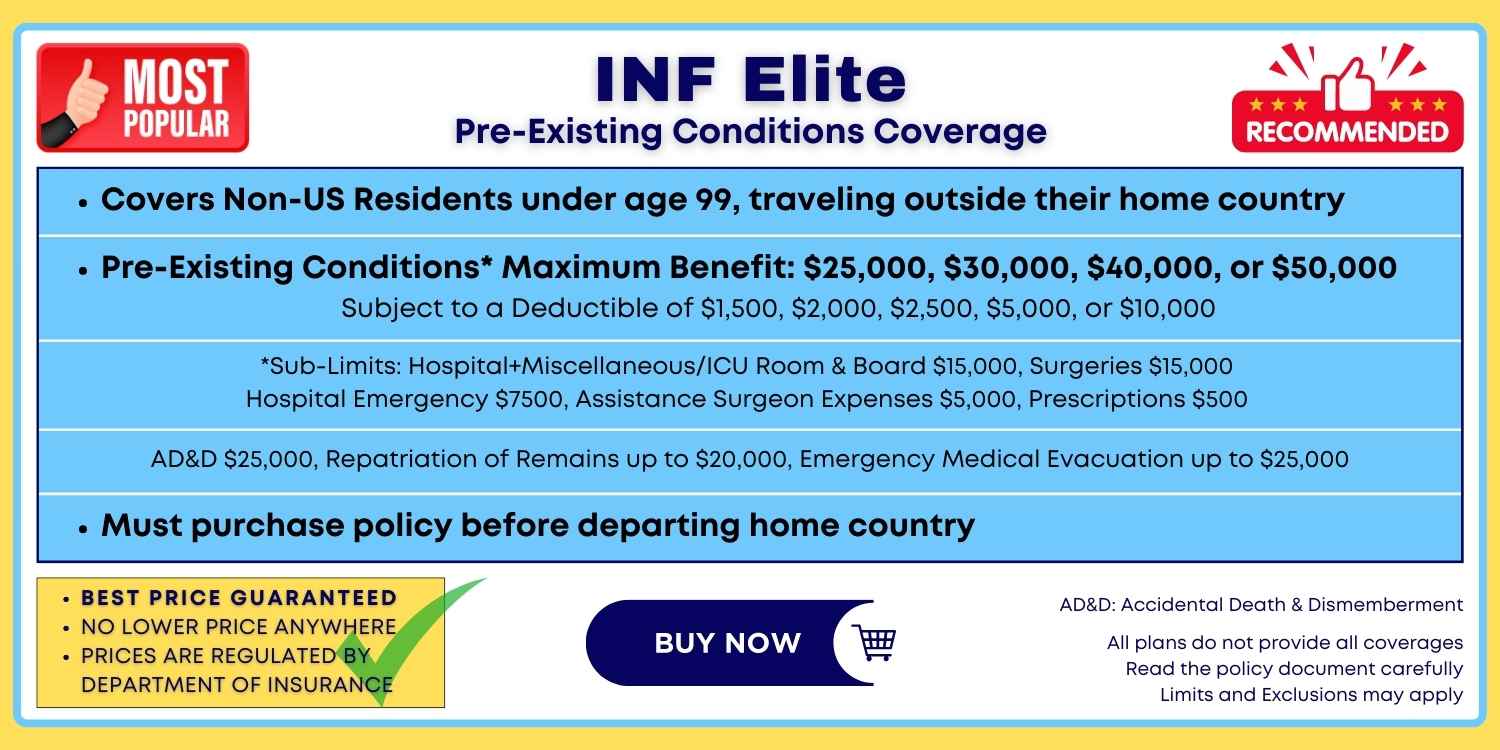

We recommend comprehensive travel insurance that provides medical coverage to people with pre-existing conditions as not all insurance providers will provide medical expense benefits to those individuals. There are a couple of travel insurance plans offering coverage for pre-existing medical conditions:

There are some conditions though that the plans need to be bought for a minimum of 90 days and before leaving home country etc. Do read the policy terms carefully.

Senior-Specific Benefits:

Some providers offer relaxed age limits on travel insurance plans, while others offer senior-specific benefits such as COVID-19 coverage for medical evacuation and your trip cost.

How to Find the Best Travel Insurance for Seniors?

Certain policies provide a free look period during which you can cancel or apply for a refund. The general rule of thumb is to read the fine print to fully understand the policy and determine which option best meets your needs.

Specific travel policies require you to purchase a travel medical coverage plan before your trip begins. However, there are travel medical policies available even after you have arrived. For example, if you are traveling to the United States you can buy senior travel insurance after you have arrived.

Keep in mind that your effective date will be used for any claims and coverages in either case.

Here are a few points to look for in your policy to help you make an informed decision:

- Exceptions:Understand all of the expenses covered by your insurance policy. It is strongly advised to be aware of the exceptions listed in the policy plans and to be aware of any additional hidden costs.

- Exclusions:Certain conditions or situations are not covered, such as self-inflicted injuries, trauma from extreme sports such as bungee jumping, or losses incurred as a result of intoxication or criminal activity.

- Documentation:It is critical to keep all documents/bills on file in order to submit a claim. To support and complete all paperwork completely and accurately.

What Does Travel Insurance Cover?

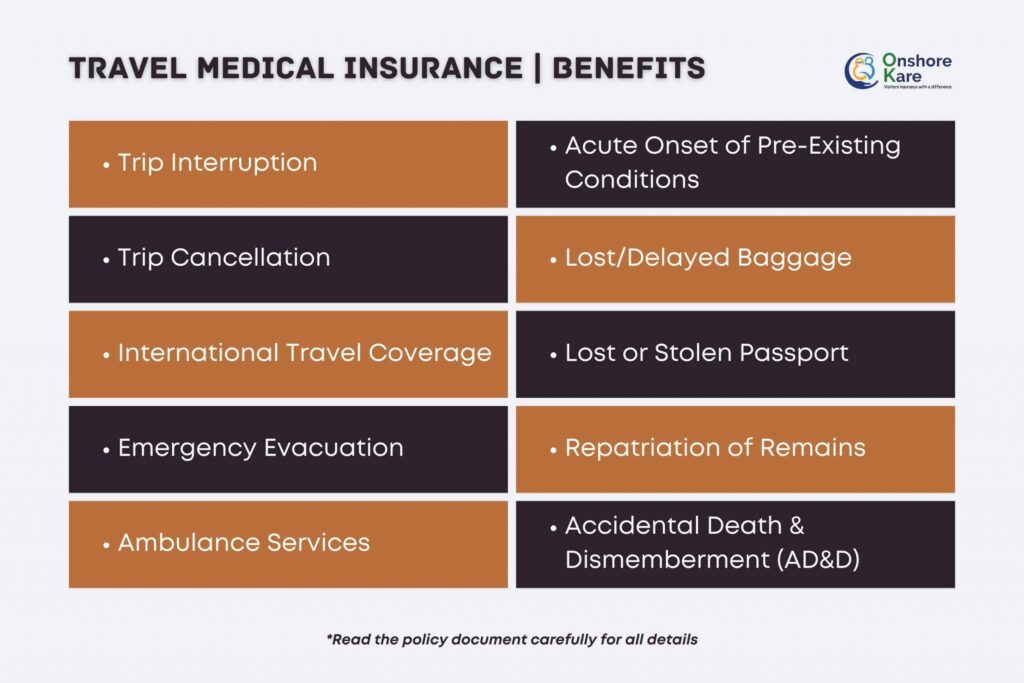

Trip Cancellations:

Aside from personal reasons, a trip may be postponed because of inclement weather or other unanticipated events that could financially impact the traveler. Standard trip cancellation insurance includes coverage for unforeseeable events like terrorism or severe weather like a tsunami and covers the trip cost.

Trip Interruption Coverage:

In the event that your vacation is cut short, you will be reimbursed for the trip cost of the nonrefundable portion of the trip as well as the cost of transportation for each insured passenger by trip interruption benefits.

Trip Delay:

If your journey is delayed for a predetermined amount of time, you may be entitled to reimbursement for the trip cost of a particular amount per day by trip interruption benefits.

Cancel For Any Reason – (CFAR):

As the name implies, check for travel insurance with CFAR coverage if you want the freedom to cancel whenever you like. CFAR enables you to safeguard your funds or trip costs against non-refundable pre-paid travel charges and is typically offered as an add-on.

Lost or Stolen Baggage:

Your travel insurance policy also covers medicines and other important things in your suitcase in addition to clothing. Although airlines offer baggage coverage for lost or delayed baggage, insurance will provide you with an extra safety net.

Medical Emergencies:

Seniors are more likely to experience medical emergencies than younger travelers, so they can happen anytime, anywhere. A travel insurance policy must offer medical protection that would pay for the medical expenses of potential transportation while overseas.

Pre-Existing Conditions:

If you are 60 years of age or older, it is essential that your insurance provides protection for pre-existing conditions. Although treatment for Pre-Existing medical issues is rarely covered by insurance policies, however, some plans provide coverage for the acute onset of pre-existing medical conditions.

If your trip is going to be of longer duration you can consider INF Elite and INF Premier as we have mentioned earlier in the article. These plans provide coverage for pre-existing medical conditions. Limits with respect to age, a minimum number of 90 days of coverage, maximum limit of coverage for pre-existing medical conditions, etc. do apply, please read the policy document carefully.

Car Rental:

As an extra, you can purchase rental car coverage to assist pay for accident-related costs including damage to the rented car and other trip costs. You may be eligible for car rental insurance from your credit card provider if you make payments for the rented card using your card. Speak to your credit card issuer to make use of such travel insurance benefits on your card.

Medical Evacuation:

Also known as medevac, is an optional policy that offers airlift assistance in the event that you require emergency medical transportation.

Accidental Death and Dismemberment (AD&D):

This benefit provides financial cover due to death or dysfunction of a bodily part due to an accident. If you pass away while traveling due to an accident, your beneficiary would be entitled to benefits by accidental death and dismemberment coverage.

This accidental death and dismemberment benefit will cover the cost of returning a deceased traveler’s remains home if they die while on vacation.

What are the top Travel Insurance providers for Seniors over 60?

The terms and conditions of a travel insurance policy differ from insurance company to insurance company in terms of the legislation, policies, prices, and medical coverage. In the USA, there are two main types of travel medical insurance: fixed and comprehensive. Fixed insurance is less expensive than comprehensive coverage but provides little protection.

Because it gives greater coverage, we advise elderly frequent travelers to get comprehensive travel insurance packages.

The best plans and travel insurance companies to start with are:

Patriot America Plus Insurance

Administrator: IMG Global

Coverage Type: Comprehensive Coverage

Medical Benefit Options: Up to $500,000

PPO Network: United HealthCare

Benefits of Patriot America Plus Travel Insurance

- The plan pays up to 100% of the policy maximum after all deductibles

- Coverage for non-U.S. citizens traveling to the U.S.

- Coverage for acute onset of pre-existing conditions up to $500,000 or policy maximum

- Coverage is available from 5 days to 365 days and renewable up to 24 months

- Deductible options from $0 to $2,500

- Policy maximum up to $500,000

We have covered Patriot America Plus Insurance in detail.

Liaison Travel Elite Insurance

Administrator: Seven Corners Insurance

Coverage Type: Comprehensive Coverage

Medical Benefit Options: Up to 5,000,000

PPO Network: United HealthCare

Benefits of Liaison Travel Elite Insurance

- Provides maximum policy coverage up to $5,000,000

- After the deductible, the plan pays 100% up to the policy maximum, in-network

- Coverage is available from 5 days up to 3 years

- Acute onset of a pre-existing condition coverage for non-US residents up to $50,000

- Emergency Medical Evacuation up to $1,000,000

- State restriction for Colorado (CO), Maryland (MD), New York (NY), South Dakota (SD) & Washington (WA)

We have covered Liaison Insurance in detail.

Cover America Gold

Administrator: Seven Corners Insurance

Coverage Type: Comprehensive Coverage

Medical Benefit Options: Up to $250,000

PPO Network: United HealthCare

Benefits of Cover America-Gold Insurance

- After the deductible, the plan pays 100% up to the policy maximum

- Policy maximum up to $100,000 for ages 70 – 79

- Provides coverage for acute onset of pre-existing conditions up to $30,000.

- For anything other than cardiac and stroke, an additional $20,000 can be purchased with an optional rider

- Emergency Evacuation up to $1,000,000

We have covered Cover America Gold insurance in detail.

SAFE TRAVELS USA COMPREHENSIVE

Administrator: Trawick International

Coverage Type: Comprehensive Coverage

Medical Benefit Options: $50,000 to $1,000,000

PPO Network: First Health Network

Benefits of Safe Travels USA Comprehensive

- After the deductible, the plan pays 100% up to the policy maximum

- Policy maximum up to $100,000 for ages 70 – 79

- Provides coverage for acute onset of pre-existing conditions up to $35,000.

- Emergency Evacuation Coverage limits up to $2,000,000

- Coverage from 5 days to 1 year and Renewable up to 2 years

- $30 copay for urgent care

We have covered Safe Travels USA insurance in detail.

Patriot Platinum Insurance

Administrator: IMG Global

Coverage Type: Comprehensive Coverage

Medical Benefit Options: Up to $2,000,000

PPO Network: United Healthcare.

Benefits of Patriot Platinum Travel Insurance

- After the deductible, the plan pays 100% up to the policy maximum.

- Coverage is available from 5 days to 365 days, renewable up to 24 months.

- Urgent Care Copay is $25, not subject to the deductible.

- Emergency Evacuation up to policy maximum.

- Policy maximum up to $100,000.

- $15 Copay for urgent care depending on policy maximum.

- Coverage for medical expenses, emergency evacuation, and repatriation.

We have covered Patriot America insurance in detail.

Is Travel Insurance for Seniors available at a cheap price?

You can purchase fixed benefits or limited travel medical insurance coverage for your parents traveling to the US

Here are some of the affordable travel insurance plans for senior travelers:

Choice America Insurance

Administrator: IMG Global

Coverage Type: Limited or Fixed Benefits Plan

Medical Benefit Options: Up to $150,000

PPO Network: First Health Network

Benefits of Choice America Insurance

- Coverage from 5 days to 365 days.

- Provides Coverage for U.S., Mexico, and Canada.

- Limited Pre-existing Condition Coverage.

- Emergency Evacuation coverage up to $100,000 per evacuation.

- Also gives coverage for Border Entry Denials, Loss of Passports, Adventure Sports, and Amusement Park Injury Coverage.

We have covered ChoiceAmerica Insurance in detail.

Visitors Care Insurance

Administrator: IMG Global

Coverage Type: Limited Coverage

Medical Benefit Options: Up to $100,000

PPO Network: First Health Network

Benefits of Visitors Care Travel Insurance

- Coverage is available from 5 days to 2 years.

- Coverage for acute onset of pre-existing conditions up to $100,000.

- Emergency Evacuation up to $25,000.

- Policy maximum up to $100,000.

- Deductible per-incident options are available at $0, $50 & $100.

Top 5 Reliable Travel Insurance Providers in the United States

There are several factors to consider when your parents or senior citizens travel to the United States for business or pleasure. Here are some travel insurance companies that meet all of your requirements while traveling to the USA:

IMG – International Medical Group

International Medical Group (IMG) is a well-known international business insurer in the United States, offering medical, property, liability, and other related coverages. As an A-rated company by A.M. Best Company since 1998, IMG has been one of only five agencies in its class to have an A rating for financial strength and claims payable ability.

IMG offers top-notch customer service both in person and online. If you apply within 24 hours of when your trip is supposed to start, IMG will also be happy to cancel, delay, or stop it for you without cost. If you need to make a claim while traveling, IMG gives you a free phone number for their foreign claims center.

Trustpilot rating – 4.6/5

AM Best Rating – A- (Excellent)

Read here to find out if IMG travel insurance is worth it or not.

Trawick International

Trawick International is one of the most well-known travel insurance providers. Most importantly, it covers the topics that are essential to you including medical expenses during emergencies. In the event of an accident when you are traveling in the US (such as getting sick or needing to cancel), it offers emergency medical evacuation coverage and trip cancellation coverage, medical expenses and other trip cost saving you money.

This firm provides comprehensive coverage at a reasonable cost, including coverage for lost luggage and medical expenses for emergency medical help. In the event that you are hurt by someone else or have damage to your property while outside of India, it also offers third-party liability coverage.

Trustpilot rating – 4.5/5

AM Best Rating – A+ (Excellent)

Click here to read the complete review of Trawick International Travel Insurance policies

Seven Corners

The most popular option for frequent visitors to the US is Seven Corners, with policies ranging from $27 to $52 per trip, depending on whether they cover medical evacuation and other add-ons. Agents are accessible in airports or in India upon your return if you need to change your plan while traveling, but all insurance can be purchased online or over the phone.

Seven Corners provides a guarantee against trip cancellation or trip interruption for any reason. This implies that you can cancel the insurance without incurring any fees within 24 hours of buying it even after you’ve left for your trip and get a full refund of your trip cost.

Trustpilot rating – 3.9/5

AM Best Rating – A (Excellent)

Also read: Complete guide to Seven Corners Travel insurance policies

WorldTrips, formerly Tokio Marine HCC

Obtaining inexpensive travel insurance is essential if you are planning a vacation to the US. It might be challenging to choose the right policy for you because there are so many various types of plans and providers of this coverage, especially if you aren’t aware of all your alternatives.

One of the better plans is provided by WorldTrips, formerly Tokio Marine HCC. There are many tiers according on your coverage requirements. Additionally, their policies offer several travel insurance benefits, including as pre-existing condition coverage and emergency support when traveling, which are typically extras on other plans.

Trustpilot rating – 2.8/5

AM Best Rating – A++ (Superior)

Global Underwriters

No matter where in the US you are, Global Underwriters travel insurance enables you to receive emergency medical care at nearby hospitals, and provides emergency medical coverage whether it is for a sickness you picked up in New York or an injury you sustained while trekking in California.

These policies are typically more extensive than those provided by the majority of healthcare providers domestically if something were to happen to you while you are overseas. Without having to pay exorbitant deductibles or premiums, you can even obtain supplementary coverage for stolen goods as well as lost or damaged luggage. With their affordable prices and attentive service, Global Underwriters will make you feel safe and secure about your travels.

Trustpilot rating – Not available

Read The best travel insurance companies in the US

How Much Does Travel Insurance for Seniors Cost?

The ages of the travelers, the duration of the trip, and the trip cost will all affect how much travel insurance will exactly cost you. Senior travel insurance often costs 7% to 9% of the total cost of the trip. Keep in mind that you are only insuring the pre-paid, non-refundable components of your trip.

What to Look for When Purchasing the Best Senior Travel Insurance?

Superior medical and evacuation coverage is essential because senior travelers frequently have more medical concerns than younger travelers.

A Minimum of $150,000 Per Person in Medical Insurance

Everything from an ambulance cost to hospitalization, X-rays, diagnostic testing, and prescription medication can be covered by visitor medical insurance. Seniors should search for travel insurance providers with a high level of coverage because costs like this can mount up.

Coverage for Medical Evacuation of at least $250,000

Medical evacuation insurance may pay for a medevac to transport you to a better hospital if necessary. When you need to travel to a better hospital where your condition may be treated, you can buy medical evacuation insurance. For instance, a clinic may not be equipped to address a cardiac issue. Additionally, the emergency help staff of your travel insurance provider can arrange for medevac evacuation, saving you from having to do it in a foreign land.

Covid-19 Coverage

Even elderly travelers who are completely immunized may wish to take precautions against a Covid-19 outbreak. Only travel insurance policies that include coverage for Covid-19 related trip cancellation and medical costs are recommended to consider.

Pre-Existing Medical Conditions Coverage

A preexisting medical condition waiver, which eliminates exclusions for problems you currently have, should be provided by your plan. To qualify for the waiver, you typically need to get travel insurance within two to three weeks after your initial trip deposit. Without the waiver, the provider of your travel insurance will probably not cover illnesses you had between 60 and 180 days prior to departure. (Each provider’s look-back window is different.)

Adding “Cancel For Any Reason” Coverage if possible

Common difficulties like illness, injury, and bad weather are among the list of excuses standard travel insurance policies provide for trip cancellation claims. A “cancel for any reason” upgrade is available on select plans providing an additional level of freedom.

If you purchase cancel for any reason benefit and need to cancel for a reason not covered by the base policy, you will be able to get a portion of your money back (about 75% of the trip costs). For instance, you may file a “cancel for any reason” insurance claim if you learn that your granddaughter’s birthday would fall during your vacation.

The average cost increase for travel insurance due to cancel for any reason benefit is 50%. Only plans with the opportunity to add this cancel for any reason benefit are recommended.

Frequently Asked Questions

can I buy travel insurance for my parents or seniors traveling to USA?

Yes, you can buy travel insurance which provides medical coverage for your parents visiting the USA. Before purchasing travel insurance for seniors, always compared travel insurance companies to get the best travel insurance that covers medical expenses during unforeseen events.

You can compare travel insurance plans and buy from an online reputed travel insurance marketplace like OnshoreKare.

What type of insurance is most important for senior citizens who travel?

Seniors should place a higher priority on a travel insurance policy’s medical benefits, particularly the emergency medical evacuation and visitor medical insurance provisions. This is particularly crucial if you’re going outside of the United States because Medicare will only function in a very narrow range of circumstances.

Look for these two coverage kinds to have large maximum coverage limits. For instance, there are policies that provide $1 million for emergency evacuation and $500,000 for medical expenses.

How can seniors get travel insurance at a lower cost?

You can save money by doing comparison shopping. However, if you want to cut costs even further, put less emphasis on baggage delay coverage, missing connections, and other non-medical issues and prioritize having comprehensive medical and trip cancellation insurance.

Just the prepaid and nonrefundable portions of your trip will be insured by the provider. Don’t pay for insurance on your plane tickets, for instance, if they are totally refundable. You won’t be compensated for refundable deposits by travel insurance.

Does my credit card have travel protection?

Some credit cards could include both travel insurance and rewards incentives. For instance, some credit cards provide a variety of travel insurance features, including reimbursement for hotel costs, trip cancellation insurance, baggage delay coverage, and rental car coverage.

Which travel insurance policy is the best for COVID-19?

Most companies that offer travel insurance have modified their rules and regulations to include COVID-19 coverage. For instance, if you have to postpone your trip and undergo quarantine as a result of a positive COVID-19 test, depending on the travel insurance plan you purchased from your provider, they may be able to reimburse cancellation fees. First, confirm with your provider.

Purchasing an annual travel insurance coverage might not be a good idea if you’re planning a short trip. You should pay more attention to single-trip plans rather than annual travel insurance plans if you’re trying to save money and discover an affordable travel insurance policy that covers the essentials, such as travel delay and trip cancellation.

When you travel outside of the country, is Medicare still in effect?

You cannot receive medical care outside of the United States through Medicare. To get extra coverage, it’s important to buy a travel insurance policy that provides medical coverage.

What does travel insurance not cover?

Some insurance companies won’t grant coverage if you have previous ailments, suffered war losses, or can’t afford the trip.

Is cruise insurance important when choosing the best visitor medical insurance for seniors?

If you are planning to travel on a cruise, it is best to consider cruise insurance to prevent yourself from unforeseen circumstances while traveling. Cruise insurance provides travel medical coverage for seniors, trip interruption insurance, baggage coverage, emergency medical expenses, and many more.

Bottom Line

Traveling can be a joyful adventure, but it can also be made even more stress-free and enjoyable with the correct travel medical insurance and coverage. When organizing a trip, it’s critical to consider your finances, schedule, means of transportation, and the kinds of coverage you’ll require.

You might want to purchase a travel medical insurance policy that covers people with preexisting medical illnesses if you are older than 65 and have such conditions. If you frequently travel and are concerned about unforeseen medical issues or auto accidents, you might want to consider purchasing travel insurance that allows you to add this kind of coverage.

Safe Travels!