Best Travel Insurance For Parents Visiting USA – 2024

Planning for your parents’ visit to the United States involves more than just arranging their itinerary and accommodation; it also entails ensuring their health and well-being throughout their stay.

Consider buying Health insurance for parents visiting USA to safeguard their well-being during their stay in the USA. Travel insurance offers temporary health care protection for international visitors in the U.S.

It operates similarly to standard U.S. health insurance, featuring deductibles, copays, and access to provider networks, distinguishing itself from conventional travel insurance policies.

With the complexities of healthcare systems and the unpredictability of travel, securing the right insurance coverage becomes paramount.

In this guide to the best travel insurance options for parents visiting the USA in 2024, we delve into the intricacies of selecting the ideal plan to provide peace of mind and comprehensive coverage for your loved ones’ journey.

From understanding the nuances of travel insurance to evaluating the specific needs of senior travelers, we offer insights and recommendations to help you make informed decisions and ensure a worry-free experience for your parents during their time in the USA.

Which Insurance Is Best For Parents Visiting USA From India?

Travel medical insurance is popularly known as visitors insurance. There are many travel insurance options, here is a list of some of the best visitor insurance for parents visiting the USA:

- Atlas America

- Patriot America Plus

- Patriot America Lite

- Visitors Care

- VisitorSecure

- Safe travels USA

- Safe Travels USA Comprehensive

Most of these visitors’ insurance plans provide coverage for the acute onset of pre-existing conditions. If you need emergency medical expenses for treatment of pre-existing conditions to be covered, explore the following visitors’ insurance plans:

There is a difference between acute onset of pre-existing conditions and pre-existing conditions. Visitors’ insurance plan that offers coverage for the acute onset of pre-existing conditions will not cover the medical expenses for treatment of the pre-existing conditions.

It will only cover medical expenses to help stabilize the pre-existing conditions.

Is USA Travel Medical Insurance Available To Parents Visiting USA?

International travelers visiting the United States can buy visitors insurance from travel insurance providers based in the USA.

When you buy visitors insurance for parents visiting USA from a local insurance provider, you get the following benefits:

- Insurance providers in the USA are regulated by the Dept of Insurance

- Top-rated plans offered with A.M.Best Ratings

- The USA-based insurance provider is entrenched in the medical eco-system

- Major medical expenses need prior approval from the insurance provider

- 24/7 multilingual support available across the globe

- It is easier to manage the claims process by USA-based family members

The Times of India has featured OnshoreKare where we talk at length about this.

Without short-term health insurance coverage, foreign visitors risk encountering financial difficulties should they sustain injuries or require medical attention during their stay in the U.S.

Types Of Travel Insurance For Visitors To The U.S.

Travel insurance options for visitors to the U.S. are typically categorized into two main groups:

- Fixed/limited coverage travel insurance plans

- Comprehensive travel insurance plans

Get to know the difference between:

limited coverage travel insurance and comprehensive coverage travel insurance.

Fixed benefits travel insurance sub-limits, restrict coverage amounts for each specified medical scenario outlined in the policy, whereas comprehensive visitor travel insurance plans provide higher coverage limits and may go up to the policy maximum.

A comprehensive travel insurance policy also provides higher coverage for travel-related incidents like flight delays, interruptions, cancellations, lost or delayed baggage, and more.

Please note that the incident should be covered and not excluded in the policy document to receive compensation. Always read your travel medical insurance policy document.

Fixed Plan Travel Insurance

Fixed plan travel insurance is a cost-effective option with limited coverage that pays set maximum amounts for specific medical services, while comprehensive plans offer broader coverage and benefits for travelers visiting the US or traveling overseas

Key features of fixed benefits visitors insurance plans include:

- Affordable: Fixed plan travel insurance plans are more cost-effective than comprehensive travel plans for visitors, making them an attractive option for travelers seeking budget-friendly coverage.

- Acute Onset of Pre-Existing Conditions: Some fixed benefit plans may offer coverage for the acute onset of pre-existing conditions, although the coverage is subject to the predetermined benefit limits

- Medical Evacuation and Repatriation: Fixed benefit plans typically include coverage for medical evacuation expenses to the nearest facility and repatriation of remains to the insured’s home country in case of an unfortunate event

- Go out of network for treatment: Offers flexibility to seek treatment from any hospital or doctor of your choice; however, fixed plan benefits will only cover expenses up to the predetermined limits for each service.

- Deductibles apply per event: For each injury or sickness, you are responsible for paying an initial deductible, after which the fixed travel plan covers the remaining eligible expenses as per limits defined in the policy document

- Coverage caps: There is an overall medical maximum limit and specific limits for various covered medical expenses

- Limited coverage: These plans provide limited coverage for specific medical services such as hospital expenses for sickness or accidents, doctor visits for sudden injury or sickness, and prescribed pharmacy drug expenses

- Minimal to no coverage for travel-related expenses: Fixed plan travel insurance typically offers minimal, if any, coverage for trip cancellation, interruption, or delay

- No Co-insurance Factor: Unlike comprehensive plans, fixed benefit plans do not have a co-insurance factor, which means the plan pays a fixed amount for covered expenses without a percentage-based cost-sharing arrangement

- Higher Policy Maximum for Seniors: Fixed benefit travel plans may offer higher policy maximums for individuals above the age of 80 years compared to comprehensive visitor insurance plans

Short fixed-plan travel insurance for visitors offers less coverage compared to comprehensive coverage plans (short-term health insurance for visitors)

Fixed benefits travel insurance plans are characterized by their affordability, limited coverage for specific medical services, potential coverage for acute onset of pre-existing conditions, inclusion of medical evacuation and repatriation benefits, absence of a co-insurance factor, and higher policy maximums for older individuals

International Medical Group – IMG’s Visitors Care plan is an example of this type of plan.

For example:

- Visitors Care Lite plan provides hospital emergency room coverage up to $200 maximum per visit

- While the comprehensive Patriot Platinum plan provides the same coverage up to the policy maximum of $8 million

Comprehensive Plan Travel Insurance

In the realm of travel insurance, when the term “comprehensive” is used, it generally indicates plans that offer benefits with coverage amounts up to the policy’s maximum limit rather than a predetermined cost

Comprehensive travel insurance plans offer extensive coverage and benefits for travelers, providing a wide range of protections beyond medical expenses.

Here are the key features of comprehensive plan travel insurance:

- Robust coverage: Comprehensive plan travel insurance offers more extensive coverage compared to fixed plan travel insurance, making it a worthwhile option if you’re apprehensive about the potential high expenses of a medical emergency during your time in the U.S.

- Emergency Medical Evacuation: These plans cover emergency medical evacuation expenses to transport the insured to the nearest suitable medical facility if local facilities are unable to provide adequate treatment

- Coverage for Various Risks: Comprehensive plans cover a broad range of concerns such as trip cancellation, trip interruption, baggage loss or damage, flight delays, emergency medical coverage, dental care, evacuation, and 24-hour assistance

- Deductibles and coinsurance apply: You cover the deductible along with a predetermined percentage for coinsurance. For instance, the coinsurance may be set at 20% for the initial $5,000 for medical expenses incurred. Beyond $5,000, the plan covers 100% of eligible medical expenses up to the plan’s maximum. Alternatively, some plans may cover 90% up to the first $5,000 and 100% after that.

- No sub-limits: Covered medical expenses are reimbursed up to the plan maximum, after deducting your deductible and coinsurance.

- Network coverage: Typically, comprehensive plan travel insurance operates within a preferred provider organization network, resulting in higher costs if you opt for providers outside of the network.

- More expensive: Comprehensive plan travel insurance tends to be pricier than fixed plan travel insurance due to its considerably broader coverage. For instance, policy maximum coverage amounts can extend into the millions of dollars.

- Trip coverage: Certain comprehensive plan travel insurance policies offer benefits for trip cancellation, interruption, and delay.

- Flexible Benefits: These plans can be tailored to specific trip needs with optional benefits like coverage for business or sports equipment, pre-existing condition waivers if purchased within a specific time window, and additional coverage for rental car damage or financial default

- No Benefit Limits: Comprehensive plans do not have benefit limits based on the type of medical expense, providing comprehensive coverage for various unforeseen circumstances during travel

- High Policy Maximums: Policyholders can choose from a range of policy maximums typically starting from $50,000 up to $1,000,000 based on age and specific plan options

- Trip Cancellation Coverage: Comprehensive plans include coverage for trip cancellation due to covered reasons such as injury, death of a family member, natural disasters, or other unforeseen circumstances

- Additional Benefits: Some comprehensive plans may offer additional benefits like coverage for canceling for any reason or financial default protection, catering to specific travel needs like cruise insurance

In summary, comprehensive travel insurance plans provide extensive coverage for various travel-related risks beyond medical expenses, offering flexibility with optional benefits and high policy maximums to protect travelers during their trips

What Does Travel Insurance For Parents Visiting the U.S. Cover?

Travel insurance for parents visiting the U.S. typically covers a wide range of essential aspects to ensure their well-being during their stay.

A travel medical insurance plan generally encompasses coverage for inpatient and outpatient services, emergency medical services, as well as other healthcare services and some plans may also provide for emergency dental treatment, to prescription drugs.

A comprehensive visitors’ medical insurance plan consolidates various types of insurance. This may encompass:

- Medical bills for a new sickness or injury

- Hospitalization expenses

- Pre-existing conditions coverage

- Emergency medical evacuation coverage

- Repatriation of remains coverage

- Accidental death and dismemberment

- Emergency medical expenses

- Emergency dental treatment

- Coverage for Covid-19

- Prescription drugs

- Coverage for trip cancellations and interruptions

- Loss or delayed baggage

Travel Medical Insurance

Travel medical insurance for parents visiting the USA given the exorbitant costs of healthcare makes it necessary to have. Parents visiting the USA may also have pre-existing conditions and may need coverage for them.

While plans differ in terms of policy maximum, deductible, and coverage offered, usually a travel medical insurance plan for international visitors provides coverage for the following:

- Intensive care

- Local ambulance service

- Emergency room care

- Urgent care clinic visits

- Nursing care at home

- Walk-in clinic visits

- Surgeries

- Lab work and X-rays

- Physician visits

- Physical therapy

- Prescription drugs

Please be aware that these plans might grant complete coverage if you obtain medical care from a doctor within the preferred provider organization network i.e. PPO network, whereas they may only provide partial coverage for a specified portion of eligible expenses incurred outside of the PPO network.

Depending on the selected plan:

- For short-term travel medical insurance policies

- Deductibles and coinsurance may also apply

Consequently, even after purchasing the plan, your parent could potentially face significant medical expenses amounting to thousands of dollars if they fall ill or get injured while visiting the United States.

It’s crucial to thoroughly review the travel medical insurance policy to ascertain the extent of your parent’s financial responsibility for paying out-of-pocket in case of injury or illness.

Emergency Medical Evacuation Coverage

Emergency medical evacuation coverage is beneficial for elderly visitors who are susceptible to medical emergencies. It caters to the expenses associated with transporting your injured or ill parent for emergency treatment and services (in a life-threatening situation):

- To the nearest medical facility where they can receive treatment

- Or to the airport closest to a suitable hospital (for emergency treatment and services)

Upon discharge from the hospital:

- This coverage may additionally cover ground or air transportation back to your parent’s temporary residence in the U.S., or

- To their home country

The necessity for air transportation for medical treatment can swiftly accumulate substantial medical bills, underscoring the importance of this insurance for parents visiting the U.S.

Travel medical insurance plans frequently include emergency medical evacuation coverage of up to $1 million or policy maximum, with options for plans offering greater coverage also available.

The emergency medical evacuation coverage under acute onset of pre-existing conditions is usually a lesser limit or amount lesser than the policy maximum. Refer to your policy document to see if this is covered and by how much.

Coverage For Pre-Existing Medical Conditions

Pre-existing medical conditions are typically excluded from a travel medical insurance plan:

- Some plans may include coverage for the acute onset of pre-existing conditions

- This benefit is typically available only for travelers under a certain age limit

- The usual age limit is under 80 years old

- There is usually fine print for this coverage

- Read the policy document carefully to understand the coverage offered

There are some other common exclusions in your travel medical insurance plan as well.

For example, the Patriot America Plus plan offers:

- Coverage for the acute onset of pre-existing conditions up to the policy maximum limit

- Emergency Medical Evacuation: Arises or results directly from a covered Acute Onset of a Pre-existing Condition maximum limit of $25,000

- The insured person must be under 70 years of age

- See complete details of the Patriot America Plus Plan

Emergency Dental Insurance

Emergency dental coverage might be incorporated into a policy, albeit with typically low coverage limits.

For example:

The CoverAmerica-Gold plan offers:

- $250 in travel dental coverage

- subject to a $50 deductible

Medical Coverage For COVID-19

Many travel health insurance plans for international visitors provide coverage for COVID-19.

Travel medical insurance plans like Seven Corners’ Travel Medical Basic plan and WorldTrips’ Atlas America insurance offer coverage for COVID-19-related expenses up to a chosen medical maximum, protecting unexpected medical costs due to the virus

Plans like Patriot America Plus plan, offer coverage for testing and treatment for COVID-19 the same way as any other illness.

Some plans may also provide coverage for required quarantine for individuals who test positive for Covid-19.

Coverage For Trip Cancellation And Trip Interruption

Some travel medical insurance plans may also include some traditional travel insurance elements, such as coverage for:

- Trip Cancellation

- Trip Interruption

The Atlas America plan offers coverage of:

- Travel Delay: Up to $100 a day after a 12-hour delay period requiring an unplanned overnight stay. Subject to a maximum of 2 days – not subject to deductible

- Trip Interruption: Up to a maximum of $10,000 – not subject to deductible

- See complete details of Atlas America Plan

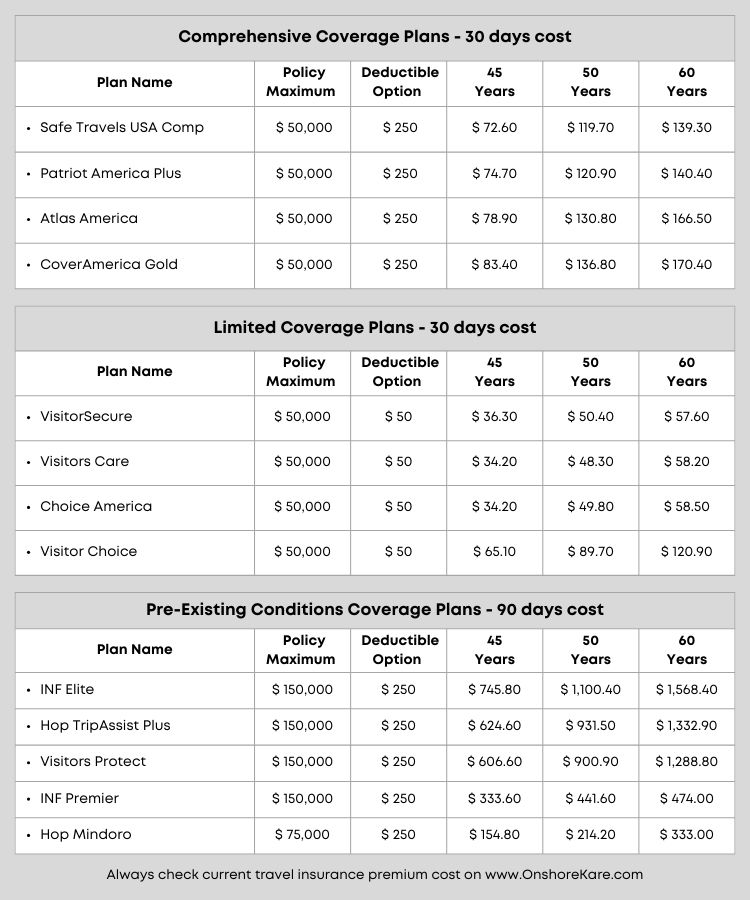

How Much Does Travel Medical Insurance Cost For Parents Visiting the U.S.?

Travel insurance for parents visiting the U.S. will vary in cost depending on the following among other factors:

- The plan you choose for your parents visiting the U.S.

- The age of your parents

- The length or duration of their visit

- Policy Maximum and deductible options selected

The Travel insurance cost – budget-friendly guide gives you a detailed understanding.

The cost of travel health insurance with pre-existing conditions coverage will be higher with a minimum of 90 days of coverage needed.

Call +1 855 652 5565 to discuss your needs with a licensed associate who can help with travel insurance cost savings.

Travel Insurance for Parents Visiting the U.S. Frequently Asked Questions (FAQs)

Do tourists get free healthcare in the U.S.?

No, tourists do not get free healthcare in the U.S. The government does not provide free health benefits to visitors or citizens. Anytime medical care is needed, visiting parents or their family needs to pay for it. Remember healthcare is extremely expensive in the U.S. bill for breaking your leg could cost you around $7,500 or more depending on the extent of the injury and treatment required.

What happens if a tourist gets sick in the USA without insurance

High medical expenses in the USA could cost an uninsured patient hundreds or thousands of dollars for a simple doctor visit.

What does travel insurance for parents visiting the U.S. cover?

Travel medical insurance plans typically cover inpatient and outpatient services, emergency medical services, dental care, prescription medication, and other healthcare services, providing comprehensive coverage for various medical needs during their visit.

Do each of my parents need a separate individual travel policy?

No, both parents can be covered under the same travel insurance policy, eliminating the need for separate policies while ensuring coverage for both individuals. Coverage can be purchased so that both parents are on the same travel insurance policy.

Can I cancel the travel insurance and get a refund if my parents’ travel plans change?

Yes, You can usually cancel a travel insurance policy and be refunded the cost of the policy if:

- It’s during the “look-back” review period

- Which is usually 14 days after the purchase date

It’s crucial to carefully review the specified review period outlined in your travel policy’s fine print.

Can foreign visitors buy medical insurance from U.S. travel insurance companies?

Yes, foreign visitors can buy travel medical insurance from U.S. travel insurance companies.

Is it better to buy travel insurance from India or USA?

Buying travel insurance from a U.S.-based company is your best bet:

- U.S.-based companies are regulated and are required to address any claim disputes

- U.S. doctors and hospitals are more likely to recognize a U.S. based travel insurance providers

- In case of requiring immediate assistance while in the USA, connecting with the customer support of an American company is easier than connecting with an Indian company due to the time zone factor.

- Many U.S. travel insurance policies are renewable while most Indian travel insurance policies are not

- Indian companies only offer limited coverage plans, U.S. travel insurance companies offer comprehensive medical coverage plans

As a policyholder:

- U.S.-based travel insurance company is better able to protect your rights

- Indian insurance regulations might not be able to protect your rights in U.S. jurisdictions

Can I buy health insurance for my parents in the USA?

Yes, as a U.S. citizen, immigrant, or permanent resident, you can purchase health insurance for your parents visiting the USA to ensure they have coverage for medical expenses during their stay.

Which health insurance is best for elderly parents visiting the USA?

Plans like Safe Travel USA Comprehensive, Patriot Travel, and Atlas America are recommended comprehensive options for elderly parents visiting the USA due to their coverage benefits and flexibility in choosing deductibles and policy maximums.

Can I purchase travel insurance for my parents?

Certainly, you can purchase visitor travel insurance for your parents, friends, or relatives, provided you have their consent and the requisite personal information necessary for acquiring the policy.