INF Insurance Review: Which INF Visitor Insurance Plan Is Best for Pre-Existing Conditions?

Choosing visitor insurance for the United States becomes significantly more complex when pre-existing medical conditions are involved. This is especially true for parents and long-stay visitors, where conditions such as diabetes, blood pressure, thyroid disorders, or cardiac history are common and rarely considered “minor” in the U.S. healthcare system.

Most visitor insurance plans marketed to international travelers focus on acute onset emergencies only, meaning they provide limited protection when a medical condition suddenly worsens but exclude non-emergency or ongoing care related to pre-existing conditions. This distinction is often poorly understood and leads to claim disputes and unexpected out-of-pocket expenses.

INF Insurance offers a range of visitor insurance plans that address this gap more directly than many standard options. Select INF plans provide structured coverage for stable pre-existing conditions within defined limits, making them a common choice for parents visiting the United Spretates for extended periods, including visitors from India.

However, INF insurance is not a one-size-fits-all solution. Coverage varies significantly by plan type, benefit structure, eligibility rules, and purchase timing. Some INF plans are comprehensive, others follow fixed-benefit schedules, and certain plans do not cover pre-existing conditions at all.

This review explains:

- Whether INF insurance is worth considering

- Which INF plans cover pre-existing conditions and under what structure

- How INF plans differ from standard visitor insurance

- Which INF plans are best suited for parents and long-stay visitors

- When INF may not be the right choice

The goal is to help families make an informed decision based on actual coverage mechanics, not marketing language.

Quick Answer: Is INF Insurance Worth It?

INF insurance is a strong option for parents and long-stay visitors to the United States who have pre-existing medical conditions and need coverage that goes beyond acute onset emergencies.

Unlike many visitor insurance plans that limit pre-existing condition coverage to sudden, emergency-only situations, select INF plans offer structured coverage for stable pre-existing conditions within defined limits. This makes INF a commonly chosen option for parents visiting the U.S. for extended stays, including visitors from India.

That said, INF insurance is not designed for everyone. These plans are typically more expensive than standard visitor insurance, offer limited cancellation flexibility once coverage begins, and require careful plan selection. For short visits, travelers without medical history, or those prioritizing the lowest possible premium, other visitor insurance options may be more suitable.

In summary

INF insurance works best when medical risk is the primary concern, the stay is long enough to justify comprehensive or fixed-benefit coverage, and the policy is purchased with a clear understanding of its structure and limits.

Key Takeaways (Optional but Recommended to Keep)

- INF insurance is best suited for visitors — especially parents — with pre-existing medical conditions planning longer stays in the U.S.

- Select INF plans provide coverage beyond acute onset, within clearly defined limits.

- INF Elite and Elite Plus are comprehensive plans, while INF Premier and Premier Plus follow a fixed-benefit structure.

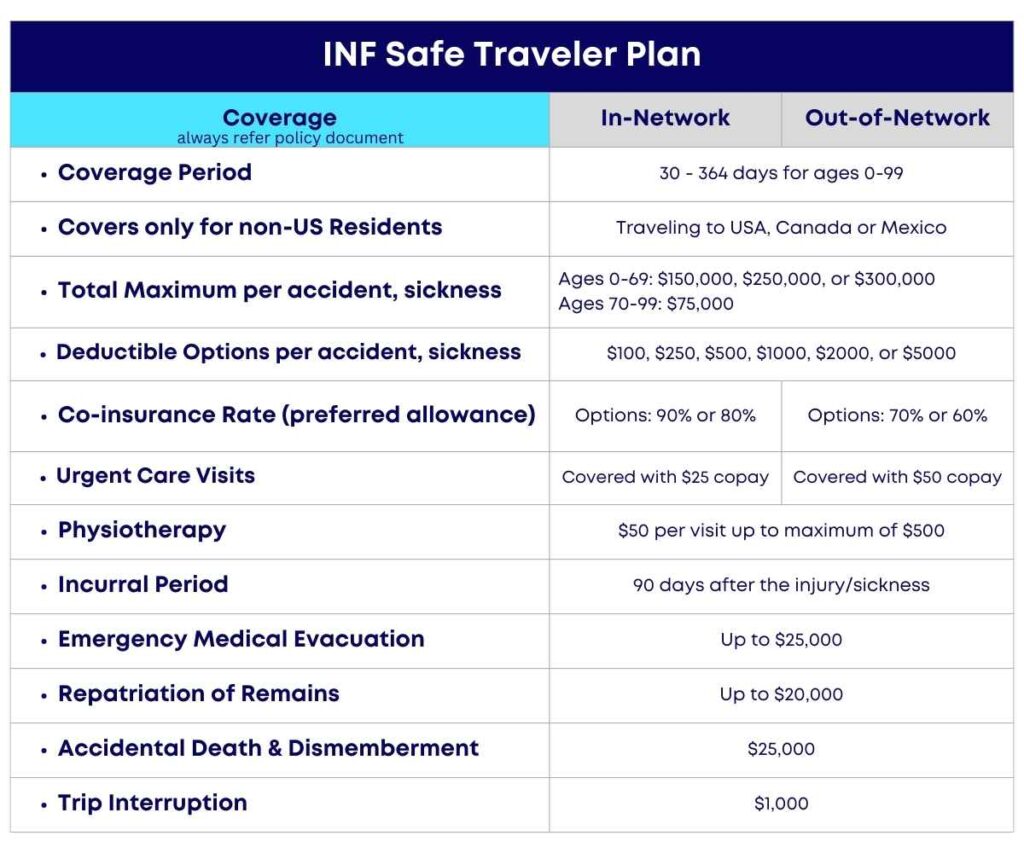

- Plans such as INF Safe Traveler USA and INF Standard are designed for travelers without pre-existing conditions.

- INF travel assistance plans (Hop Assist, BMI plans) provide coordination services, not medical expense coverage.

- Understanding eligibility rules, purchase timing, cancellation terms, and extension limits is essential before buying.

Which INF Plan Fits Your Situation?

INF does not offer a single universal plan. Coverage varies significantly based on medical history, length of stay, and risk tolerance. Choosing the wrong INF plan often leads to unmet expectations, particularly around pre-existing condition coverage.

The table below helps identify which INF plan aligns best with common visitor scenarios. It is especially relevant for parents and long-stay visitors, including families planning extended visits from India, where stable chronic conditions are common.

Important: This table is intended as a directional guide. Final eligibility, coverage limits, and benefits are governed strictly by the policy document.

| Parent’s Situation | Stay Length | Best INF Plan |

| Diabetes, BP, thyroid conditions | 90+ days | INF Elite or Elite Plus |

| Stable heart condition | 3–6 months | INF Premier Plus |

| No medical history | Under 3 months | INF Safe Traveler USA |

| Lowest cost priority | Any | INF Standard (with risk) |

Unsure which INF plan is right for your parent?

Choosing visitor insurance based only on price or plan names can be risky — especially when pre-existing conditions are involved. Coverage structure, benefit limits, and eligibility rules matter more than brochures suggest.

At OnshoreKare, we help families select INF plans based on real claim behavior and on-ground experience, not just published summaries.

Why Visitor Insurance Gets Complicated in the U.S. Healthcare System

Visitor insurance often looks simple on paper, but it becomes complicated when tested against the realities of the U.S. healthcare system. Medical care in the United States is expensive, fragmented, and commonly billed by multiple providers for a single episode of treatment.

A single emergency room visit may result in separate bills from the hospital facility, emergency physician, radiologist, laboratory, ambulance service, and specialists. Even short evaluations can trigger multiple charges, each subject to its own billing rules and insurance limits.

For parents and long-stay visitors, this complexity carries higher risk. Chronic conditions such as diabetes, blood pressure disorders, thyroid conditions, or cardiac history often prompt diagnostic testing, observation stays, or specialist consultations in the U.S. These services may be considered medically appropriate but are not always treated as emergencies under visitor insurance definitions.

This is where many visitor insurance plans fall short. While policies may advertise high maximum coverage amounts, coverage for pre-existing conditions is frequently limited to acute onset emergencies only, excluding non-emergency care, follow-up treatment, or services related to known conditions.

As a result, the challenge with visitor insurance is not finding a policy with a large dollar limit. It is understanding how coverage is triggered, how pre-existing conditions are defined, and whether benefits extend beyond sudden emergencies when medical care is required.

These structural realities explain why visitor insurance decisions for parents and long-stay visitors demand more careful evaluation than standard short-term travel coverage.

How INF Handles Pre-Existing Conditions Differently

Most visitor insurance plans limit coverage for pre-existing conditions to acute onset emergencies only. In practice, this means coverage is typically restricted to sudden and unexpected medical events that require immediate emergency treatment. Ongoing care, routine monitoring, or non-emergency treatment related to known medical conditions is commonly excluded.

This limitation is one of the primary reasons claims are denied or partially paid under standard visitor insurance plans.

INF Insurance takes a more structured approach under its eligible travel medical insurance plans. Rather than relying solely on acute onset definitions, INF distinguishes coverage based on plan type, benefit structure, and pre-existing condition eligibility.

Under INF policies, a pre-existing condition is generally defined as any illness, injury, or condition for which medical advice, diagnosis, care, or treatment was received within the twelve months prior to the policy’s effective date. This definition aligns with standard industry practice and is applied consistently across INF plans.

Under select INF plans, stable pre-existing conditions may be eligible for coverage when medical care is required, subject to clearly defined limits, benefit schedules, and policy maximums. Coverage availability depends on whether the plan is comprehensive or fixed-benefit in structure, as well as age and eligibility requirements.

It is important to understand that INF does not treat all plans equally:

- Comprehensive plans are designed to cover eligible medical expenses up to an overall medical maximum.

- Fixed-benefit plans cover specific services up to predefined dollar limits, regardless of the total billed amount.

These structural differences directly affect how claims related to pre-existing conditions are processed and paid.

Several INF plans are underwritten by insurers with strong financial ratings, including plans backed by an AM Best rating of A. INF also maintains a strong customer reputation, reflected in a Trustpilot rating of 4.9, based on consistent feedback related to customer support, responsiveness, and claims assistance.

Understanding how INF defines, structures, and limits pre-existing condition coverage is essential before selecting a plan. The differences are not subtle, and choosing the wrong plan can materially affect claim outcomes.

INF Travel Insurance Plans: What’s Available for Visitors

INF offers a range of travel medical insurance and travel assistance plans designed for non-U.S. residents visiting the United States, Canada, or Mexico. These plans are structured to address different visitor profiles, from comprehensive medical coverage for longer stays to limited-benefit and assistance-only options.

The plans differ significantly in coverage structure, benefit limits, and eligibility, making it important to understand which category a plan falls into before purchase.

INF Travel Medical Insurance Plans

INF’s travel medical insurance plans include:

- INF Elite

- INF Elite Plus

- INF Premier

- INF Premier Plus

- INF Safe Traveler USA

- INF Standard

These plans are medical insurance products that may cover eligible medical expenses, subject to plan-specific limits, deductibles, and exclusions.

INF Travel Assistance Plans (Not Medical Insurance)

In addition to medical insurance, INF offers travel assistance programs such as:

- Hop Assist

- Hop Mindoro Assist

- BMI Travel Assist plans

These plans focus on coordination and support services, including medical referrals, appointment assistance, and travel-related support. They do not cover medical expenses and do not reimburse hospital or physician bills. Travel assistance plans should not be considered substitutes for travel medical insurance.

Eligibility Notes

- INF Elite, INF Premier, INF Safe Traveler USA, and INF Standard plans are available only to non-U.S. residents.

- Travel assistance plans provide services but no financial protection for medical costs.

- The suitability of any INF plan depends on medical history, length of stay, and overall risk tolerance.

Understanding the distinction between comprehensive medical insurance, fixed-benefit insurance, and assistance-only plans is essential before selecting coverage.

Note: INF Elite, INF Premier, INF Safe Traveler USA, and INF Standard plans are available only to non-U.S. residents. Hop Assist and Hop Mindoro Assist are travel assistance plans and not medical insurance.

INF Elite & Elite Plus: Comprehensive Coverage for Pre-Existing Conditions

INF Elite and INF Elite Plus are comprehensive travel medical insurance plans designed for parents and long-stay visitors who have pre-existing medical conditions and require broader medical protection during extended visits to the United States.

These plans are commonly chosen when medical risk is a primary concern and the visitor has known conditions that may require medical attention beyond emergency-only scenarios.

INF Elite and Elite Plus Are Typically Chosen When:

- The visitor has pre-existing conditions such as diabetes, blood pressure disorders, thyroid conditions, or a cardiac history

- The planned stay in the United States is 90 days or longer

- Comprehensive medical coverage is prioritized over lower premium cost

- The policy can be purchased before departing the home country

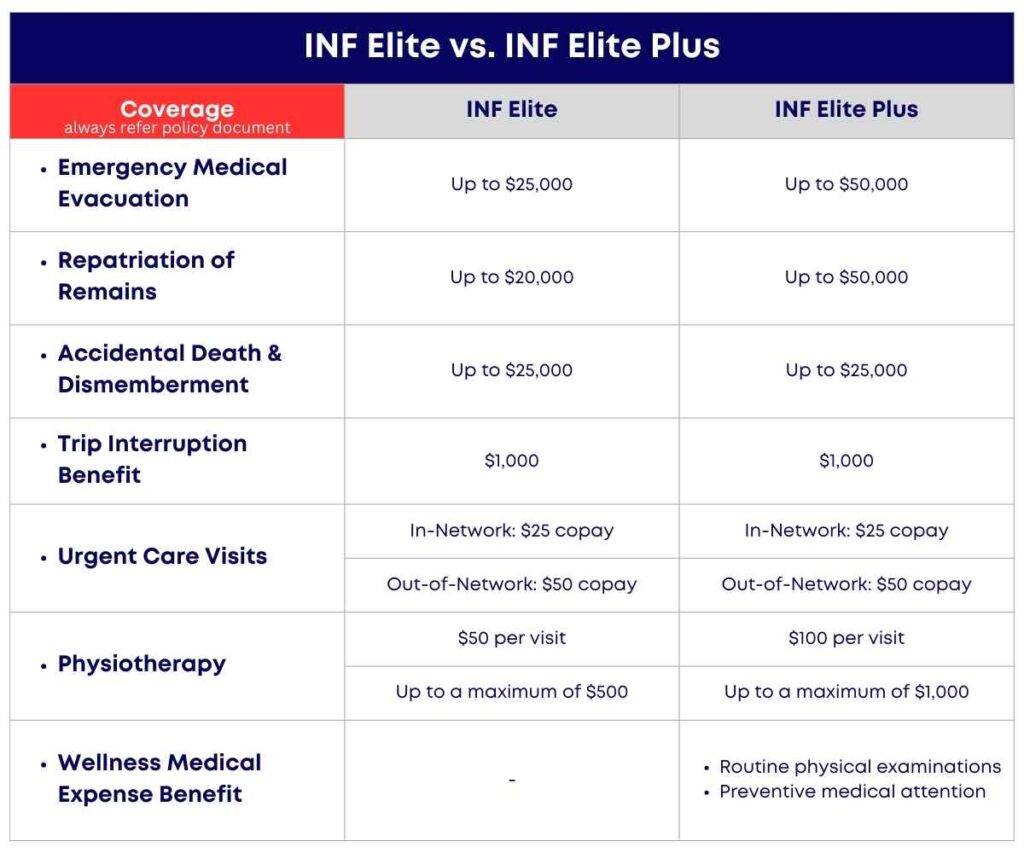

INF Elite and Elite Plus differ primarily in benefit limits, with Elite Plus offering higher coverage limits for certain critical benefits, including emergency medical evacuation.

Both plans are structured to cover eligible medical expenses up to an overall policy maximum, subject to deductibles, exclusions, and policy terms. Coverage for pre-existing conditions is available within defined limits, as specified in the plan documents.

Important: INF Elite and INF Elite Plus must be purchased before departure from the home country, and both plans require a minimum coverage period of 90 days.

The INF Elite Plans – Overview

Policy Maximum Limits and Pre-Existing Condition Coverage

INF Elite Plan and INF Elite Plus Plan

Emergency Coverage Limits

INF Elite Plan and INF Elite Plus Plan

What to Understand Before Choosing INF Elite or INF Elite Plus

While INF Elite plans offer broader protection than fixed-benefit plans, they are not unlimited or unconditional. Coverage is governed strictly by policy definitions, benefit limits, and eligibility requirements. Understanding these parameters is essential to avoid mismatched expectations at the time of a claim.

For families planning long visits for parents from India, these plans are often selected because they offer structured coverage beyond acute onset emergencies, while still operating within clearly defined policy boundaries.

[NOTE: The INF Elite and INF Elite Plus Plan need to be purchased before departing the home country and the minimum period of coverage is 90 days.]

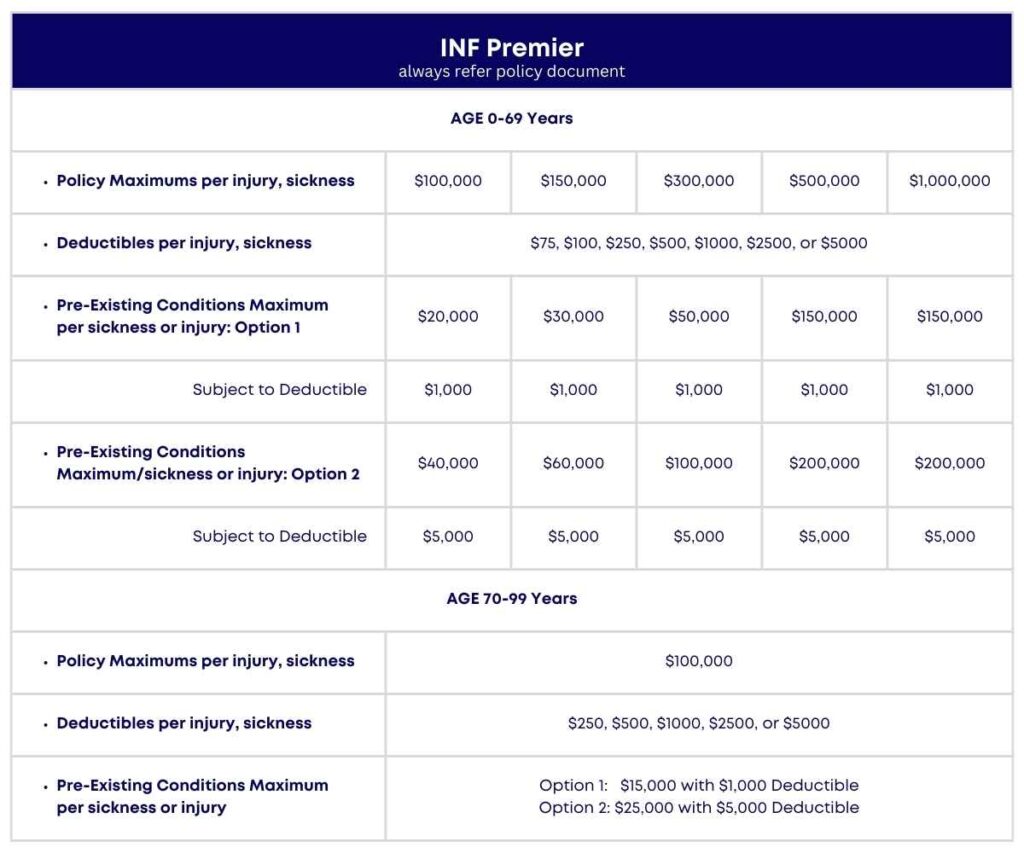

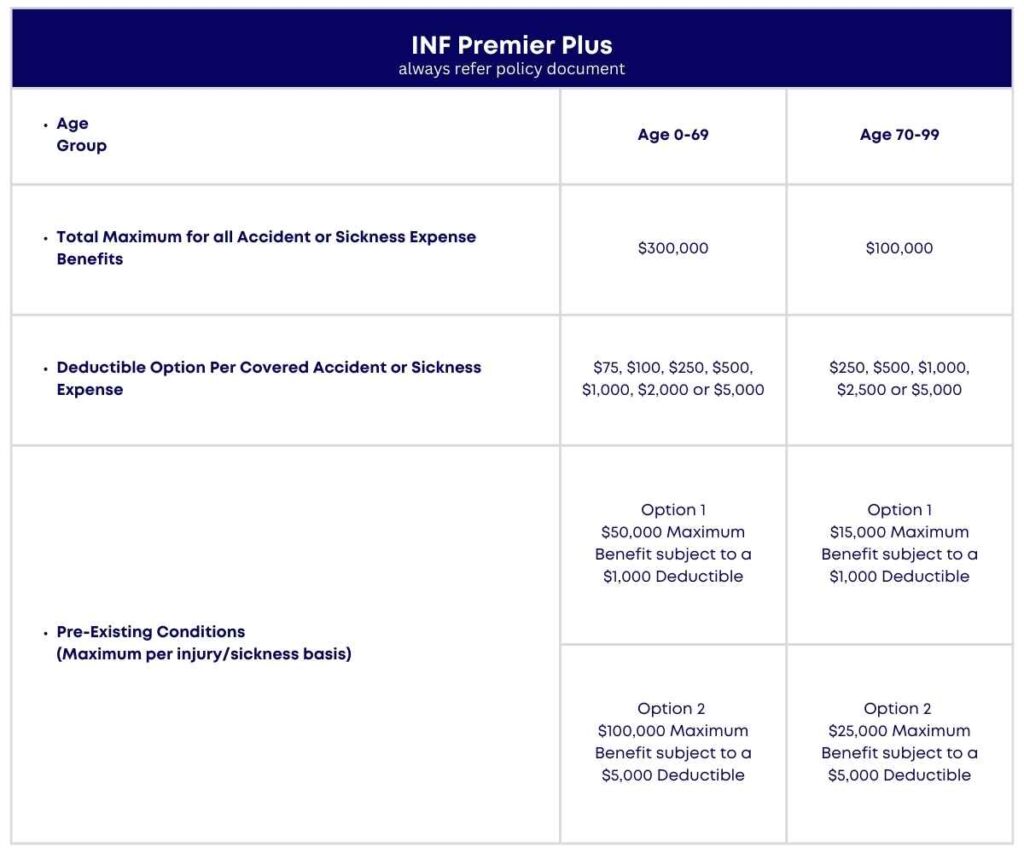

INF Premier & Premier Plus: Fixed-Benefit Plans With Predictable Limits

INF Premier and INF Premier Plus are fixed-benefit travel medical insurance plans designed for visitors who want predictable coverage limits and controlled costs, including those with stable pre-existing conditions.

Unlike comprehensive plans that pay eligible expenses up to an overall medical maximum, fixed-benefit plans pay predefined dollar amounts for specific services, regardless of the total billed charges. This structure can be helpful for budgeting but requires a clear understanding of benefit caps.

These plans are commonly considered when:

- Pre-existing conditions are present but stable

- Predictable, service-specific limits are preferred

- Budget certainty matters more than open-ended coverage

INF Premier Plus generally offers higher benefit limits than INF Premier, while maintaining the same fixed-benefit structure.

(Detailed benefit limits, deductibles, and comparisons are outlined in the tables below.)

INF Premier – Policy and Pre-Existing Conditions: Maximum Coverage Limits

INF Premier Plus – Policy and Pre-Existing Conditions: Maximum Coverage Limits

What These INF Premier & Premier Plus Plans Typically Cover

Under the fixed-benefit structure, INF Premier and Premier Plus may cover eligible services such as:

- Ambulance expenses

- Emergency medical treatment

- Dental treatment (injury only)

- Prescription drug expenses

- Emergency medical evacuation

- Repatriation of remains

- Accidental Death and Dismemberment benefits

- Urgent care visitslimoit

Coverage is subject to service-specific caps, deductibles, exclusions, and policy terms as outlined in the plan documents.

Important Considerations With Fixed-Benefit INF Plans

Fixed-benefit plans are often misunderstood. While they can be cost-effective and predictable, they may result in higher out-of-pocket expenses if U.S. medical bills exceed the predefined benefit amounts.

For families evaluating coverage for parents visiting from India, these plans may be appropriate when:

- Medical needs are expected to be limited

- The family understands how U.S. billing can exceed fixed limits

- Cost predictability is prioritized over comprehensive coverage

The plan covers eligible medical expenses like ambulance expenses, dental treatment (injury only), prescription drug expenses, emergency medical evacuation, repatriation of remains, accidental death and dismemberment benefits, urgent care visits, and more. The limits and exclusions are available in the policy document.

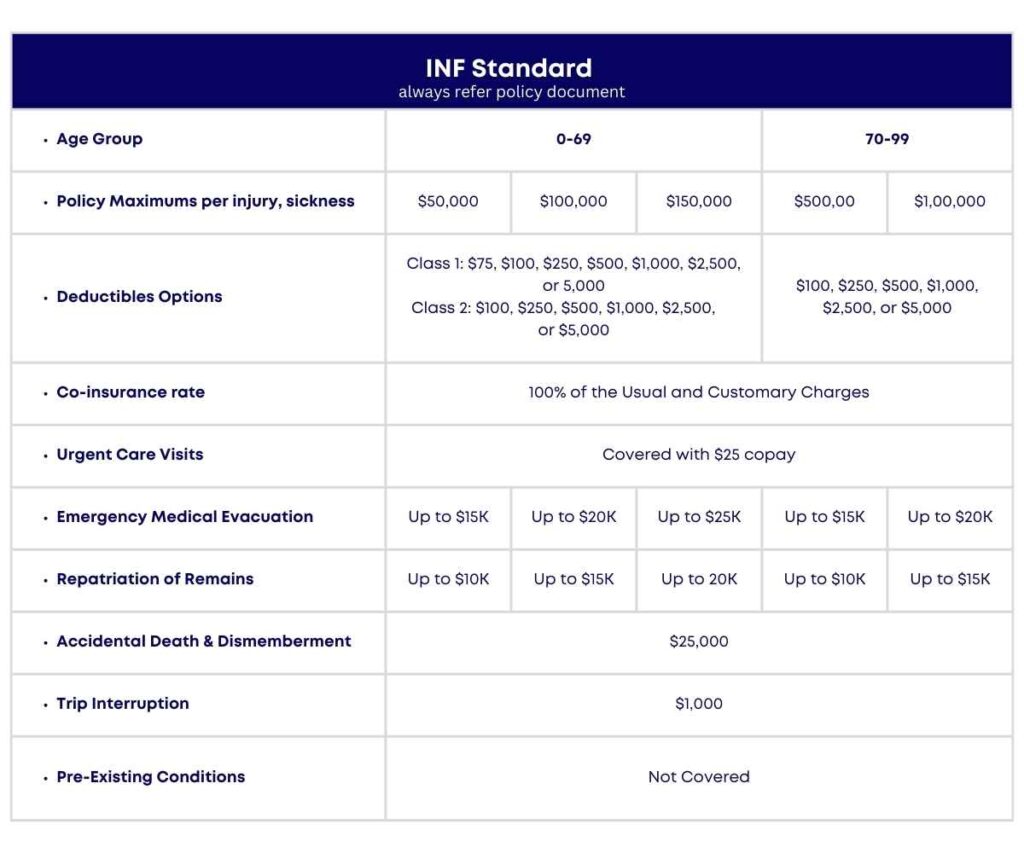

INF Standard: Budget Coverage Without Pre-Existing Benefits

INF Standard is a budget-oriented travel medical insurance plan intended for visitors who are generally healthy and primarily focused on lower premium costs.

This plan is not designed for visitors with pre-existing medical conditions. Coverage is limited, benefit amounts are lower than other INF plans, and exclusions are broader. As a result, INF Standard should be selected only when the risk profile is low and cost is the overriding concern.

INF Standard May Be Considered When:

- Cost is the primary decision factor

- There is no known medical history

- Lower coverage limits and exclusions are acceptable

- The visitor understands the financial exposure in the U.S. healthcare system

Important: INF Standard does not include benefits for pre-existing medical conditions. Visitors with chronic conditions or ongoing medical needs should not rely on this plan for meaningful medical protection.

(Detailed limits, deductibles, and benefit breakdowns are provided in the tables below.)

INF Standard – Coverage Overview

(Detailed coverage limits and exclusions are outlined in the tables below.)

Why INF Standard Requires Extra Caution

INF Hop Assist and BMI Travel Assist: Assistance, Not Insurance

INF also offers travel assistance programs such as Hop Assist, Hop Mindoro Assist, and BMI Travel Assist plans. These are not travel medical insurance plans and should not be evaluated or purchased as substitutes for medical coverage.

Travel assistance plans are designed to provide coordination and support services during a trip. Typical services may include medical referrals, appointment coordination, emergency assistance, and travel-related support. These services can be helpful during stressful situations, particularly when navigating an unfamiliar healthcare system.

However, it is important to understand the limitation clearly:

Hop Assist and BMI Travel Assist plans do not cover medical expenses and do not reimburse hospital, physician, or diagnostic bills.

These plans do not provide financial protection against medical costs incurred in the United States. Any hospital or doctor charges remain the responsibility of the traveler unless a separate travel medical insurance policy is in place.

For this reason, Hop Assist and BMI plans may be used:

- As a supplement to travel medical insurance

- By travelers who require assistance services only, not insurance coverage

They should not be relied upon as standalone protection for medical emergencies or pre-existing condition treatment.

Understanding the difference between assistance services and medical insurance is essential. Confusing the two can lead to uncovered medical bills and serious financial exposure during a medical event in the U.S.

What Are the Common Benefits Across INF Plans?

While INF plans differ significantly in coverage structure, benefit limits, and eligibility, most INF travel medical insurance plans include a core set of protections designed to support visitors during medical emergencies and unexpected situations.

These benefits are provided subject to plan-specific limits, deductibles, exclusions, and policy terms, and their availability may vary by plan type and age group.

Common Benefits Typically Included Across INF Travel Medical Plans

Most INF travel medical insurance plans may include:

- Emergency medical coverage for new illnesses and accidental injuries, within plan limits

- Emergency medical evacuation benefits, subject to defined maximums

- Repatriation of remains coverage

- Accidental Death and Dismemberment (AD&D) benefits

- Access to telemedicine or virtual consultations for non-emergency care

- PPO network access on eligible plans

- Coverage for COVID-19 as a covered illness, subject to policy terms

- Optional deductible choices, depending on the plan

The extent and dollar limits of these benefits vary widely between plans such as Elite, Premier, Safe Traveler USA, and Standard. Reviewing individual plan schedules is essential to understand what is covered and how much protection is provided.t

Important Clarification

The presence of a benefit category does not imply uniform coverage across all INF plans. For example:

- Emergency medical coverage limits differ by plan

- Evacuation benefits may vary significantly in maximum amounts

- Deductibles and cost-sharing requirements differ

- Some benefits may be excluded for certain age groups or conditions

Understanding these variations is critical when selecting a plan, especially for parents and long-stay visitors where medical exposure is higher.

Cancellation, Extensions, and Policy Rules For INF Plans You Must Know

Understanding INF’s policy rules is essential before purchasing coverage. These rules directly affect refund eligibility, coverage duration, and whether protection can be continued once a policy is active.

Many dissatisfaction issues with visitor insurance arise not from coverage limits, but from misunderstandings around cancellation and extension rules.

Cancellation Policy

INF considers the premium fully earned once the policy becomes effective.

- A refund is generally available only if a cancellation request is submitted before the coverage start date

- Once coverage has begun, cancellations are not permitted and premiums are typically non-refundable

For this reason, travelers should avoid purchasing long coverage durations upfront if travel dates are uncertain or subject to change.

Extension of INF Plans

Certain INF travel medical insurance plans, including INF Elite, INF Premier, and INF Standard, may be eligible for extension, subject to plan rules and approval.

Key points to understand:

- Extensions must be completed before the existing policy expires

- Coverage may be extended up to a maximum total duration of 364 days, where permitted

- Once a policy lapses, reinstatement is not allowed

Extensions are not automatic and may be subject to eligibility conditions at the time of request.

Why These Rules Matter

For parents and long-stay visitors, especially those planning extended visits from India, these rules can have significant implications. Purchasing too much coverage upfront reduces flexibility, while allowing a policy to lapse can permanently end coverage eligibility.

Understanding cancellation and extension terms upfront helps avoid:

- Unrecoverable premium loss

- Gaps in coverage

- Ineligibility for future extensions

Is INF Right for Your Situation?

INF travel medical insurance is best suited for visitors to the United States who require structured medical protection, particularly those with pre-existing medical conditions or longer stay durations. Its comprehensive and fixed-benefit plans address scenarios that standard visitor insurance often does not, especially when acute-onset-only coverage is insufficient.

INF plans are most appropriate when:

- The visitor has known medical conditions that may require treatment during the stay

- The planned visit is extended, often several months

- Medical risk management is prioritized over lowest-cost premiums

- The policy can be purchased before departure and kept active without lapses

This is why INF is frequently chosen for parents visiting the United States, including long-stay visitors from India, where chronic but stable medical conditions are common and healthcare expectations differ significantly from the U.S. system.

However, INF insurance is not designed for every traveler.

INF may not be the right choice if:

- The visit is short and medical risk is low

- The traveler has no medical history and is seeking minimal coverage

- Cancellation flexibility and refunds after coverage begins are important

- The primary objective is finding the lowest possible premium

INF plans require careful selection. Choosing the wrong plan type — or misunderstanding fixed-benefit versus comprehensive coverage — can result in unmet expectations during a claim.

Final Consideration

INF remains one of the more reliable visitor insurance options available when medical exposure is the primary concern and coverage decisions are made with a clear understanding of policy structure, limits, and rules.

For families evaluating coverage for parents or long-stay visitors, professional guidance can help ensure the selected INF plan aligns with age, medical history, and length of stay.

If you would like assistance comparing INF plans based on your specific situation, the OnshoreKare team can help clarify options and eligibility before purchase.

Compare INF plans based on your needs.

For visitors needing pre-existing condition coverage, complete INF Insurance Reviews can help to decide if their plans can meet visitors needs.