Travel Medical Insurance – Cost, Coverage, And Benefits

Travel medical insurance is extremely important for international travel, it provides you with medical coverage ensuring your health and financial security.

International travel medical insurance is available to anyone visiting a foreign country be it leisure travelers or business travelers, whether you are visiting family members or holidaying solo.

Unforeseen medical emergencies can arise when you travel, potentially leaving you vulnerable to high costs and logistical nightmares. This is where travel insurance steps in as a crucial safeguard.

In some countries like the USA, healthcare is very expensive, while you get the best medical coverage it can be a huge financial burden without travel medical coverage.

In this comprehensive guide, we’ll explore the intricacies of travel insurance, including its cost, coverage options, benefits, and key considerations, catering to international travelers’ needs and seeking peace of mind on their journeys.

Understanding Travel Medical Insurance

Also referred to as travel health insurance, is a specialized insurance product designed to provide coverage for unexpected medical expenses incurred during international travel.

Travel medical coverage offers financial protection against a wide range of medical emergencies, ensuring that travelers have access to necessary medical care without facing overwhelming costs or logistical challenges.

Also known as travel health insurance plans these also provide coverage against travel-related risks like trip cancellation, trip interruption, travel delays, lost or stolen passport, baggage delay, etc.

Do you live in the USA and have parents visiting you from your home country? Best travel insurance for parents visiting USA can be a helpful guide.

Importance Of Travel Medical Insurance

Traveling abroad exposes individuals to various risks, including accidents, illnesses, injuries, and unforeseen medical emergencies.

Your primary health insurance coverage from your home country will most likely not provide medical coverage when you are traveling abroad.

In such scenarios, having travel insurance can become your primary insurance and make all the difference, offering peace of mind and financial security.

Here’s Why Travel Insurance Is Indispensable:

- Coverage Options: A Comprehensive travel medical insurance plan is available for coverage for medical expenses, including hospitalization, doctor visits, prescription medications, emergency medical treatment, and medical evacuation services. Comprehensive plans offer great coverage. For the budget-conscious traveler with low risks, the fixed benefits or limited coverage plans can be a perfect fit. See the differences between comprehensive plans and limited coverage plans.

- Financial Security: Medical expenses incurred abroad can be substantially higher than those in your home country. Travel insurance provides financial protection, preventing travelers from facing crippling medical bills and potential financial ruin.

- Access to Quality Healthcare: In the event of a medical emergency, travel health insurance ensures that travelers have access to quality healthcare services, regardless of their location. This includes access to reputable medical facilities and healthcare providers worldwide. A travel insurance company based in the USA will most likely offer PPO Network plans that give you access to quality healthcare at competitive prices.

Travel Medical Insurance Cost

The cost of travel insurance depends on several factors, like the traveler’s age, destination country, duration of coverage, policy maximum limits, Deductibles emergency medical coverage, pre-existing medical conditions coverage…

Popular Travel Medical Insurance Plans To Provide Robust Coverage:

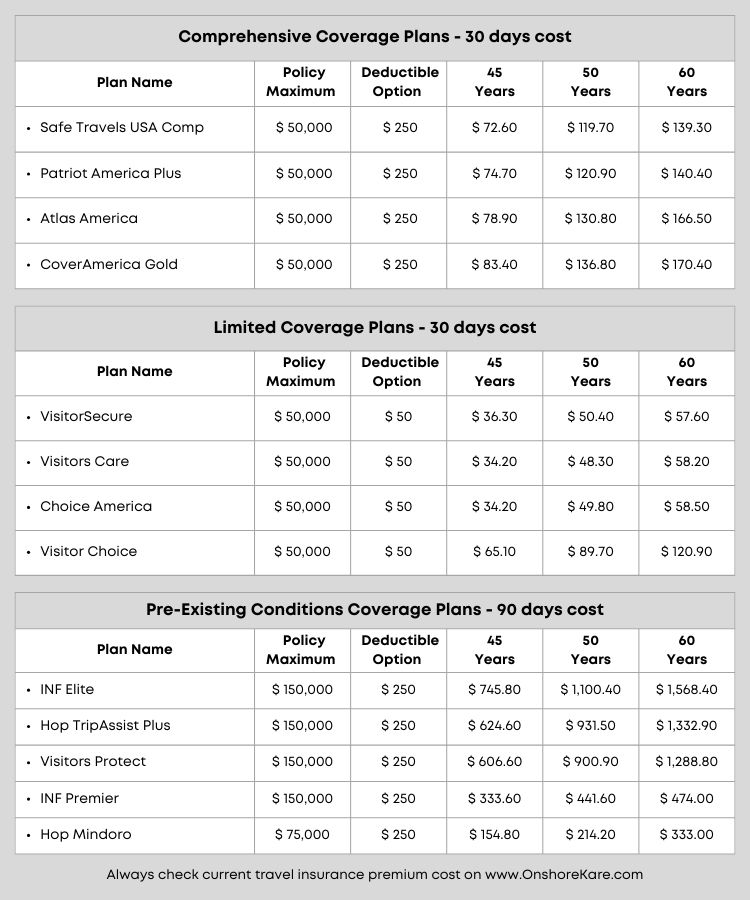

Comprehensive Plans

Safe Travels USA Comprehensive

Limited Coverage Plans

While some travelers may perceive travel medical insurance as an additional expense, the benefits far outweigh the costs.

Travel medical insurance plan cost varies by age and other factors, here is a sample premium cost for ease of understanding:

Here’s What Influences The Cost:

Destination:

The cost of travel insurance may vary based on the destination’s healthcare costs, medical infrastructure, and risk factors associated with the region.

Duration Of Travel:

Longer trips typically incur higher insurance premiums due to an increased exposure to potential medical emergencies over an extended period.

Age Of Traveler:

Older travelers may face higher insurance premiums due to the increased likelihood of medical issues and the associated risks.

Coverage Limits:

Travelers can choose from a range of coverage limits based on their preferences and budget. Higher coverage limits generally result in higher premiums.

Pre-Existing Medical Conditions:

Travelers with pre-existing medical conditions may face higher insurance premiums or limited coverage options.

Most medical travel insurance plans exclude coverage of pre-existing conditions and provide only the acute onset of a pre-existing condition benefit.

For travel insurance plans that cover pre-existing conditions the cost is much higher. At OnshoreKare we provide options for coverage of a pre-existing condition. Call +1 855 652 5565 for assistance from our licensed associates.

Popular Travel Health Insurance Plans That Provide Medical Coverage For Pre-Existing Conditions:

Popular Travel Protection Plans With Pre-Existing Conditions Coverage:

Note: Hop plans are travel protection plans and not travel insurance plans.

Travel Medical Insurance Coverage

Travel medical insurance plans offer comprehensive coverage for a wide range of medical expenses and emergencies. Here’s what travel medical insurance typically covers:

- Emergency Medical Treatment: Coverage for emergency medical treatment, including hospitalization, doctor visits, diagnostic tests, and prescription medications.

- Medical Evacuations: Coverage for emergency medical evacuation to the nearest adequate medical facility or repatriation to the traveler’s home country in the event of a medical emergency.

- Trip Interruption/Cancellation: Some travel insurance plans offer coverage for trip interruption or cancellation due to covered medical reasons, such as illness, injury, or death of the traveler or a family member.

- Repatriation of Remains: Coverage for the repatriation of remains in the unfortunate event of a traveler’s death while abroad, including funeral expenses and transportation costs.

- 24/7 Assistance Services: Many travel medical insurance providers offer 24/7 assistance services, including access to medical professionals, medical referrals, coordination of emergency medical transportation, and assistance with lost prescriptions or medical supplies.

Key Considerations Before You Purchase Travel Medical Insurance

When purchasing travel medical insurance, several key considerations can help travelers make informed decisions and choose the right coverage for their needs:

- Coverage Limits and Exclusions: It’s essential to review the coverage limits, exclusions, and terms and conditions of a travel insurance policy to ensure it provides adequate protection for the intended travel destination and activities.

- Pre-existing Conditions: Travelers with pre-existing medical conditions should disclose their medical history accurately and inquire about coverage options available to them, as some policies may exclude coverage for pre-existing conditions or impose restrictions and waiting periods.

- Duration of Coverage: Choose a travel medical insurance policy that aligns with the duration of your trip and offers flexibility in case of unexpected changes or extensions.

- Claim Process and Documentation: Familiarize yourself with the claim process and documentation requirements of your travel medical insurance provider to ensure a smooth claims experience in the event of a medical emergency. Keep copies of your policy documents, medical records, and receipts for medical expenses incurred during the trip.

Note: Always read the policy document which lists the travel insurance benefits, emergency medical benefits, eligible expenses, exclusions, limits, and other terms like prior approval needed from the insurance company or the insurance provider before any major medical expenses are all explained.

Frequently Asked Questions About Travel Medical Insurance:

- What is travel medical insurance, and do I need it? Travel medical insurance provides coverage for unexpected medical expenses incurred while traveling abroad. It is essential for anyone traveling internationally as it offers financial protection against medical emergencies, which can be costly and unpredictable.

- Does my regular health insurance cover me while I’m traveling abroad? While some health insurance policies may offer limited coverage for overseas travel, they often come with restrictions and exclusions. Travel medical insurance fills these gaps by providing specialized coverage tailored to the needs of travelers, including emergency medical treatment and evacuation services.

- What does travel medical insurance typically cover? Travel medical insurance typically covers expenses related to hospitalization, doctor visits, prescription medications, emergency medical treatment, emergency medical evacuation, repatriation of remains, and in some cases, trip interruption or cancellation due to medical reasons.

- Are pre-existing medical conditions covered under travel medical insurance? Pre-existing medical conditions may be excluded from coverage or subject to restrictions and waiting periods depending on the policy. It’s essential to disclose your medical history accurately and inquire about coverage options available for pre-existing conditions.

- How much does travel medical insurance cost? The cost depends on factors such as the traveler’s age, destination, duration of travel, coverage limits, and pre-existing medical conditions. It’s advisable to obtain quotes from multiple insurance providers to compare coverage and prices.

- When should I purchase travel medical insurance? Travel medical insurance cover should ideally be purchased at the time of booking your trip to ensure coverage for unforeseen events that may arise before or during your travels. However, some policies may offer options for purchasing coverage after booking your trip but before departure.

- Do I need travel medical insurance if I’m traveling domestically? While travel medical insurance is primarily designed for international travel, it may still be beneficial for domestic travelers, especially if their regular health insurance does not provide coverage outside their home state or if they are traveling to remote areas with limited medical facilities.

- Can I purchase travel medical insurance for specific activities such as adventure sports? Some travel medical insurance policies offer optional coverage for specific activities such as adventure sports, hazardous activities, or high-risk destinations. It’s essential to review the policy’s coverage exclusions and limitations to ensure adequate protection for your planned activities.

- What should I do if I need medical assistance while traveling abroad? In the event of a medical emergency abroad, contact your travel medical insurance provider’s 24/7 assistance services immediately for guidance and assistance. They can help coordinate emergency medical treatment, arrange for medical evacuation if necessary, and assist with claims processing.

- How do I file a claim for medical expenses incurred during my trip? To file a claim for medical expenses incurred during your trip, you will typically need to submit a claim form along with supporting documentation such as medical bills, receipts, and medical records. Follow the instructions provided by your travel medical insurance provider to ensure a smooth claims process.

Conclusion

Travel medical insurance is a crucial component of responsible travel planning, offering essential protection and peace of mind for travelers venturing abroad.

By understanding its cost, coverage options, benefits, and key considerations, travelers can make informed decisions and ensure they have adequate protection against unforeseen medical emergencies.

Remember, investing in travel medical insurance is not just about protecting your health—it’s about protecting your financial well-being and ensuring a worry-free travel experience wherever your adventures may take you.

Safe travels!