Cover America Gold Travel Insurance Review

This Cover America Gold Travel Insurance review gives you details about the plan, coverage limits and other benefits. This will help you decide if this visitors insurance plan can meet your insurance needs.

The most asked question on the Travel Insurance Companies helpline is: Can you provide me with information on the best Travel Insurance plan? International visitors to the United States want to know if there is an easy and affordable access plan for visiting the USA.

Watch this short video

CoverAmerica Gold Plan Details

CoverAmerica Gold is a comprehensive coverage plan for visitors to the USA, providing just about the right amount of limits.

This travel medical insurance plan is available for purchase from 5 days to 365 days and covers individuals from the age of 14 days to 79 years.

The limits for coverage options are lower for the age group 70 to 79 years. Buy Cover America Gold.

The plan offers access to the United Healthcare PPO Network.

CoverAmerica Gold plan covers the acute onset of pre-existing conditions, but if you need pre-existing condition coverage you need to consider other suitable plans that cover preexisting conditions:

Cover America Gold is a good plan to consider for international travelers who are primarily visiting the USA. The plan provides incidental coverage to other countries like Canada, Mexico, Latin America, the Bahamas, and South America. The primary destination though has to be the United States.

For senior travelers over the age of 79 need to look for other visitors insurance plan options as this plan will not cover them.

What Is The CoverAmerica Gold Comprehensive Coverage plan?

CoverAmerica – Gold travel insurance plan is a Comprehensive Travel Medical Insurance plan. It provides excellent coverage to the insured person both in the USA and for trips from the USA and certain other countries.

To answer the question about looking for insurance for parents traveling to the USA, the CoverAmerica Gold travel insurance plan should be your consideration when comparing travel insurance plans for the USA.

Parents traveling abroad generally are concerned with pre-existing condition coverage. This plan offers a solution as part of its comprehensive benefits offer.

CoverAmerica Gold Policy Maximum Limits:

International travelers looking for a policy maximum limit of more than $250,000 can consider other travel insurance plans like:

- Patriot America Plus – policy maximum limit of up to $1mn

- Atlas America – policy maximum limit of up to $2mn

- Safe Travels USA Comprehensive – policy maximum of up to $1mn

International visitors visiting USA for a very short period can evaluate if they need cheaper options i.e. comprehensive coverage or limited coverage plans.

CoverAmerica Gold, Emergency Services And Coverage Limits:

Senior Travelers worried about their current medication can carry prescription medicines to the USA. Emergency services can very essential as healthcare costs in the USA are very expensive, even a visit to a doctor or urgent care clinic for common ailments can set you back by a few hundred dollars.

Cover America Gold offers Adventure Rider optional coverage, the activities include Abseiling; BMX; Bobsledding; Bungee Jumping; Canyoning; Caving; Hot Air Ballooning; Jungle Zip Lining; Parachuting; Paragliding; Parascending; Rappelling; Skydiving; Spelunking; Wildlife Safaris; And Windsurfing.

A 20% additional premium is chargeable for this optional coverage.

Cover America Gold Compared With Other Best Travel Insurance Plans

While the best travel insurance plan is one that meets your specific travel insurance needs, some popular plans sell a lot, see this Guide to Best Travel Insurance Plans 2023.

Some of the best-selling comprehensive travel insurance plans are:

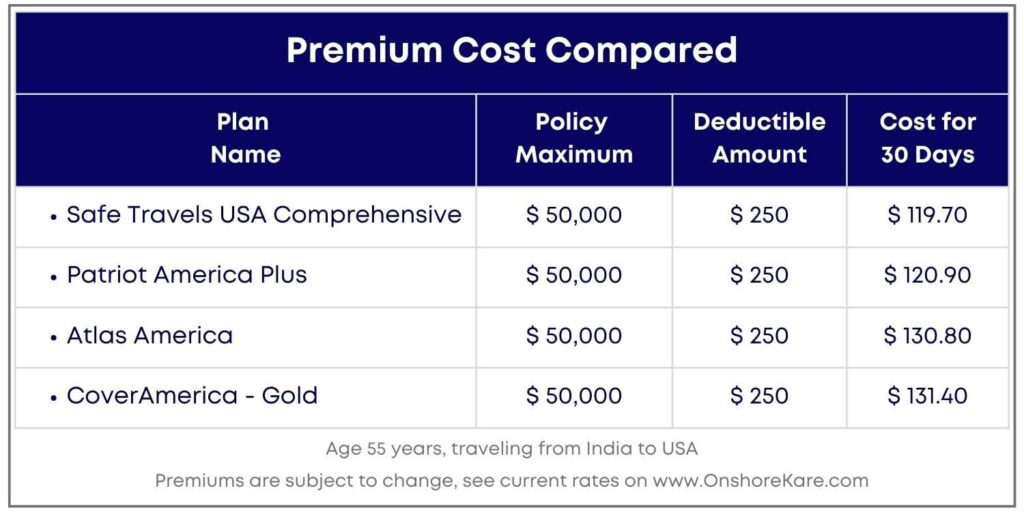

CoverAmerica Gold Premium cost for coverage compared to 30 days of coverage with a policy maximum of $50,000 and a Deductible of $250 with these travel insurance plans:

We have some tips on how to save money on travel insurance costs for the USA.

A detailed comparison of Cover America Gold with these best-selling plans is available:

- Cover America Gold vs. Safe Travels USA Comprehensive

- Cover America Gold vs. Patriot America Plus

- Cover America Gold vs. Atlas America

Why Buy Travel Insurance?

Search for the best travel insurance becomes an exercise when we have parents visiting the USA and we are looking for Visitors Coverage options.

The USA has one of the most expensive healthcare service costs, and getting adequate insurance with proper coverage is key to preventing spending on unwarranted medical expenses.

It is super important when planning international trips, always add travel medical insurance to the total trip cost.

No one wants to end up cutting their international trip short and planning a return trip back to their home country due to uncalled-for medical expenses.

Traveling to the USA on business frequently? You can opt for multi-trip travel insurance.

Who Needs CoverAmerica Gold Travel Insurance Plan?

Cover America Gold plan offers comprehensive travel medical insurance for visitors to the USA

If you are a non-American citizen and a non-US resident, traveling to the USA for an extended period, the Cover America Gold travel medical insurance plan is for you.

The plan is available for purchase for a minimum period of 5 days up to 365 days and renewable for up to 24 months.

Keep in mind, that Cover America Gold is a plan strictly for those traveling to the USA. The other countries available for coverage (Canada, Mexico, Latin America, Bahamas, and South America) are only covered if the trips happen while you stay in the USA and subsequently travel to these other countries.

If you are traveling to, say, Canada only, then the Cover America Gold plan will not serve you any purpose. Your itinerary needs to have the USA as part of your travel plan.

Say if your parents are traveling to the USA to visit you and then plan to visit Canada as well to meet your siblings, then Cover America Gold offers one of the best comprehensive travel medical insurance options.

Pro Tip: CoverAmerica Gold is one of the best-suited A-rated plans for comprehensive coverage travel medical insurance coverage. Available for travelers with ages up to 70 years and provides acute onset of pre-existing conditions coverage. The plan is not available for those who are 80+.

Features Of CoverAmerica Gold Travel Medical Insurance Plan

- No Cancellation Fee

- Offers COVID-19 coverage and daily quarantine benefits

- Urgent Care copay at $15 only

- Offers Acute onset of pre-existing conditions cover

- Pays 100% in the network after applicable deductibles for all covered benefits

- Border Entry protection at the port of entry for denied entry to the USA

- Loss of passport or travel documents

- Missed Connection benefit available during connection and transit to the USA

- Cruise Coverage and Foreign Excursions Coverage around North America

- Emergency Dental treatment

- Emergency Eye Exam

- Emergency medical reunion

- Return of Mortal Remains

- Coverage for natural disasters and terrorism

- Coverage for political evacuation and repatriation

- Flu Shot coverage options with a $25 deductible

Evaluate a travel insurance plan on the overall coverage limits and benefits along with the reputation and rating of the insurance company. Some benefits a plan offers may look good on the face but the benefit may not be too valuable.

CoverAmerica Gold Travel Insurance – Special COVID-19 Benefits

- COVID-19 screening test and eligible medical expenses coverage

- Quarantine indemnity allowance

- Repatriation of remains

Pro Tip: for all the comprehensive coverage features listed above for the CoverAmerica Gold Travel insurance plan, always see the detailed description in the policy document. This not only applies to this plan but any other travel insurance plans you are evaluating.

Cover America Gold Offers A Full Refund Promise

Cover America Gold offers its buyers a full refund promise if they are not completely satisfied with this travel insurance plan.

The comprehensive plan refund promise comes with some logical conditions, a refund can be considered with no cancellation charges:

- A full refund if the travel insurance plan is not effective

- A pro-rata refund if the plan is currently effective

- There have to be no claims made for the refund to be considered

Cover America Gold Comprehensive Medical Coverage

Cover America Gold offers you a couple of options for travel medical coverage.

This comprehensive coverage provides a policy maximum of $50,000 – $250,000 up to age 69.

From ages 70-79 the plan policy maximum will cover $50,000 or $100,000.

Choose to pay a deductible amount of $100 – $5,000 up to age 69.

From 70-79, you can choose from $1,000, $2,500, or $5,000.

All of these choices will determine how much your premium will cost.

- After the deductible is paid, the plan pays 100% for covered benefits in the network.

- For treatment outside of the PPO network, after deductible, the plan pays 80% of eligible expenses up to $1,000 then 100% up to the policy maximum.

- The PPO Network used is United Healthcare PPO Network.

- United Healthcare is one of the widest PPO networks in the USA.

- This plan can be bought for a 5-days to 365 days of coverage.

- The plan is renewable for up to 24 months.

- Urgent care visits cost $15 based on the policy maximum selected, the deductible will be waived.

- If you travel for 30 days or longer, emergency dental treatment and eye exams will be added to your coverage.

Pro Tip: What is the Policy maximum? It is the maximum amount that the plan will pay for eligible medical expenses or covered services. What is a PPO Network? Always look for the PPO network in the policy document, PPO means Preferred Provider Organization and travel insurance plans mention details of the PPO Network in their policy documents. Getting a treatment outside of your plans PPO Network generally will cost you more out-of-pocket.

CoverAmerica Gold – Acute Onset Of Pre-Existing Conditions Coverage

CoverAmerica Gold plan is a comprehensive travel insurance plan and it covers the acute onset of pre-existing conditions.

This CoverAmerica Gold plan feature becomes effective after 48 hours of the start date of travel insurance coverage.

This means that if you have a pre-existing condition, CoverAmerica Gold will cover an occurrence or re-occurrence within 24 hours.

Acute onset is considered to be spontaneous and without warning, so gradual symptoms or treatment may not be considered.

CoverAmerica Gold plan provides coverage up to the policy maximum for acute onset of pre-existing conditions for travelers up to age 69 and $30,000 coverage for travelers 70-79 years.

Pro Tip: Travel insurance plans are designed to cover new risks and medical expenses related to these new injuries or sicknesses. This is to ensure that the insurance company can manage risk and payouts under the travel insurance plans in a way that they do not go bankrupt paying for treatment of pre-existing medical conditions. Now you know why travel insurance plans do not cover pre-existing conditions. Disappointing but that’s how it is.

CoverAmerica Gold Travel Protection Coverage

Under this comprehensive coverage plan, along with medical coverage and support, you also get border entry protection.

If entry is denied to either the USA or one of the other covered countries, you will have border entry protection. This means you may be reimbursed for a ticket or a carrier change fee.

If you miss an international flight, not from your home country though, you can be reimbursed for the ticket and any lost luggage.

This plan also gives you access to travel on cruises and excursions from the USA to other countries and back.

You will have access to 24/7 travel assistance and be covered for the loss of any travel documents, including your passport.

Pro Tip: Comprehensive coverage plans are always better than fixed benefit plans as they extend several benefits apart from medical coverage.

CoverAmerica Gold Emergency Medical Evacuation Coverage

Cover America Gold provides emergency medical evacuation coverage. The policy maximum limit for emergency medical evacuation is up to $1,000,000.

Do note that medical evacuation coverage only applies if there is a pre-approval obtained from the insurance company.

Conclusion

CoverAmerica – Gold is an excellent plan that offers comprehensive coverage for those planning to travel to the USA, especially seniors like parents visiting the USA.

You have the flexibility to travel and make memories without having to worry about trip cancellation due to medical expenses or an illness or accident. This travel insurance will provide coverage for you and your family members.

Other Plans that you can consider are

Patriot America Travel Insurance

Atlas America Travel Insurance